Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $3.062 Billion

Last week, the U.S. Bitcoin spot ETF saw a net inflow for five consecutive days, totaling $3.062 billion, with a total net asset value reaching $109.27 billion.

Ten ETFs experienced net inflows last week, primarily from IBIT and BITB, which saw inflows of $1.445 billion, $621 million, and $573 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $157 Million

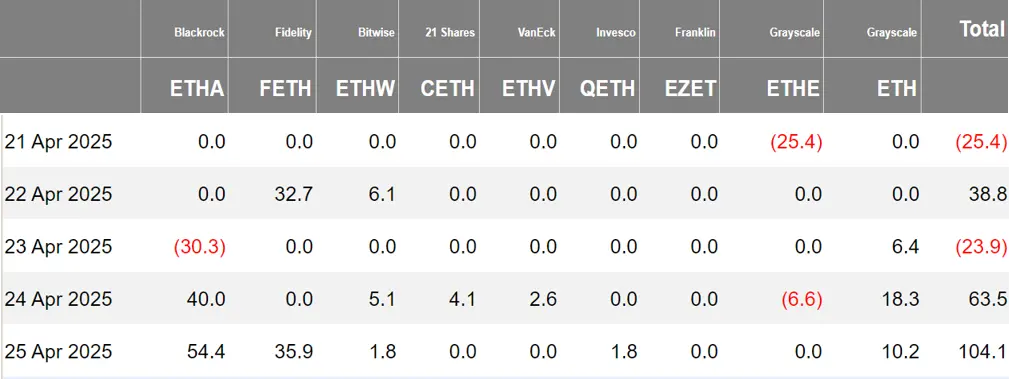

Last week, the U.S. Ethereum spot ETF had net inflows for three days, totaling $157 million, with a total net asset value of $6.14 billion.

The inflow last week mainly came from Fidelity's FETH, with a net inflow of $68.6 million. Only one Ethereum spot ETF had no fund movement.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETF

Last week, the Hong Kong Bitcoin spot ETF had no fund inflows, with a net asset value of $38.3 million. The holdings of the issuer, Harvest Bitcoin, decreased to 302.39 BTC, while Huaxia maintained 2,160 BTC.

The Hong Kong Ethereum spot ETF saw inflows of 153.71 ETH, with a net asset value of $3.574 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of April 25, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.03 billion, with a nominal total long-short ratio of 2.21.

As of April 24, the nominal total open interest of U.S. Bitcoin spot ETF options reached $11.99 billion, with a nominal total open interest long-short ratio of 2.37.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 52.38%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

U.S. SEC Delays Approval of Canary HBAR Spot ETF and Bitwise Bitcoin and Ethereum ETFs to June

According to Cryptoslate, the U.S. Securities and Exchange Commission (SEC) has postponed the decision deadline for the listing plan of the HBAR spot ETF submitted by Canary Capital to June 11, as per regulatory documents released on April 24.

Additionally, the approval for Bitwise's Bitcoin and Ethereum ETFs has also been extended to June 10. The SEC stated that more time is needed to evaluate the proposals and public opinions.

According to Globenewswire, Trump Media Technology Group (DJT.O) has signed a binding agreement with cryptocurrency exchange Crypto.com and asset management firm Yorkville America Digital to launch a series of ETFs under the Truth.Fi brand.

This agreement follows a non-binding agreement signed by the companies in March this year. The law firm Davis Polk & Wardwell LLP will provide consulting services for product development and launch. These ETFs will be offered through Crypto.com's brokerage subsidiary Foris Capital US LLC and are expected to include digital assets as well as securities from diversified industries with a "Made in America" feature, including energy. Following regulatory approval, these funds are expected to launch later this year and will be widely available in international markets, including the U.S., Europe, and Asia, covering existing platforms and brokers.

These ETFs are planned to be launched alongside a series of Truth.Fi separately managed accounts (SMA). TMTG plans to invest in these ETFs and SMAs using its own cash reserves, which is part of TMTG's financial services and fintech strategy, utilizing up to $250 million in funds, managed by Charles Schwab.

U.S. SEC Approves ProShares Trust XRP ETF for Public Listing on April 30

According to Cointelegraph, the U.S. Securities and Exchange Commission (SEC) has approved the ProShares Trust XRP ETF for public listing on April 30.

Market News: Bitwise NEAR ETF Registered in Delaware

Market News: U.S. SEC Delays Approval of Grayscale Spot Polkadot ETF

Market News: 21Shares Registers SUI ETF in Delaware

Canary Registers SEI ETF in Delaware

U.S. SEC Confirms VanEck's Application for Spot Avalanche ETF

Views and Analysis on Crypto ETFs

Ripple CEO: CME's Launch of XRP Futures is Slightly Delayed but Paves the Way for Spot ETF

According to FinanceFeeds, Ripple CEO Brad Garlinghouse acknowledged the upcoming launch of XRP futures contracts by the CME, calling it an important and exciting step for the continued growth of the XRP market. He noted that while this initiative is somewhat delayed in many aspects, it is significant as it marks XRP's recognition in mainstream financial markets. This move not only provides regulated trading tools for professional investors but may also pave the way for the future launch of an XRP spot ETF, validating XRP's status as a mature and investable asset class.

Michael Saylor: BlackRock's IBIT Will Become the Largest ETF in the World in Ten Years

Michael Saylor, founder of Strategy, stated that BlackRock's Bitcoin exchange-traded fund iShares Bitcoin Trust (IBIT) will become the largest exchange-traded fund (ETF) in the world within the next ten years. IBIT currently has a market capitalization of $54 billion, with a daily trading volume exceeding $1.5 billion. Over the past five trading days, the U.S. spot Bitcoin ETF saw a net inflow of approximately $2.8 billion, with IBIT accounting for $1.3 billion, which is one of the reasons Bitcoin's price rose from about $85,000 to $94,000. Additionally, the annualized yield of Bitcoin ETF arbitrage trading on the CME has approached 10%, indicating an increase in market risk appetite.

Bloomberg senior ETF analyst Eric Balchunas stated on X platform that the Bitcoin spot ETF entered "Pac-Man" mode yesterday, with an additional $936 million, bringing the weekly total to $1.2 billion. Notably, out of 11 ETFs, 10 experienced cash inflows, which is a good sign indicating deep fund movement. Additionally, BlackRock's IBIT made a significant contribution, and overall, the Bitcoin ETF performance is quite strong.

Analyst: A Total of 72 Crypto-Related ETFs Awaiting SEC Approval

According to Bloomberg analyst Eric Balchunas on X platform, there are currently 72 cryptocurrency-related ETFs awaiting approval for listing or listing options from the U.S. Securities and Exchange Commission (SEC). These range from Ripple (XRP), Litecoin, Solana to Penguins, Dogecoin (Doge), and Melania's 2x leverage, among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。