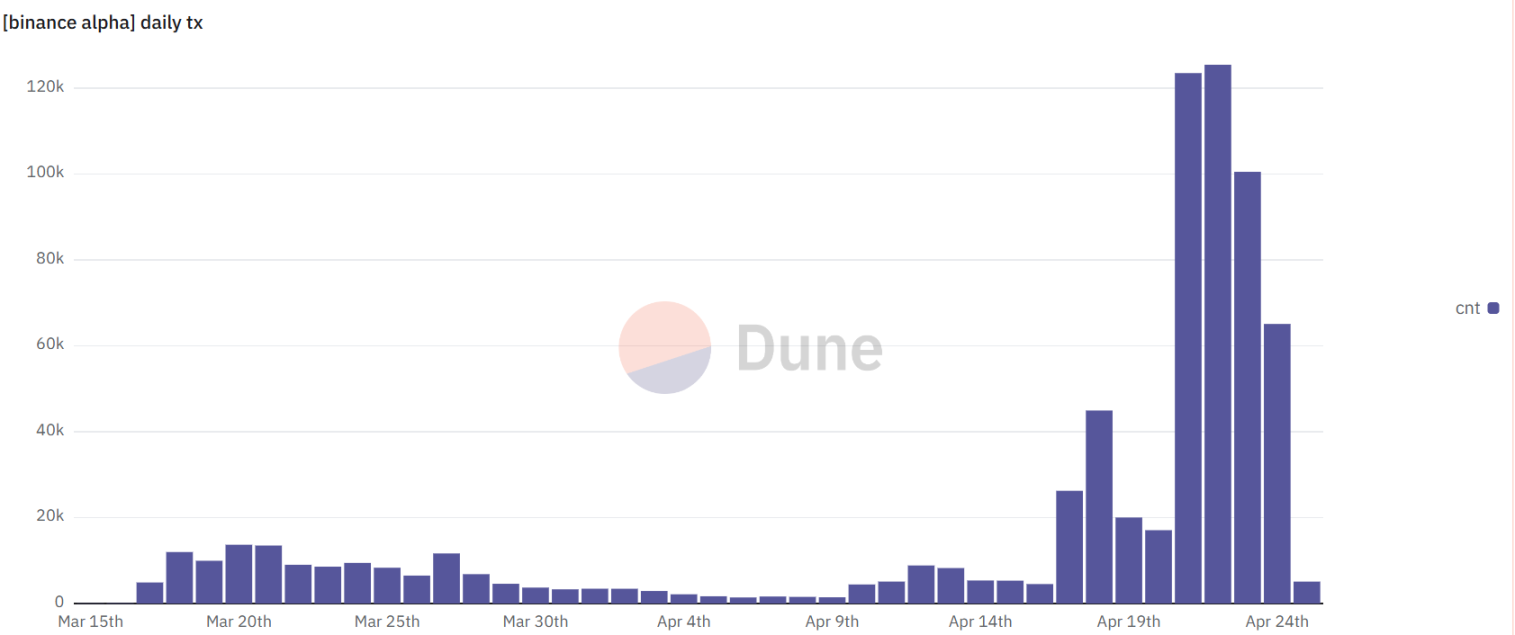

Binance Alpha exceeded 125,000 transactions in a single day on April 22, setting a new historical record.

Written by: 1912212.eth, Foresight News

At the end of 2024, Binance launched a new feature—Binance Alpha. This module embedded within the Binance wallet appears, on the surface, to be merely a platform for showcasing early projects, attracting users through airdrop activities and convenient trading functions. In reality, its influence extends far beyond that; the emergence of Alpha has subtly yet profoundly changed the Binance wallet, BNB Chain, and both the spot and contract markets of the Binance exchange.

As of now, according to data from Dune, the number of transactions has doubled since April 21, with daily transaction counts reaching a historical high. The total transaction volume of Binance Alpha on the BNB Chain has risen to $480 million, and the total number of trading accounts has reached 715,000.

What does Binance Alpha mean for Binance? What is the operational logic behind it?

The Birth and Operational Mechanism of Binance Alpha

Binance has long been dissatisfied with merely being the largest cryptocurrency exchange in the world. It aims to become the central hub of the Web3 ecosystem, connecting CeFi and DeFi. Coupled with the current market's disappointment regarding wealth effects and various controversies surrounding the tokens listed on Binance, Binance Alpha was born. It is positioned to discover and promote early projects, with the Binance team selecting a portion of potential stocks from a vast array of projects to showcase in Alpha's "window," allowing users to purchase directly through the Binance wallet.

