Bitcoin rebounds, altcoins remain at low points.

Author: WOO X Research

Bitcoin regained the 90,000 mark on April 23, partly due to the tariff war situation becoming clearer. U.S. Treasury Secretary Mnuchin stated that the tariff deadlock is unsustainable and that conditions are expected to ease in the near future.

On the other hand, Trump has been publicly pressuring Federal Reserve Chairman Powell to cut interest rates, even suggesting that he would fire Powell if rates are not lowered. This has led to global market skepticism about the independence of the Federal Reserve, resulting in distrust towards the U.S. dollar. The latest development is that when the media inquired about this matter, Trump stated, "I have no intention of firing him (Powell). I just hope he can be more proactive about cutting rates."

Bitcoin, during the time when Trump called for Powell's resignation, managed to play its role as "digital gold," showing a strong correlation with physical gold. Now that Powell's career crisis has been alleviated and U.S. stocks have rebounded significantly, Bitcoin continues to rise, enjoying the benefits of liquidity asset premiums, increasing by 12% over the past week.

In our previous article, we mentioned that during this Bitcoin rally, altcoins have not kept pace, with Bitcoin's market share currently at 64.2%, reaching a four-year high. While it is still uncertain when the altcoin season will arrive, we can observe which altcoins have outperformed Bitcoin during market turbulence to identify funding preferences, which may continue to show strong performance in the future.

