Sure enough, as soon as Trump relaxed the market, it started to become uncontrollable. Although many friends are shouting that the bull market is back, I still don't know if my understanding is correct. Even now, I still feel that we are some distance away from a "bull market," especially for the overall risk market, where liquidity constraints still exist. I still believe that this is a rebound, not a reversal, though I may not be right.

Additionally, I don't think it's the right time to short the market. Even if I believe this is just a rebound, I won't open positions during non-U.S. stock trading hours; I will wait to see the reaction of U.S. investors after the U.S. market opens.

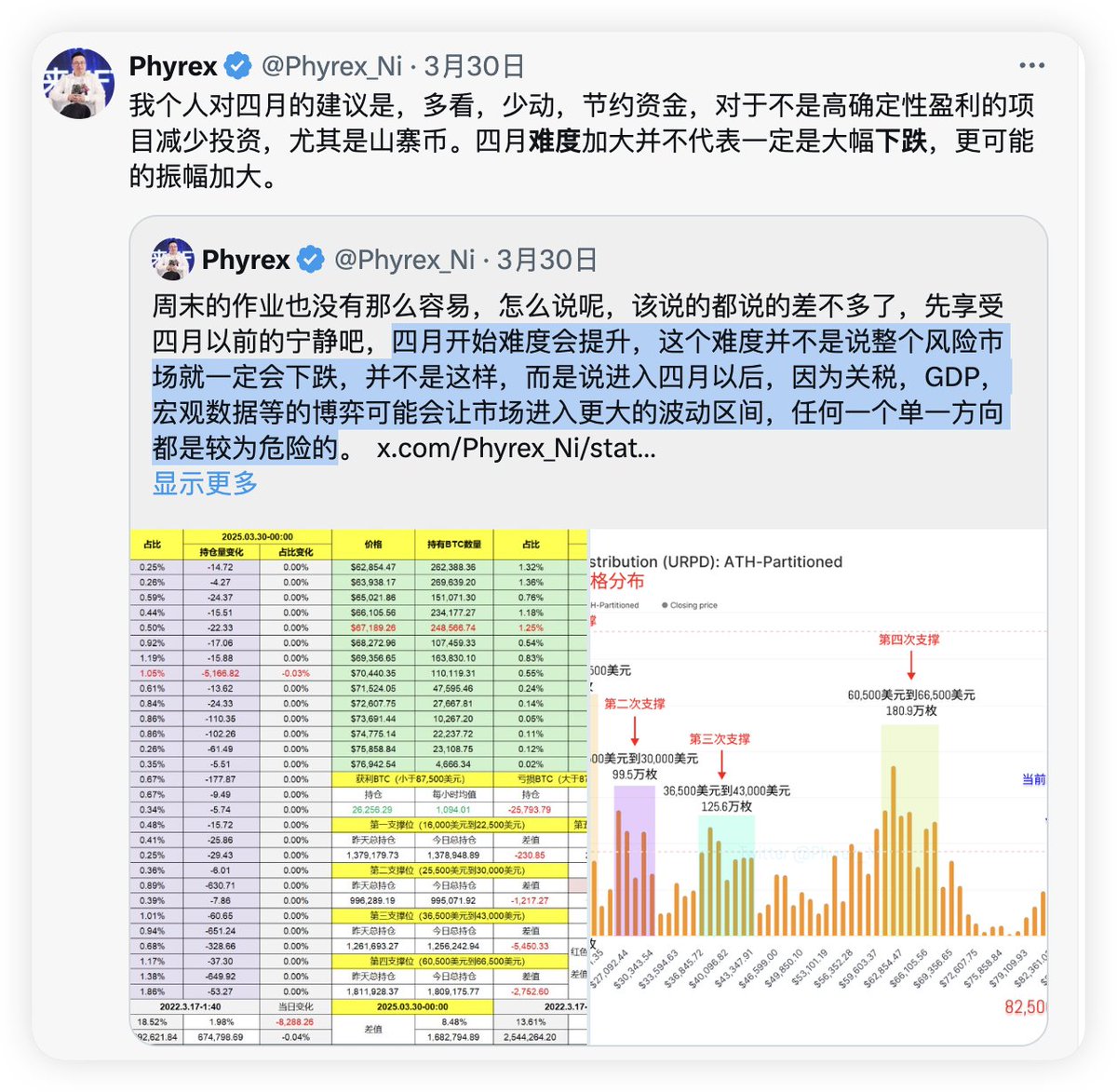

I want to reiterate that the trading difficulty in April is still very high. High trading difficulty does not mean a decline; it indicates that the long-short game is more complex, and many of the reasons for this game are driven by events, especially with Trump being the biggest uncertainty.

An increase in difficulty does not equate to a bearish outlook. I'm also worried that friends may not understand this. I've explained this issue multiple times. If your reading comprehension isn't good, don't blame me. The difficulty in the second quarter is already evident, and the volatility caused by Trump's statements doesn't need further elaboration, not to mention that there will be GDP data at the end of the month.

Really, I enjoy discussing with everyone and don't mind being criticized if I'm wrong, but the premise is that you can actually read through it before criticizing, rather than just throwing out random comments.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。