Stablecoins are becoming independent from the cryptocurrency market, penetrating every crevice of the global economy.

Written by: Deep Tide TechFlow

In the spring of 2025, the chill in the cryptocurrency market is palpable, with Bitcoin's price plummeting from $109,000 at the beginning of the year to a low of $75,000.

Weak trading volumes accompany market fluctuations, with various sectors cooling off one after another, and the sector effect fading away, leaving only sporadic movements in certain coins to capture short-term market attention.

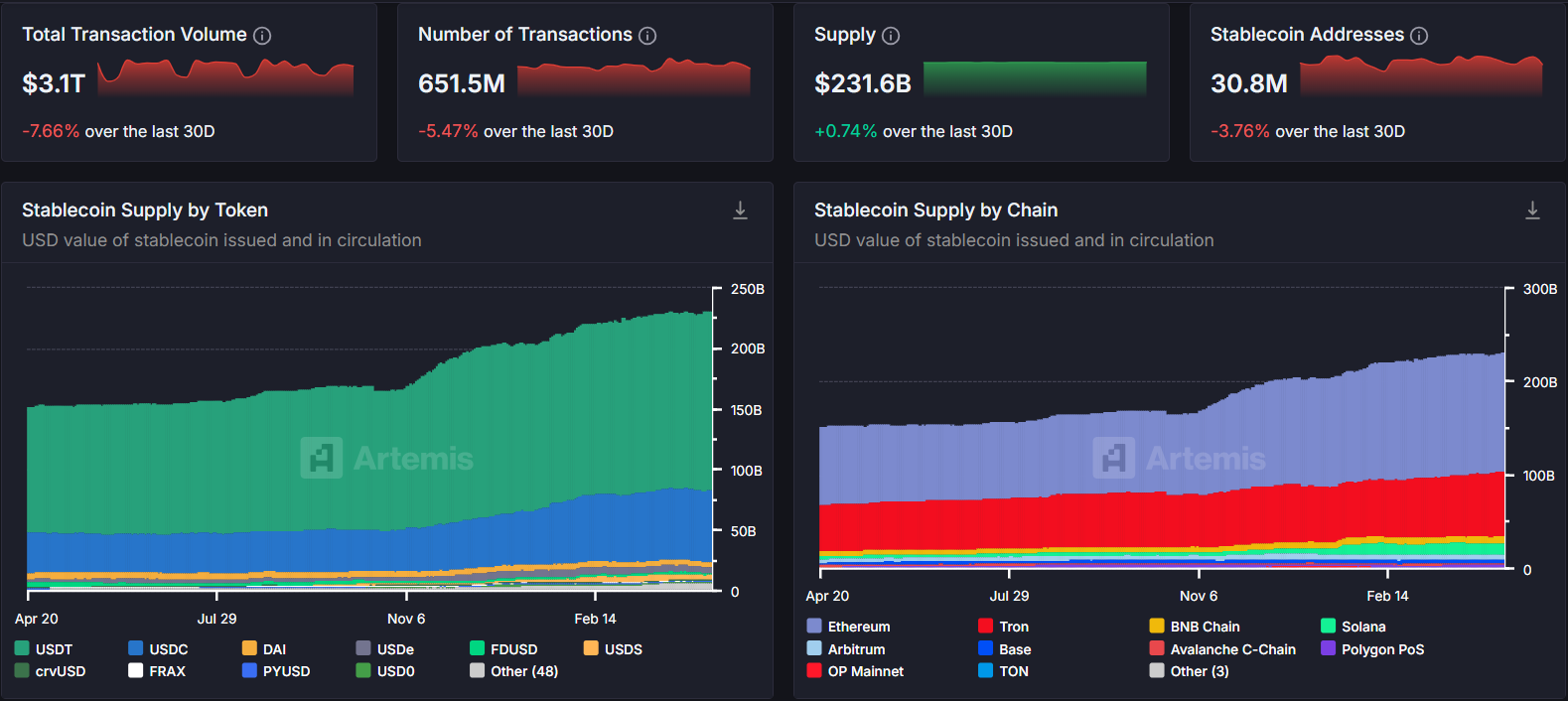

However, amidst this gloomy market situation, the stablecoin market presents a starkly different picture: according to data from Artemis, as of April 2025, the total market capitalization of stablecoins has reached $231.6 billion, a significant increase of 51% compared to $152.6 billion in the same period of 2024.

