Original author: @woonomic, on-chain analyst

Original translation: Rhythm Little Deep

Editor’s note: The fundamentals of Bitcoin have turned bullish, capital inflows are increasing, liquidity is recovering, and it may consolidate or slowly rise in the short term, but the long-term bullish trend is clear. Pullbacks are buying opportunities, with target prices of $103,000 and $108,000.

The following is the original content (reorganized for better readability):

The fundamentals of Bitcoin have turned bullish, creating a favorable situation for breaking historical highs.

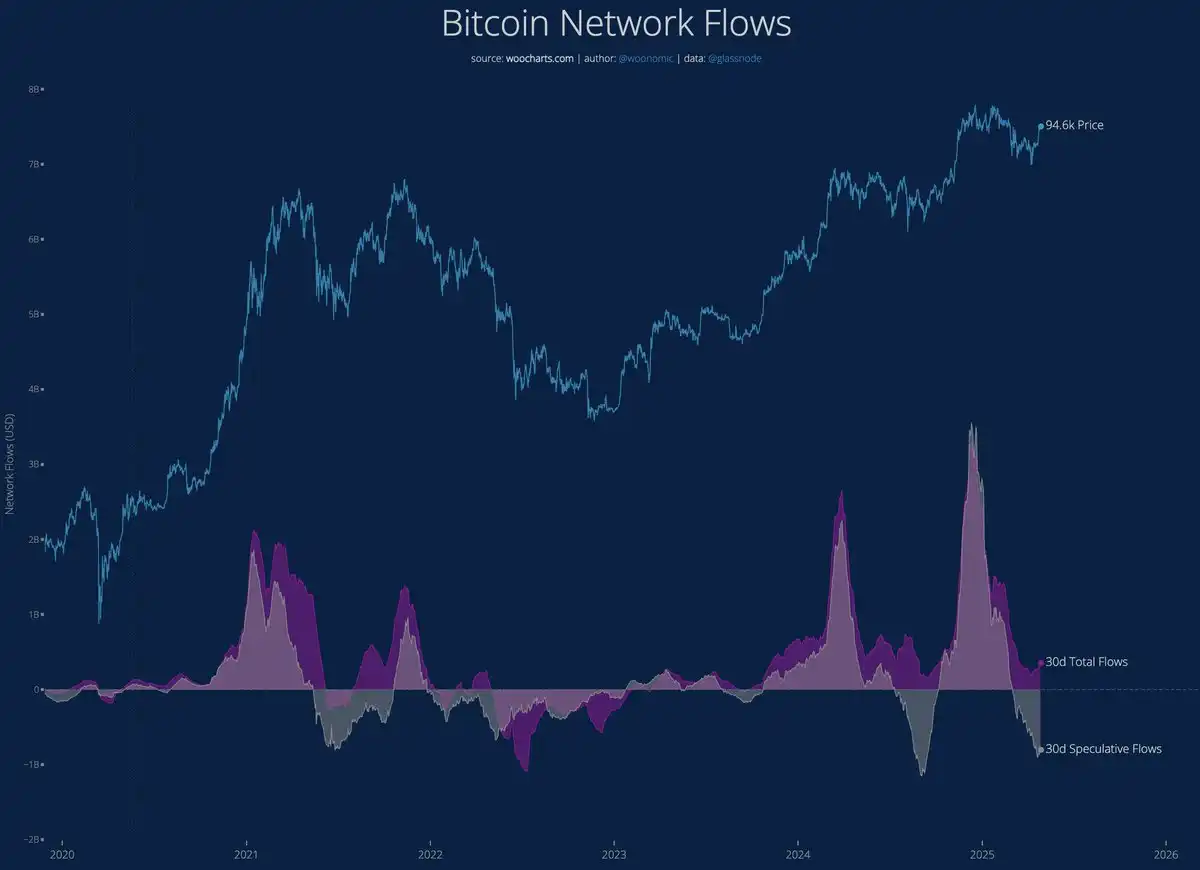

Capital inflows into the network are accelerating.

