In the morning, the cryptocurrency circle was stirred by a major news: Brandon Lutnick, son of U.S. Secretary of Commerce Howard Lutnick and chairman of Cantor Fitzgerald, teamed up with SoftBank, Tether, and Bitfinex to launch a $3 billion Bitcoin SPAC (21 Capital). This tool is backed by Bitcoin from Tether ($1.5 billion), SoftBank ($900 million), and Bitfinex ($600 million), with a valuation of $85,000 per coin, and plans to go public through Cantor Equity Partners. Coupled with the Trump administration's friendly policies towards cryptocurrencies, the BTC price broke through $94,000, with mainstream coins like ETH and SOL also rising, leading to an overall optimistic market sentiment.

Against this backdrop, multi-account traders face two major challenges:

1. Insufficient execution efficiency: Manual switching between multiple trading accounts leads to significant delays in order placement, making it easy to miss key price points.

2. Risk control execution out of sync: There is a time lag in the execution of stop-loss strategies across different accounts.

Solution: AiCoin multi-account ordering—batch opening and closing, efficient execution, precise capture of volatility.

Scenario: The $3 billion SPAC may trigger significant volatility in Bitcoin prices, requiring traders to place orders simultaneously across multiple trading accounts to avoid price impact on a single account.

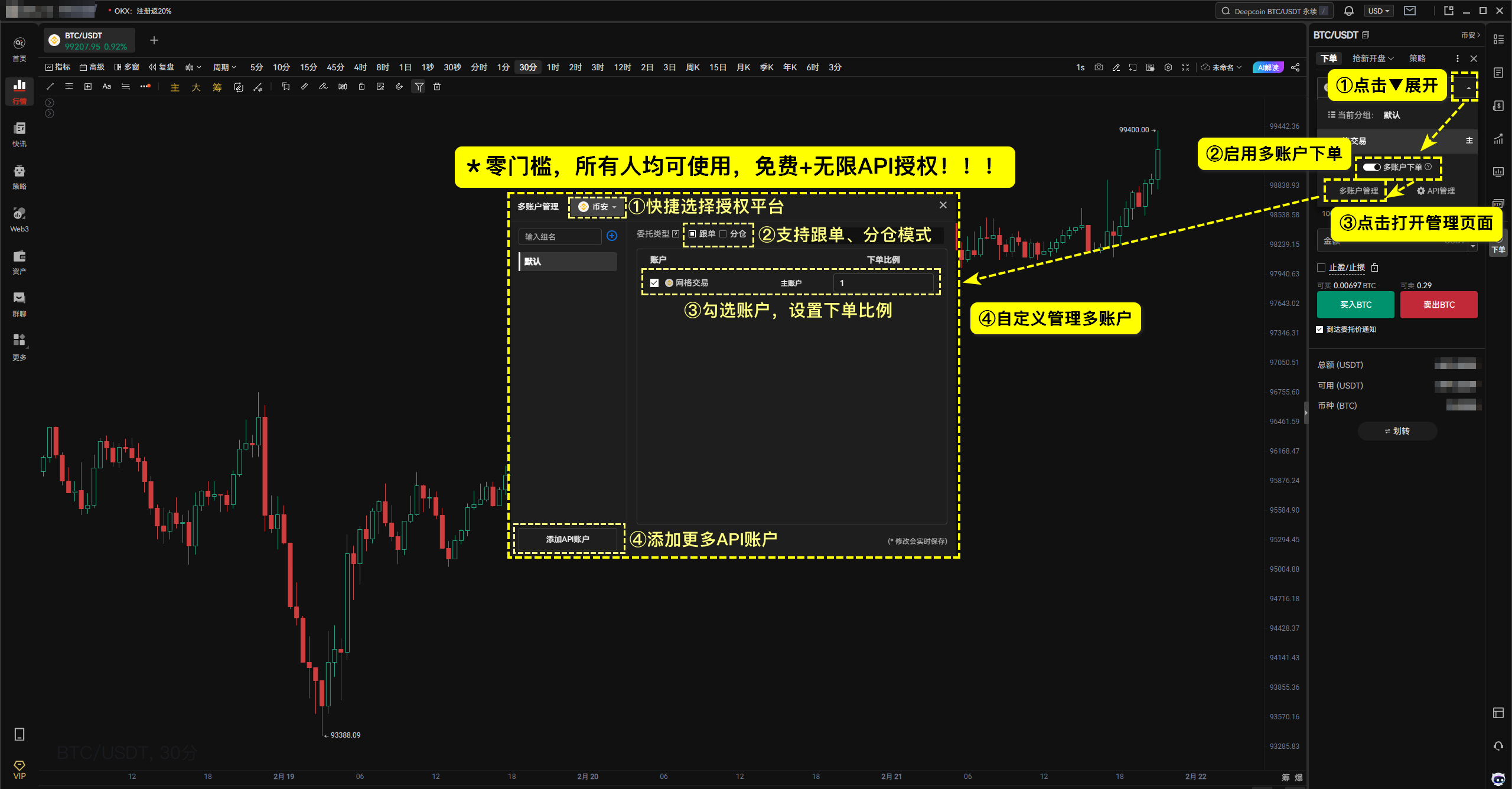

Operational Steps:

1. Bind API: Authorize AiCoin, supporting major trading platforms like Binance, OKX, Bybit, Bitget, for one-stop management.

2. Set batch orders (position allocation or following mode, ratio customizable):

(1) Opening positions: If BTC breaks $95,000, all accounts will place simultaneous buy orders.

- Following mode: Assuming you have 3 accounts, with an order ratio of 1:2:2, the main account buys 0.5 BTC, while Account A and Account B each buy 1 BTC.

- Position allocation mode: Assuming you have 3 accounts, with an order ratio of 2:3:3, for a total opening of 1 BTC, the main account buys 0.2 BTC, while Account A and Account B each buy 0.3 BTC.

(1) Closing positions: If BTC breaks $96,500, all accounts will batch take profit.

3. Effects:

Efficient transactions: Multi-account execution with zero delay in opening and closing;

Risk diversification: Distributing funds from a single account across multiple accounts to avoid the impact of market fluctuations on a single account;

Not missing opportunities: When breaking through key price points, one-click batch opening and closing to quickly capture sudden opportunities.

4. Applicable audience: Those seeking efficiency and low costs, including institutional investors, large fund traders, high-frequency traders, and signal providers.

Experience AiCoin's multi-account ordering feature now to respond to market hotspots and win the future: https://www.aicoin.com/tg/multi-account

AiCoin multi-account ordering guide: https://www.aicoin.com/article/430706

Download AiCoin for PC: https://www.aicoin.com/download

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。