Core Points

– Practical value drives growth: Projects that can provide real solutions, such as the launch platform features of DLC or the integration applications of FUNToken in the iGaming sector, have successfully outperformed meme coins that rely solely on trending topics, thanks to the combination of practicality and vision.

– Exposure brings momentum: The extensive discussions on exchanges and social media are key factors in driving trading volume growth and attracting investor attention. BANANAS31 and UPCX are typical representatives.

– The power of community and transparency mechanisms cannot be ignored: Projects like UPCX maintained information transparency and quick responses during crises, gaining strong community support and ultimately achieving counter-cyclical growth.

– Institutional funds are entering the market: This round of market capitalization increase is not solely driven by retail investors; more institutional investors and professional funds are beginning to pay attention to these projects, indicating that the crypto market is gradually moving away from emotional speculation towards a more rational and mature development stage.

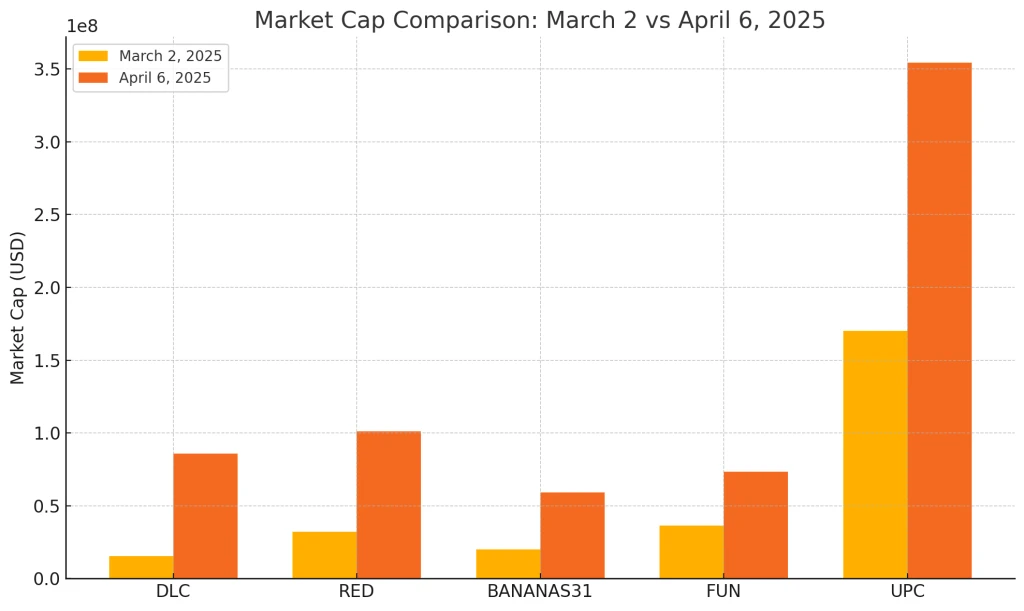

In April 2025, the global cryptocurrency market capitalization rankings underwent dramatic changes. Despite significant declines in mainstream coins like Bitcoin and Ethereum, some previously smaller crypto projects rose against the trend, breaking the overall market slump. Against the backdrop of trade frictions and increasing macroeconomic uncertainties, these rising tokens achieved market capitalization growth of 100%–450%, quickly attracting the attention of retail and institutional investors.

This article will focus on analyzing five tokens that performed exceptionally well on the market capitalization list: Diamond Launch (DLC), RedStone (RED/USDT), Banana For Scale (BANANAS31/USDT), FUNToken (FUN/USDT), and UPCX (UPC).

Table of Contents

Market Capitalization Comparison Overview

Explosive Rising Stars – Diamond Launch (DLC) – RedStone (RED) – Banana For Scale (BANANAS31) – FUNToken (FUN) – UPCX (UPC)

Research Methodology

We adopted a data-driven approach to filter these market capitalization dark horses. The team reviewed market capitalization snapshots from aggregation platforms like CoinMarketCap from March 2 to April 6, 2025, focusing on projects with consistent codes, no frequent name changes, and initial market capitalizations that were not too low to avoid percentage distortion. The final list was narrowed down to tokens that possess "high growth × sufficient liquidity × high community activity."

