From DeSci to Institutional-Level DeFi, here are 10 early projects worth your attention.

Written by: Stacy Muur

Translated by: Tim, PANews

I have selected 10 early protocols from the AI-driven social analysis platform Moni that are 100% worth your attention:

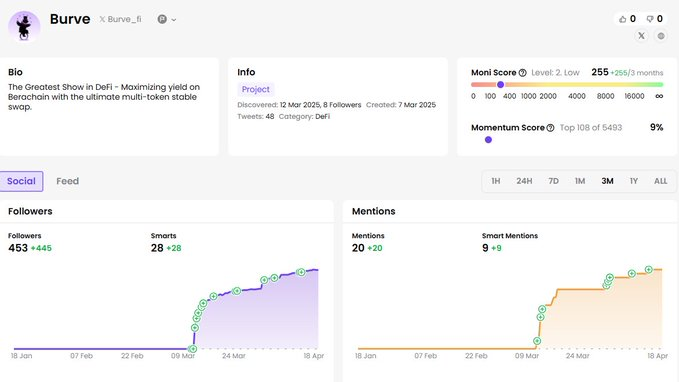

1. Burve

Category: DeFi yield aggregator based on Berachain

Introduction: Maximizes on-chain yields on the Berachain through multi-token swaps, liquidity pool leverage, and de-pegging insurance mechanisms.

Airdrop Potential: Medium to High (the project is in the very early stages, with few followers, has not issued tokens, classic airdrop model)

Token: Not issued

Highlights: Builds an ecosystem around optimizing liquidity providers + risk management tools (insurance, leverage). Expected to launch a liquidity mining phase soon.

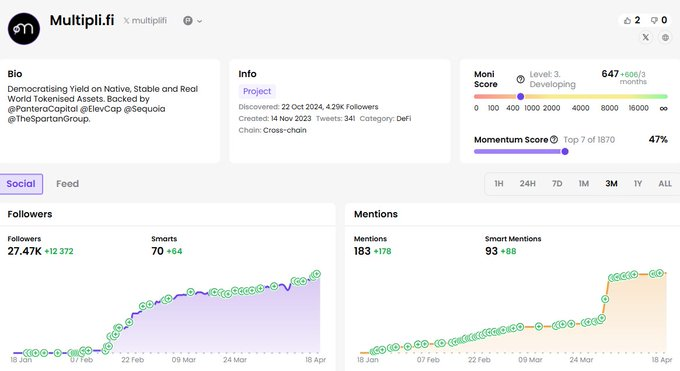

2. Multipli.fi

Category: DeFi yield aggregation

Introduction: Democratizes yields from native assets, stablecoins, and tokenized real-world assets.

Airdrop Potential: High (ORB rewards can be obtained during both testnet and mainnet phases; token issuance has been confirmed)

Token: Not yet issued

Highlights: ORB (on-chain reward bonds) can be obtained by participating in testnet and mainnet staking, and will be redeemable at TGE.

3. ambient.xyz

Category: Web3 + AI infrastructure

Introduction: A PoW (Proof of Work) blockchain that transforms AI model training into secure, rewardable on-chain activities.

Airdrop Potential: Official airdrop plan has not been announced.

Token: Not yet issued

Highlights: Currently no point mining or airdrop mechanisms. Supported by investments from a16z, Delphi Ventures, and Amber Group.

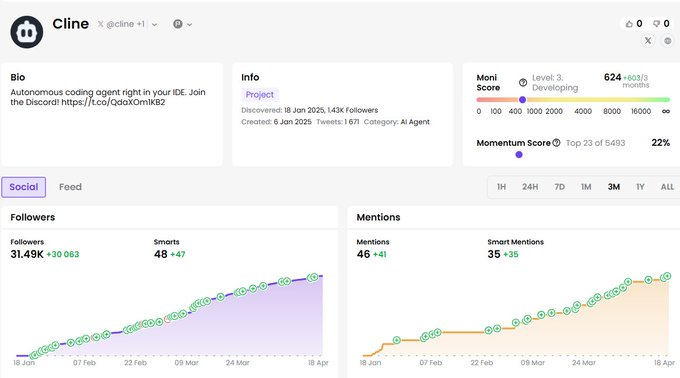

4. Cline

Category: AI developer tools, autonomous programming agents

Introduction: An open-source AI programming agent that supports collaborative writing, debugging, and delivery of full-stack code.

