Euler has addressed some of the most pressing issues in DeFi lending, such as MEV, high gas fees, and the risks of traditional liquidation mechanisms.

Written by: Tommy.eth

Compiled by: Alex Liu, Foresight News

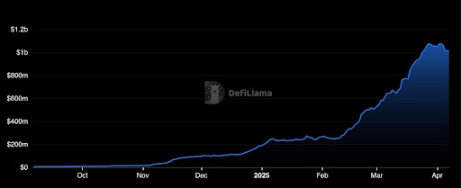

Euler Finance has been on a remarkable upward trajectory since October 2024, marking one of the most stunning comebacks in DeFi history. Despite facing significant setbacks—a hack in 2023 that temporarily halted the protocol—the Euler team has tirelessly worked to rebuild and regain user trust.

The data speaks for itself:

- Total deposits reached $1 billion (a 1000% increase in 4 months)

- $430 million in loans

- Over $100 million TVL on Sonic

- Deployed on 8 chains

Total deposits of Euler Finance, source: DeFiLlama

The significant rise in deposits demonstrates Euler's growing appeal in the DeFi space.

But why should users consider using Euler for lending now? To understand why Euler stands out, we first need to explore some of the issues present in other lending products on the market and how Euler addresses these problems.

Liquidation and MEV Issues

One of the main problems with DeFi lending protocols is the liquidation process. In traditional lending markets, central institutions (like banks) may liquidate bad debts. However, in a decentralized world, this process relies on third parties—liquidators—who act as arbitrageurs. These users create bots that automatically liquidate positions when collateral is insufficient. In return, they receive discounts on the collateral, and competition to liquidate these positions is fierce.

This competition leads to rising gas fees, especially on networks like Ethereum, where the first liquidator to act will receive a reward. As a result, gas wars can escalate, making it difficult for ordinary users to interact with the blockchain when gas prices soar. This phenomenon is known as MEV, which is a significant issue facing the DeFi ecosystem.

How Other Protocols Handle Liquidation

Leading DeFi platforms, such as Aave, Compound, and Curve, have liquidation systems in place. When a borrower's position falls below the collateral threshold, liquidators compete to seize the collateral at a discounted price. However, this process often leads to rapid declines in collateral prices, exacerbating liquidation issues and driving up gas costs.

These protocols incentivize arbitrageurs to facilitate liquidations, but intense competition often results in unfair outcomes and high transaction costs for ordinary users.

Euler's Innovative Liquidation Approach

Euler Finance has adopted a fundamentally different liquidation approach aimed at directly addressing these issues.

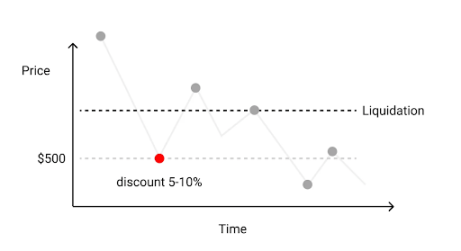

Dutch Auction Liquidation

Unlike Compound or Aave, which use fixed discount rates during liquidation, Euler employs a Dutch auction mechanism. This means that as the borrower's position becomes more under-collateralized, the liquidation discount gradually increases over time. Liquidators can choose the optimal time to intervene based on their risk and return expectations.

Liquidation discounts increase over time

This mechanism reduces the congestion and competition that lead to MEV, thereby helping to stabilize gas prices. By transforming liquidation into an auction, Euler creates a more favorable and controllable environment for all parties involved.

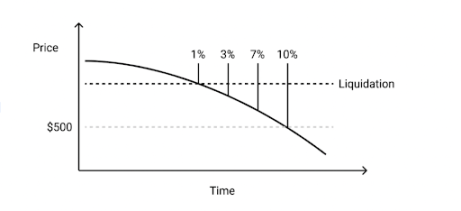

Soft Liquidation

A major highlight of Euler is its soft liquidation mechanism, designed to protect borrowers from the fear of complete liquidation. Under the soft liquidation mechanism, when a borrower's collateral value decreases or debt increases, only a portion of the collateral will be liquidated. However, if the collateral price rebounds, the borrower can reclaim the liquidated portion.

This gives borrowers more time to recover from market fluctuations without immediately losing their entire position. Soft liquidation allows users to maintain control over their assets, increasing their ability to withstand temporary price drops and minimizing losses.

Euler's innovative liquidation mechanisms have had a direct and positive impact on its metrics:

Active Lending Activity

Compared to other protocols like Aave (0.38) and Compound (0.3), Euler boasts the highest loan-to-TVL (Total Value Locked) ratio (0.45). This indicates that borrowers are attracted to Euler due to its unique features, such as more favorable liquidation conditions and the ability to utilize funds with lower risk.

Attractive Fees and Returns

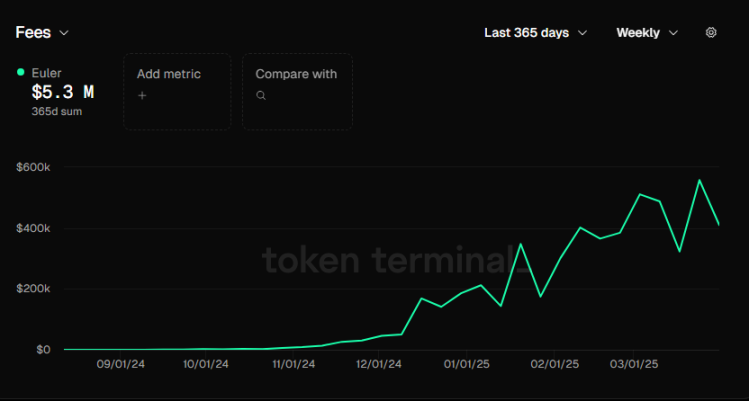

Weekly fees generated by Euler, source: token terminal

Euler's user-centric approach provides borrowers with highly competitive fees (up to $557,000 per week) and offers substantial returns for depositors. By minimizing the negative impact of liquidations on users, the protocol helps ensure that both borrowers and lenders benefit from a smoother and more efficient process.

Loan-to-Value Ratio (LTV)

Euler's average loan-to-value ratio reaches as high as 90%, significantly higher than most other DeFi platforms. This is thanks to its soft liquidation mechanism, which provides borrowers with greater security and flexibility in managing their positions. Borrowers can use higher leverage while ensuring a lower likelihood of losing all their collateral in a liquidation event.

Conclusion

Euler's innovative features, such as Dutch auction liquidation and soft liquidation, address some of the most pressing issues in DeFi lending, including MEV, high gas fees, and the risks of traditional liquidation mechanisms. The protocol's strong recovery and growth, along with its highly attractive metrics, indicate that Euler is not only reliable but also one of the most user-friendly and secure options in today's DeFi space. Whether seeking favorable terms as a borrower or stable returns as a lender, Euler offers compelling solutions that set it apart in the field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。