The ultimate big winner may be the small-cap tokens with the greatest growth potential.

Written by: Token Dispatch, Prathik Desai

Translated by: Block unicorn

Introduction

Last week, Paul Atkins was sworn in as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC), taking on the heaviest workload in SEC history related to cryptocurrencies: over 70 applications for cryptocurrency exchange-traded funds (ETFs) awaiting review.

Just three days into his tenure, Atkins faced significant cryptocurrency decisions from his predecessors. He postponed rulings on multiple ETF proposals until June.

These delays were not surprising. However, they highlight the daunting task facing the new chairman, who has a friendly attitude towards cryptocurrencies.

Interestingly, as the altcoin ETF craze rises, funds tracking the second-largest cryptocurrency—Ethereum—are experiencing a remarkable outflow of capital.

Despite this, fund companies are still racing to apply for various ETFs. From established altcoins like Solana and XRP to meme coins like Dogecoin, Penguins, and even Trump Coin, Atkins's work is fraught with challenges.

This contrast raises an intriguing question: Given that Ethereum's experience provides such a troubling precedent, why are altcoins still racing to apply for ETFs?

A Mountain of ETF Applications

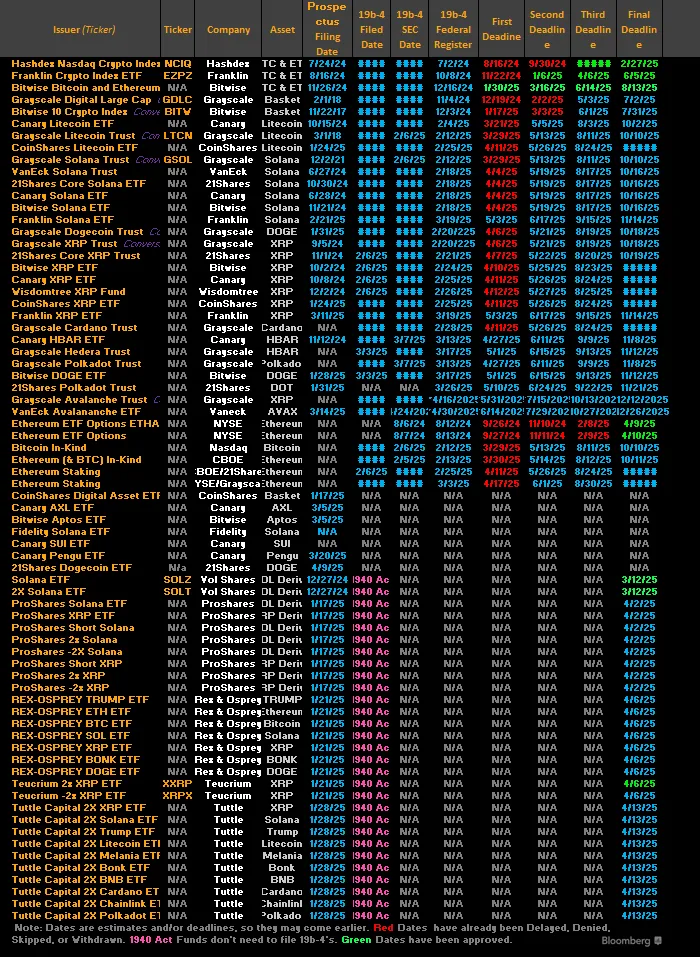

Asset management firms have submitted ETF applications for at least 15 cryptocurrencies other than Bitcoin and Ethereum.

Grayscale alone has applied for funds tracking Solana, Cardano, XRP, Dogecoin, Litecoin, and Avalanche. Bitwise hopes to gain approval for ETFs based on Dogecoin and Aptos, while Canary Capital has been particularly aggressive, submitting applications for Hedera, Penguins, and Sui, and recently introduced a staking TRX (Tron) product that even includes yield generation features.

First, a fundamental question: Why apply for an ETF?

Bloomberg ETF analyst Eric Balchunas recently posted: "Turning your cryptocurrency into an ETF is like a band adding their song to all music streaming services. While there's no guarantee anyone will listen, it puts your music in front of the vast majority of listeners."

In simple terms, this means providing better accessibility for investors and achieving broader adoption through fund companies.

The implications of this issue extend beyond the cryptocurrency realm and involve the complexities of politics. Moreover, we are discussing complexities involving U.S. President Donald Trump.

Trump's media and technology group recently announced plans to invest up to $250 million in cryptocurrency-related ETFs.

