Public chain development, DePIN, real-world asset on-chain RWA, privacy protection, cross-border payment Payfi, are not actually prohibited in mainland China at present.

Written by: Lu Wenlong, Liu Honglin

From April 6 to 9, the 2025 Web3 Carnival, initiated by Wanxiang Blockchain Lab and HashKey Group, was successfully held in Hong Kong. The event covered various popular topics in the industry, including public chain development, DePIN, real-world asset on-chain RWA, privacy protection, and cross-border payment Payfi. The scale of the venue and the number of registered attendees during the event saw significant growth compared to last year, with a majority of attendees being of Chinese descent, including many from mainland China.

* Image source from the internet

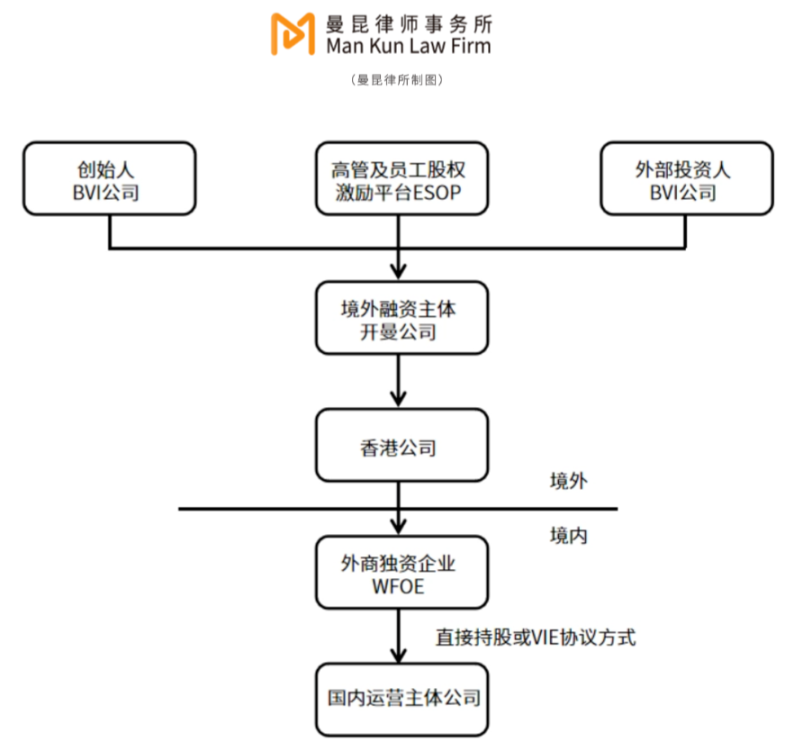

This also reflects an interesting phenomenon in the Chinese Web3 community. Due to the differences in policy regulation between mainland China and Hong Kong regarding the Web3 industry, many Chinese teams choose to place their market and project implementation in Hong Kong while conducting the underlying technology development in mainland China to meet compliance requirements. On one hand, they can leverage Hong Kong's status as an international financial center and its policy innovations to build international brand and product influence; on the other hand, they can rely on the strong reserve of technical developers in mainland China for technological iteration and updates.

However, one industry pain point arising from this model is how Web3 companies can achieve sustainable interaction between their mainland and overseas business segments in compliance, facilitating better cross-border capital flow. For example, how can mainland projects comply with going overseas, how can profits from overseas projects be legally repatriated, and how can overseas financing legally support the development of mainland teams?

In fact, the Mankun team has encountered many mainland clients who resort to personal advances by the boss, or payments to employees' overseas bank accounts, or payments in USDT to maintain daily expenses. In our view, these practices may provide short-term relief, but in the long run, they are neither compliant nor sustainable.

Current Compliance Risk Points of Common Methods in the Market

1. Personal Advances by the Boss

This is essentially a company loan, lacking sustainability. Subsequent withdrawals from the company's income to the boss's personal account may lead to the mixing of company and personal assets, and long-term hanging accounts may be viewed as dividends, incurring tax costs. If the advance is not reflected in the company account, it may be deemed as concealing employee income, potentially involving tax evasion.

2. Overseas Payments to Employees' Overseas Bank Accounts

This does not comply with current salary payment management regulations, causing inconvenience to employees and potentially leading to tax evasion, creating tax risks. Additionally, the social security and housing fund contributions of mainland employees are linked to their salaries; if paid directly overseas, it may harm employee rights, and the company may later claim rights to make up contributions, facing administrative penalties.

3. Payments in USDT and Other Virtual Currencies

This does not comply with current salary payment management regulations, causing inconvenience to employees. Converting USDT to fiat currency carries significant compliance risks and is a common scenario for administrative and criminal violations in mainland China. Once the mainland police intervene, it may lead to the freezing of funds in mainland bank accounts or, in severe cases, allegations of illegal business operations or aiding in information network crime activities or concealing criminal proceeds.

Reasons for the Pain Points

1. Regulatory Policies Limit Some Product Application Scenarios to Overseas

From the 2013 "Notice on Preventing Bitcoin Risks" to the 2017 "Announcement on Preventing Token Issuance Financing Risks," and the 2021 "Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation," regulatory measures have tightened continuously, especially in product implementation and trading aspects. Currently, there are three main areas strictly prohibited in mainland China: token issuance financing and virtual currency derivative trading, virtual currency exchange services, and Bitcoin mining operations.

This means that the aforementioned businesses can only be conducted overseas, and care must be taken to avoid any association with mainland users.