While the overall cryptocurrency asset market shows weakness, stablecoins continue to expand. So the question arises: Where are the continuously issued stablecoins going if they are not flowing into cryptocurrency investments?

Beyond Crypto, Stablecoins Are Rapidly Taking Root in the Real World

As the infrastructure of the blockchain world, stablecoins not only dominate on-chain transactions but are also the core tools for crypto users to conduct token exchanges, DeFi operations, and transfers.

However, their influence has long surpassed the boundaries of crypto and is taking root and growing in the real world.

From a market capitalization perspective, stablecoins directly account for 5% of the total cryptocurrency market capitalization. If we include companies managing stablecoins and blockchains primarily focused on stablecoins (such as Tron), this proportion rises to 8%.

Notably, mainstream stablecoin issuers have adopted an operational model similar to MasterCard, reaching end-users through intermediaries such as exchanges and payment service providers.

Taking Argentina as an example, although local crypto exchanges like LemonCash, Bitso, and Rippio are not globally well-known, their user base has reached an astonishing 20 million, equivalent to half of Coinbase's user group, while Argentina's population is only one-seventh that of the United States. Just Lemon Cash alone generated about $5 billion in trading volume last year, primarily focused on stablecoin-related transactions.

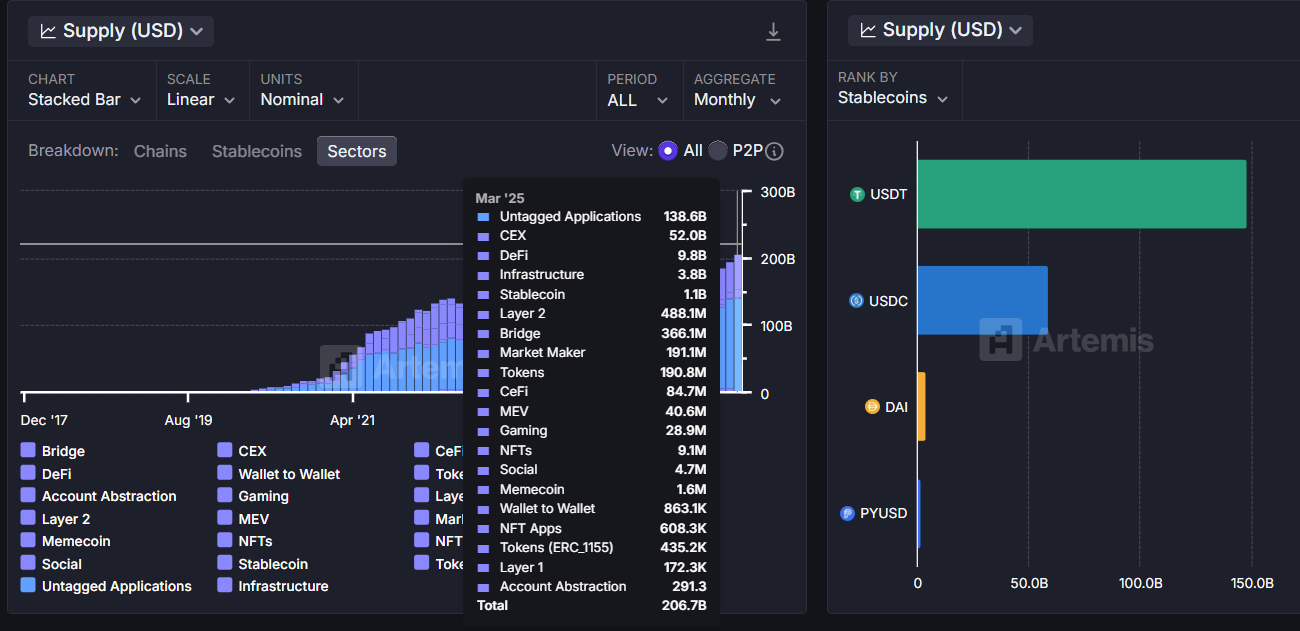

More thought-provoking is that, according to Artemis data, as of March 2025, out of the total circulation of $206.78 billion in stablecoins, traditional CEX, DeFi, and other crypto scenarios account for only a small share, with as much as 67% ($138.6 billion) of stablecoins flowing into "uncategorized applications."

Most stablecoins circulate in data blind spots that are not clearly tracked, with their secrets locked in a black box outside of crypto.

In the dark side of social rules, stablecoins are weaving a vast network of gray and black industries.

