Source: Cointelegraph

Original: “Solana (SOL) Eco Lending Protocol Loopscale Suspends Services After $5.8 Million Hack”

The Solana (SOL) decentralized finance (DeFi) protocol Loopscale has temporarily suspended its lending market services after suffering a vulnerability attack worth approximately $5.8 million.

On April 26, hackers stole about 5.7 million USDC and 1,200 Solana from the lending protocol through “a series of under-collateralized loans,” said Loopscale co-founder Mary Gooneratne on the X platform.

In a statement on the X platform on April 26, Loopscale announced that it has “reopened loan repayments, fund additions, and cycle termination functions,” but “all other application functions (including treasury withdrawals) remain temporarily restricted to allow us to investigate and ensure the vulnerability is controlled.”

Gooneratne further explained that the attack only affected Loopscale's USDC and SOL treasury, with losses accounting for about 12% of the protocol's total value locked (TVL).

“Our team is fully committed to investigating, recovering funds, and ensuring user rights,” Gooneratne emphasized.

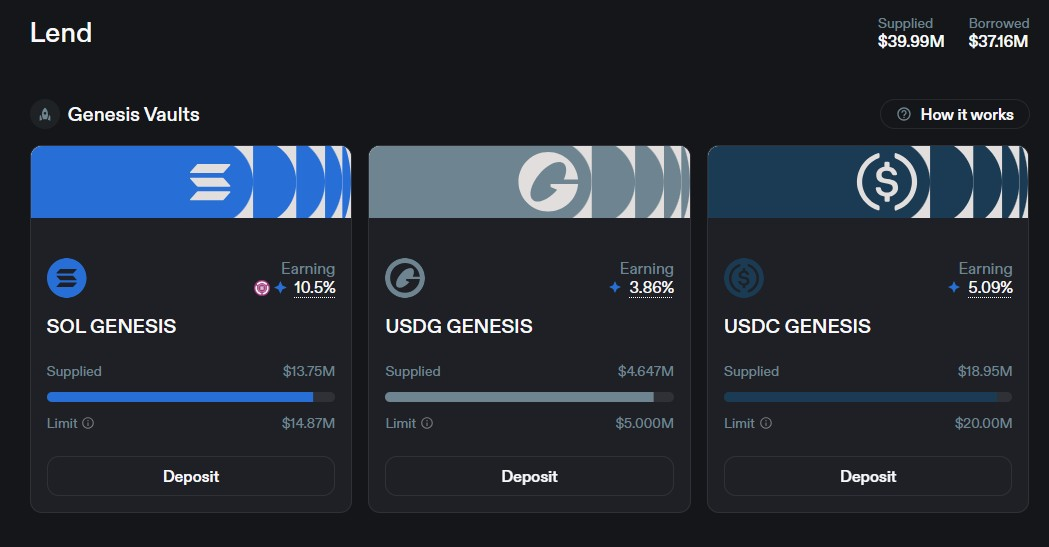

Image: Loopscale's ‘Genesis’ lending treasury Source: Loopscale

Blockchain security company PeckShield reported in April that hackers stole over $1.6 billion worth of cryptocurrency from exchanges and on-chain smart contracts in the first quarter of 2025.

More than 90% of the losses stemmed from a $1.5 billion attack by the North Korean hacker group Lazarus on the centralized exchange ByBit.

Innovative DeFi Lending Model

After six months of closed testing, Loopscale officially launched on April 10. The protocol enhances capital efficiency by directly matching borrowers and lenders and supports specialized lending markets such as "structured credit, accounts receivable financing, and under-collateralized loans" (according to an April announcement provided by Loopscale to Cointelegraph).

Its order book model distinguishes it from DeFi lending platforms like Aave that use liquidity pool aggregation.

