Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

This year marks the tenth anniversary of Ethereum.

Over the past decade, it has supported the prosperity of DeFi and ignited the wave of NFTs. Countless developers and idealists have converged, collided, and built on this chain, crafting one crypto narrative after another.

However, in this tenth year, Ethereum finds itself at a crossroads of fate. New public chains are emerging one after another, narrative dominance is frequently shifting, and prices have lost momentum during a prolonged adjustment.

After ten years of trials and tribulations, can Ethereum still welcome a massive "pump"?

Chip* Tendency** Concentration, Is Ethereum “Changing Hands”?*

The notion of Ethereum “changing hands” has actually been circulating since last year. Some believe that early holders of ETH, the industry old-timers, are gradually exiting, and the chips are quietly being taken over by institutions like Wall Street. Is this transition genuinely happening, or is it just a story told to oneself?

According to on-chain analyst @Murphychen888, the Herfindahl index of ETH (which measures chip concentration) has been continuously declining since 2016, indicating that chips are being dispersed to retail investors. It bottomed out in March 2023 but suddenly began to rise in December 2024, indicating that funds are being concentrated again. Whether through active accumulation or passive replenishment, the actions of whales are pushing up the concentration.

Ethereum Herfindahl Index: measuring chip concentration

A high index indicates that a few large holders are dominating the market, while a low index indicates a more even distribution of chips.

However, this is an extremely slow process, as some large holders are still offloading, reducing the concentration trend. Although this increase in concentration may help the price trend positively in the future, the slow process could mean a long and torturous wait for market participants.

Additionally, according to glassnode data, since the end of March, the RSI (Relative Strength Index) of ETH's "faithful buyers" has remained as high as 80, while the number of loss sellers peaked in mid-April and quickly cooled down. This indicates that despite a significant price correction, there are still steadfast buyers continuously stepping in, which has not stopped since March 26.

RSI is used to measure market overbought or oversold conditions

The range is from 0 to 100. Typically, RSI > 70 indicates overbought, while RSI < 30 indicates oversold.

Whether Ethereum is truly “changing hands” remains inconclusive, but on-chain data shows a trend of chip re-concentration, perhaps hiding a long-term layout by large funds and the steadfastness of faithful buyers.

Ethereum “Changing Heart” Proposal: Execution Layer Set for Major Upgrade

On April 20, Vitalik released a significant proposal to replace the current Ethereum Virtual Machine (EVM) with the open-source instruction set architecture RISC-V as the long-term evolution direction for Ethereum Layer 1's execution layer.

According to the design, existing EVM contracts will continue to run and achieve bidirectional compatibility with the new architecture, while core abstractions such as account models, cross-contract calls, and storage will be fully retained. The original opcodes like SLOAD, SSTORE, BALANCE, CALL, etc., will be mapped to RISC-V system calls. The new architecture supports writing contracts in languages like Rust while also being compatible with existing languages like Solidity and Vyper, ensuring that the developer experience remains largely unaffected.

If this direction comes to fruition, it will fundamentally change the way Ethereum smart contracts operate and lay a technical foundation for scalability in the coming decades. Crypto KOL Dayu pointed out that if the proposal succeeds, the speed of the Ethereum mainnet could increase by 100 times, transaction fees could drop by over a thousand times, the value of Layer 2 might decrease, and Ethereum would directly challenge high-speed public chains like Solana and Sui, leveraging its advantages in decentralization and ecosystem accumulation to take flight with speed.

Although the proposal currently faces risks such as community opposition, its emergence has sent a strong signal: Ethereum is refocusing on the value of its mainnet. As community user @shmula commented, Vitalik's proposals have historically led to Ethereum Layer 1 being "abandoned," but this proposal is expected to inject new value into it.

The “Default Choice” of Traditional Finance?