The charm of Alpha lies in its convenience and incentive mechanism. Users can directly purchase Alpha project tokens using main chain tokens like BNB, ETH, and SOL through the exchange function within the Binance wallet. Compared to the complex operations of other DEXs, the exchange function allows for smoother transactions and higher success rates by automatically adjusting slippage and employing anti-MEV (Maximum Extractable Value) mechanisms. Even more enticing are Alpha's airdrop activities, where users have the chance to receive additional rewards whether they participate in trading or hold specific tokens.

Some users have shared their experiences of frequently operating within the Binance wallet for airdrops. This "play-to-earn" model not only lowers the threshold for ordinary people to engage with Web3 but also makes Binance Alpha a new growth point within the Binance ecosystem. Although Alpha projects do not guarantee listing on the Binance exchange, their high exposure and potential opportunities are enough to attract investors.

Alpha Boosts Wallet Activity

During the previous inscription wave, OKX Wallet received high praise for its user experience and support for inscriptions. In contrast, the Binance wallet has faced criticism for its less user-friendly experience, which has become its biggest flaw.

As a bridge connecting CeFi and DeFi within the Binance ecosystem, the Binance wallet has long had a somewhat ambiguous positioning—it is neither as focused on decentralization as Trust Wallet nor entirely a tool for the exchange. The emergence of Binance Alpha seems to be reversing this situation. It injects new vitality into the wallet, making it the preferred entry point for users to engage with Web3.

Alpha's airdrop activities and early project investment opportunities have attracted a large number of new users to download and register for the Binance wallet. Investors, eager to participate in Alpha projects, have specifically deposited BNB, ETH, or SOL into their wallets, driving a dual increase in asset volume and transaction volume. This user growth is reflected not only in numbers but also in activity levels. Users frequently conduct transfers, token swaps, and even engage in multi-account strategies to obtain airdrop rewards, prompting Binance to continuously raise participation thresholds and restrictions.

On April 25, the latest version of the Binance App launched the Alpha Point scoring system. According to the official explanation, this system is used to assess user activity within the Binance Alpha and Binance Wallet ecosystems, determining eligibility for participation in activities such as Wallter TGE and Alpha token airdrops. Binance Alpha points are calculated daily based on the total asset balance in the user's Binance CEX and Binance non-custodial wallet address over the past 15 days, as well as the total number of Alpha tokens purchased; currently, selling Alpha tokens will not contribute to Alpha points.

The latest 12th phase of the Binance wallet TGE project OKZOO has begun requiring participants to have at least 45 points.

Alpha has driven a surge in on-chain activities within the wallet. More importantly, compared to 2024, it has continuously optimized the user experience of the Binance wallet. Additionally, Alpha has enhanced the synergistic effects of the Binance wallet within the ecosystem. Users depositing main chain assets into the wallet and participating in Alpha project trading not only increase the liquidity of wallet assets but also promote interactions with BNB Chain and others. This cross-platform flow of funds has transformed the Binance wallet from a mere storage tool into an active node within the Web3 ecosystem.