Market Capitalization Comparison Overview

(Data coverage period: early March to early April)

Diamond Launch (DLC)

Quick Metrics

– Market Capitalization: $16 million → $85 million (+450% growth)

Image Credit: Diamond Launch Official Website

Recently rebranded to divergeloop

Project Overview

Diamond Launch (DLC) aims to lower the entry barrier for early investments, allowing ordinary investors to participate in new project token presales without the need for VC endorsements. It is a cross-chain launchpad, with the core selling point being easier access to initial shares and more transparent processes.

Diamond Launch Market Capitalization Performance

DLC's market capitalization surged from $16 million to $85 million, an increase of 450%. The continuously expanding trading volume indicates that the market is not merely a short-term speculation but has genuinely formed a bullish consensus.

Image Credit: CoinMarketCap

Growth Drivers

– Launchpad blockbuster effect: Multiple successful launches of popular tokens have attracted attention.

– Expansion plans: The official announcement of support for new public chains like zkSync and Base has driven market expectations.

– Community activity: With the "fair participation" concept, the number of followers on Telegram and X (Twitter) has surged.

Risks and Challenges

– Intensifying competition: The launchpad space is crowded, and maintaining a lead requires continuous iteration.

– Compliance pressure: Early token sales are easily monitored by regulators in various countries, and policy risks need attention.

Investor Sentiment

The atmosphere in the DLC community is generally bullish, with many investors viewing DLC as a "ticket" to capture the next batch of potential projects, especially appreciating its fair and open model.

RedStone (RED/USDT)

Quick Metrics – Market Capitalization: $32 million → $100 million (+212%)

Image Credit: Red Stone Official Website

Project Overview

RedStone (RED) adopts a new oracle approach, pulling off-chain data onto the chain only when a request is initiated by a smart contract. This on-demand pull model effectively reduces costs and enhances the efficiency of multi-chain development.

RedStone Market Capitalization Performance

In just one month, RedStone's market capitalization skyrocketed from $32 million to nearly $100 million, with a growth rate of 212%, indicating significant market enthusiasm.

Image Credit: CoinMarketCap

Growth Drivers

– DRILL Program: A large staking reward campaign initiated by the official team, airdropping RED tokens to early supporters.

– Multi-chain Deployment: Developers have deployed the RedStone oracle on mainstream public chains like Ethereum and Arbitrum.

– Technical Flexibility: The modular architecture meets project parties' demands for a "fast and customizable" oracle.

Risks and Challenges

– Intense Oracle Competition: Established platforms like Chainlink have ample funding and deep ecosystems.

– Sustained Adoption: Continuous developer interest is necessary for ongoing growth.

Investor Sentiment

Developers generally view RedStone as a more cost-effective choice, and the market atmosphere is optimistic; high trading volumes indicate that both builders and speculative funds are actively entering the market.

Banana For Scale (BANANAS31/USDT)

Quick Metrics

– Market Capitalization: $19.9 million → $59 million (+198% growth)

Image Credit: Banana For Scale Official Website

Project Overview

BANANAS31 pays homage to the classic meme "banana for scale," finding a balance between humor and practicality. The project aims to build a community-driven and fun ecosystem while venturing into the DeFi and NFT sectors.

Banana For Scale Market Capitalization Performance

The market capitalization surged from $19.9 million to over $59 million, nearly tripling. Although positioned as a meme coin, its continuous rise indicates it is not just a fleeting hype.

Image Credit: CoinMarketCap

Growth Drivers

– Exchange Listings: Binance, MEXC, XT.COM, and several smaller platforms have listed the token, injecting liquidity.

– Meme Culture Spread: Viral content on social media and discussions on Reddit have attracted a large number of new users and funds.

