This week, the market saw a significant increase in stablecoin issuance, with substantial net inflows into Bitcoin spot ETFs in the U.S. and minor net inflows into Ethereum ETFs.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.94 trillion, with BTC accounting for 63.45%, amounting to $1.87 trillion. The market cap of stablecoins is $238 billion, with a 7-day increase of 1.61%, of which USDT accounts for 61.66%.

This week, BTC's price showed a fluctuating upward trend, currently priced at $94,734; ETH exhibited range-bound fluctuations, currently priced at $1,800.

Among the top 200 projects on CoinMarketCap, most experienced declines while a few saw increases, including: VIRTUAL with a 7-day increase of 98.2%, BRETT with a 7-day increase of 92.8%, TRUMP with a 7-day increase of 81.1%, and TURBO with a 7-day increase of 122.77%.

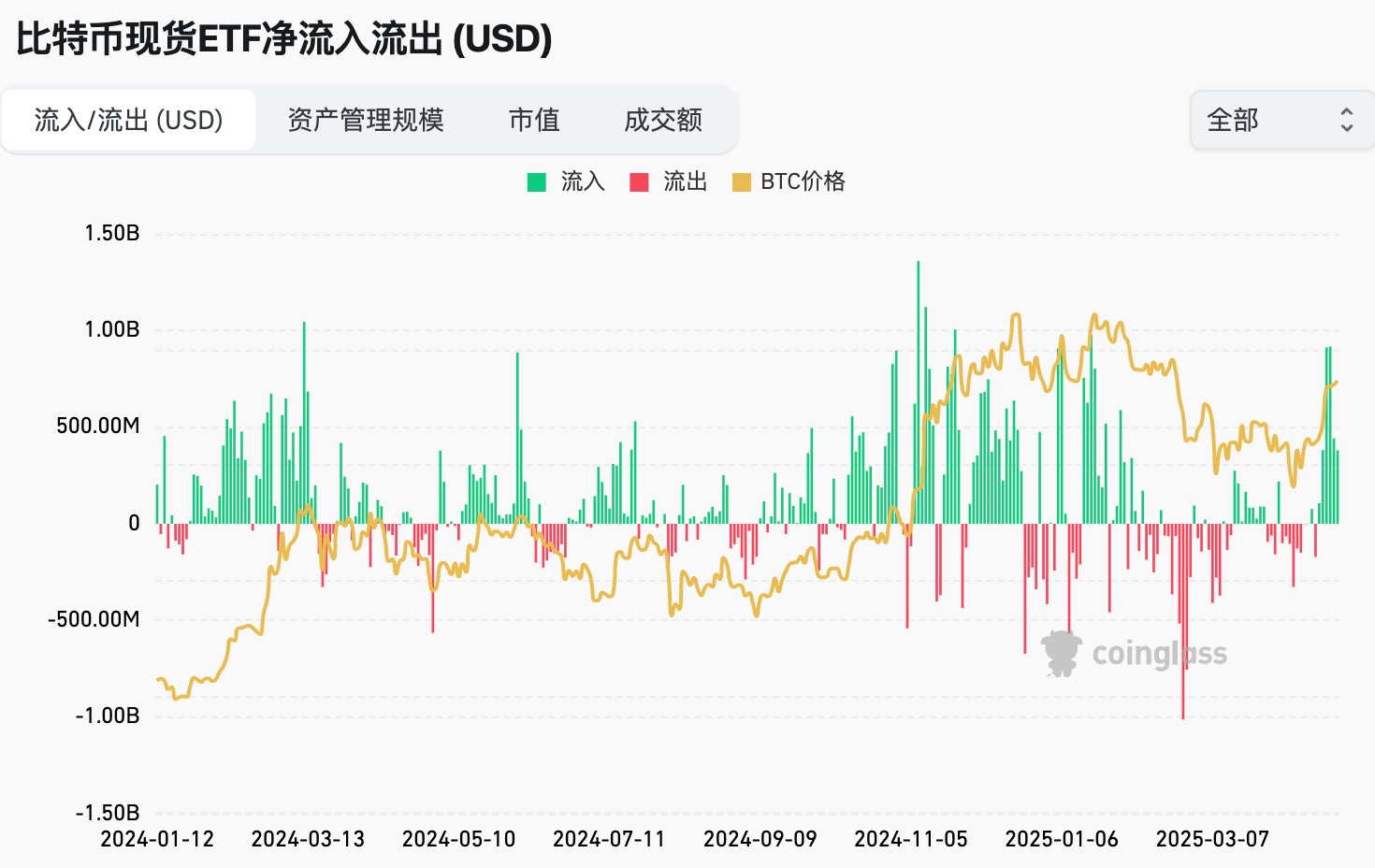

This week, the net inflow into U.S. Bitcoin spot ETFs was $3.033 billion; the net inflow into U.S. Ethereum spot ETFs was $157 million.

The "Fear & Greed Index" on April 26 was 65 (lower than last week), with this week's sentiment: 2 days of fear, 2 days of neutrality, and 3 days of greed.

Market Prediction: This week, the market saw a significant increase in stablecoin issuance, substantial net inflows into U.S. Bitcoin spot ETFs, and minor net inflows into Ethereum ETFs. Due to the easing stance of the Trump administration on high tariffs, combined with the Federal Reserve board member's comments on "possible interest rate cuts," market morale has been greatly boosted. BTC surged from $85,000 to break through $95,000, with large buy orders primarily from institutions and listed companies, leading altcoins to rally.