The Dilemma of Ethereum ETFs

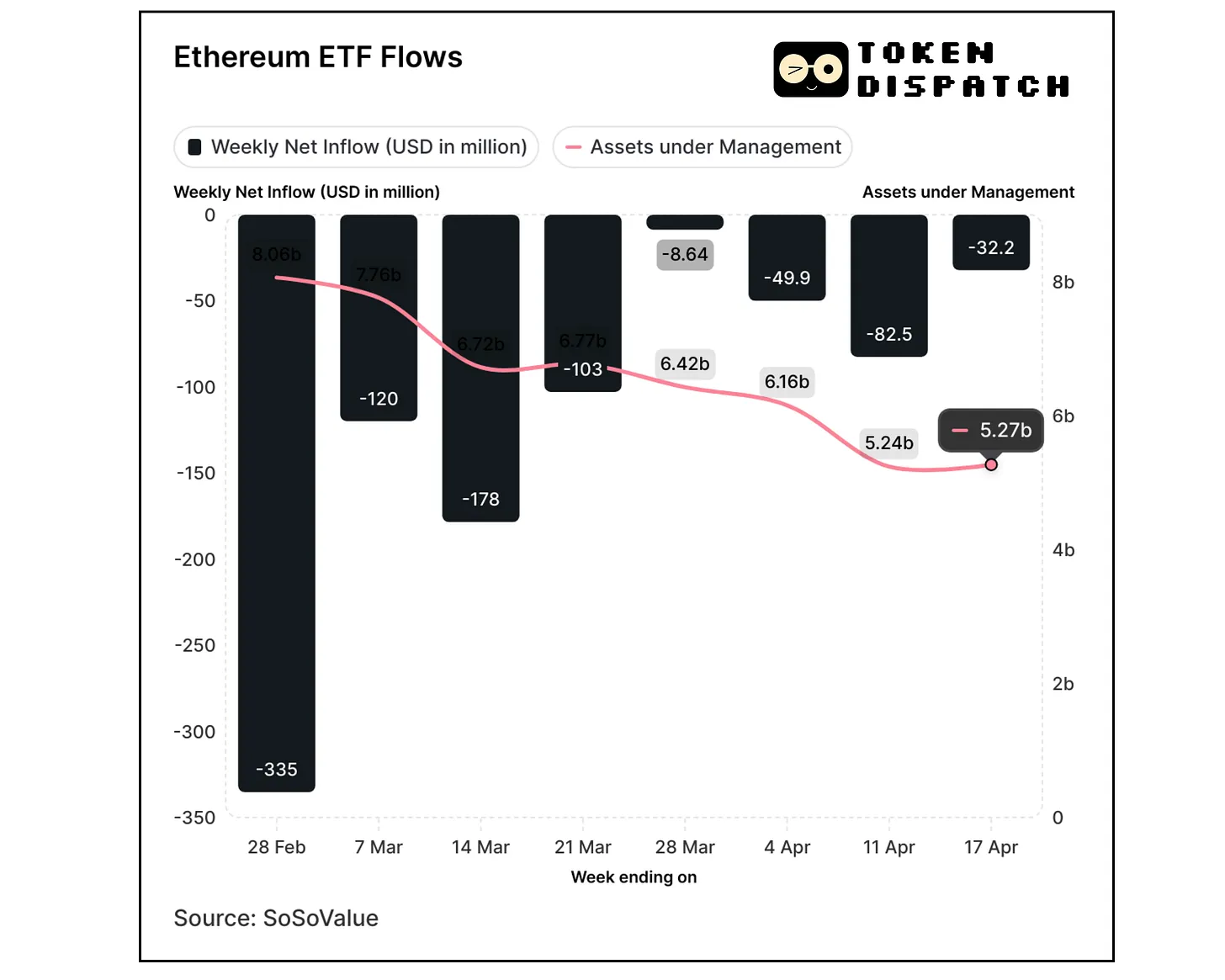

The timing of these application waves is particularly perplexing, as they come at a time when Ethereum ETFs are experiencing a crisis of investor confidence.

As of April 18, Ethereum ETFs have seen seven consecutive weeks of outflows, totaling over $1.1 billion. As of April 11, assets under management plummeted to $5.24 billion, marking a historic low since these products were launched in July 2024.

This struggle stands in stark contrast to Bitcoin ETFs, which, despite market volatility, recorded nearly $1 billion in inflows on both Thursday and Friday of last week, causing Bitcoin prices to rebound to around $95,000.

For altcoin investors hoping to get into Ethereum ETFs, the experience of Ethereum ETFs raises a troubling question: If the second-largest cryptocurrency by market cap cannot maintain investor interest in ETF packaging, what hope is there for less mature tokens?

Lessons from Ethereum

Beyond the numbers, the story of Ethereum ETFs involves some fundamental issues that altcoin ETF investors must seriously consider to avoid a similar fate.

First is the issue of fee structures, with Grayscale's ETHE being a prime example. When competitors like BlackRock offer similar investment opportunities at one-tenth the price, its 2.5% annual fee is clearly unsustainable.

This fee disparity creates a mathematical inevitability—over time, high-fee products will significantly underperform low-fee products tracking the same asset. This is crucial for investors planning to hold for years.

Second is the increasingly complex value narrative of Ethereum. While Bitcoin benefits from its straightforward "digital gold" positioning, Ethereum's value proposition encompasses a smart contract platform, a settlement layer for DeFi, an NFT market pillar, and potential assets generating yield through staking—features that the current Ethereum ETFs lack.