– Expansion Plans: Ongoing rumors about NFT collaborations and staking features continue to raise market expectations.

Risks and Challenges

– Meme Coin Volatility: If community enthusiasm wanes, sentiment may quickly turn negative.

– Practicality Requirements: Relying solely on memes is insufficient; the project needs functional implementations to retain users.

Investor Sentiment

The "Banana Legion" of BANANAS31 is highly enthusiastic, with investors comparing it to historically successful meme coins. The continued rise in social media attention indicates that market speculation is far from over.

FUNToken (FUN/USDT)

Quick Metrics

– Market Capitalization: $36 million → $73 million (+103% growth)

Image Credit: FunToken Official Website

Project Overview

FUNToken (FUN) initially served the iGaming sector, aiming to provide greater transparency and faster settlement speeds for online gambling and gaming. With short transaction confirmation times and an expanding ecosystem, it has recently made a mark in the DeFi space.

FUNToken Market Capitalization Performance

FUN's market capitalization steadily rose from $36 million to over $73 million, an increase of 103%. The trading volume has also expanded, with new collaborations and application scenarios laying the groundwork for future growth.

Image Credit: CoinMarketCap

Growth Drivers

– XFUN Wallet: A multi-chain wallet that supports gas-free transactions, lowering the entry barrier for users.

– Expansion of Online Gaming Scenarios: An increasing number of gaming platforms accept FUN for betting and purchasing in-game items.

– DeFi Cross-Industry Collaborations: Partnerships with multiple DeFi protocols further broaden FUN's usage scope.

Risks and Challenges

– Compliance Pressure: Gambling projects face additional regulation in many jurisdictions.

– Increased Competition: There are numerous gaming tokens, and market share still needs to be continuously contested.

Investor Sentiment

The crypto community and gaming enthusiasts generally view FUN as a promising project. Stable daily trading volumes indicate that the market holds an optimistic outlook on its long-term development prospects.

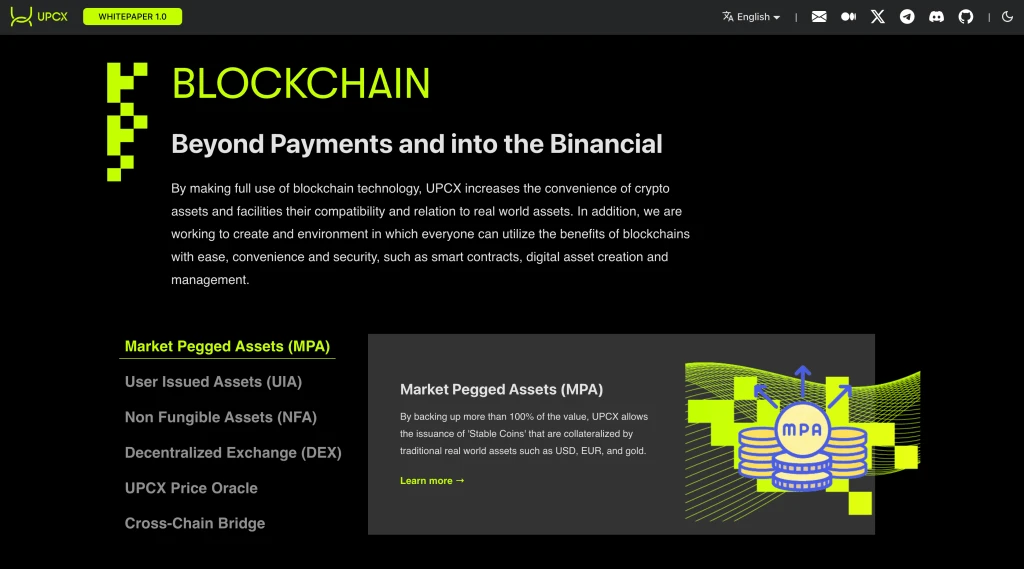

UPCX (UPC)

Quick Metrics

– Market Capitalization: $170 million → $354 million (+108% growth)

Image Credit: UPCX Official Website

Project Overview

UPCX positions itself as a global digital payment solution, integrating smart contract functionality and convenient merchant gateways for retailers and financial institutions. Its emphasis on compliance and scalability allows it to stand out in the crowded payment space.