Liu Ping (pseudonym), engaged in cross-border e-commerce, explains that although legitimate dollar collection platforms like Airwallex, Pionex, and PingPong require strict qualification reviews and real order data, "there are always those who need other solutions," especially merchants dealing in counterfeit goods, infringement, or illegal arms. These illegal merchants either purchase high-priced access to the platform's "gray market" accounts or directly use USDT for transactions.

As Liu Ping explains, the corresponding industrial chain breeds in the shadows, with illegal merchants quickly converting their collections through underground money houses into USDT, "equivalent to letting those who open backdoors for illegal merchants suffer losses for their own companies."

In the advertising sector, she also mentions some more covert operations: "There are gray market accounts specifically running illegal ads on platforms like Facebook, such as for firearms and ammunition, with most of the funds for advertisers coming from stolen credit cards. Some people specialize in purchasing stolen credit card limits, recharge them to advertising accounts, and then sell them at a discount in USDT. An advertising account worth $2,000 might only require $1,500 to $1,700 in USDT."

"Cross-border merchants are actually quite eager to use USDT for settlements; it's flexible, has no price difference, and can somewhat avoid asset risks. But legitimate platforms have licenses, collect dollars, and currency exchanges must comply." Liu Ping admits.

"But legitimate platforms have licenses, collect dollars, and currency exchanges must comply. The gray market essentially gives scammers a time window to find opportunities to escape using USDT." Small amounts are withdrawn directly, causing losses for the platform; "sometimes, the scammers using backdoors share profits with platform staff, for example, if a scammer collects $3 million, they might ultimately withdraw $2 million, with the $1 million difference possibly split between the platform and the staff who opened the backdoor."

This situation extends to the domestic market, particularly in the Shenzhen Shuibei market, the largest gold and jewelry trading hub in China, where thousands of gold merchants are concentrated within a square kilometer, accounting for 75% of the Chinese market share. Stablecoins have become a secret tool for gray currency exchange.

