1. Bitcoin Market

From April 19 to April 25, 2025, the specific trends of Bitcoin are as follows:

April 19: Bitcoin's price fluctuated relatively steadily, maintaining around $84,450 in the morning session. In the afternoon, it showed a mild upward trend, reaching $85,383 and $85,465, indicating that market sentiment began to shift towards cautious optimism.

April 20: After opening, Bitcoin faced short-term pressure and quickly retraced to $84,744. However, buying gradually strengthened, and the price rebounded to around $85,200, consolidating in this range. In the afternoon, the market weakened slightly, with the price falling back to $84,028, but after finding support at the low, it oscillated back up to $84,623, showing strong buying support in the market.

April 21: Bitcoin continued the rebound momentum from the previous day, stabilizing around $84,540 at the opening, then slightly rising to $85,126. In the afternoon, market sentiment significantly strengthened, and Bitcoin began a rapid rally, breaking through from $85,047 to $87,472, forming a strong breakout pattern in a short period. After a brief consolidation around $87,420, bullish sentiment further released, pushing the price up to $88,353. This strong rise indicates that Bitcoin has officially exited the downward channel of the previous months and has technically entered a new upward cycle. On the macro front, the market is generally focused on the increasingly tense relationship between President Trump and Federal Reserve Chairman Powell, combined with uncertainties regarding the future policy path of the dollar, which has made Bitcoin, as "digital gold," favored for its safe-haven attributes.

April 22: Due to the significant increase in the previous trading day, Bitcoin experienced a technical correction in the morning, falling to a low of $86,696. Subsequently, after receiving buying support at the support level, the price resumed its upward trend, breaking through the key resistance levels of $87,401 and $88,505. In the afternoon, after the market digested the positive news of "Trump announcing a significant reduction in tariffs on China," risk appetite rebounded, and Bitcoin quickly surged from $88,719 to $91,297, successfully breaking through the psychological barrier of $90,000, indicating a tendency for funds to reallocate towards risk assets.

April 23: Bitcoin maintained a high-level range throughout the day. After a brief technical adjustment, the price quickly stabilized at $91,164, then continued a strong rebound, breaking through $92,000 and rising to an intraday high of $93,152. The price then maintained a high-level consolidation, with a steady trend, reaching $93,715 and $94,381. During the midnight period, a quick retracement occurred, dropping to a low of $92,202, but the decline was quickly repaired, showing that market buying support remained strong.

April 24: After the previous night's retracement, Bitcoin regained its upward momentum, rebounding to $94,133 and oscillating narrowly around $93,530. As volatility gradually narrowed, the market direction became clearer, with the price retreating from the high to $91,733, completing a phase of adjustment. The decline then slowed, and buying intervention led to a gradual price recovery, indicating that short-term support had initially stabilized.

April 25: Bitcoin continued the rebound momentum from the previous trading day, still operating within an upward channel. The current trend shows some upward potential, but whether the upward momentum can continue will depend on further increases in trading volume and breakthroughs at key resistance levels.

Summary

This week, Bitcoin's performance was strong, successfully breaking through key resistance levels on the technical front and restarting the upward channel, driven by multiple changes in the macro fundamentals. The market focused on the increasingly tense relationship between President Trump and Federal Reserve Chairman Powell, which intensified uncertainty regarding the future policy path of the dollar, thereby enhancing Bitcoin's appeal as a non-sovereign asset for hedging. Meanwhile, Trump's announcement of a significant reduction in tariffs on China boosted global risk sentiment, leading to a rebound in U.S. stocks and an increase in risk appetite for funds, providing support for further increases in Bitcoin's price. Additionally, existing inflation pressures and the ambiguous outlook for Federal Reserve policy have accelerated the allocation of Bitcoin by institutions and long-term funds to hedge against potential systemic risks.

Overall, Bitcoin has significantly detached from the previous mid-term downward range, and the market structure has shown positive changes. Future trends should focus on whether prices can establish effective support in the high-level area, while the continuity of trading volume and on-chain capital flow will be key indicators to verify the continuation of a new bullish trend.

Bitcoin Price Trends (2025/04/19-2025/04/25)

2. Market Dynamics and Macro Background

Capital Flow

- Continuous outflow from exchanges reflects an increased willingness to hold long-term positions.

In the past 7 days, centralized exchanges (CEX) have seen a total outflow of approximately 10,467.8 BTC, indicating that investors prefer to transfer assets to on-chain or cold wallets. Bitfinex saw an outflow of 3,638.18 BTC; OKX saw an outflow of 5,120.23 BTC. The trend of capital outflow is generally viewed as bullish, indicating reduced selling pressure and increased market bullish expectations.

- Institutional and whale dynamics: Divergence intensifies, large holders continue to build positions.

CME position divergence: Institutions and retail investors have shown significant divergence in the futures market, with asset management institutions' net long positions dropping from $6 billion to $2.5 billion. The net long positions of "other participants" increased to $1.5 billion, a new high for the year, indicating a shift in retail sentiment towards bullish.

The number of whale wallets reached a near four-month high: wallets holding 1,000+ BTC reached 2,107, an increase of over 60 since early March. Bitcoin returned to $87,400 on April 21, marking the first breakthrough of the consolidation range since March 28.

- ETFs continue to attract capital, rapidly warming up fund sentiment.

April 21: Fidelity ETF saw a net inflow of 306 BTC, with total holdings of 194,578 BTC, valued at $17.17 billion. The net inflow for U.S. Bitcoin spot ETFs was $382 million.

April 22: Net inflow of $912 million.

April 23: Net inflow of $917 million.