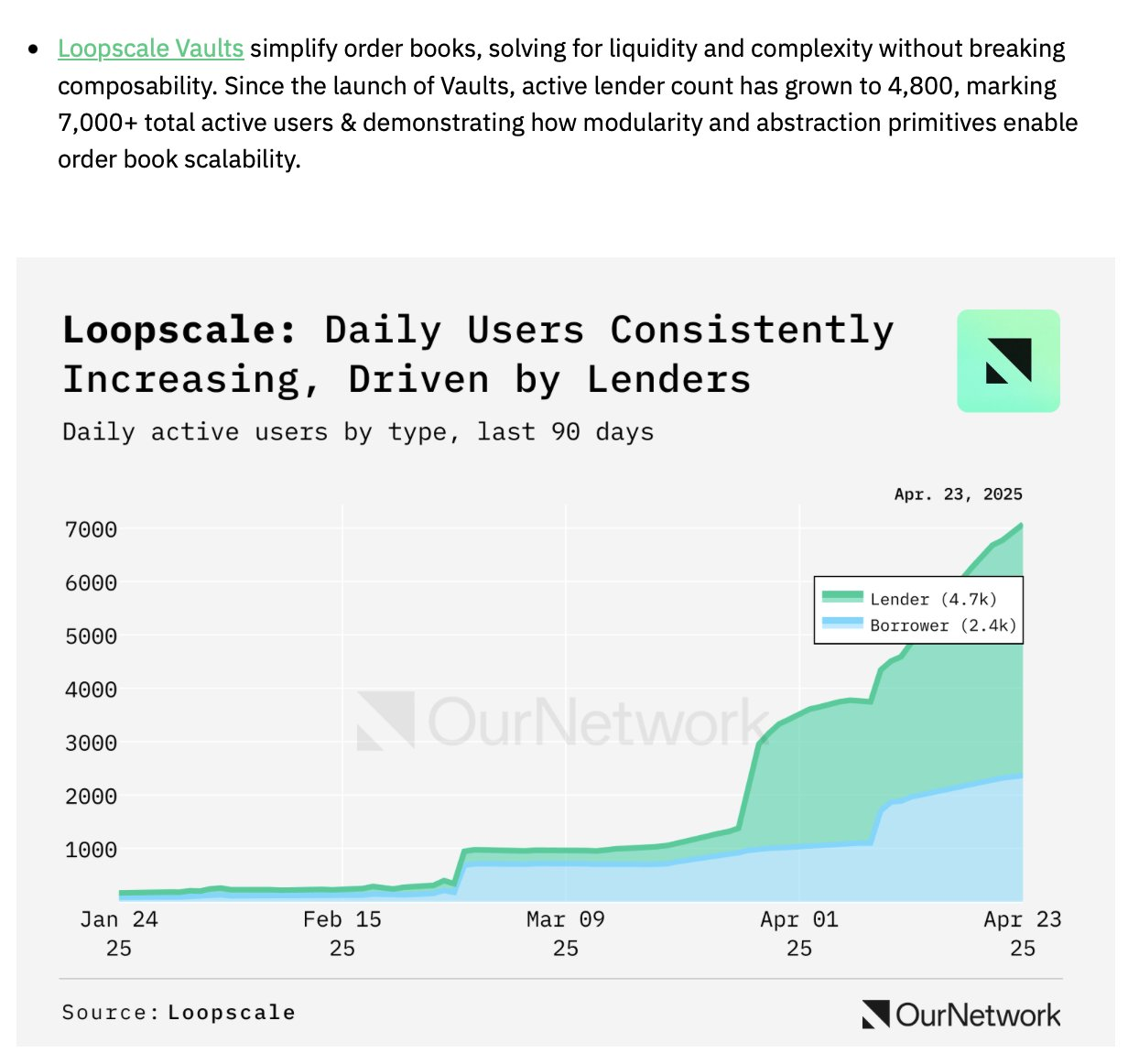

Image: Loopscale daily active users Source: Mary Gooneratne

Loopscale's main USDC and SOL treasuries have annualized yields exceeding 5% and 10%, respectively, while also supporting lending markets for tokens like JitoSOL and BONK (BONK), as well as cyclical strategies for over 40 token pairs.

According to data from research firm OurNetwork, the protocol's TVL is approximately $40 million, having attracted over 7,000 lenders.

Related Articles: DeFi Development Corp Increases Holdings of $11.5 Million in Solana (SOL), Stock Rises 12%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。