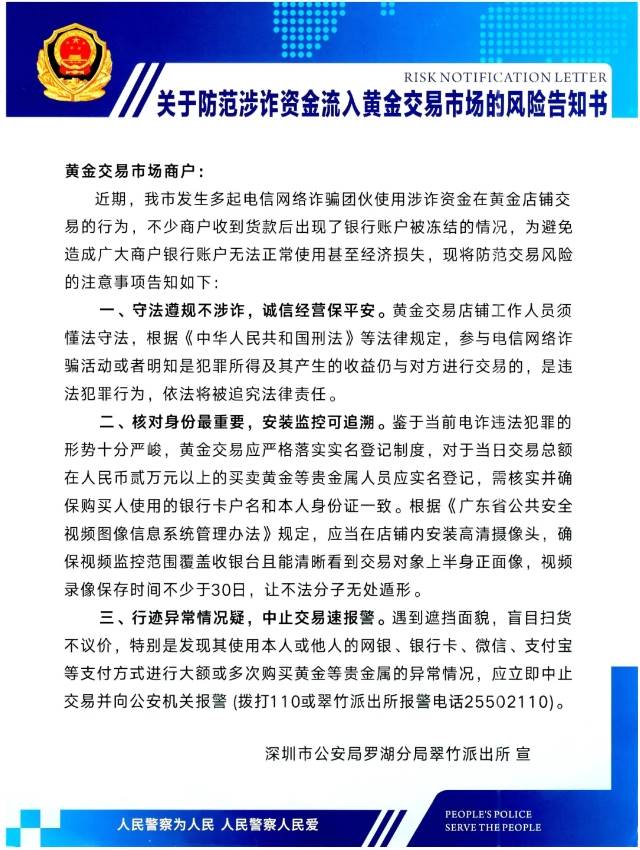

In 2024, the Luohu branch of the Shenzhen Public Security Bureau issued a risk notice requiring real-name registration for gold transactions exceeding 20,000 yuan on the same day, targeting underground trading in Shuibei.

Industry insiders reveal that currency exchange transactions in Shuibei are "mature and convenient," with customers contacting "currency exchange service providers" through acquaintances, who then arrange the transaction process.

Some inconspicuous stalls in the market handle large amounts of funds daily. "Regular customers" purchase gold bars with cash or credit cards, and staff deliver the physical goods at real-time gold prices in one go.

To mitigate risks, currency exchange service providers generally have "runners" handle small transactions (under 10 million). Larger transactions are completed through membership positions at gold exchanges. Compared to offline stalls, using exchanges is more suitable for short-term, large fund transfers, though the corresponding fees are also higher.

In this buy-sell process, the customer's renminbi is transformed into an anonymized gold entity.

Of course, the most critical step in currency exchange is converting the gold into USDT or other stablecoins. Service providers assist customers in installing cold wallets (like imToken) to store the USDT after exchanging the gold. If customers wish to exchange immediately, they can also directly convert to dollars, euros, or other foreign currencies. The entire transaction can be completed in as little as one day, with commissions typically within 6% of the transaction amount.

This type of transaction is not foolproof. Although the real-name registration new rule has not been strictly enforced, regulators are already keeping an eye on large transactions.

Industry insiders indicate that the risk of "black eating black" in gold currency exchange transactions has always existed, as illegal merchants may forge documents and abscond with funds. With gold prices soaring, this default risk is also expected to increase.

Local "currency exchange service providers" help customers convert renminbi into anonymized gold entities through a complex gold trading network, which can then be exchanged for USDT or other foreign currencies. The entire process can be completed in as little as one day, with commissions typically controlled within 6% of the transaction amount.

Although this operation carries the risk of "black eating black," it remains a typical reflection of stablecoins' involvement in illegal fund flows, revealing a much larger underground money laundering network operating globally.

The Billion-Dollar Stablecoin Money Laundering Chain

Underground money houses are an indispensable part of the stablecoin money laundering chain.

Underground money houses, also known as "underground banks," are illegal financial service institutions that primarily conduct cross-border remittances and fund transfers through informal channels. These illegal financial service institutions are mostly located in East Asia and Southeast Asia and play a core role in the overall money laundering network. Typically, they quickly launder illegal funds by collaborating with casinos, online gambling platforms, and transnational criminal groups, embedding them in the shadowy corners of the global economy.

USDT, due to its stability linked to the dollar, has become the preferred tool for money launderers—in 2023 alone, illegal crypto transactions involving USDT in Southeast Asia exceeded $5 billion.

Criminals typically convert their illegal gains into USDT through over-the-counter trading markets, then convert it into cash or deposit it into cold wallets, achieving anonymity and cross-border transfer of funds.

