"PUA" veteran Zora has finally launched its token, but the community users who have been waiting for a long time did not get the "big result" they hoped for. Upon opening their wallets, they only saw a reward that couldn't even cover the Gas fees, let alone the token itself being completely useless. The community's sentiment has completely "broken down."

Author: Nancy, PANews

"PUA" veteran Zora has finally launched its token, but the community users who have been waiting for a long time did not get the "big result" they hoped for. Upon opening their wallets, they only saw a reward that couldn't even cover the Gas fees, let alone the token itself being completely useless. In an instant, the community's sentiment has completely "broken down." The on-chain reputation protocol Ethos unexpectedly became an outlet for users to vent their dissatisfaction, and Zora's "crash site" has been permanently recorded on-chain, becoming a mark of trust collapse.

Airdrop "slaps" early users in the face, token distribution accused of betraying the community

Last month, Zora announced the upcoming launch of its native token ZORA, raising the community's expectations that had been building for years. On the eve of the token launch, Base's official account released multiple tweets to hype Zora, successfully capturing attention, with various memes circulating and multiple metrics skyrocketing.

However, this airdrop ultimately turned into a "century crash" that left many disappointed. On April 23, Zora opened the airdrop claim, stating that this airdrop would distribute 1 billion ZORA tokens to 2,415,024 addresses. Most of the airdrop tokens were based on the first snapshot distribution (from January 1, 2020, 8:00 to March 3, 2025, 22:00), while the second snapshot distribution accounted for a smaller proportion (from March 3, 2025, 22:00 to April 20, 2025, 8:00), and included the Coins activity on Zora's latest protocol. The specific distribution amounts were calculated based on user activity on Zora and overall participation in the current protocol and its previous versions, including but not limited to minting, trading, and referrals.

At the same time, the ZORA token was listed on Binance Alpha, and eligible users would receive 4,276 ZORA tokens as an airdrop. However, the results of this airdrop left many long-term participants in the Zora ecosystem feeling angry, as they received only a small amount of tokens, insufficient even to cover Gas fees.

In contrast, recent speculators and Binance Alpha users easily divided a large number of tokens among themselves. This severely imbalanced distribution method not only sparked widespread anger in the community but was also seen as a betrayal of early supporters. Even more frustrating for the community was that the Zora airdrop snapshot was divided into two parts, yet the specific distribution criteria were never made public, leading to a lack of transparency throughout the process.

Moreover, Zora faced strong skepticism from the community due to its highly concentrated and opaque distribution ratio. According to the token economic model disclosed by ZORA, community airdrops accounted for only 10%, while the team, treasury, and strategic contributors received as much as 65%, with only a 6-month lock-up period before unlocking could begin, and the specific unlocking schedule was also not detailed.

Additionally, Zora's official statement indicated that the ZORA token is merely a "just for fun" MEME coin, not carrying any technical or governance functions, primarily used for community rewards and ecological incentives. This positioning raised a series of questions from the community: since the token has no substantial use, why does the team still need to occupy such a high proportion? What basis does the community have to believe that ZORA possesses long-term value?

