The price of Bitcoin has once again surpassed $94,000 today, leading to a surge in altcoins. Behind this wave of market activity, have on-chain data released signals of a bull market? By analyzing key indicators such as trading volume, wallet addresses, and token distribution, we can gain insights into market trends from a fundamental perspective.

Is this a temporary fluctuation driven by institutions, or is it a future celebration lurking beneath the surface of on-chain whales?

Trading Volume and Market Activity

Data Source: bitsCrunch.com

Data Source: bitsCrunch.com

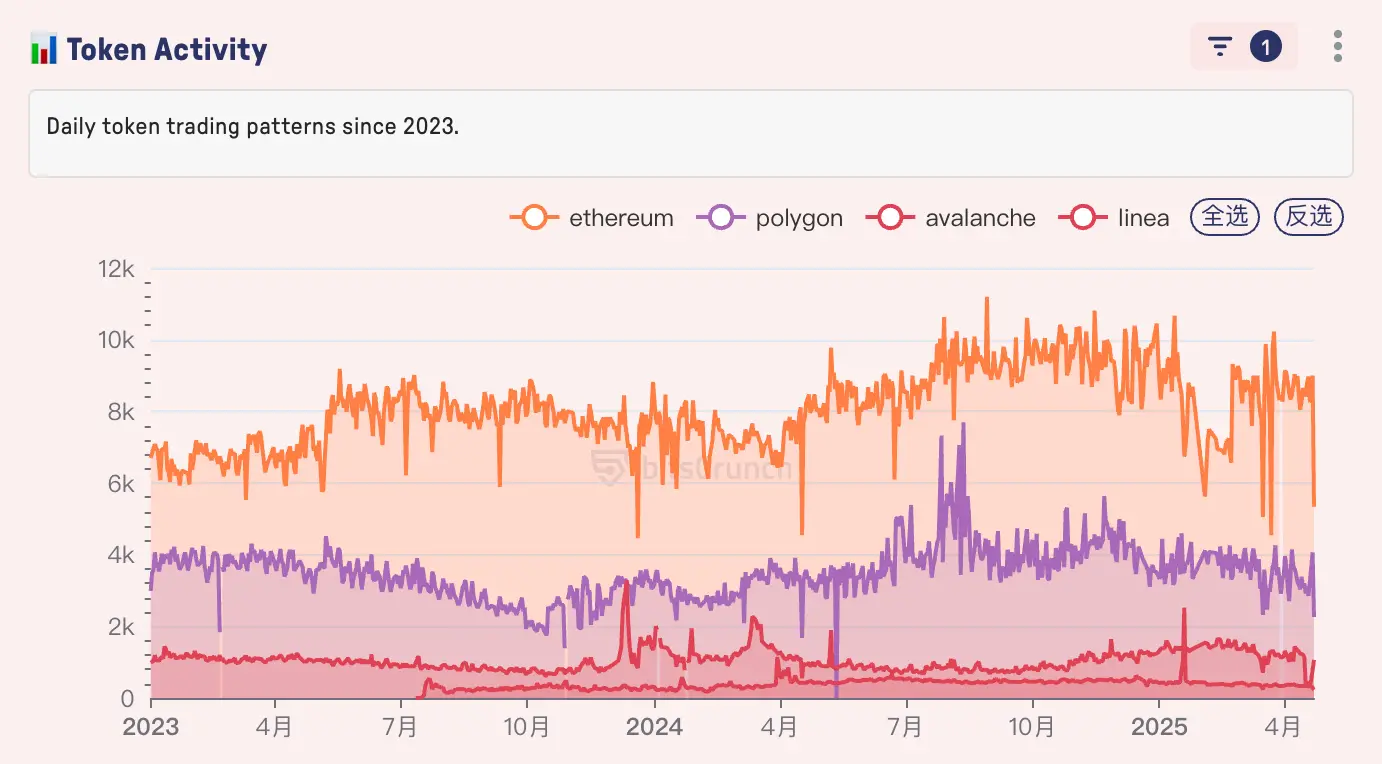

According to bitsCrunch data, the total trading volume across the network reached $39.9 billion in the past 24 hours, with the number of transactions exceeding 7.2 million and the number of unique addresses participating in trading at 3.03 million, involving 13,800 different tokens. Since July 2023, trading volume has steadily climbed from a low of 2 million to 10 million, especially accelerating after April 2024, significantly enhancing market liquidity. Although the number of on-chain transactions saw a sharp decline in March this year, there is an overall short-term upward trend.

Trader Composition

Data Source: bitsCrunch.com

Data Source: bitsCrunch.com

The trader trend chart reveals fluctuations in the number of on-chain traders since 2023. According to bitsCrunch data, the number of traders fell below 2 million in October 2023 but quickly rebounded to 8 million in the second half of 2024, maintaining a relatively high level into January 2025. This change aligns closely with the market cycle's "recovery-explosion" phase. It is noteworthy that the growth in the number of traders is not linear, with short-term pullbacks occurring at the middle of each quarter (such as May and August). The chart also shows how explosive news can lead to phase adjustments in the sentiment of institutional investors and retail traders. However, the current daily active trader count of 3.03 million is still at a relatively low point, only one-third of peak periods, requiring further observation.