Total flow and speculative flow have both bottomed out, and when both synchronize, they work together to create a bullish environment based on fundamentals.

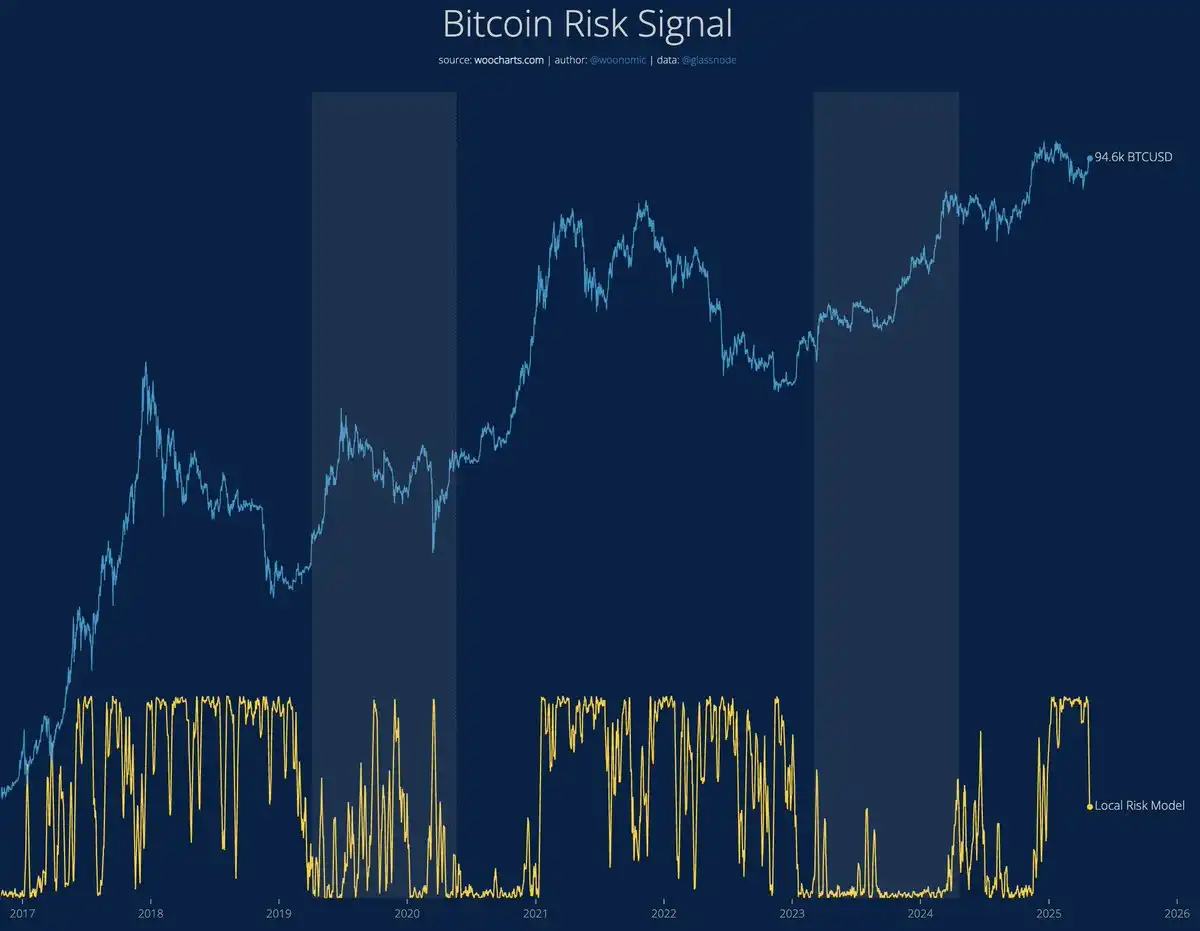

Our risk model has begun to trend downward, indicating that market liquidity has recovered.