Airdrop Potential: Low (no token model, focuses on SaaS and open-source direction, no reward mechanism announced)

Token: None (no plans or signs of issuing a native token)

Highlights: Over 1.3 million installations, community followers exceed 31,000, active developer ecosystem; high GitHub popularity (over 40,000 stars), positioned more as open-source infrastructure rather than an on-chain protocol.

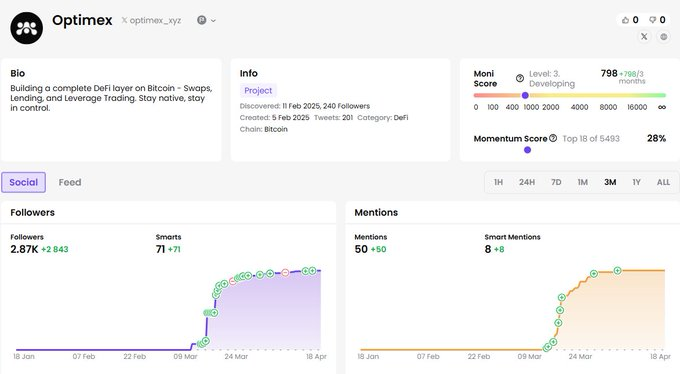

5. Optimex

Category: BTCFi

Introduction: A non-custodial DeFi protocol layer for native Bitcoin, supporting flash swaps, lending, and margin trading.

Airdrop Potential: Medium (no official plans yet, but early application users + alpha testers may qualify)

Token: Not yet launched (no public information on TGE or token economic model)

Highlights: No point system, no tokens. The project may be building a retrospective reward mechanism (future rewards based on early contributions).

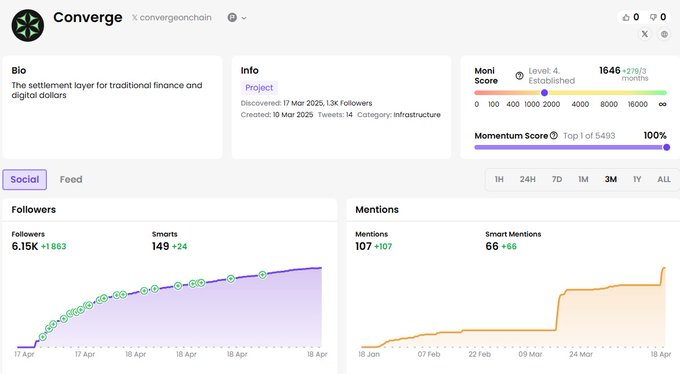

6. Converge

Category: Institutional DeFi protocol, asset tokenization settlement layer

Introduction: An EVM-compatible Layer 1 public chain that merges traditional finance with decentralized finance, achieving compliant asset tokenization and stablecoin settlement.

Airdrop Expectation: Low (no airdrop announced; focuses on institutional adoption and compliance)

Token: No native token; uses USDe and $ENA for settlement.

Highlights: Supported by Ethena and Securitize. Designed to cater to both institutional and permissionless application scenarios. Early partners include AAVE, Pendle, Morpho, and Maple Finance.

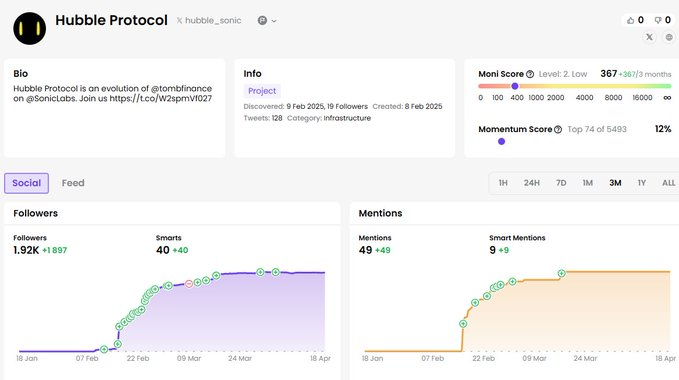

7. Hubble Protocol

Category: DeFi, yield strategy fork

Introduction: An evolved version of Tomb Finance, reimagined on Sonic, aimed at optimizing DeFi yield strategies.