Market Capitalization Performance

UPCX's market capitalization doubled from $170 million to $354 million. Even after a $70 million security breach in early April, the token price remained upward, demonstrating strong resilience.

Image Credit: CoinMarketCap

Growth Drivers

– Exchange Listings: Platforms like MEXC and Bitget have listed UPCX, enhancing its exposure and liquidity.

– Payment Tool Implementation: Newly launched merchant tools and wallet integrations have expanded real-world use cases.

– Response to Security Incidents: After the hacking incident, the team quickly mitigated losses and communicated transparently, stabilizing investor confidence.

Risks and Challenges

– Security Pressure: Payment projects must prove their network security.

– Compliance Challenges: Cross-border payments involve multi-national regulations, and compliance processes are complex, requiring ongoing investment.

Investor Sentiment

"Resilience" has become the keyword. Despite facing a hacking attack, the UPCX community remains united, with significant funds continuing to flow in. Many investors view UPCX as a long-term opportunity in the blockchain payment sector.

Insights and Trends

Reviewing the cryptocurrencies that performed outstandingly in April market capitalization, the following commonalities can be observed:

Practicality and Usability

Tokens that can solve real problems and enhance user experience (such as FUNToken's XFUN Wallet and RedStone's oracle solution) quickly capture the market.

Exposure and Liquidity

New exchange listings (BANANAS31, UPCX) or large-scale marketing promotions can directly translate into higher trading volumes and market capitalizations.

Resilience in Adversity

UPCX demonstrates that transparent communication and quick loss mitigation during crises can stabilize or even enhance investor confidence. In the highly volatile crypto market, transparency is a hard currency.

Institutional Funds Flowing In

High-net-worth individuals and hedge funds (such as Brevan Howard) are increasingly participating, indicating that market capitalization is no longer an exclusive indicator for retail investors. Projects with practical implementations and solid fundamentals are more likely to attract large capital.

Macro Tailwinds

Concerns about inflation and regulatory evolution are prompting both institutions and retail investors to allocate digital assets, leading to an overall increase in market participation.

Future Outlook

– Diamond Launch (DLC): Soon to support new public chains like zkSync and Base, potentially further expanding its user base.

– RedStone (RED/USDT): New chain integrations and developer incentive programs are expected to continue expanding the ecosystem.

– Banana For Scale (BANANAS31/USDT): Attention on NFT collaboration rumors may reignite the meme market.

– FUNToken (FUN/USDT): Broader iGaming adoption and DeFi collaborations will help solidify its dual market position.

– UPCX (UPC): Security upgrades and merchant tool implementations following the hacking incident will be key drivers in attracting new users and institutions.

Conclusion

The performance in April 2025 reaffirms that when emerging projects have solid fundamentals and are supported by precise execution, the landscape of crypto market capitalization can change dramatically. From the momentum of DLC's Launchpad, RED's modular oracle, to FUNToken's real applications in the iGaming space, these tokens stand out through user-oriented practical innovations.

Even meme coins like BANANAS31 can achieve unexpected growth with strategic launches and community enthusiasm.

Meanwhile, UPCX's experience reminds us that in the fast-paced crypto industry, crisis response capabilities are as important as product development. Projects that are adaptable and communicate transparently tend to gain more market trust.

Ultimately, these five soaring crypto market capitalization tokens convey a core message: real, implementable applications, resilient community strength, and smart ecological collaborations remain the unchanging core of success in the crypto field.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality coins and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and contract trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

Disclaimer: Cryptocurrency investment involves high volatility and risk. The content of this article is for reference only and does not constitute investment advice. Please be sure to conduct your own research and consult professionals before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。