The Solana Foundation has launched a new policy aimed at enhancing the independence of validators by reducing their reliance on the foundation. However, the ultimate outcome may still lead to the optimization of large and medium-sized nodes.

Written by: Frank, PANews

As SOL ETFs are being pushed onto the agenda by institutions, the Solana ecosystem seems to be accelerating its reform towards decentralized governance. On April 23, the Solana Foundation introduced a new policy for the Solana Foundation Delegation Program (SFDP). For each new validator added to the SFDP, three existing validators will be removed if certain validators have been eligible for Solana Foundation delegation on the mainnet for at least 18 months and have less than 1000 SOL staked outside of the Solana Foundation delegation. This policy aims to enhance validator independence by reducing their reliance on the foundation. However, it seems that the final result may still be the optimization of large and medium-sized nodes.

"One In, Three Out" Optimizing Validator Structure

The most striking aspect of the new policy is its "one in, three out" replacement rule. Specifically, for every new validator added to the Solana Foundation Delegation Program (SFDP), three existing validators will be removed.

The criteria for triggering removal are very clear and include two key conditions. First, the validator must have been eligible for foundation delegation for at least 18 months; second, the validator must have less than 1000 SOL staked from external sources outside of the foundation delegation. These two conditions precisely target those validators who have long participated in the delegation program but have failed to demonstrate their independent viability by attracting community support.

It is noteworthy that this policy took effect immediately upon announcement, indicating that the Solana Foundation is urgently advancing the decentralization process of the Solana network.

