Source: Cointelegraph Original: "{title}"

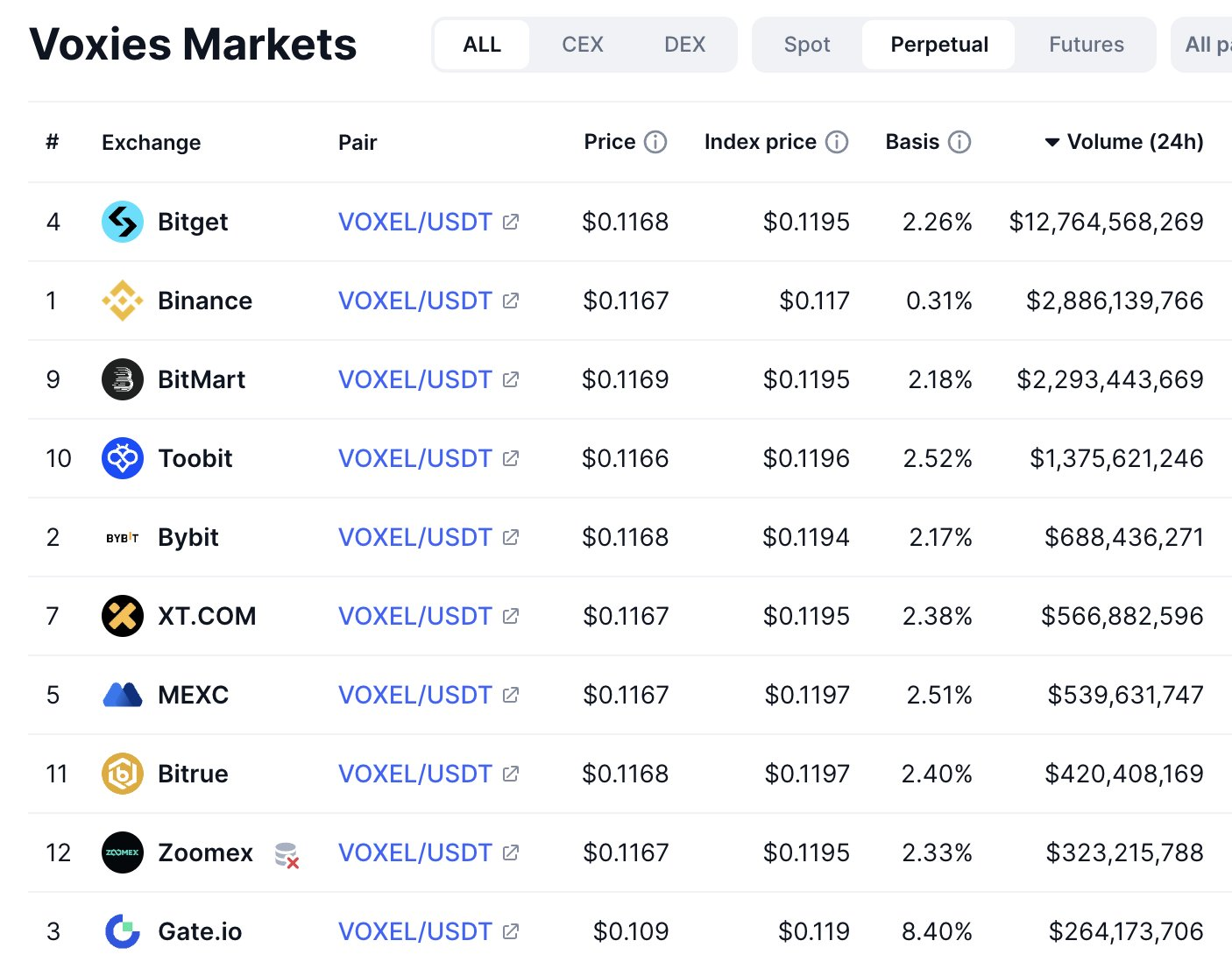

On April 20, a little-known VOXEL trading pair on the cryptocurrency exchange Bitget suddenly exploded with over $12 billion in trading volume, dwarfing the same contract on Binance.