This phenomenon is particularly prevalent in Southeast Asia's gambling industry. According to a report by SlowMist Technology and UNODC, there are currently over 340 licensed and illegal casinos in the region, mainly distributed along the lower Mekong River border areas.

The relationship between casinos and underground money houses is best described as "mutually beneficial."

Southeast Asian casinos conceal the sources of funds through "custodial" transactions and "investments," forming a complex money laundering chain. The anonymity and non-face-to-face transaction characteristics of online gambling platforms further complicate the tracking of funds.

Gambling intermediaries play a pivotal role in the entire money laundering chain. The founders of the two largest gambling intermediaries globally—Sun City and Dejin—were sentenced to 18 and 14 years in prison, respectively, for money laundering and organized crime. They processed over $100 billion in funds through casinos, online gambling platforms, and underground money houses. These intermediaries utilize stablecoins to transfer funds, circumvent capital controls, and rely on unregulated payment companies to complete transactions.

Huione Group is a financial entity in Cambodia that provides fund transfer services for online gambling and scams in Southeast Asia through guarantee businesses. The group's payment platform, Huione Pay, is deeply involved in money laundering activities.

In July 2024, Tether froze TRON wallets related to Huione, involving 29.62 million USDT. However, despite the freezing of Huione's accounts, they continued operations through new addresses.

Due to insufficient regional regulation and a surge in unauthorized virtual asset service providers (VASPs), the activities of underground money houses continue to expand, leading to estimated economic losses of $18 billion to $37 billion in East Asia and Southeast Asia due to online fraud in 2023.

Stablecoins in Geopolitics

In geopolitical conflicts, stablecoins are playing an increasingly important role.

Since Western sanctions cut off Russia's SWIFT access in 2022, cryptocurrencies, especially stablecoins, have become an important alternative channel for cross-border settlements for Russian entities. Russian companies are converting rubles into USDT to pay overseas suppliers, thereby circumventing the dollar settlement system.

To adapt to this situation, the Russian government has taken proactive measures, deciding to allow the use of digital currencies in cross-border transactions starting September 1, 2024, and will begin legalizing cryptocurrency mining in November, allowing legal entities and individual entrepreneurs registered with the Ministry of Digital Development of the Russian Federation to engage in cryptocurrency mining activities.

Meanwhile, many wealthy Russians are choosing to transfer assets in the UAE, which has not joined Western sanctions, cashing out through cryptocurrencies in Dubai or directly purchasing real estate.

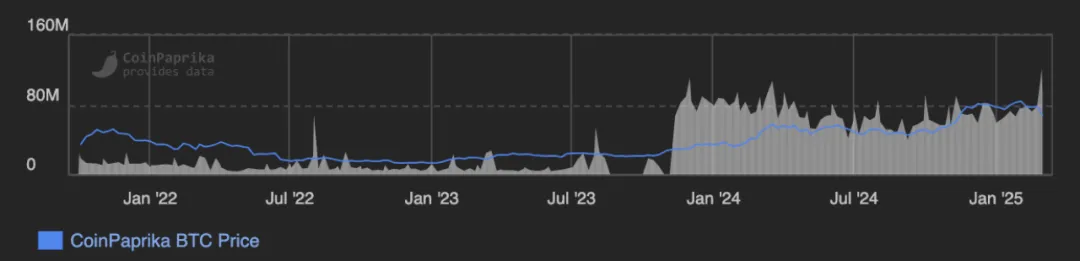

However, the United States has also taken corresponding countermeasures. The Russian cryptocurrency exchange Garantex is a typical case: despite being sanctioned by the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) in April 2022, the exchange's daily trading volume surged from about $11 million in March 2022 to $121.6 million in March 2025, an increase of over 1000%.

Good times are hard to last. With increased regulatory pressure, the European Union issued its 16th round of sanctions against Russia in February 2025, placing Garantex on the sanctions list.