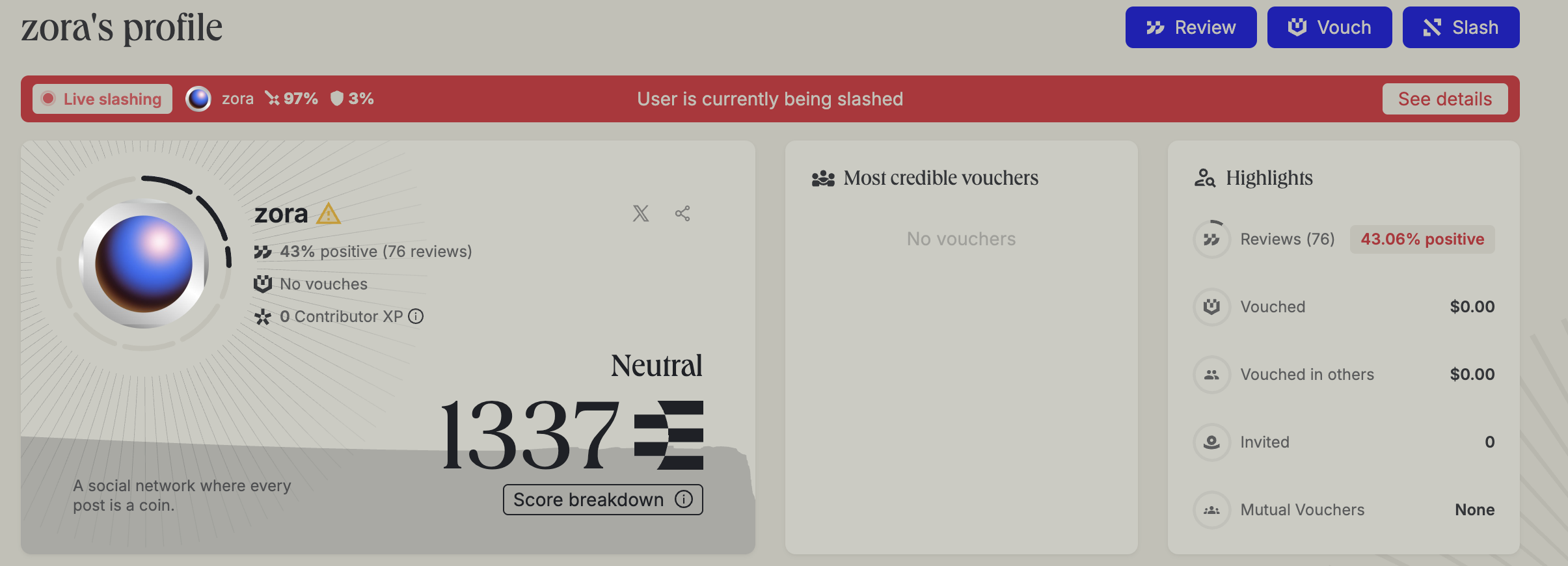

Amidst multiple layers of disappointment, Ethos's negative review feature was seen as a channel for emotional expression, with community users leaving "negative reviews," causing Zora's credibility score to plummet. Many users stated, "On-chain records are immutable; malicious projects must be recorded in history."

Airdrop progress halfway, user claim rate below 20%, average only $37

From a price performance perspective, Binance data shows that after ZORA was launched, it briefly surged to $0.0466, but the next day it dropped to a low of $0.0172, with a maximum decline of nearly 63%, and market enthusiasm quickly cooled.

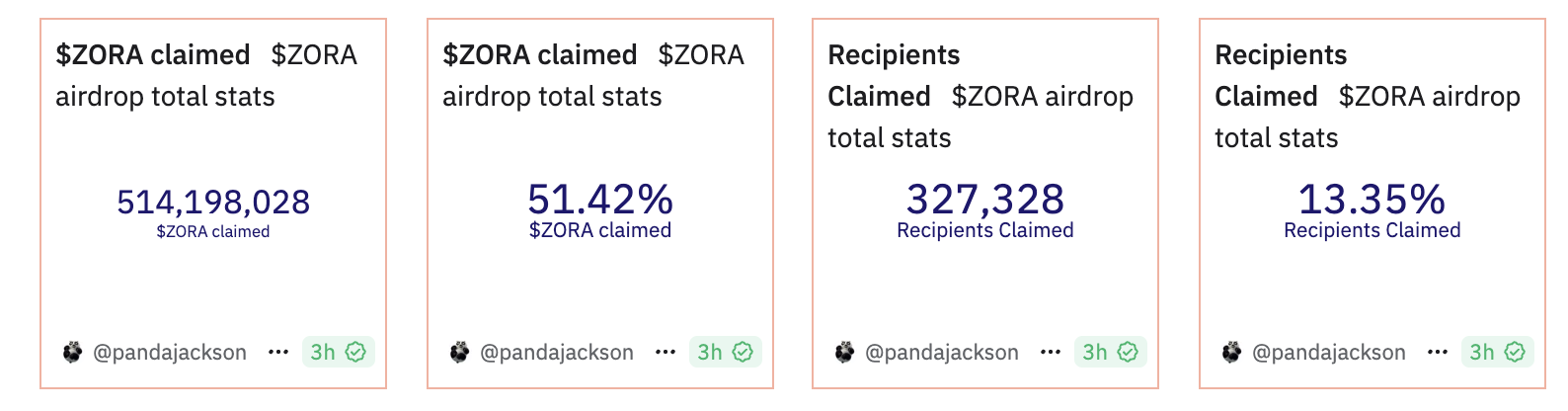

Dune data shows that as of the time of writing, over 514 million tokens from the ZORA airdrop have been successfully claimed by users. Among them, the top 50 addresses collectively received over 190 million tokens, averaging about 3.931 million tokens per address, which, at the current price (approximately $0.0235), is worth about $92,000, accounting for 36.9% of the total claimed amount. This indicates a clear dominance of top addresses in the airdrop distribution.