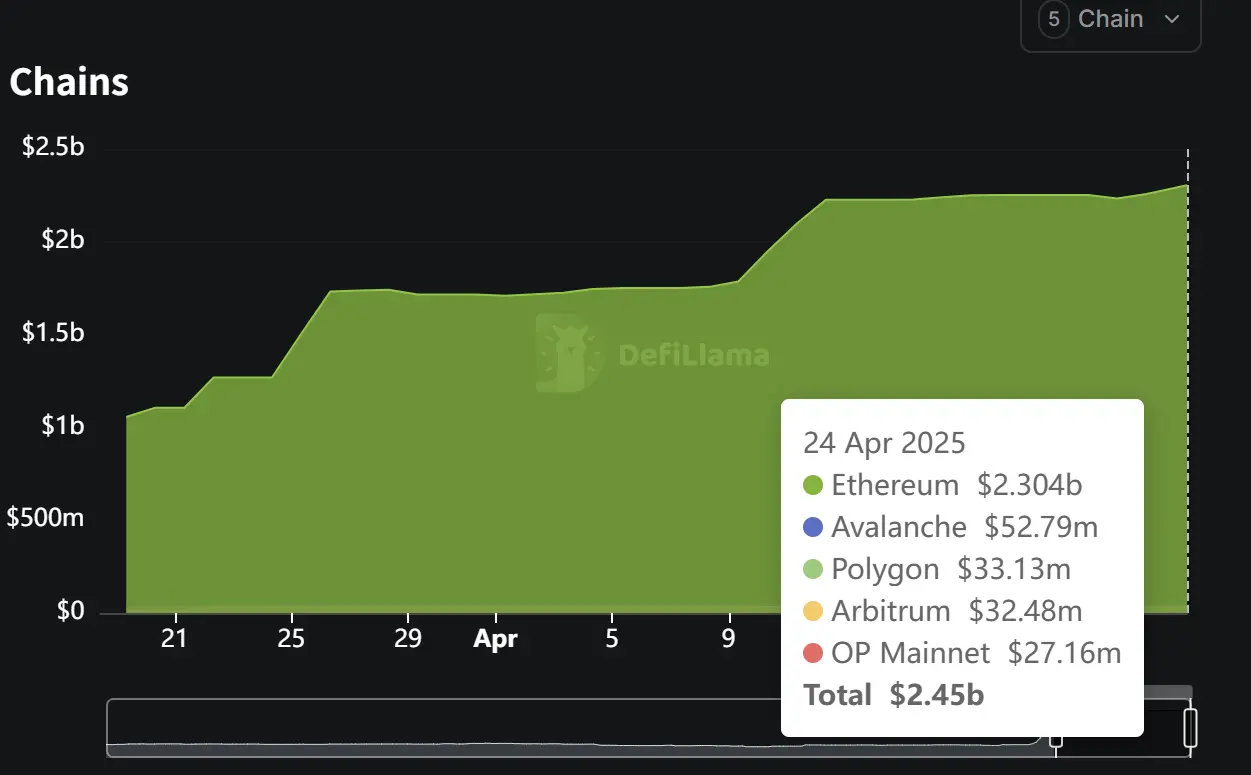

Traditional institutions also seem to favor Ethereum. One of the world's largest custodial banks, BNY Mellon, recently launched an on-chain data tool, Digital Asset Data Insights, on Ethereum, while BlackRock's tokenized fund BUIDL has deployed over $2.3 billion on Ethereum.

Data: Defillama, BUIDL fund distribution across chains

Does all this mean that traditional institutions are actively engaging with the Ethereum ecosystem, beginning experiments around its security, transparency, and composability? Crypto KOL Blue Fox also proposed a forward-looking idea: will large financial institutions build exclusive L2s or private chains on top of Ethereum's security layer in the future?

The views of LXDAO founder brucexu.eth may provide some insight; he stated that some Hong Kong financial institutions and asset on-chain projects he has recently interacted with generally choose Ethereum as the underlying platform because, at this stage, it is almost the only preferred option. He pointed out: “From a functionality perspective, Bitcoin lacks flexible scalability; from a stability and neutrality perspective, financial institutions cannot accept public chains that may be subject to state intervention or face downtime risks; while emerging blockchains have not yet been tested by time and security, their maturity still needs validation.”

These early actions may just be the prologue. However, in the short term, whether Ethereum can realize value redemption is crucial for the explosion of the application layer.

Looking Up to Ten Thousand Chains, or the Hero's Twilight?

Since the Ethereum Foundation replaced its core team in February this year, and with the recent proposal to support the RISC-V virtual machine, Ethereum is showing a posture of “active correction.” Tomasz K. Stańczak, executive director of the Ethereum Foundation, recently admitted that Ethereum's “secondary goal” is to become the preferred infrastructure for institutions, winning the market for real-world assets like RWA and stablecoins.

Various trends are not pessimistic, and even signs of a turnaround are emerging on the technical front. According to Trend Research, ETH is at a critical position for support and resistance exchange; if it breaks through, it may welcome a favorable trend reversal. ETH has experienced a long decline over the past five months since December 2024, with the number of profitable addresses dropping to a lower position in the bear market, remaining oversold, and currently entering a critical support and resistance exchange zone alongside the recovery of the crypto market.

Profitable address data

Trend Research points out that multiple technical indicators are also releasing potential bottoming signals. The K-line pattern of ETH, moving averages, MACD, Momentum, RSI, and MFI all point to the possibility of a short-term turning point between bulls and bears, and the current price is approaching the upper edge of the downward channel and horizontal resistance level, attempting to break through.

Ethereum seems to be entering its “critical window period,” but as the Chinese saying goes, “Before considering victory, one must first consider defeat.” Even if the situation shows a glimmer of light, one cannot help but ask: if ultimately the efforts fail, what then? If these efforts ultimately still struggle to break through performance bottlenecks, if ecosystem development stagnates, or if confidence in prices is not restored, will Ethereum become the “doomsday vehicle” of the new era?

Ten years is a milestone of time, but also a test of faith. The wheels of the era roll forward; success means looking up to ten thousand chains, while failure means the hero's twilight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。