On March 6, Tether directly froze approximately $28 million in USDT, involving multiple Garantex-related wallets, forcing the exchange to suspend all trading and withdrawal operations and issue asset risk warnings to Russian users.

Stablecoins have stepped onto the stage of international geopolitical games.

A Safe Haven Against High Inflation in Latin America

In Latin America, stablecoins are becoming an important safe haven against high inflation and currency devaluation.

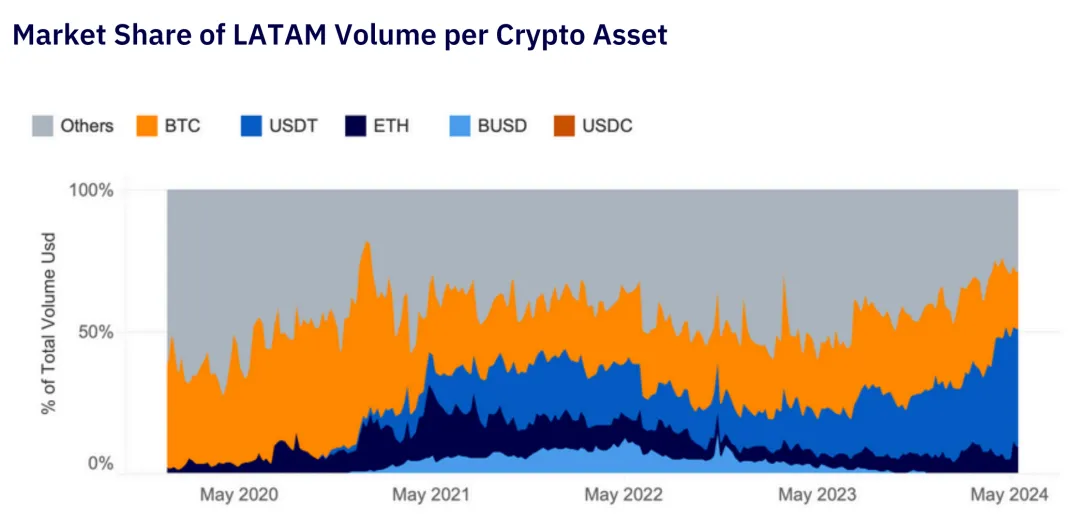

According to the "LATAM Market Report" published by Aiying Compliance, political instability and economic crises in the region have driven the popularity of cryptocurrencies, especially in countries like Argentina, Venezuela, and Brazil. In 2024, the total cryptocurrency trading volume in Latin America reached $16.2 billion, with USDT-related transactions accounting for over 40%.

Cryptocurrency trading volume in Latin America continues to grow, with stablecoins seeing even greater increases.

Source: "LATAM Market Report," Author: Aiying Compliance

Taking Argentina as an example, the inflation rate in Argentina surpassed 200% in 2024, and the peso continued to depreciate. "Yesterday's peso can't buy today's goods" has become a daily reality for the Argentine people under the economic crisis.

A report by Chainalysis pointed out that in response to the economic crisis, some Argentinians have started turning to the black market to purchase foreign currency, with the most common being the U.S. dollar (USD).

This so-called "blue dollar" is traded at informal parallel exchange rates, usually obtained at underground exchange points known as "cuevas" scattered throughout the country.

Additionally, stablecoins pegged to the dollar have also become a choice for Argentine residents to preserve their assets against inflation.