On-Chain Token Holding Distribution

Data Source: bitsCrunch.com

Data Source: bitsCrunch.com

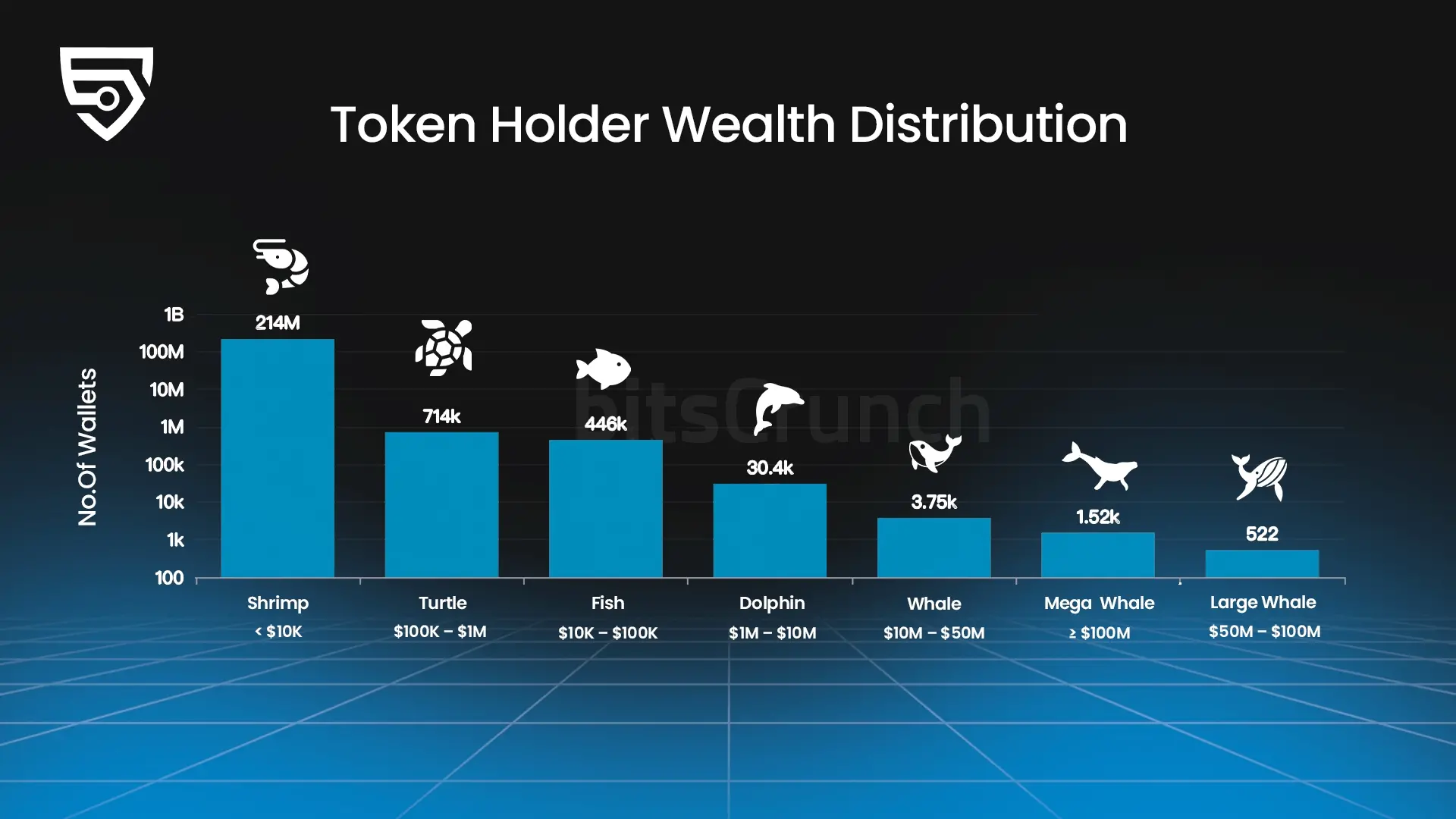

Among the aforementioned traders, bitsCrunch further categorizes wallet addresses based on different holding amounts. Currently, there are 1,052 "Mega Whale" wallets holding over $100 million in assets, while the number of retail (Shrimp, $10,000) wallets, although constituting an absolute majority at approximately 214 million, holds far less in total value compared to the whale holdings. This "80/20 distribution" is particularly typical in financial markets—whales often enter the market first to accumulate assets, followed by smaller funds pushing up asset prices. It is also noteworthy that the number of "Dolphin" ($1 million - $10 million) and "Fish" ($10,000 - $100,000) tier wallets provides crucial support for market liquidity.

Token Ecosystem

Data Source: bitsCrunch.com

As seen in the above chart, trading on the Polygon chain remains relatively stable, with daily transactions stabilizing around 4,000. It is important to note that, according to bitsCrunch's Ethereum on-chain data, there was a significant drop in on-chain activity on Ethereum at the beginning of 2025, while the price response lagged behind. With the launch of more Layer 1 solutions, the decline in Ethereum's ecosystem activity may reshape the market landscape.

Conclusion

Although Bitcoin has returned to $90,000 and many altcoins have seen significant gains, the current market's on-chain trading volume has not yet returned to a relatively active level. With news policies and regulations progressing in 2025, the structure of on-chain traders is becoming more diversified, with both whales and retail investors active simultaneously. Even with new hotspots and sectors, investors still need to pay attention to marginal changes in data, maintain rationality in a fervent market, and monitor whale activities to avoid potential short-term selling pressure due to highly concentrated capital distribution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。