The activity centered around the VOXEL/USDT perpetual futures, with traders reporting that orders were filled instantly—this anomaly was described by many as a glitch, allowing savvy traders to reap massive profits by exploiting unusual price behavior.

These atypical indicators caught the attention of Bitget. In the early results of their investigation, the exchange suspended accounts suspected of market manipulation and canceled all irregular trades that occurred throughout the day. Traders who suffered losses during this period will be compensated.

Bitget's response and remedial plan may have prevented investors from suffering lasting damage, but this incident is the latest in a series of cases that raise questions about how exchanges handle market makers, internal systems, and user protection measures. While Bitget promotes an open API and regularly publicizes its global market maker program, it has yet to disclose the puppet masters behind the April 20 activity or which technical factors led to this event.

The lack of details surrounding the incident has sparked speculation, similar to a recent crash on Binance, the world's largest exchange by trading volume, which included a sudden price drop of the cryptocurrencies GoPlus (GPS) and MyShell (SHELL) in March. Binance expelled an unnamed market maker believed to be responsible for the manipulation, but the lack of information disclosure has exacerbated the notorious rumor-mongering in the cryptocurrency industry.

On April 20, Bitget's VOXEL/USDT perpetual futures trading volume exceeded the total of all other top ten markets combined.

Source: Thành Crypto

Traders question VOXEL market maker system vulnerabilities, Bitget denies

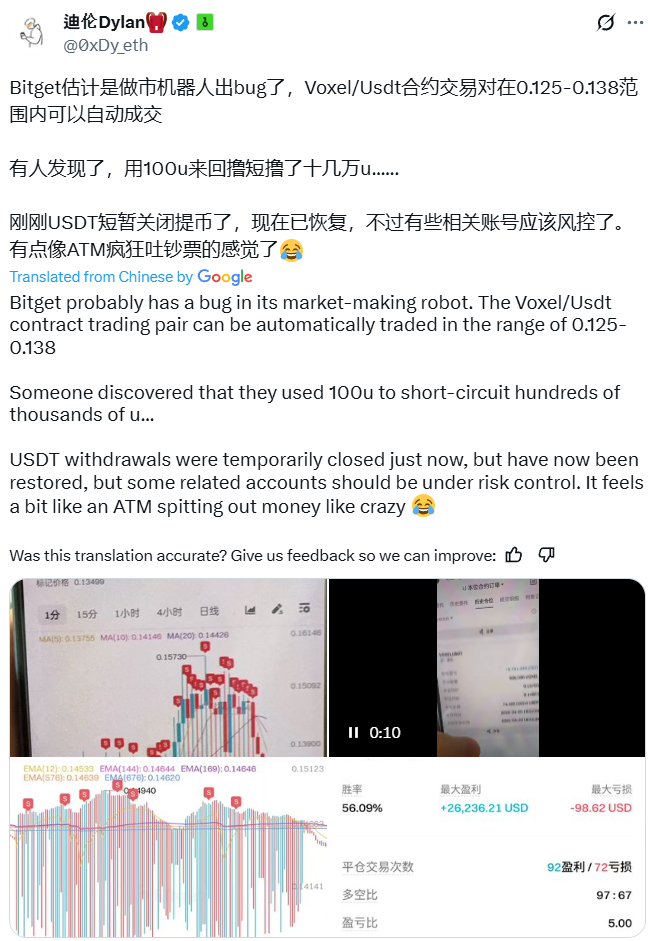

Cryptocurrency market participants attribute the abnormal trading volume of VOXEL to extreme price fluctuations and alleged "market maker bot vulnerabilities" pointed out by several Chinese X accounts.

Traders claim that the VOXEL price rapidly flashed between various ranges, such as $0.125 to $0.138. X platform user Dylan shared screenshots and videos of profitable accounts, stating that due to the suspected system vulnerabilities, orders within these price ranges were filled instantaneously.

