The Cross-Border Salary Dilemma in Latin America: A Common Challenge for Global Enterprises

As talent mobility and business models become increasingly globalized, the demand for secure and efficient cross-border payments is rising, especially in salary disbursement. From remote employees and content creators to suppliers and contractors, companies must navigate numerous obstacles such as system fragmentation, exchange rate fluctuations, and inconsistent regulations to ensure timely salary payments.

In Latin America, these challenges are particularly pronounced. Countries like Mexico, Argentina, Colombia, Peru, and Brazil have long been deeply integrated into the global technology, service, and manufacturing ecosystems. However, conducting cross-border payments between these countries is far from straightforward. Companies face independent local banking systems, strict currency controls, and high inflation rates, as well as the need to comply with varying local regulations. For instance, Mexico's year-end bonus system and Colombia's mandatory statutory allowances represent two vastly different compliance requirements, significantly increasing operational complexity for businesses.

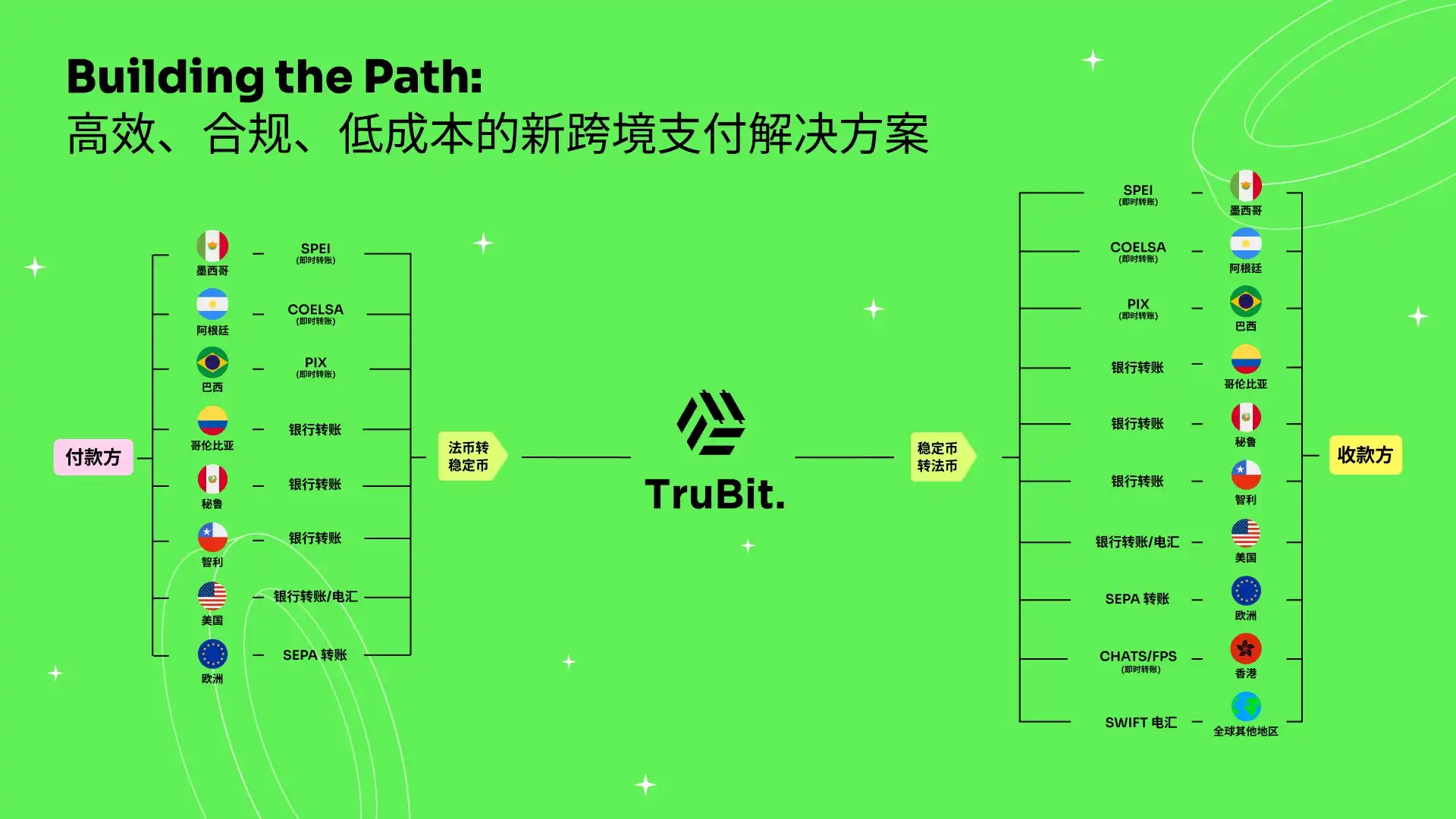

For multinational companies, it often requires connecting with multiple local service providers, opening regional bank accounts, and familiarizing themselves with various payment networks such as SPEI, PIX, or ACH. This not only incurs high costs and cumbersome processes but also increases the likelihood of errors. Common issues include remittance delays, exchange rate losses, and increased administrative burdens, which can affect financial efficiency and undermine local employees' trust in the company.

In high-inflation economies like Argentina, the risks are even more pronounced. Exchange rates fluctuate daily, and international wire transfers can take several days, often resulting in employees receiving reduced salary amounts and uncertain payment timelines.

Thus, cross-border salary payments in Latin America face systemic challenges characterized by "slow, expensive, and unstable" conditions. In this region, timely and accurate salary disbursement is not just an operational issue but directly impacts employee stability and corporate competitiveness.

Did you know?

· 66% of companies globally use more than two international payroll service providers;

· 25% of international payroll errors stem from exchange rate conversion issues;

· In 2023, the use of stablecoins in Latin America grew by over 100%.

Innovation Under Pressure: Latin America Accelerates the Application of Blockchain and Stablecoins