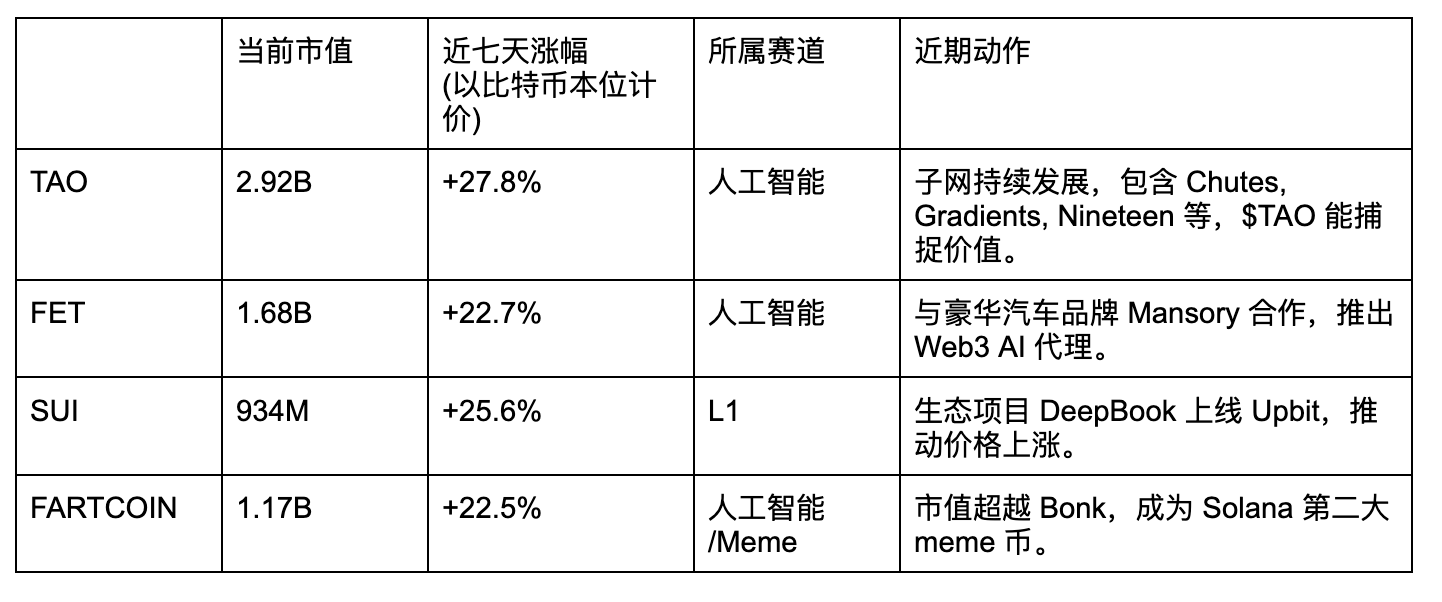

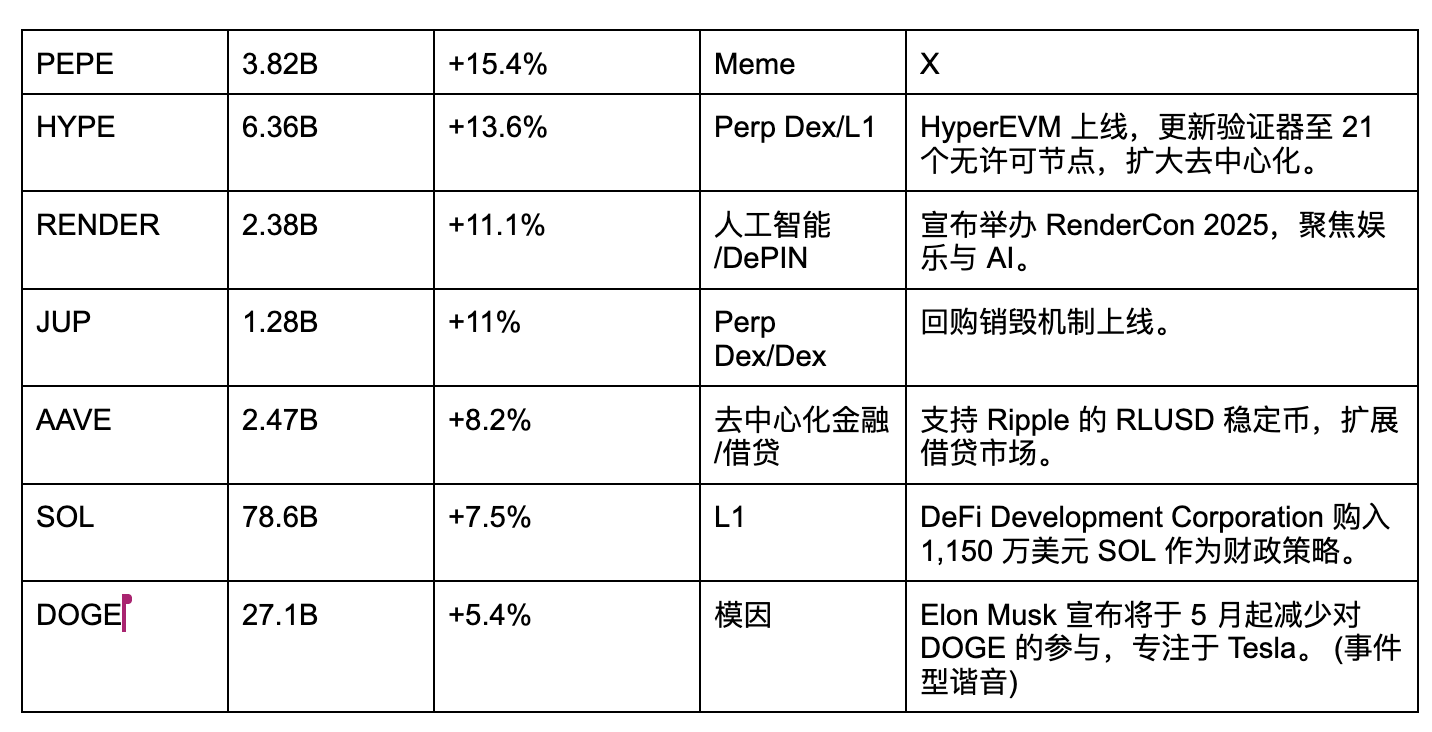

Top 100 cryptocurrencies outperforming BTC in the past week

The table below lists the top 100 tokens by market capitalization that have outperformed BTC in the past week. In fact, there are not just the 11 tokens listed below; on April 23, while Bitcoin surged, its market share slightly decreased (0.2%), indicating that many altcoins generally experienced gains. As a result, many tokens that had been declining for a long time overtook Bitcoin's seven-day gains overnight, but this increase should be interpreted as liquidity overflow rather than a result of funding selection.