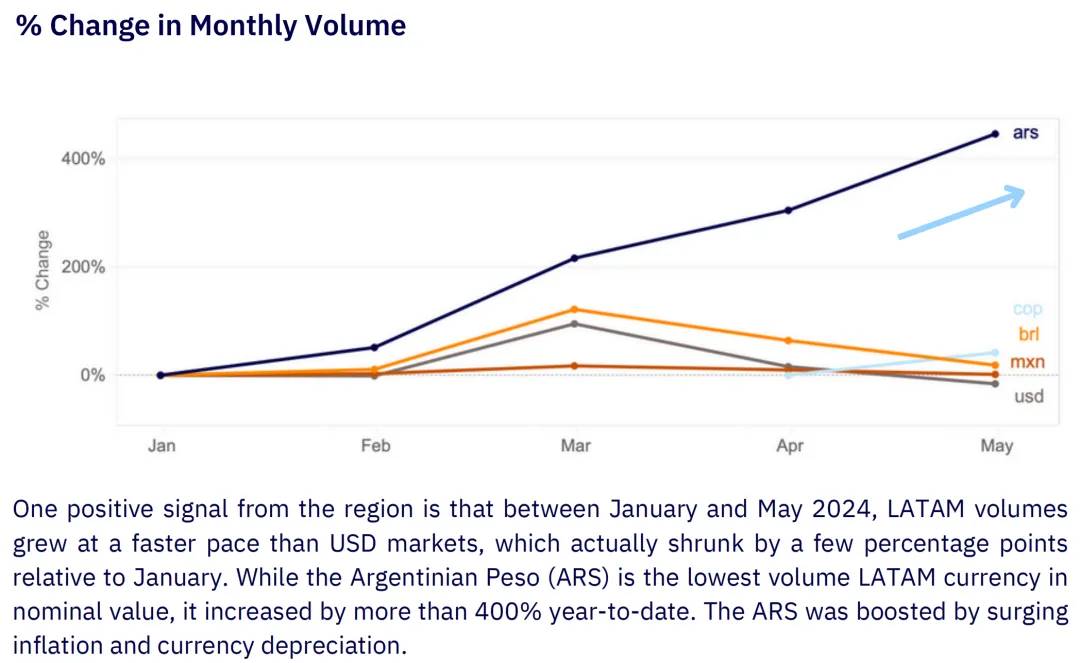

Argentina's stablecoin market is leading in the Latin American region, with stablecoin trading volume accounting for 61.8%, slightly higher than Brazil's 59.8%, and far above the global average of 44.7%. From January to May 2024, Argentina's cryptocurrency trading volume grew by over 400%.

Argentina's cryptocurrency trading volume grew by 400% from January to May 2024.

Source: "LATAM Market Report," Author: Aiying Compliance

The popularity of stablecoins not only provides a solution to combat inflation but also opens up new economic avenues for tens of millions of unbanked people in Latin America.

In Latin America, tens of millions rely on smartphones and USDT wallets for transactions due to a lack of banking services. Mexico's largest exchange, Bitso, holds 99.5% of the local cryptocurrency market share. In the daily savings and remittances of Latin Americans, USDT trading volume is steadily increasing.

A Future Interwoven with Light and Shadow

The continuously expanding stablecoins flow into both the light and dark sides of the global financial system.

On the surface, stablecoins bear the responsibility of facilitating the trading and circulation of crypto assets, providing users with a sense of calm amidst asset volatility; on the dark side, stablecoins build more secretive channels for the transfer of interests in gray and black industries.

Stablecoins are becoming independent from the cryptocurrency market, penetrating every crevice of the global economy.

By 2025, the total market capitalization of stablecoins has approached $250 billion. Behind this number lies a multi-layered game between crypto and reality, order and violation, freedom and regulation.

Perhaps stablecoins have not yet made as visually striking an impact on the world as Bitcoin, but they are undoubtedly changing the rules of capital flow in a more subtle and detailed manner, becoming an indispensable part of the global financial system.

On one hand, they provide a stable value anchor for the digital economy, serving a vast user base that includes tens of millions of unbanked people in developing countries; on the other hand, their anonymity also provides a more concealed channel for cross-border capital flows, drawing the ongoing attention of global regulatory agencies.

While providing users with price stability, "stablecoins" are quietly shaking the foundations of the traditional financial system. This seemingly contradictory yet unified characteristic may be a new key to understanding the new landscape of the future financial world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。