Impact May Involve Half of Validators

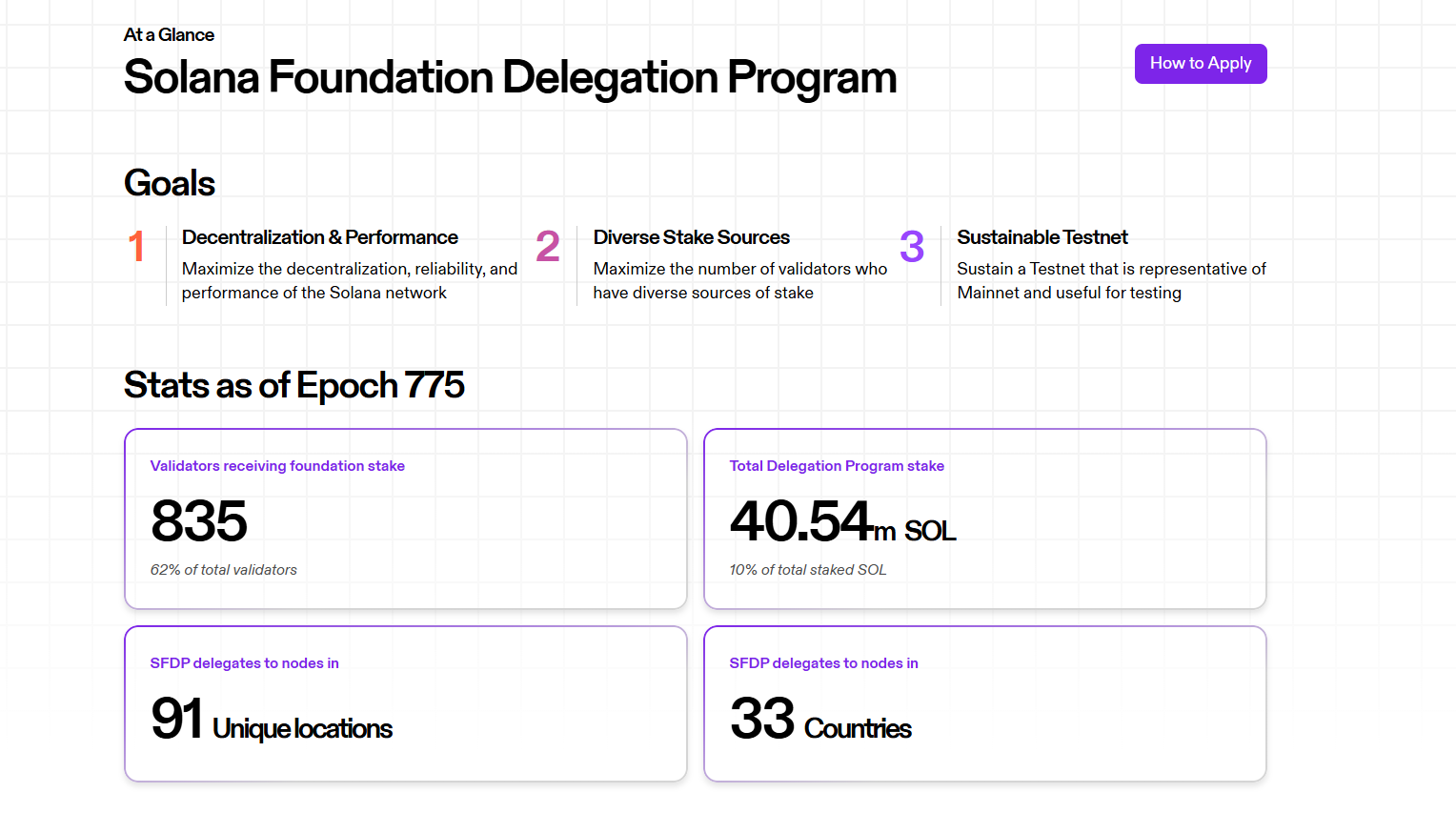

According to official data, as of April 24, there are 835 validators participating in the SFDP, accounting for 62% of the total number of validators on the Solana network. The total amount of SOL delegated through this program is approximately 40.5 million SOL, representing 10% of the total staked SOL on the Solana network.

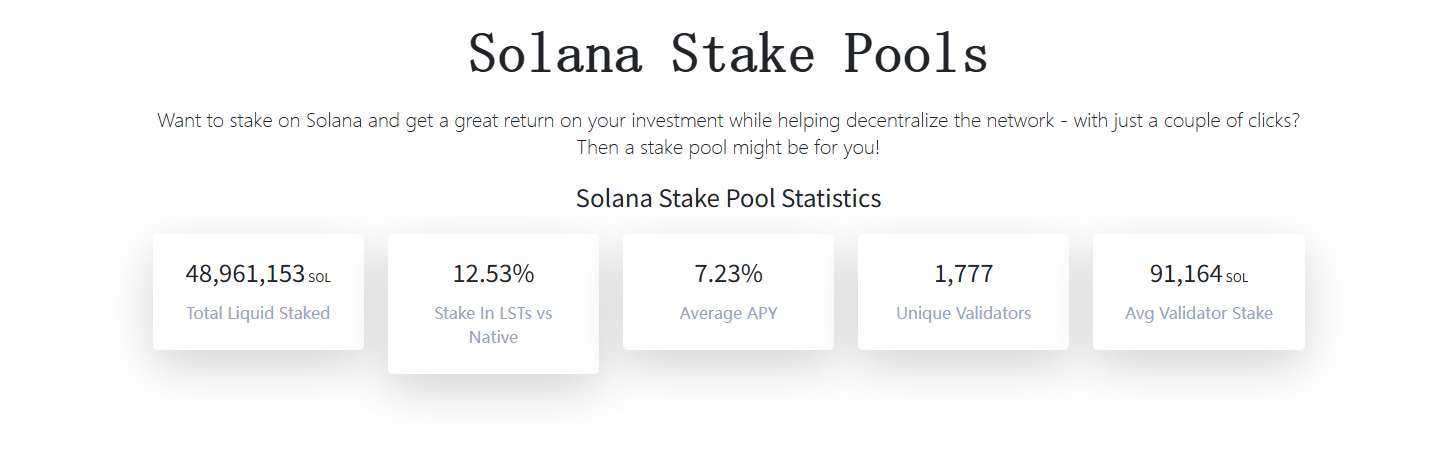

According to a report by Helius at the end of August 2024, about 51% of validators have less than 1000 SOL staked from external sources. If this ratio remains relatively stable, the current number of eligible validators is approximately 686. In the future, these validators may be forced to exit the validator ranks if they fail to attract more SOL staking, primarily because many validators rely on the Solana Foundation's SFDP program for their survival.