A machine-translated post shared how a trader profited hundreds of thousands of dollars with just 100 USDT in starting capital.

Source: 0xDy_eth

X user Qingshui stated that traders who early detected the suspicious vulnerabilities leveraged high bets to increase profits, calling the strategy "zero-cost exploitation." Like Dylan, Qingshui blamed the issue on the malfunctioning market maker bots and questioned why traders were prevented from profiting if the problem originated from Bitget.

A third user, Hebi555, accused Bitget's market-making team of poor performance. Xie Jiayin, head of Bitget's Asia region, responded, stating that the exchange collaborates with over 1,000 market makers and institutional clients. He added that Bitget's API is open to the public and emphasized that the specific identities of market makers cannot be disclosed due to confidentiality agreements.

Bitget CEO Gracy Chen responded to Cointelegraph on April 20, stating that the suspicious trading occurred between individual market participants, not between platforms. In a follow-up inquiry on April 21, Chen neither confirmed nor denied the involvement of market maker bots, merely reiterating that the trades were "between users."

"We are conducting a thorough review, and once completed, trading and account restrictions will be lifted at our discretion. Bitget's security infrastructure is designed to capture such violations in real-time, as demonstrated in this incident," Chen said.

Bitget's VOXEL anomaly adds to the cryptocurrency market manipulation mystery

Concerns about market manipulation in the cryptocurrency industry are escalating. In early March, the prices of the tokens GPS and SHELL plummeted simultaneously with their listing on Binance.

The exchange's investigation found that both tokens employed the same unnamed market maker. Binance expelled this suspicious trading firm from its platform and confiscated its profits to help fund compensation for GPS and SHELL traders. In the absence of suspects, social media users began to accuse several market makers and trading firms, with those named denying any involvement.

GSR is one of the most frequently accused companies but denies being the market maker removed by Binance. Source: GSR

Subsequently, Binance expelled another unnamed market maker, this time due to trading activity related to the Movement (MOVE) token. The market maker for MOVE on Binance was found to have connections to the market makers for GPS and SHELL.

A recent report by Cointelegraph found that market makers are adopting a loan-based model, which is stifling small to medium-sized projects. The loan model allows market makers to acquire tokens from projects in exchange for providing liquidity. However, the opposite often occurs, with market makers selling borrowed tokens on the open market only to repurchase them at a lower price, thereby damaging the project's price chart.

VOXEL has appeared on Bitget, but the exploitation of vulnerabilities is not limited to CEX

The cases of Bitget and Binance demonstrate that even the largest centralized exchanges (CEX) are not immune to market manipulation or traders exploiting the platform for profit.

However, a recent case involving the decentralized exchange (DEX) Hyperliquid indicates that this issue is not confined to CEX. In late March, it was alleged that whales exploited liquidation parameters on Hyperliquid, leading to the delisting of the platform's JELLY perpetual contract product. Hyperliquid subsequently announced a compensation plan for affected users, similar to Bitget's response to its VOXEL incident.

X users highlighted the double standards of exchanges in how they respond to errors. Source: Dotyyds1234

Ironically, Bitget's Chen had made some strong statements about Hyperliquid at the time, raising concerns about network centralization. She compared DEX to FTX, which was once a billion-dollar trading firm whose founder is now serving a 25-year prison sentence for multiple fraud charges.

"The way it handled the JELLY incident was immature, unethical, and unprofessional, leading to user attrition and serious doubts about its integrity. Although Hyperliquid positions itself as an innovative decentralized exchange with bold visions, its operations resemble those of an offshore CEX without 'know your customer/anti-money laundering' protocols, facilitating illicit fund flows and misconduct," she said.

While Bitget's VOXEL incident may have been contained and Hyperliquid users may receive compensation, the broader pattern is harder for traders to ignore. As platforms scramble to maintain trust, the industry's vulnerabilities are not just about errors or glitches, but the ensuing silence.

Related articles: Market maker agreements are quietly destroying crypto projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。