Technical Indicator Analysis

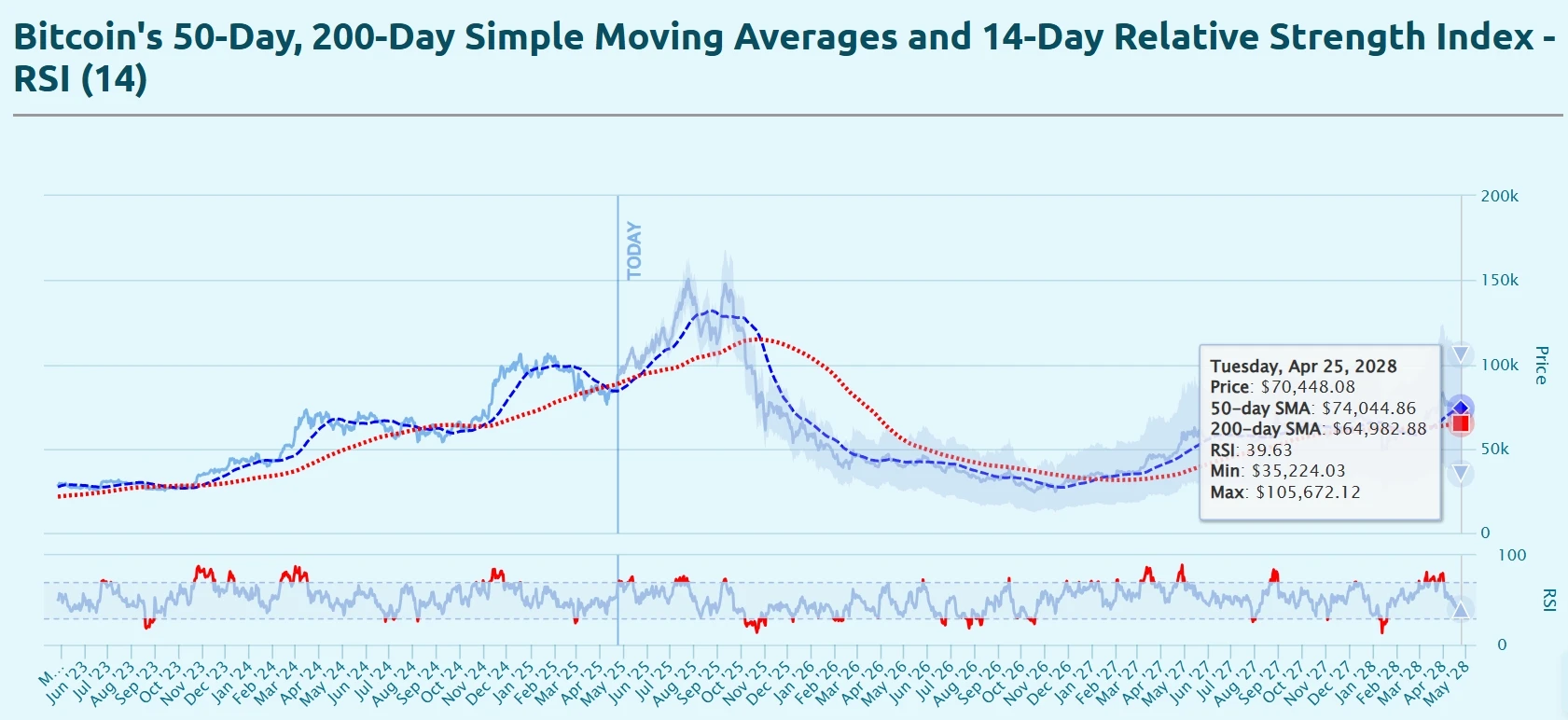

- Relative Strength Index (RSI 14)

As of April 25, Bitcoin's 14-day Relative Strength Index (RSI) was approximately 39.63, in a weak range. This level indicates that short-term buying momentum remains insufficient, and the market has not yet entered an oversold state, but has retreated from previous highs, reflecting a weakening of momentum during the recent price correction after a rapid rise. If the RSI continues to drop to around 30, caution is warranted for a potential short-term technical correction; conversely, if it rises again and breaks above 50, it may provide signal support for the start of a new upward trend.

- Moving Averages (MA)

As of April 25, Bitcoin's key moving averages are as follows:

50-day moving average (MA50): $74,044.86

200-day moving average (MA200): $64,982.88

Currently, Bitcoin's price continues to operate above both MA50 and MA200, indicating that the overall trend remains in a medium to long-term bullish structure. MA50 is significantly above MA200, forming a "golden cross" pattern, which is a typical confirmation signal for a medium-term upward trend. Additionally, as the current price significantly deviates from these two moving averages, attention should be paid to whether there is a need for price correction or whether it will undergo technical consolidation in a range to solidify the foundation for a new upward trend.

RSI 14, 50-day SMA, 200-day SMA data image

- Key Support and Resistance Levels

Support Levels: Current support levels are at $92,000 and $90,000. If Bitcoin's price falls to these levels, it may find support and rebound.

Resistance Levels: Bitcoin's recent upward resistance level is at $94,000. If the price breaks through this resistance level, it may drive further increases.

Market Sentiment Analysis

Price Recovery, Optimistic Sentiment

This week, Bitcoin market sentiment shifted from cautious to optimistic. On April 22, Bitcoin's price broke through the key psychological barrier of $90,000, reaching a high of $90,900, marking an important signal for the market's short-term recovery. Subsequently, on April 23, it broke through $92,000 and $94,000 consecutively, reflecting a clear warming of fund sentiment, with increased buying power pushing prices further up. This round of rebound is closely related to the market's reassessment of safe-haven asset allocations, and is also driven by fluctuations in Federal Reserve policy expectations and macro uncertainties, making Bitcoin once again the focus of capital attention.