Latin America is not just a region with complex financial systems and high economic volatility; it is also a "battlefield" at the forefront of innovation amid high inflation, fragmented banking systems, and insufficient financial service coverage. In such an environment, innovation is not a choice but a necessity. Companies facing challenges such as foreign exchange restrictions, high intermediary costs, and payment delays urgently need more flexible and efficient solutions.

Driven by this reality, blockchain technology and stablecoins are rapidly taking root in Latin America, moving from concept to large-scale application. Stablecoins bring speed, transparency, and predictability to payments; blockchain provides automated, traceable, and scalable underlying capabilities. By leveraging these technologies, companies can bypass the structural barriers of traditional finance and build a more resilient and inclusive cross-border payment system. From employee salary disbursement to content creator settlements, Latin America is actively driving the transformation of the global payment system, no longer just a follower of technology but a leader of trends.

Case Study 1: How TruBit Business Helps Companies Achieve Efficient Salary Disbursement in Latin America

A typical case comes from a U.S. technology company that significantly improved its salary disbursement efficiency in Latin America by partnering with TruBit Business. The company needed to pay salaries to over 40 employees distributed across Mexico, Argentina, Colombia, and Peru.

When using traditional payroll service providers, the company often faced issues such as remittance delays, high costs, and cumbersome operations. However, after adopting TruBit's solution, the company could directly remit U.S. dollars from the U.S., convert them into the U.S. dollar-pegged stablecoin USDT, and instantly distribute it to employees' digital wallets—this entire process takes only a few minutes. Salary payments arrive quickly and transparently, with no hidden fees. In countries where TruBit has established local infrastructure, employees can even convert digital assets into local currency and transfer them directly to their bank accounts while maintaining the high efficiency and transparency of the blockchain system. All operations are completed through a unified platform.

This solution not only optimized processes and reduced costs but also significantly enhanced employee experience, eliminated remittance uncertainty, and provided the finance team with greater payment visibility and control.