In this environment, downward pullbacks will be suppressed.

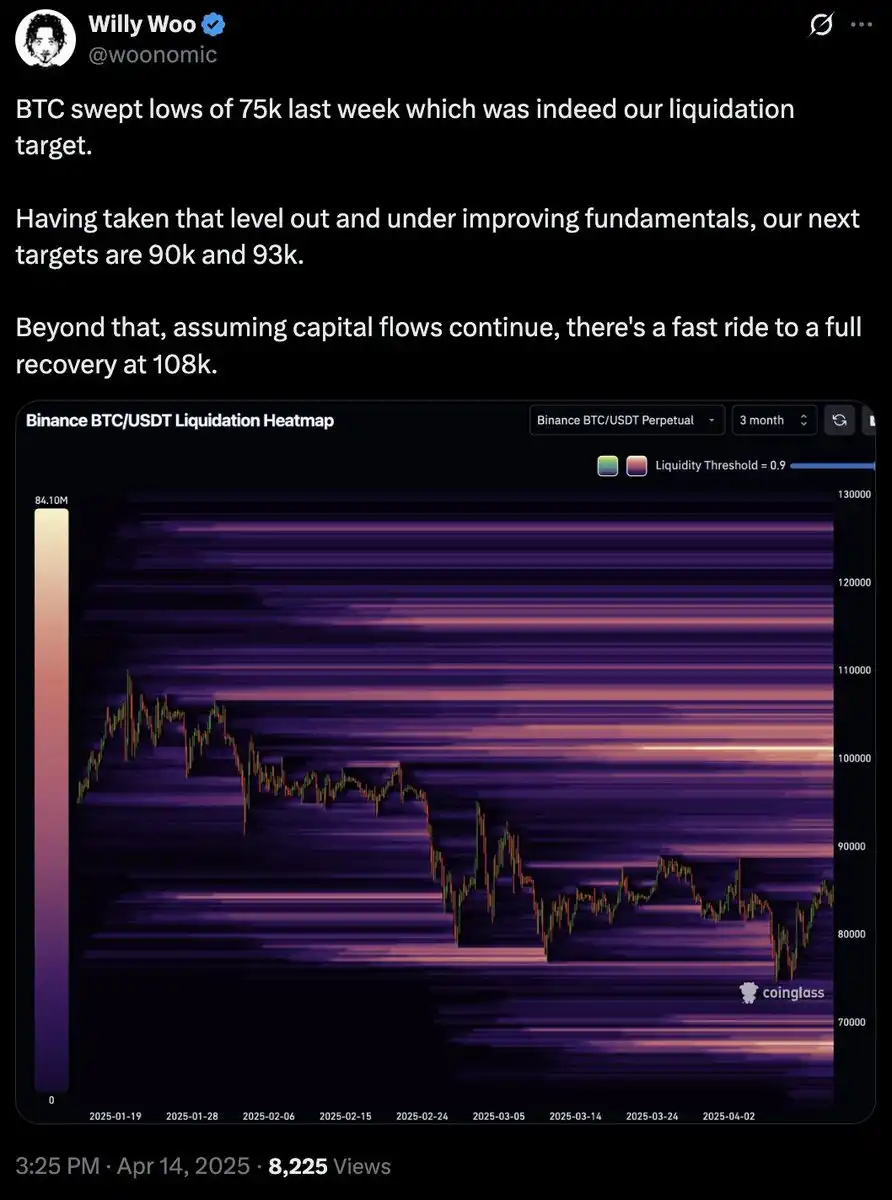

Strategically, our mid-term targets of $90,000 and $93,000 have been surpassed.

The target of $108,000 remains valid, while a new mid-term target of $103,000 is forming.