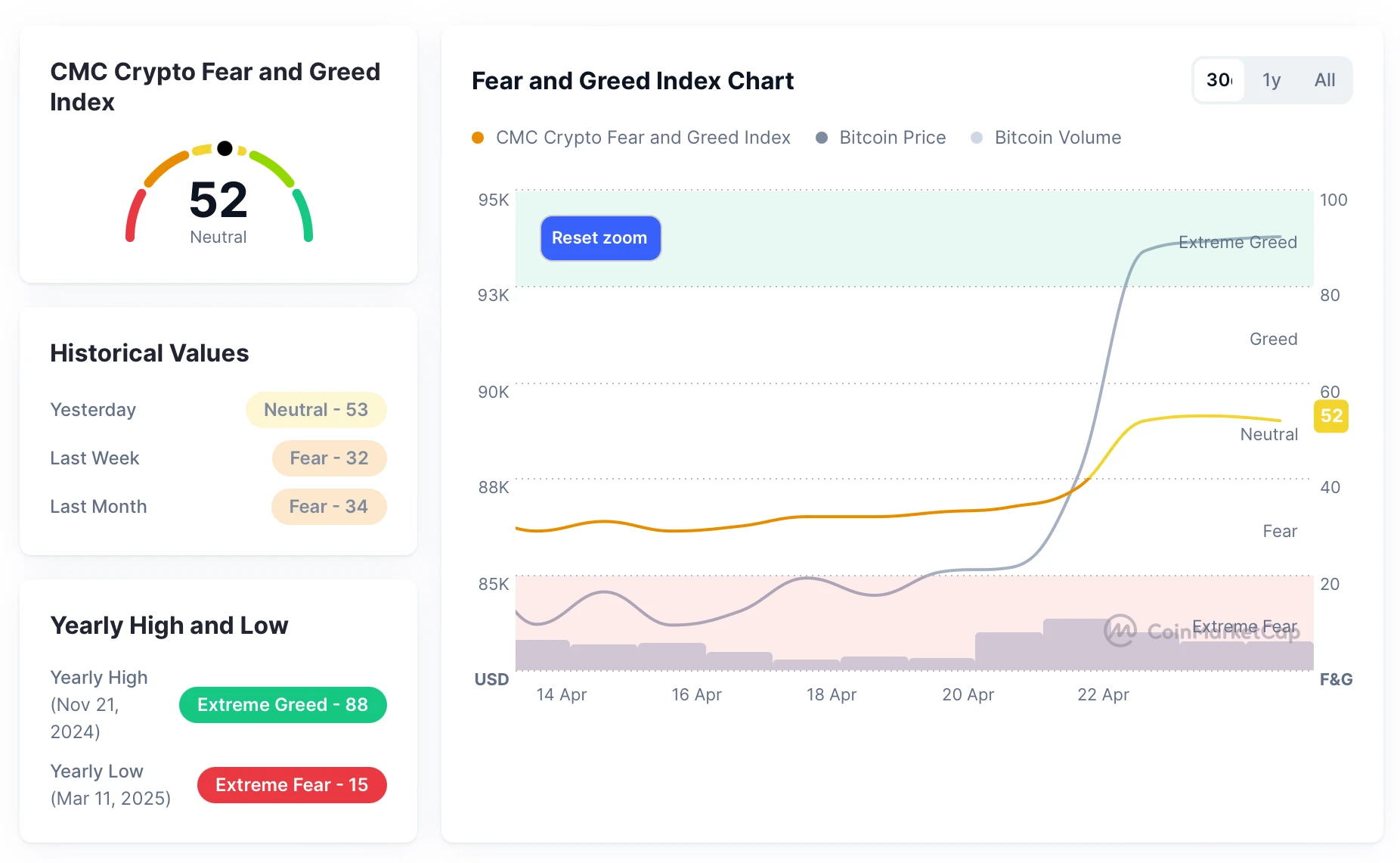

Key Sentiment Indicators (Fear and Greed Index)

According to CoinMarketCap data, as of April 25, the Fear and Greed Index was at 52, in the "neutral" zone, indicating that market sentiment has recovered from previous panic. This week, the index showed a clear upward trend: April 21: 34 (fear); April 22: 38 (edge of fear); April 23: 52 (rapid improvement in sentiment); April 24: 53 (close to the "greed" zone). The continuous rise of the sentiment indicator corroborates the simultaneous strengthening of prices, showing that the market is gradually moving away from pessimistic expectations, and there may be a basis for continued rebound in the short term.

However, the current index has not entered a clearly greedy zone. Although investor sentiment has improved, it remains in a state of cautious optimism, and whether the market can continue to form a sustained upward trend will require further observation of capital momentum and macro news alignment.

Fear and Greed Index data image

Macro Economic Background

1. Controversy Over Federal Reserve Independence

On April 21, President Trump criticized Federal Reserve Chairman Jerome Powell, suggesting the possibility of removing him from office, raising concerns about the independence of the Federal Reserve, leading to a weaker dollar, a drop in the stock market, and a surge in gold prices, as investors flocked to safe-haven assets.

However, on April 23, Trump retracted his threat to dismiss Powell, stating he had no intention of removing him and calling for further interest rate cuts. This move alleviated market concerns about policy intervention, leading to a rebound in the dollar exchange rate and restoring investor confidence.

2. Easing of China-U.S. Trade Relations

On April 23, the Trump administration announced a "substantial" reduction in tariffs on Chinese imports, significantly cutting the previously set 145% tariff. Treasury Secretary Scott Basset stated that the current tariff levels are unsustainable and that the China-U.S. trade conflict is expected to cool down.

This move was interpreted by the market as a positive signal for easing China-U.S. relations, boosting global market sentiment and driving up the prices of risk assets, including Bitcoin.

3. Changes in Hash Rate

During the period from April 19 to April 25, 2025, the Bitcoin network hash rate exhibited fluctuations, as detailed below:

On April 18, the hash rate dropped from 888.05 EH/s to 794.95 EH/s, then quickly rebounded to 907.88 EH/s, but fell back to around 860 EH/s. On April 19, the downward trend from the previous day continued, reaching a low of 748.20 EH/s, after which it gradually oscillated upward, peaking at 986.24 EH/s, followed by several rounds of declines to 814.48 EH/s, 752.16 EH/s, and 692.90 EH/s.