Airdrop Potential: Medium (tokens have not been confirmed in the early stages, but mentions of user guidance mechanisms suggest future incentives may be available)

Token: Not yet launched

Highlights: The project claims to originate from Tomb Finance and may be building a flexible supply or algorithmic yield structure.

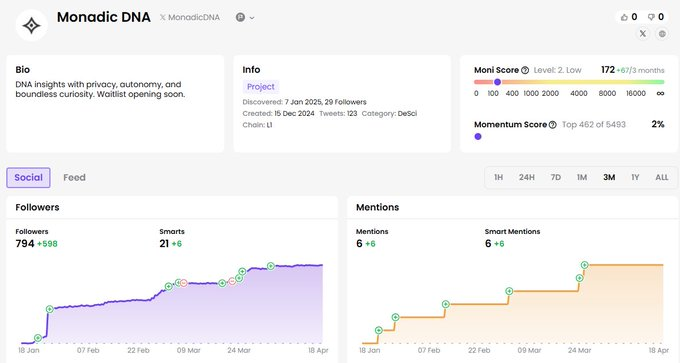

8. Monadic DNA

Category: Decentralized science, privacy-preserving genomics

Introduction: Provides health and lifestyle insights from DNA without relinquishing data control.

Airdrop Potential: Medium (waitlist will soon open, early development momentum is good, tokens have not been announced but may adopt typical DeSci incentive models)

Token: Not yet launched (no confirmation of tokens or governance mechanisms)

Highlights: Positioned as an alternative to 23andMe's user ownership, 23andMe is a winning project of ETHGlobal 2024.

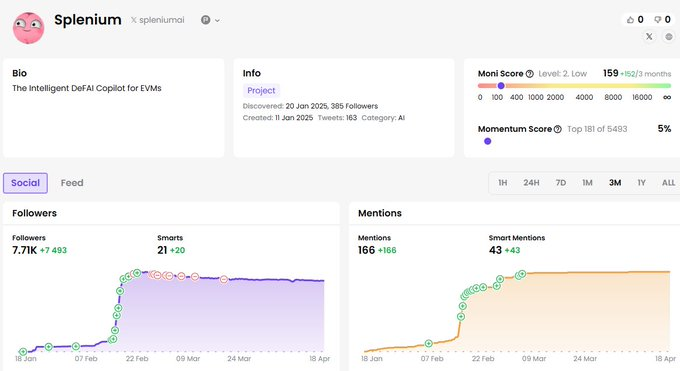

9. Splenium

Category: Decentralized artificial intelligence (DeAI)

Introduction: A chat-based AI co-pilot tool that supports users in real-time NFT trading, asset management, and market tracking across EVM chains.

Airdrop Potential: Medium (13,000 user base, early growth stage, high interaction frequency suggests future reward mechanisms may be launched)

Token: Not yet issued (token plans have not been confirmed)

Highlights: Expected to develop into a personal DeFi application layer or integrate into existing wallet ecosystems, needs to build a long-term growth flywheel through token economics or protocol layers.

10. Metadrip

Category: AI agents, DeFi user experience layer

Introduction: A one-stop platform for cryptocurrency trading, staking, tracking, and token issuance through a conversational AI assistant.

Airdrop Potential: High (staking mechanisms, DAO governance, and DRIP token design suggest future rewards or early user incentives)

Token: Planned (DRIP token will be used for voting governance)

Highlights: Focused on retail users, creating an "All-in-One" DeFi assistant experience, integrating multiple Web3 functions in the interface.

Time always rewards those who rise early.

This list is not a prophecy but a snapshot. Please consider and make good use of it.

Not every early project can become a breakout star, but every breakout star shares the same growth trajectory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。