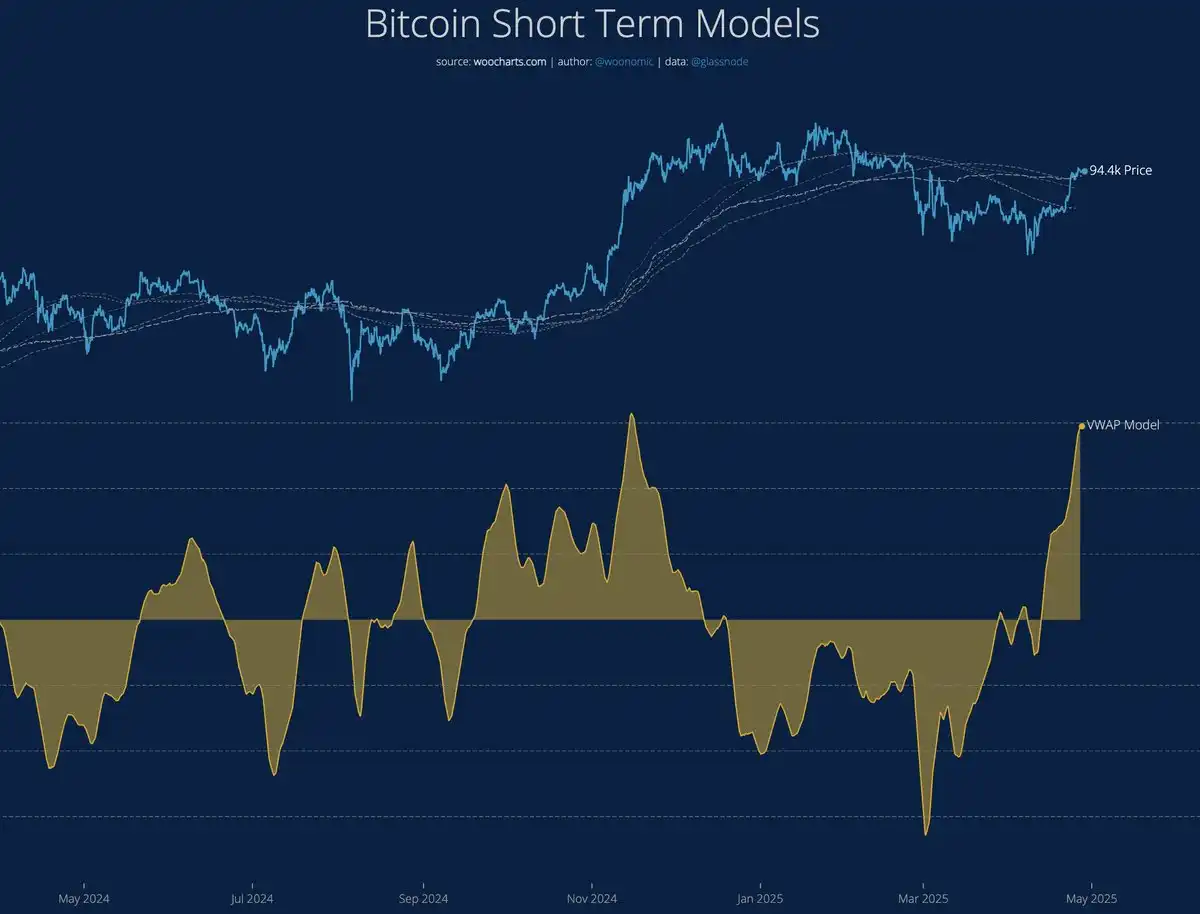

…However, in the short term, the on-chain VWAP (Volume Weighted Average Price) has reached +3 standard deviations, indicating that due to excessive stretching, the upward momentum is difficult to maintain.

The current trend is sideways consolidation, or in the most bullish case, a slow upward climb.

Summary:

If the trend of capital inflows continues, Bitcoin will be ready to break historical highs again. This is a solid long-term layout.

In the current environment, all pullbacks are buying opportunities. In the short term, the likelihood of a pullback is higher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。