Therefore, we exclude tokens that surged overnight and instead focus on altcoins that have steadily outperformed BTC over the past seven days.

Which sectors should we pay attention to?

From the above tokens, we can identify key sectors to focus on: AI, L1, Meme, and DeFi.

- AI: The previous narrative was initiated by AI, starting from the combination of GOAT and memes, and later exploring more possibilities and applications. The AI frenzy led to a bubble, which eventually burst under the continuous issuance of tokens by the Trump family, resulting in most AI tokens dropping over 90%, reshaping valuations.

The bursting of the bubble does not mean the end of the sector; rather, it is a mechanism that eliminates mixed-quality projects in the market. This means that with the continued development of Web 2 AI, Web 3 AI projects have undergone a round of reshuffling. If we believe that Web 2 AI can transition to Web 3, then the current valuations in the AI sector are relatively cheap, and the remaining projects have been tested in terms of fundamentals. If the altcoin season arrives in the future, this sector is expected to absorb the liquidity overflow from Bitcoin.

Representative tokens outside the table: VIRTUAL, ARC, ALCH, SWARMS, Zerebro.

- L1: Public chain tokens have always been a relatively stable choice when the altcoin season arrives. The overall logic is that the development of public chains determines the ceiling of their ecosystem projects while capturing the most liquidity.

However, unlike in 2021, funding is no longer paying for "EVM copy-paste" but is seeking public chains that can truly bring new applications through TPS and developer tools. Once specific catalysts (exchange listings, institutional custody) appear, price elasticity will be significantly higher than that of established L1s.

Emerging public chains without issued tokens: Monad, MegaETH.

Meme: Bitcoin is the largest meme coin in the entire cryptocurrency space. Meme coins have become a prominent trend in this cycle and are likely to continue to survive in the future. The key factor is that meme coins serve as carriers of consensus and culture, and the leading meme coins on various public chains can also be seen as leveraged versions of public chain tokens. Most meme coins are natively on-chain, and their pricing power is not monopolized by centralized exchanges, making them prone to wealth effects. In the cryptocurrency space, as long as there is a wealth effect, there will be a continuous influx of liquidity and participants.

DeFi: In the cryptocurrency space, DeFi is a rare sector with a genuine business model. Perp Dex and Dex earn transaction fees; lending can earn interest rate spreads; Yield Farming earns deposit and withdrawal fees; LaunchPad earns token issuance fees. The tokens HYPE, JUP, and AAVE in the table are all dominant players in the DeFi field. More importantly, they all have token buyback mechanisms, meaning that as the altcoin season arrives and liquidity recovers, trading volumes will increase. Due to the network effects of leading DeFi protocols, overall projects will achieve higher profitability, and higher profitability means stronger buyback efforts. When demand for tokens increases, the likelihood of sustained price increases also rises.

Conclusion: Closely monitor Bitcoin's market share

The start of the altcoin season means that funds are flowing from Bitcoin to riskier, smaller market cap altcoins. Therefore, there are two key indicators to observe: first, whether Bitcoin can stabilize above 90,000, providing a stable confidence anchor for the market; second, and more importantly, whether Bitcoin's market share (BTC.D) can begin to decline, reflecting a shift in funding preferences.

On April 23, Bitcoin surged to 90,000, but BTC.D only slightly decreased by 0.2%, indicating that we are still in a phase where "funds are concentrated in BTC, with steady growth." However, if BTC.D starts to decline significantly, such as returning to the 57% level seen earlier this year, it will signal that funds are officially overflowing into the altcoin market, at which point a "rotation market" may fully unfold.

In other words, the true starting point of the altcoin season is not only Bitcoin continuing to reach new highs but also the process of rising risk appetite and funds spreading from BTC to other thematic sectors. When both of these occur simultaneously, we have the opportunity to see a comprehensive revitalization of the overall market. Now is the time to observe, filter, and position ourselves; whether the altcoin boom is coming will be indicated by the trend of BTC.D.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。