Rethinking Ethos @ethos_network

- Ethos as an On-Chain Reputation Aggregation Platform - Built-in Traffic

The core positioning of Ethos can be theorized as a "reputation aggregation platform" within the blockchain ecosystem, similar to Yelp in the real world, but its traffic mechanism is rooted in the collective behavior and emotional drive of the crypto community.

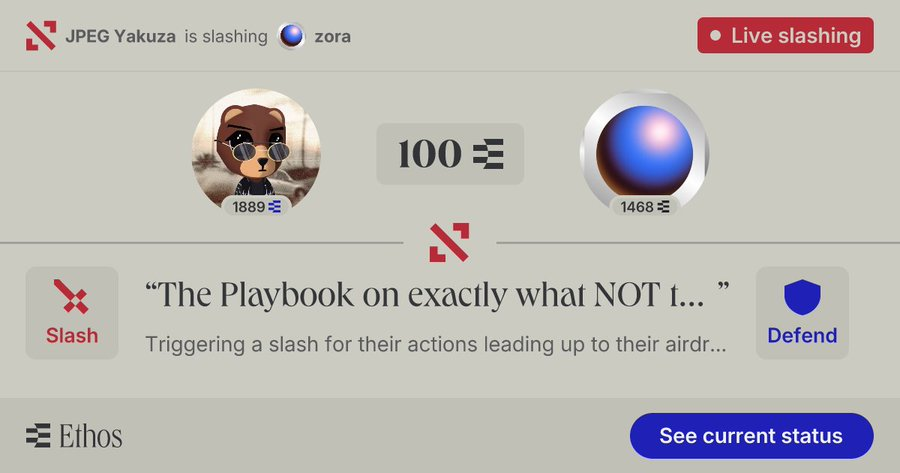

Ethos's traffic comes from the community's collective response to inappropriate behavior by project teams/devs (the Zora incident is a typical case). When a project team incites public anger, users tend to concentrate their dissatisfaction on Ethos, forming clear reputation signals. This centralization contrasts sharply with the decentralized and fragmented tweets on platform X. Ethos's square-like design amplifies group resonance through social feedback mechanisms (such as ratings and comments).

Taking Bubblemaps as an example, its development path validates the token model that combines practicality with trending topics, and Ethos may replicate this path:

Essential Functionality: The bubble chart meets the demand for on-chain data visualization, occupying users' minds.

Driven by Trending Events: By analyzing on-chain hotspots (such as the Argentine president issuing a token), it continuously attracts community attention.

Tokenization and Market Sentiment: The launch of the $BMT token, positioned as an "on-chain detective system," combined with the FOMO effect brought by the launch on Binance alpha, drives up the token price.

Theoretically, the value of such tokens does not come from sustainable cash flow but from the short-term amplification of attention economy and community sentiment. However, the lack of stable income sources raises doubts about their long-term value capture ability.

- Ethos's Reputation Incentive Mechanism and the Game of Publicizing Familiar Networks

The core innovation of Ethos lies in making the implicit trust relationships of familiar networks explicit through token incentives and airdrop expectations, constructing a decentralized reputation system. From the perspective of social capital theory, trust information within familiar networks is usually limited to a small scope. Ethos makes this information public through a mutual evaluation mechanism, providing credible signals for third parties. For example, users can assess based on third-party ratings from KOLs, reducing information asymmetry. However, this mechanism faces the following game theory issues:

Insufficient Positive Incentives: People tend to avoid publicly disclosing negative information among acquaintances (social norm constraints), leading to a lack of motivation for negative reviews. Currently, the proportion of positive reviews on the Ethos platform is significantly higher than that of negative reviews, which may weaken the objectivity of the reputation system.

Risk of Retaliatory Negative Reviews: Negative reviews may trigger malicious counteractions, requiring users to weigh the benefits of disclosing the truth against potential social costs, suppressing genuine feedback.

Limitations of Incentive Design: Token incentives may lead to "review spamming" behavior, similar to the early fake review issues on Yelp, damaging the platform's credibility.

- Ethos's InfoFi Value and Long-Term Potential

Ethos can be classified as an InfoFi (Information Finance) innovation, with its core value lying in reducing trust costs in the blockchain ecosystem through the datafication of reputation. Ethos's bilateral network effect (between project teams and users) gives it the potential to become a commonly used tool on-chain. However, its value capture ability is limited for the following reasons:

Ambiguous Revenue Model: Ethos relies on token incentives and airdrops to attract users but lacks a clear profit mechanism. Advertising or subscription models may not be suitable for a decentralized ecosystem.

Competitive Pressure: Similar reputation systems are easy to replicate, with low differentiation barriers.

Conclusion

The theoretical value of Ethos lies in reducing trust costs in the blockchain ecosystem through reputation aggregation and the publicization of familiar networks, with its traffic mechanism benefiting from community sentiment and network effects. However, flaws in incentive design, risks of retaliatory negative reviews, and insufficient value capture ability limit its long-term potential. If it can optimize its incentive mechanisms and improve operational efficiency, Ethos is expected to become a benchmark tool in the InfoFi field, but it must remain vigilant against the dual challenges of competition and user trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。