Meanwhile, in terms of the number of participating users, over 320,000 users have participated in the claim, but the average claim per user is only 1,571.1 ZORA, equivalent to about $37. This stark contrast highlights the extreme imbalance in the distribution structure—large holders reaped substantial airdrops, while ordinary users received very limited allocations.

In terms of claim progress, approximately 51.42% of the total token supply has been claimed, but only 13.35% of eligible users have actually completed the claim, further indicating that the proportion of users actively claiming is very low, with most users preferring to forgo the claim.

User participation significantly declines, transformation to on-chain social raises controversy

Founded in 2020, Zora was initially positioned as an NFT marketplace protocol. Public data shows that the project has raised at least $52 million in funding, with investors including Coinbase Ventures, Paradigm, Haun Ventures, etc., with the last round of financing valuing the company at $600 million. However, as the NFT market cooled and competition intensified, Zora gradually evolved into a focus on on-chain social and creator economy ecosystems, including the launch of the "Coins" feature, which automatically mints each piece of social content (such as images, videos, text) into ERC-20 tokens, and the launch of its own Layer 2 network, Zora Network.

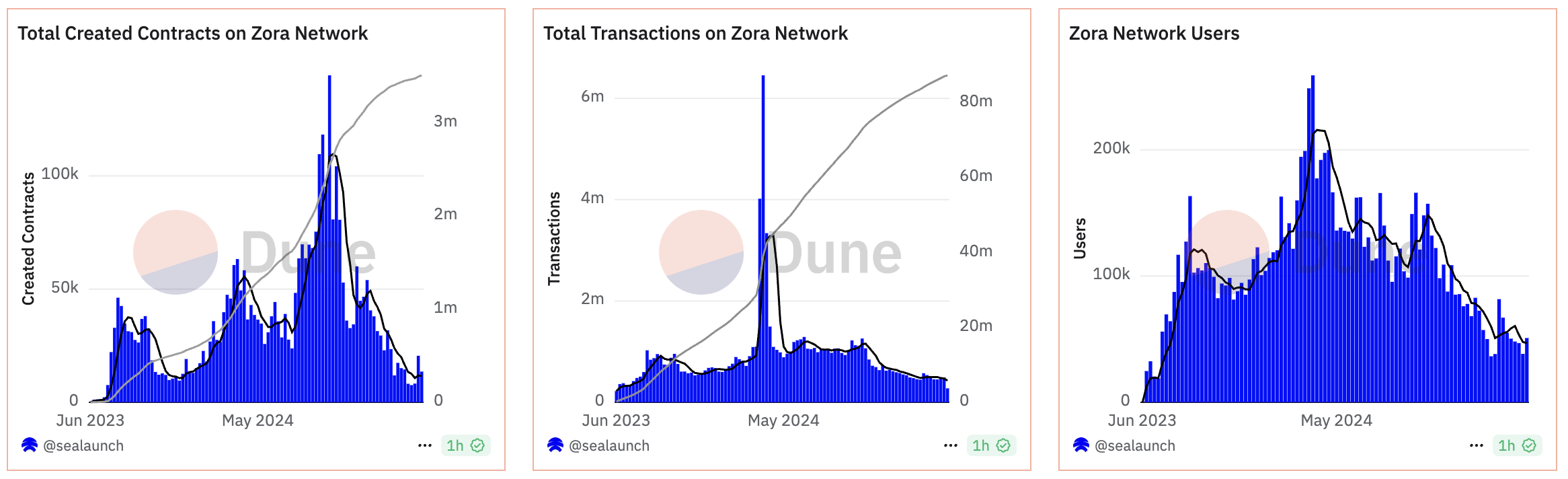

Despite continuously exploring new narrative directions, Zora's overall ecological activity has significantly declined. According to Dune data, as of April 24, over 3.51 million smart contracts have been created on the Zora network, but the daily contract creation numbers have dropped from a peak of 144,000 to about 13,000, less than one-tenth of the peak; similarly, the cumulative transaction volume on the Zora network has exceeded 87.4 million, but the daily transaction volume has also fallen from a historical high of 3.338 million to about 428,000; although the total number of active addresses has reached 470,000, compared to about 259,000 daily active users at last year's peak, it is now only 50,900, indicating a decline in user participation.