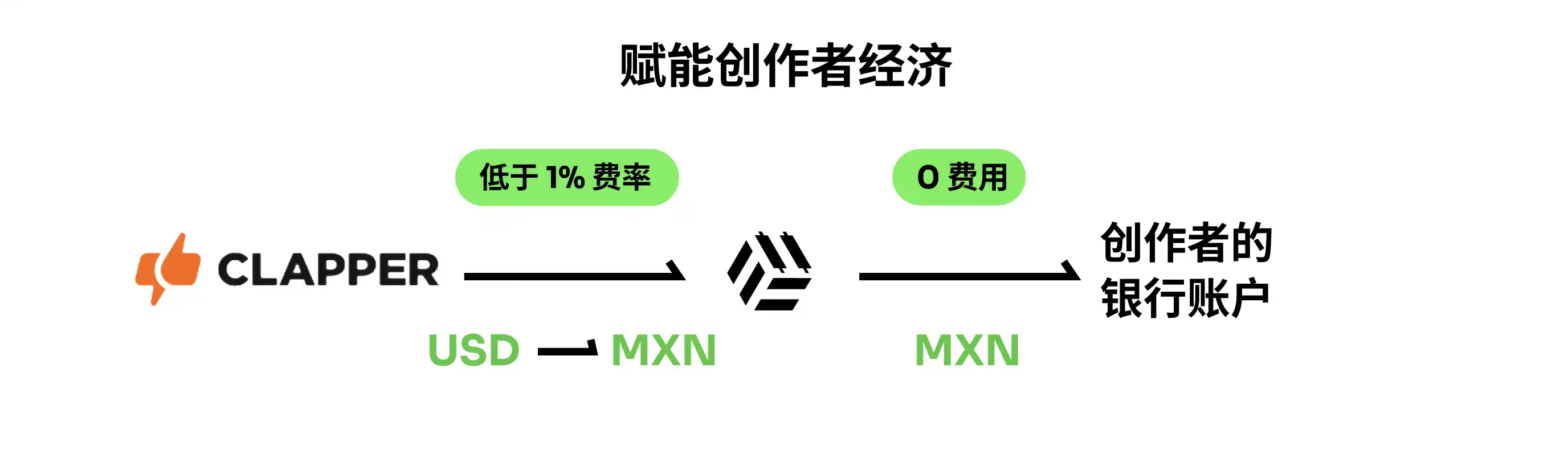

Case Study 2: Clapper and TruBit Join Forces to Reshape the Payment System for Content Creators

The innovative model for batch salary payments is equally applicable to the digital economy. Clapper, a U.S.-based social platform, has a large user base of content creators in Mexico. The platform faced numerous issues when paying content creators: payment delays of 4 to 6 days, fees as high as 30%, and additional charges for transferring funds to local banks after they were received.

Since integrating TruBit's solution, Clapper has achieved full automation of the settlement process using stablecoins and supports direct settlements in Mexican pesos. Creators can now receive payments on the same day, with total fees below 1%, requiring no manual intervention, and the payment process is fully transparent.

This move has not only significantly improved user satisfaction and platform loyalty but also provided Clapper with a scalable and cost-effective settlement model, aiding its expansion into more Latin American markets.

The Future of Global Payments: Salaries are Just the Starting Point, the Future is Boundless

Currently, cross-border salary payments are one of the most pressing challenges; as companies continue to globalize, the demand for fast, transparent, and flexible payment systems is also on the rise.

In some mature markets, traditional banking systems still play a significant role. However, in many high-friction areas, blockchain-driven solutions have demonstrated undeniable advantages. Digital wallets are becoming operational hubs for companies, integrating payments, finance, compliance, and business logic; smart contracts are building rule-based automated payment mechanisms; and stablecoins are enabling companies to conduct global business without replicating traditional banking structures.

Companies that embrace this infrastructure early not only enhance operational efficiency but also gain a competitive edge. They are empowering teams, optimizing collaborations, and collectively shaping the future of global payments.

The transformation of global salary payments is already underway, and Latin America is at the forefront of this era.

This article is contributed and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。