Creating a "Testbed" for Token Listing Systems

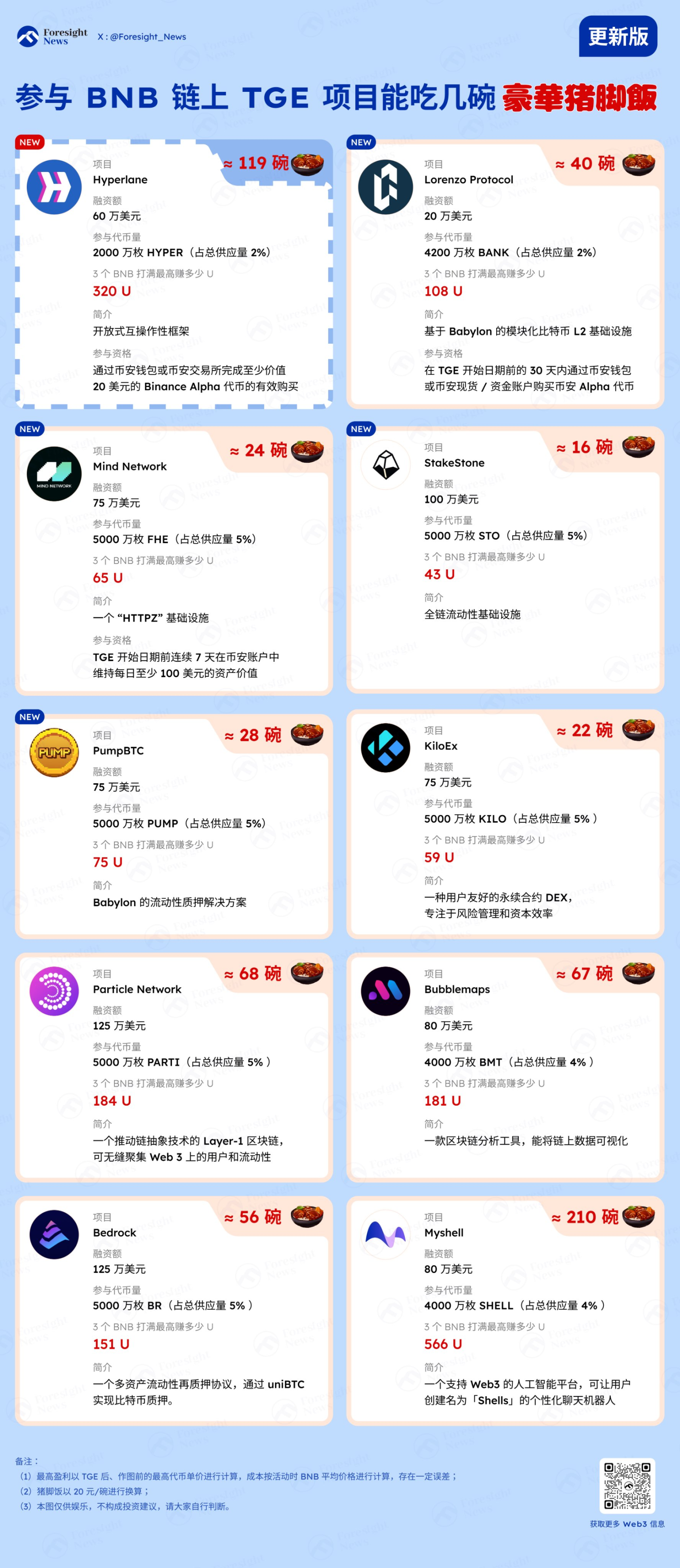

In this cycle, given that most VC tokens peak upon listing on Binance and the backdrop of extremely sluggish wealth effects, Binance has become increasingly cautious about directly listing tokens while also exploring new traffic entry points. Under the MEME wave, many wealth codes often appear on-chain; thus, the collaboration between Binance Alpha and the wallet has become a "testbed" for both the spot and contract markets.

As a "pre-listing observation zone," Alpha provides potential listing candidates for the spot market. Although Alpha projects do not guarantee listing on exchanges, their selection criteria closely align with the listing processes of exchanges, allowing investors to see potential opportunities. Many users believe that trading Alpha projects within the Binance wallet can increase their weight for receiving exchange airdrops. This expectation directly stimulates trading interest in the spot market. Users may purchase BNB or other main chain tokens in the spot market, transfer them to the wallet to participate in Alpha activities, thereby boosting trading volume.

The community enthusiasm for Alpha projects also brings additional volatility to the spot market. When a project goes live in the Alpha section, its token often experiences significant price fluctuations due to airdrop expectations or short-term speculation. This volatility provides opportunities for short-term traders, enhancing the activity of the spot market. More importantly, Alpha has increased the transparency of the exchange listing process through publicly available selection criteria and project information. This enhancement of transparency and trust not only attracts retail investors but also draws institutional investors' attention to the potential listing opportunities of Alpha projects.

The launch of Binance Alpha has brought new trading opportunities to the contract market, accompanied by higher volatility and risk. The short-term volatility and community enthusiasm of Alpha projects make them ideal targets for contract trading. Historically, Binance Launchpool projects often quickly enter the contract market after listing, and Alpha projects have similar potential. Binance contracts support leverage of up to 125 times, allowing short-term traders to capture price fluctuations during the launch of Alpha projects by going long or short. Alpha's 24-hour display mechanism and airdrop activities further amplify this volatility, injecting new vitality into the contract market.

However, high volatility is a double-edged sword. Leverage trading in the contract market amplifies risks, and ordinary users may suffer significant losses in pursuit of short-term profits. Binance is aware of this and has included risk warnings and educational content in the promotion of Alpha, reminding users to participate cautiously in high-leverage trading.

Conclusion

The launch of Binance Alpha is a bold attempt by Binance. It is not only a platform for showcasing early projects but also a catalyst for the Binance ecosystem. The Binance wallet has become a popular entry point for Web3 due to Alpha, BNB Chain has benefited from Alpha, and even the price of BNB has received some support, while both the spot and contract markets have profited from project enthusiasm and trading activity.

However, the success of Alpha is not without challenges. The quality of early projects varies, and high volatility may deter some users. From a broader perspective, Binance Alpha serves as a bridge connecting CeFi and DeFi, as well as a strategic layout for seizing opportunities in Web3. In the future, Binance needs to further optimize the selection mechanism, strengthen user education, and ensure the long-term value of Alpha projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。