Entering April 21, the hash rate showed a pattern of initial suppression followed by a rise, slightly increasing to 813.43 EH/s during the day and maintaining oscillation around the 800 EH/s mark. By the evening, it rose again, reaching a temporary high of 982.94 EH/s. On April 23, the hash rate exhibited a unilateral downward trend, continuously falling from 971.10 EH/s to 786.62 EH/s, briefly consolidating in that area before further dropping to 690.11 EH/s.

On April 24, the hash rate showed some recovery. The Bitcoin network hash rate first rebounded to 789.24 EH/s, and after a slight pullback, it climbed again to 878.77 EH/s, indicating a gradual recovery in miner sentiment. As of April 25, at the time of writing, the hash rate continued the rebound momentum from the previous day, rising to 882.77 EH/s, suggesting that miners were gradually regaining confidence in Bitcoin's long-term growth.

In summary, this week, the Bitcoin network hash rate exhibited a broad oscillation trend. Although there was a noticeable correction in the mid-term, the short-term recovery indicates that miner confidence is gradually returning, market activity is picking up, and network security is somewhat assured. The dynamics of miners' computing power, especially in relation to price fluctuations, will remain a key factor to watch in the coming weeks.

Bitcoin Network Hash Rate Data

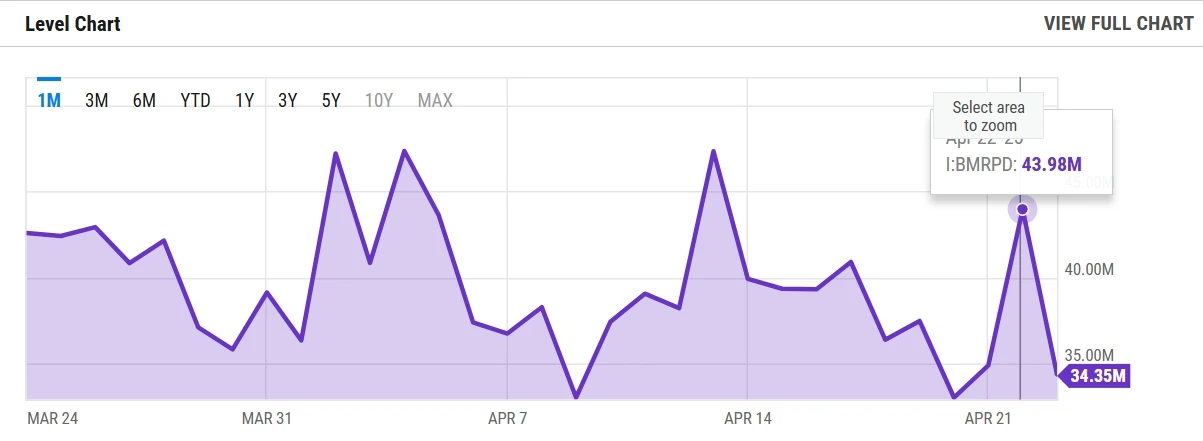

4. Mining Revenue

According to YCharts data, the total daily revenue of Bitcoin miners (including block rewards and transaction fees) for this week is as follows: April 19: $37.46 million; April 20: $33.00 million; April 21: $34.87 million; April 22: $43.98 million; April 23: $34.35 million. From the trend, on April 22, miner revenue briefly surged to $43.98 million, reaching a weekly high, but quickly fell back to $34.35 million on April 23, with a daily decline of 21.9%, indicating increased volatility in miner earnings. Additionally, compared to $65.64 million in the same period of 2024, the total revenue on April 23 declined by 47.7% year-on-year.

In terms of revenue per unit of computing power, the current "hash price" is approximately $48.52 per PH/s, which is at a relatively high level in recent times. This rebound is mainly supported by the recent price rebound of Bitcoin, which is currently hovering around $93,000. However, at the same time, the overall network computing power continues to reach new highs, and the squeezing effect on unit computing power persists, causing small and medium miners to still face operational pressure at the breakeven point, even against the backdrop of rising hash prices.

It is worth noting that some miners who previously chose to "hold and not sell" during the low price of Bitcoin may achieve additional profits by selling their held Bitcoin during this price rebound, thereby alleviating short-term cash flow pressure. Overall, whether miner revenue can achieve sustainable recovery still depends on the continued performance of Bitcoin prices and changes in on-chain transaction activity in the near future.