As for why the foundation's support is directly related to the survival of many validators, let's revisit the SFDP program. The Solana Foundation Delegation Program (SFDP) is one of the core mechanisms supporting the development of the validator network within the Solana ecosystem. The program was established to guide growth in the early stages of the network, lowering the entry barrier for validators, particularly by providing basic delegation to help validators with less capital participate in consensus and earn rewards, thereby promoting the growth of the number of validators and the overall security of the network.

The SFDP provides support to validators in various ways:

Stake Matching: This is a key mechanism to incentivize validators to attract external staking. The foundation matches the external staking obtained by validators at a 1:1 ratio, with a maximum matching amount of 100,000 SOL. However, this matching is not unlimited. Once a validator's external staking exceeds 1 million SOL, the foundation will no longer provide any delegation (including matching and residual delegation).

Residual Delegation: After completing all eligible stake matching, the remaining SOL in the SFDP fund pool will be evenly distributed among all other eligible validators. According to Helius's analysis, this portion of delegation is currently about 30,000 SOL per validator. However, the foundation has indicated that as it increases its investment in community-operated staking pools, this portion of residual delegation is expected to gradually decrease.

Voting Cost Assistance: Running a Solana validator requires ongoing payment of voting transaction fees, which can be a significant expense for new or smaller validators (approximately 1.1 SOL per day). To alleviate this initial burden, the SFDP offers a time-limited voting cost subsidy program. For new mainnet validators applying for this support, the foundation covers 100% of the voting costs for the first 45 epochs (about 3 months) after they join the program, then the coverage ratio decreases by 25% every 45 epochs until the subsidy stops after 180 epochs (about 1 year).

Is Solana Trapped in a Cycle of Increasing Centralization?

According to estimates by Laine in 2024, a validator needs at least 3,500 SOL staked to balance voting costs, not including server costs exceeding $45,000 per year. Therefore, it can be said that if forced out of the SFDP program, a large number of small validators may have no choice but to shut down.

Fortunately, this plan has two external conditions: having been part of the SFDP program for 18 months and the need for the SFDP to add a new validator. This provides a buffer period for those validators that do not meet the criteria.

From a design perspective, this plan aims to reduce validators' reliance on the Solana Foundation, enhance their independence and community support, and lower the perception that the Solana Foundation has excessive influence over the ecosystem. However, from a foreseeable outcome, if there are not enough new validators of sufficient quantity or quality to fill the gaps left by those removed, or if new validators themselves struggle to survive in a competitive environment, the total number of validators on the network may decrease, thereby harming decentralization.

On April 22, Paul Atkins was sworn in as the new chairman of the U.S. SEC. This pro-cryptocurrency chairman will have 72 crypto-related ETFs awaiting approval after taking office. Although many of these may struggle to pass, SOL, as one of the most highly anticipated tokens, may be among those likely to be approved. According to the timeline, the final approval dates for SOL are mostly concentrated in October 2025. However, the significant issue currently facing Solana is similar to the reasons for the repeated delays of Ethereum: insufficient decentralization may lead to a determination that it is a security. Therefore, this may be one of the main reasons why the Solana network must actively promote its level of decentralization.

On the other hand, as more institutions recognize the market, the Solana network may see an increasing number of large validators joining in the future. On April 23, the Canadian publicly listed company SOL Strategies announced it had secured up to $500 million in convertible note financing, which will be specifically used to purchase SOL and stake it on the validator nodes operated by the company. On the same day, another U.S. publicly listed company, DeFi Development Corporation, announced it would increase its total position in SOL to 317,000 SOL and plans to hold it long-term and participate in staking for returns.

Ultimately, whether it is the previously overturned SIMD-0228 proposal, the current "new policy" of the Solana Foundation, or the increasing number of institutions entering the space, the direct result seems to be that small and medium validators are being hindered, with the barriers appearing to rise. This outcome does not seem to contribute to advancing the level of decentralization. For Solana, how to lower the barriers for validators may be the true attitude towards promoting decentralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。