This complexity creates marketing challenges. When financial advisors cannot easily explain the investment rationale to clients in one or two sentences, adoption rates are affected. Bitcoin's simplicity easily wins in this battle.

The third issue is the SEC's cautious stance on staking. By prohibiting Ethereum ETFs from incorporating staking yields, regulators have stripped away a differentiating feature. This contrast became particularly evident when Canary Capital recently applied for a staking TRX ETF, indicating that some issuers are attempting to overcome this limitation.

Why Still Bet on ETFs?

Despite the concerning performance of Ethereum ETFs, the wave of altcoin ETF applications shows no signs of slowing down. This apparent contradiction is driven by several powerful factors that overshadow the direct concerns raised by Ethereum's predicament.

The most significant catalyst is the "Atkins Effect." Paul Atkins's appointment marks a dramatic shift from Gary Gensler's tenure, which was viewed by the cryptocurrency industry as a period of regulatory hostility.

Atkins's reputation for supporting innovation and his history of favoring market-driven solutions provide issuers with an unprecedented opportunity: a viable path to approval.

Data supports this optimistic sentiment.

Bloomberg analysts estimate that the approval probability for assets like Solana, Litecoin, and XRP is between 75-90%.

Atkins's leadership has effectively opened a regulatory window that asset management companies are racing to take advantage of before it potentially closes.

Institutional demand provides another compelling reason for this ETF frenzy. According to a report from Coinbase and EY-Parthenon in March 2025, about 83% of institutional investors plan to increase their cryptocurrency allocations this year, with many targeting over 5% of their managed assets.

Each altcoin offers a differentiated value proposition that may resonate more than Ethereum's complex narrative.

Solana's ultra-fast transactions and growing DeFi ecosystem provide a clear efficiency story. XRP focuses on cross-border payments, offering a more concrete use case that is easier to explain to institutional investors. Hedera's enterprise adoption gives it the corporate credibility that pure retail cryptocurrencies lack.

The growth potential of smaller-cap cryptocurrencies also provides a compelling reason for ETF issuers.

While Bitcoin and Ethereum may offer stability, their trillion-dollar market caps limit their upside potential. If mid-cap altcoins gain mainstream adoption, they could deliver more significant returns, attracting growth-oriented investors who missed out on early Bitcoin gains.

Potential Market Impact

The most direct impact will be capital flows. JPMorgan analysts predict that a Solana ETF alone could attract $3-6 billion in its first year, while XRP could draw $4-8 billion. These capital flows could significantly affect token prices and market dynamics.

In contrast, the entire spot Ethereum ETF market currently holds about $5.27 billion in assets. If two to three major altcoin ETFs reach these forecasts, they could collectively surpass Ethereum ETFs in scale within months of launch, creating a significant market reallocation and triggering a notable market adjustment.

However, the dispersion of institutional capital across multiple cryptocurrency ETFs also poses the risk of diluting assets.

This could spread institutional investors' interests across multiple products. This surge may lead to all altcoin ETFs failing to reach critical mass, thereby reducing their appeal to institutional portfolios.

For retail investors, the impact is twofold. On one hand, ETFs provide regulated, secure exposure to cryptocurrency investments without the challenges of self-custody. On the other hand, the premiums paid by ETF investors (through management fees and potential tracking errors) mean their investment returns may consistently lag behind those of direct holders of the underlying assets.

If a large number of altcoins are locked in ETFs, it could reduce the circulating supply and potentially exacerbate volatility in the underlying spot market.

Our Perspective

As Ethereum struggles, the gold rush for altcoin ETFs reveals the power of narrative over performance. Everyone is captivated by an ironic phenomenon: people are flocking to altcoins while Ethereum, as one of the pioneers, continues to incur losses. What they need to focus on is not replicating Ethereum ETFs but leveraging the lessons from its failures.

Smart issuers are already planning different routes.

Canary Capital's application for a staking TRX ETF is the most evident evidence of this strategic shift. By introducing staking yields—which are precisely what Ethereum ETFs lack—they are addressing the core structural flaws that have led to significant outflows from Ethereum in recent weeks.

The "Atkins Effect" merely provides the opportunity.

The catalyst is the recognition that the failure of Ethereum ETFs is not because they are ETFs, but because they cannot replace native Ethereum. When investors compare ETHE's 2.5% fee and zero staking yield with simply holding Ethereum, the decision becomes mathematically obvious.

Analysts' predictions for altcoin ETFs indicate that this is not just blind optimism. These predictions suggest that, in the face of Ethereum's complex narrative failing, specific altcoins with clearer value propositions can succeed.

The ultimate big winner may be the small-cap tokens with the greatest growth potential. The trillion-dollar valuations of Bitcoin and Ethereum limit their upside potential, but precisely targeted altcoin ETFs may offer the growth multiples that institutional investors crave.

Ethereum ETFs are not just a cautionary tale; they may become the sacrificial pioneers that pave the way for a more successful second wave. The current failures of Ethereum ETFs will not prove that cryptocurrency ETFs do not work; rather, they will provide the necessary market feedback to make the next generation operate more effectively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。