Daily Revenue Data of Bitcoin Miners

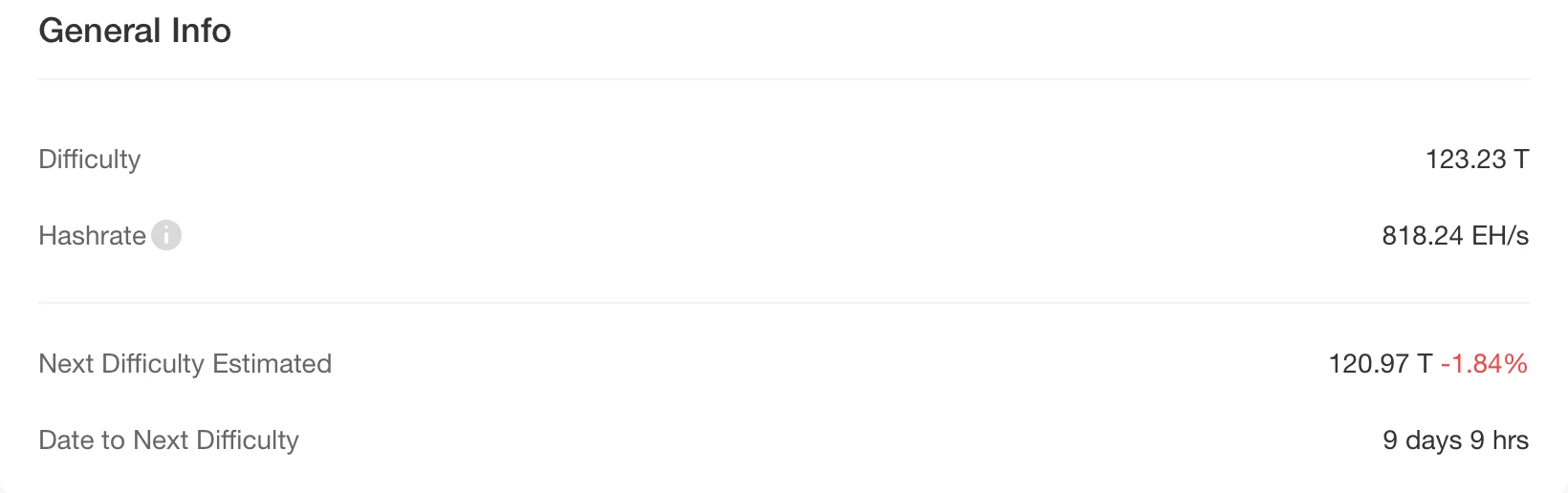

5. Energy Costs and Mining Efficiency

The Bitcoin network completed its latest round of difficulty adjustment on April 19, 2025, at 17:13:37 (block height 893,088), with the difficulty increasing by 1.42% to 123.23T, once again setting a historical peak. As of April 25, 2025, the total network computing power was 818.24 EH/s, while the current total mining difficulty was 123.23T. The next round of difficulty adjustment is expected to occur on May 4, with an anticipated decrease of about 1.84%, bringing the difficulty down to 120.97T. This trend indicates that as network computing power increases and mining efficiency improves, Bitcoin's mining difficulty will continue to undergo fluctuating adjustments, potentially changing miner participation and market computing power distribution.

According to the latest model data from MacroMicro, as of April 23, 2025, the unit production cost of Bitcoin was approximately $96,160.26, while the spot price on that day was $93,699.11, resulting in a Mining Cost-to-Price Ratio of 1.03. Compared to previous phases where costs exceeded prices, this ratio has approached balance with the rebound in Bitcoin prices. This change indicates that miners' profit margins are gradually improving, and profitability is being alleviated with the rebound in market prices, but the overall profit margin remains limited, necessitating continuous attention to price trends and dynamic changes in computing power investment.

Additionally, a report released by TheMinerMag on April 21, 2025, pointed out that due to fluctuations in Bitcoin prices and rising structural costs, the economics of Bitcoin mining deteriorated overall from March to April, with industry profit margins and valuations being squeezed. As Bitcoin prices have recently rebounded, market expectations may bring some improvement to miners' cost structures and profitability, but the overall competitive landscape remains severe.

Bitcoin Mining Difficulty Data

6. Policy and Regulatory News

News Related to Trump:

1. Trump Claims a Deal with China Will Be Reached Within a Month

On April 18, U.S. President Trump stated on April 17 local time that he is confident a deal will be reached between the U.S. and China. He believes both sides will come to an agreement in the next three to four weeks and indicated that if an agreement cannot be reached, goals will be set and adjustments made.

2. Trump: The Cryptocurrency Industry Urgently Needs Clear Regulatory Policies

On April 23, U.S. President Trump stated that the cryptocurrency industry urgently needs clear regulatory policies.

3. Trump: No Intention to Fire Powell, Calls for Fed Rate Cuts

On April 23, Trump stated during the swearing-in ceremony of SEC Chair Gary Gensler that he has no intention of firing Federal Reserve Chairman Powell and called for the Fed to cut interest rates. He expressed disappointment that the Fed has not cut rates faster and stated that now is a perfect time for rate cuts.

4. Trump: Tariffs on China Will Not Reach 145%, Will Be Significantly Reduced but Not Zero

On April 23, Trump stated that tariffs on Chinese goods will not reach 145%, will be significantly reduced, but will not be zero.

News on Bill Progress:

1. Texas House Holds Public Hearing on Bitcoin Reserve Bill SB 21

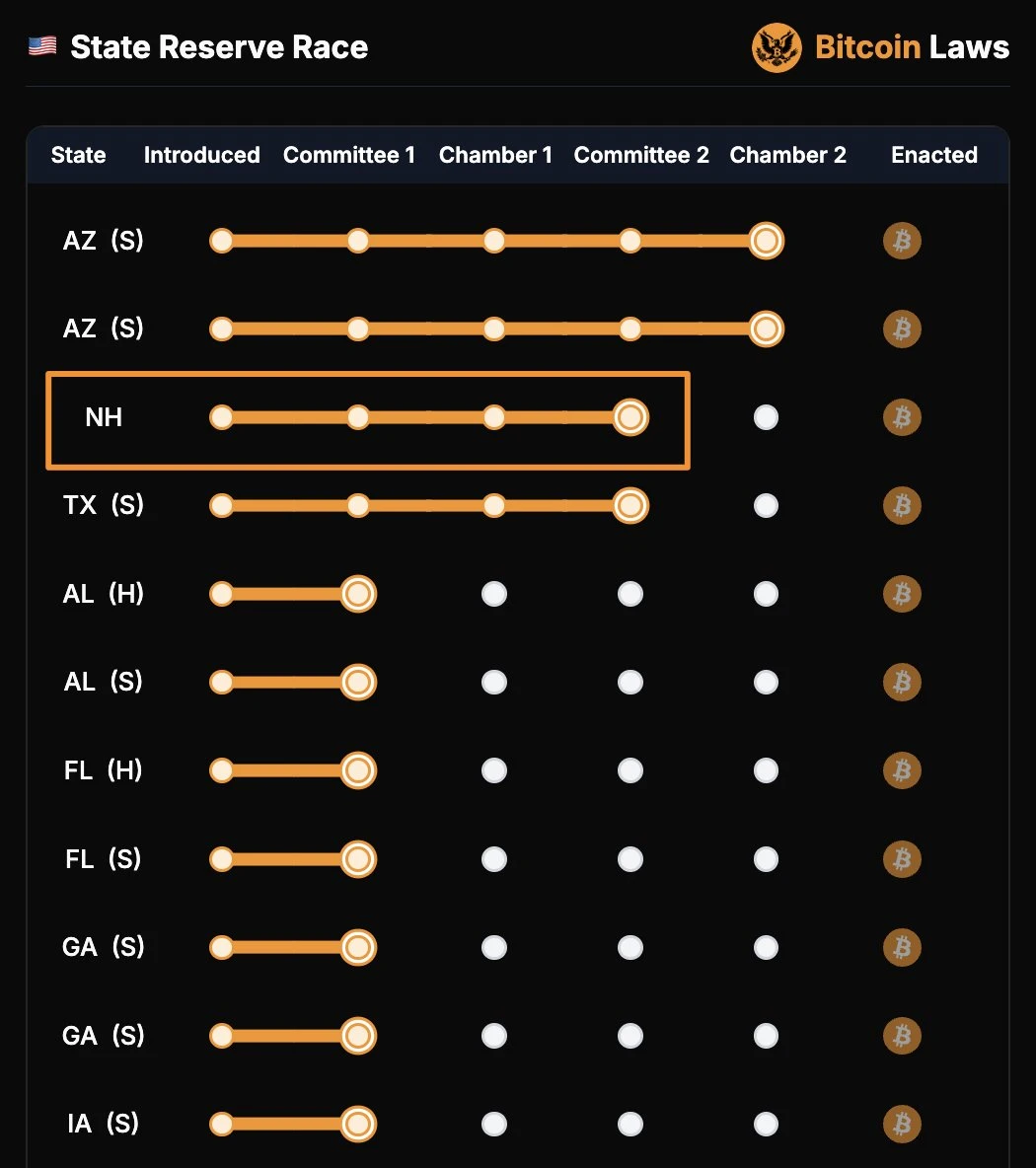

On April 24, the Texas House Government Efficiency and Delivery Committee held a public hearing on the Bitcoin reserve bill SB 21. The current status of the bill is "pending," indicating that the committee has not yet held a final vote.

2. New Hampshire Senate Finance Committee Votes to Pass Bitcoin Reserve Bill

On April 24, New Hampshire's Bitcoin reserve bill HB302 was passed by the Senate Finance Committee with a vote of 4 in favor and 1 against.

Related Images

7. Mining News

UN Report: Illegal Cryptocurrency Mining Becomes a "Powerful Tool" for Transnational Criminal Organizations to Launder Money

On April 21, the United Nations Office on Drugs and Crime (UNODC) reported that Southeast Asian transnational criminal organizations are using illegal cryptocurrency mining, stablecoins, and Telegram black markets to rapidly expand global money laundering and fraud activities, involving billions of dollars and threatening global security.

Los Angeles Police Seize $2.7 Million Worth of Stolen Bitcoin Mining Equipment

On April 23, the Los Angeles Police Department uncovered a theft case, seizing Bitcoin mining equipment worth $2.7 million. Other stolen items included tequila, pet food, and coffee. Two suspects linked to South American criminal organizations were arrested, and the investigation is ongoing, with more arrests likely. The Los Angeles Police Department has not yet disclosed how it will handle the seized Bitcoin mining equipment.

Related Images

8. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

- El Salvador Increases Bitcoin Holdings Again

On April 25, El Salvador added 1 Bitcoin, bringing its total holdings to 6,157.18 Bitcoins, valued at approximately $577 million.

- Strategy Makes a Big Purchase of 6,556 Bitcoins

Strategy purchased 6,556 Bitcoins last week for approximately $555.8 million, now holding a total of 538,200 Bitcoins, making it one of the largest Bitcoin-holding institutions globally.

- BlackRock Acquires Nearly 955 Bitcoins Through ETF

BlackRock increased its holdings by 954.535 Bitcoins through its IBIT fund, valued at approximately $84.18 million, demonstrating a continued bullish stance.

- Financial Giant Fidelity Increases Bitcoin Holdings Worth Over $123 Million, Has Increased for Three Consecutive Days

On April 25, Fidelity added 1,331.15 Bitcoins through its Bitcoin exchange-traded fund FBTC, reaching a value of $123.24 million. Fidelity has increased its Bitcoin holdings for three consecutive days this week, totaling approximately 4,706 Bitcoins.

- Australia's Monochrome Spot Bitcoin ETF Holdings Rise to 343 BTC.

As of April 24, Australia's Monochrome Spot Bitcoin ETF (IBTC) has increased its holdings to 343 Bitcoins, with a total market value of approximately $49.6851 million.

- Multiple Wall Street Institutions Increase Bitcoin Holdings

As Bitcoin prices return to $90,000, large institutions such as Bitwise and ARK Invest have made purchases today, significantly boosting market confidence.

Economist: Bitcoin Could Rise to $138,000 in the Next Three Months

On April 19, Cointelegraph reported that economist Timothy Peterson pointed out in his latest analysis that BTC could rise to $138,000 in the next three months. He believes that the current effective yield of the US High Yield Index is key, which has now exceeded 8%. Based on historical trends, this could likely push Bitcoin's price to between $75,000 and $138,000 within 90 days.

Michael Saylor Emphasizes Bitcoin's Zero Counterparty Risk

On April 20, Michael Saylor, founder of Strategy (formerly MicroStrategy), stated on the X platform that Bitcoin has no counterparty risk and does not rely on companies, countries, creditors, fiat currencies, competitors, or culture, and is even unafraid of chaos.