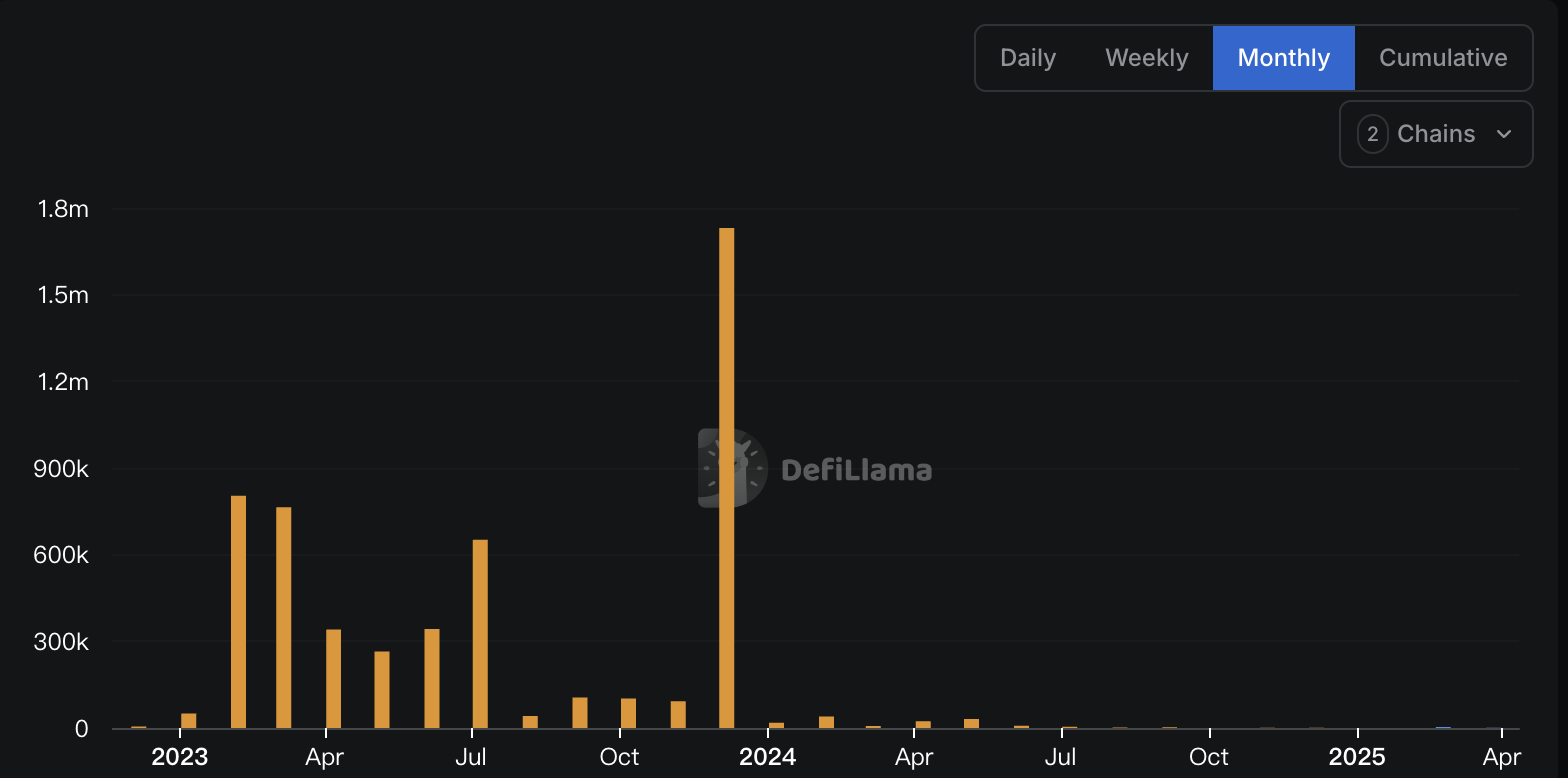

In terms of revenue, data from DeFiLlama and Dune shows that Zora's cumulative revenue is only $5.4 million, and Zora Network has only earned 527.74 ETH. The community believes this is far below the market expectations corresponding to its $600 million valuation.

Furthermore, although Zora claims to have brought tens of millions of dollars in revenue to creators, its on-chain experimental and tokenization narrative remains controversial. For instance, recently, Base protocol head Jesse Pollak praised Zora Coins for having active users reaching a historic high, but ZachXBT criticized these tokens as "viruses," with a market cap of less than $5 million. In response, Jesse admitted that most content is nearly worthless, while a few pieces of content hold significant value, but ZachXBT questioned why creators would issue a large number of tokens that dilute their brand. Jesse countered that on-chain creation does not dilute the brand; good content will spread naturally, with the market and algorithms determining its value.

Overall, Zora is attempting to reshape itself through on-chain social and tokenization narratives, but the inflated valuation and increasingly cooling ecological activity have long buried the seeds of a trust crisis, and this insincere airdrop may become the last straw that breaks the community's confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。