The market is currently in a state of greed. The probability of a 25 basis point rate cut by the Federal Reserve in May is only 3.5%, lower than last week, making a May rate cut unlikely, while a June cut remains quite possible. It is expected that the market will break out after a period of narrow fluctuations, and any positive news regarding crypto could push BTC back into the $100,000 range.

Understanding Now

Weekly Major Events Review

On April 19, Du Jun, co-founder of ABCDE, announced on social media that ABCDE has officially ceased new project investments and suspended the fundraising plan for the second phase of its fund;

On April 19, according to the latest CNBC national economic survey, U.S. President Donald Trump faced widespread dissatisfaction regarding his handling of tariffs, inflation, and government spending, with his economic approval rating dropping to the lowest level since taking office;

On April 22, Decrypt reported that the new chair of the U.S. Securities and Exchange Commission (SEC), Paul Atkins, will face 15 applications for altcoin and meme token ETFs upon officially taking office, along with the review of over 70 application documents;

On April 23, market news indicated that President Trump stated that tariffs on Chinese goods would not reach 145%, and tariffs would significantly decrease but not go to zero;

On April 23, U.S. Secretary of Commerce Howard Lutnick's son, Brandon Lutnick, led a financial services company, Cantor, in collaboration with SoftBank, Tether, and crypto trading platform Bitfinex to form a Bitcoin investment consortium exceeding $3 billion;

On April 23, the White House is set to reach a comprehensive agreement with Japan and India to avoid imposing large-scale tariffs, although many tricky details may be left for later discussion;

On April 24, official news announced that the top 25 TRUMP holders would be invited to an exclusive reception before the TRUMP dinner, dining with Trump. Additionally, the TRUMP official arranged a special VIP White House tour for these whales the following day;

On April 24, Bitcoin Laws reported that New Hampshire's Bitcoin reserve bill HB 302 passed the Senate Finance Committee vote with a result of 4 votes in favor and 1 against;

On April 25, the Federal Reserve announced the withdrawal of regulatory guidelines for banks regarding crypto assets and dollar token businesses, simultaneously updating the expected standards for related businesses. This move aims to ensure that regulatory requirements keep pace with evolving risks and further support innovation in the banking system. On April 25, Raydium released a tweet related to airdrop emojis, possibly hinting at an upcoming airdrop.

Macroeconomics

On April 24, Federal Reserve Governor Waller stated that as unemployment rises, interest rate cuts may begin;

On April 23, according to CME's "FedWatch" data, the probability of a 25 basis point rate cut by the Federal Reserve in May is 3.5%, while the probability of maintaining the current rate is 96.5%;

On April 24, Bitcoin News reported that Samson Mow, CEO of Bitcoin technology company JAN3, met with Japanese Senator Satoshi Hamada to discuss the urgent need for Japan to formulate a national Bitcoin strategy.

ETF

Statistics show that from April 21 to April 25, the net inflow into U.S. Bitcoin spot ETFs was $3.033 billion; as of April 25, GBTC (Grayscale) had a total outflow of $22.642 billion, currently holding $18.246 billion, while IBIT (BlackRock) currently holds $55.646 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $111.026 billion.

The net inflow into U.S. Ethereum spot ETFs was $157 million.

Envisioning the Future

Upcoming Events

The Staking Summit will be held on April 28 and 29, 2025, in Dubai;

TOKEN2049 Dubai 2025 will take place from April 30 to May 1, 2025, in Dubai;

Canada Crypto Week will be held from May 11 to 17, 2025, in Toronto, Canada;

Bitcoin 2025 will be held from May 27 to 29, 2025, in Las Vegas, USA.

Project Progress

The AI on-chain trading and whale tracking platform Delulu will distribute Lulu points, cash vouchers, and other rewards to beta traders before April 29 (for 21 days);

The Arcium public testnet will go live on April 30;

The application window for the Definitive token EDGE will remain open until May 1, 2025;

The AI agent Echos launched by the Cosmos ecosystem liquid staking protocol Stride will close on May 1, and users must withdraw funds before the permanent closure on that date.

Important Events

Cboe Digital, the crypto division of the Chicago Board Options Exchange, plans to launch a new Bitcoin futures product on April 28, currently awaiting regulatory approval. The new trading product, in collaboration with FTSE Russell, will be cash-settled and based on the XBTF index, which is equivalent to one-tenth of the FTSE Bitcoin index value. It will settle on the last business day of each month;

A Nigerian court has postponed the trial of Binance and its executives for tax evasion until April 30, allowing local tax authorities to respond to the cryptocurrency exchange's request to withdraw the order to serve court documents via email;

The deadline for creditor claims submission for Terraform Labs is May 1, 2025, at 7:59;

According to Techinasia, the crypto investment platform Bake will close its Singapore market and services starting May 1.

Token Unlocks

IOTA (IOTA) will unlock 15.16 million tokens on April 30, valued at approximately $2.54 million, accounting for 0.41% of the circulating supply;

Renzo (REZ) will unlock 864 million tokens on April 30, valued at approximately $13.08 million, accounting for 8.64% of the circulating supply;

dYdX (ETHDYDX) will unlock 8.33 million tokens on May 1, valued at approximately $5.64 million, accounting for 1.13% of the circulating supply;

Omni Network (OMNI) will unlock 16.64 million tokens on May 2, valued at approximately $45.97 million, accounting for 16.64% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and 24/7 market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。