Related Images

Standard Chartered: Concerns Over Fed Independence Could Push Bitcoin to Historical Highs

On April 22, Standard Chartered analyst Jeff Kendrick stated that if concerns over the Federal Reserve's independence persist, Bitcoin could rise to historical highs. He noted that due to its decentralized ledger, cryptocurrency serves as a hedge against risks in the existing financial system. This was reflected in the risks associated with US Treasury bonds after Trump hinted he might dismiss Fed Chairman Powell due to his desire for rate cuts. Kendrick mentioned that the yield premium for investors buying long-term bonds over short-term bonds has significantly increased, benefiting Bitcoin. According to LSEG data, Bitcoin rose to a six-week high of $90,459. Standard Chartered predicts that Bitcoin's price will reach $200,000 by the end of 2025.

Bitcoin Market Share Once Climbed to 64.67%, Now Retracing to 64.30%

On April 23, TradingView data showed that Bitcoin's market share (BTC.D) briefly climbed to 64.67%, reaching a new high since February 2021, but has now retraced to 64.30%. The high Bitcoin market share indicates a lull in the altcoin market, but it may also suggest that a rebound is imminent.

Historical data shows that when Bitcoin's market share surged above 60% last November, altcoins entered a mini bull market. In both 2019 and 2021, Bitcoin's market share reached over 70%, followed by a significant rally.

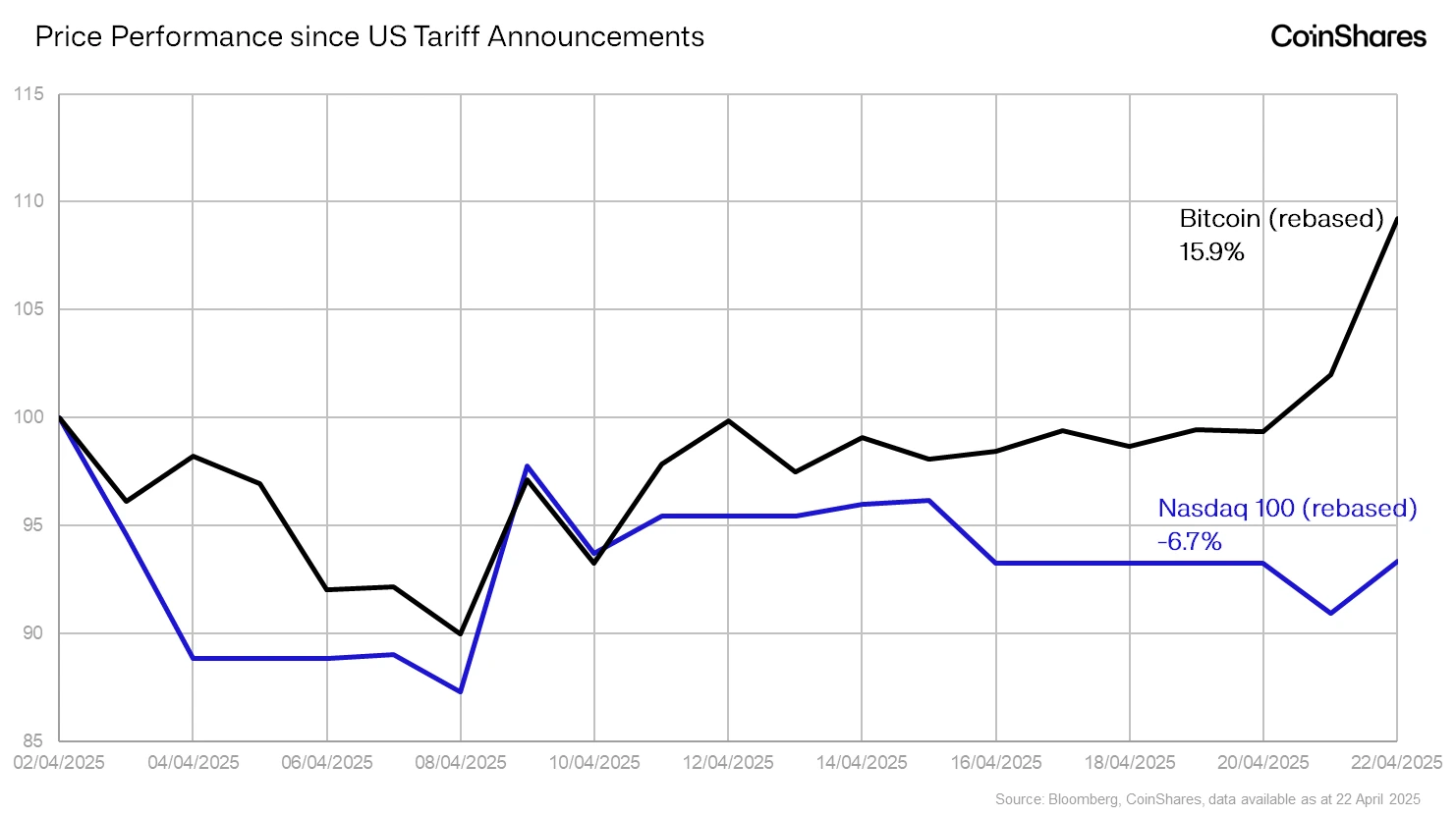

CoinShares Research Director: Bitcoin's Performance Has Outpaced Nasdaq by 15.9% Since US Tariff Announcement

On April 23, CoinShares Research Director James Butterfill stated on the X platform that since the US "Liberation Day" tariff announcement on February 2, Bitcoin's performance has outpaced the Nasdaq 100 index by 15.9%, highlighting its advantages as a decentralized investment asset.