However, other sectors mentioned at the beginning of this article, such as public chain development, DePIN, real-world asset on-chain RWA, privacy protection, and cross-border payment Payfi, are not currently prohibited in mainland China. In some areas, such as real asset on-chain RWA projects, the authorities still encourage them under the premise of legality and compliance. For example, the first RWA project in the agricultural sector, which was heavily promoted by the Shanghai authorities, can be explored in the previous article by the Mankun team: Mankun Lawyers | Detailed Explanation of the First RWA Project in the Agricultural Sector "Maluxi Grape RWA."

2. Relevant Practitioners in Mainland Focus on Neutral Technical Development

According to policies such as the "Regulations on Blockchain Information Services" and the "Guiding Opinions on Accelerating the Application and Industrial Development of Blockchain Technology," mainland China currently encourages blockchain technology mainly in areas like underlying technology development (consortium chains, privacy computing), industrial digital transformation (supply chain finance, digital government, food traceability, etc.), and industry standard formulation, aiming to promote the integration of blockchain with the real economy. Additionally, the 14th Five-Year Plan explicitly lists blockchain as a key industry in the digital economy, emphasizing collaborative innovation with technologies like artificial intelligence and big data. Local governments are also providing certain policy support in terms of financial subsidies, talent introduction, and blockchain industrial park construction.

Common Legal Ways to Repatriate Overseas Income or Financing to Mainland

1. Establishing Subsidiaries or Investing Overseas, Repatriating Subsidiary Profits

Conducting overseas business by establishing subsidiaries or investing overseas, and then legally repatriating the profits of the subsidiary to the mainland parent company.

Specific Procedure: According to the "Regulations on Management of Enterprises' Overseas Investment" (referred to as "NDRC Order No. 11"), "Regulations on Overseas Investment Management" (referred to as "MOFCOM Order No. 3"), and foreign exchange management laws and regulations, mainland enterprises must submit applications to the local NDRC, MOFCOM, and foreign exchange management bureau (delegated to banks) after meeting the authenticity, necessity, and reasonableness of overseas investment. After obtaining approval or filing from the aforementioned departments, mainland funds can be remitted to the overseas subsidiary to conduct overseas business.

When handling overseas investment filing procedures, it is important to check whether the destination country for overseas investment is a sensitive country/region and whether the industry of the overseas investment project is a sensitive industry, ensuring thorough preliminary research and preparation of application materials.

Additionally, regulatory authorities often have certain indicators regarding the establishment duration, profitability, and debt levels of mainland enterprises when assessing the reasonableness and necessity of their foreign investments.

2. Repatriating Overseas Financing Funds for Use in Mainland

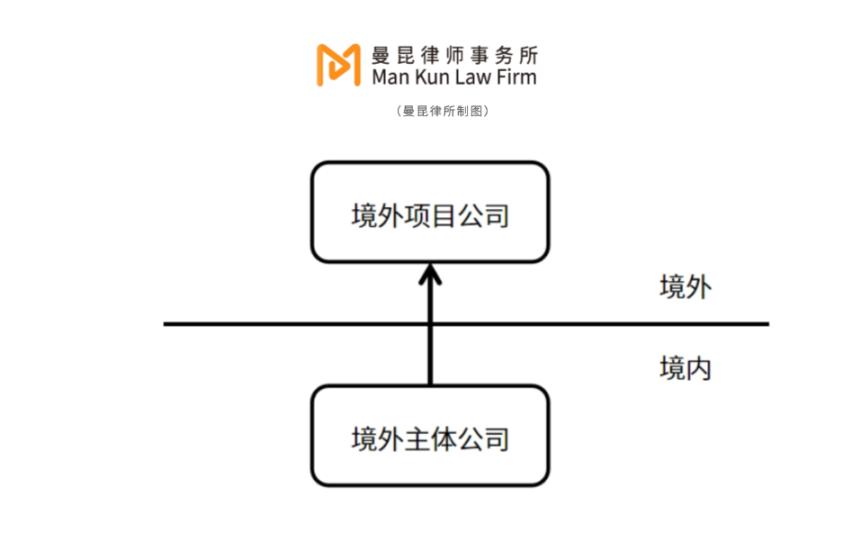

Domestic residents or enterprises can build overseas structures for financing and then reinvest the overseas financing funds back into the mainland.

Specific Procedure: According to the "Notice on Foreign Exchange Management Issues Related to Domestic Residents' Overseas Investment and Reinvestment through Special Purpose Companies" (Hui Fa [2014] No. 37), "Regulations on Foreign Exchange Management," and other laws and regulations, after meeting the authenticity of fund sources and overseas fund usage, individual shareholders of mainland enterprises submit applications to the local foreign exchange management bureau (delegated to banks) for filing. After obtaining registration, they can proceed with changes in equity of the domestic company or signing control agreements, with overseas investors injecting capital and repatriating overseas financing funds for use in the mainland or conducting reinvestment.

3. Signing Service Trade Contracts with Overseas Clients to Collect Service Fees

Through service trade (telecommunications, computer and information services, R&D, professional management consulting services, etc.), reach software service or business consulting service agreements with overseas clients and collect fees according to the agreements.

For example, if a company is engaged in software export business, if delivered via online download or other electronic means, it can handle foreign exchange collection at the bank with contracts, invoices, and other transaction vouchers. If the software is provided in physical media with permanent usage rights, it should be handled according to the relevant regulations for goods trade for foreign exchange collection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。