Related Images

Survey: Most Hedge Funds Expect Bitcoin's Dominance to Continue Rising

On April 23, a survey by Crypto Insights Group of 50 hedge funds managing over $5 billion in assets found that 70% of respondents expect Bitcoin's dominance in the crypto market to further strengthen in the next six months, three times that of the same period last year. This trend may delay the arrival of altcoin season. The report identified three main factors driving the rise in Bitcoin's dominance: In the context of increasing macroeconomic uncertainty, Bitcoin has shown strong resilience, attracting more safe-haven funds; the launch of Bitcoin ETFs and the establishment of strategic Bitcoin reserves in the US provide a clearer regulatory framework for institutional investors; and the poor performance of most altcoins has led investors to prefer Bitcoin, which has higher liquidity and lower risk.

Nevertheless, Crypto Insights Group CEO Andy Martinez stated that altcoin season has not completely ended, and funds are shifting towards projects with actual revenue, transparent finances, and reasonable token issuance plans.

Coinbase Executive: Sovereign Wealth Funds Are Accumulating Bitcoin in Large Quantities

On April 24, John D'Agostino, head of strategy for Coinbase's institutional division, stated that in April 2025, sovereign wealth funds and other institutions are accumulating Bitcoin in large quantities, while retail investors are exiting the market through ETFs and spot trading.

In a recent interview, this Coinbase executive compared Bitcoin to gold and noted that many institutional investors are buying Bitcoin to hedge against currency inflation and macroeconomic uncertainty.

The executive stated, "Bitcoin's trading is based on its core characteristics, which are similar to gold, possessing scarcity, immutability, and the portability of a non-sovereign asset. Therefore, its trading is exactly how those who believe in Bitcoin hope it will be traded."

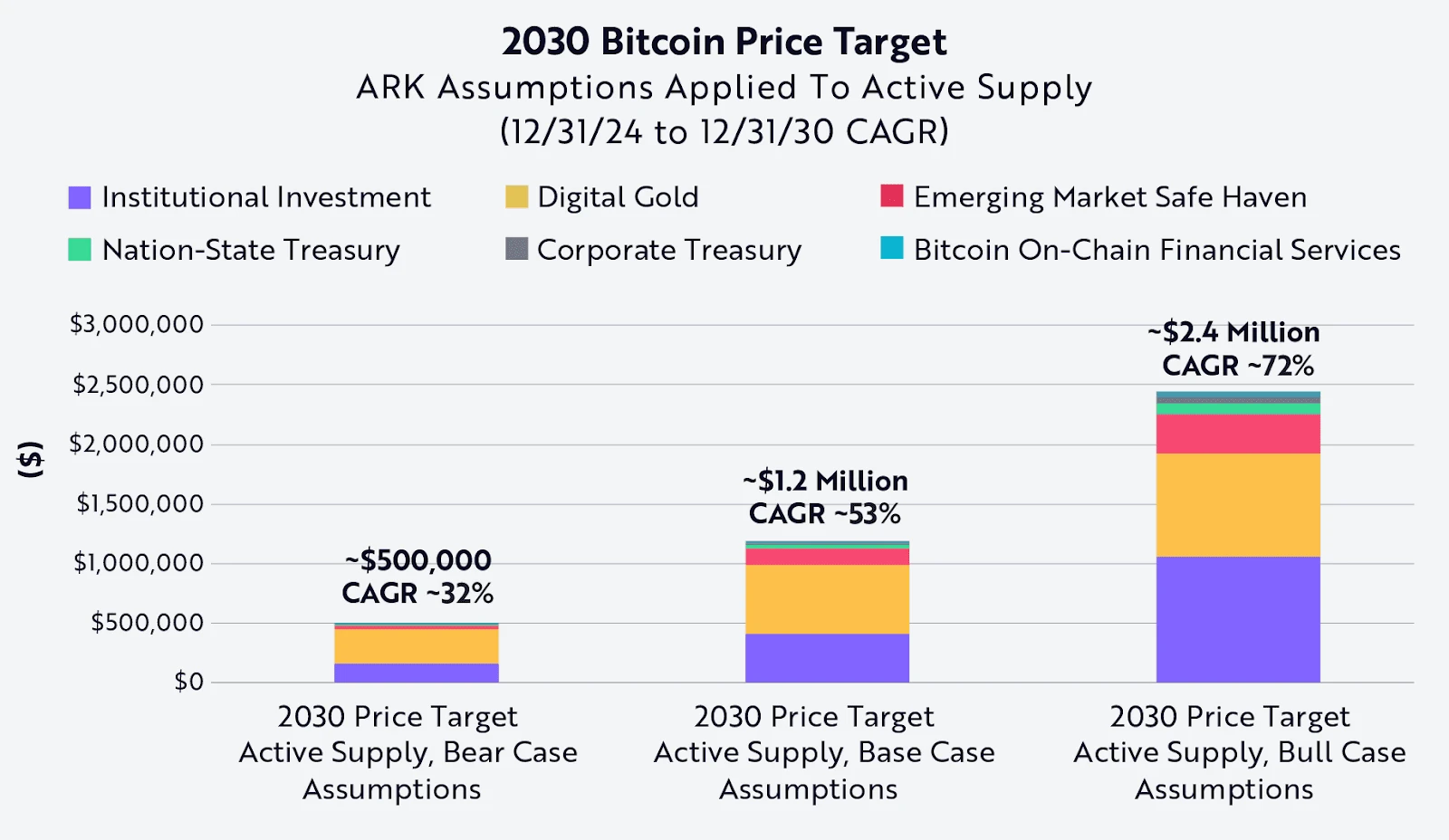

ARK Raises 2030 Bitcoin Bull Market Forecast to $2.4 Million, Citing Institutional Investment as the Main Reason

On April 25, ARK Invest raised its price target for Bitcoin in a bull market scenario for 2030 to approximately $2.4 million, with a base scenario of $1.2 million and a bear market scenario of $500,000. The report stated, "Institutional investment contributes the most to the bull market scenario." ARK noted that Bitcoin is increasingly accepted as "a more flexible and transparent means of value storage."

Related Images

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。