Source: Cointelegraph Original: "{title}"

The OM token of Mantra plummeted over 90% overnight, leaving the crypto world divided on the reasons behind it. On April 13, the price of OM dropped from over $6 to below $0.50, evaporating more than $5 billion in market capitalization and triggering widespread panic across the crypto industry.

The sudden crash drew comparisons to the implosion of Terra's LUNA, with traders scrambling for answers. Unverified rumors of insider dumping, forced liquidations, mislabeling of wallets, and exchange manipulation quickly spread, but Mantra insisted it was caught in a predicament.

As of April 13, Mantra had established a strong position in the narrative of real-world asset tokenization, securing support for $1 billion in transactions by tokenizing real estate and data centers from Dubai-based Damac Group. It obtained a license from the Dubai Virtual Assets Regulatory Authority (VARA) and launched a $108 million ecosystem fund backed by heavyweight firms such as Laser Digital, Shorooq, Amber Group, and Brevan Howard Digital. In February 2025, the OM token reached an all-time high of nearly $9.

However, on April 13, this momentum was abruptly interrupted. The following hours painted a chaotic picture of token transfers, internal speculation, and blame-shifting. Below is a detailed account of how the OM crash unfolded.

Mantra OM's Disastrous 24 Hours

April 13 (UTC 16:00-18:00)

Mantra's OM token traded sideways throughout the day. During these two hours, it fell from $6.14 to $5.52.

April 13 (UTC 18:00-20:00)

The token suddenly dropped to $1.38 in the first hour, then fell to $0.52 in the following time—losing over 90% of its value in a single day. Various theories erupted on social media, including rug pulls, insider dumping, forced liquidations, or exchange manipulation.

April 13 (UTC 20:00-22:00)

Initial speculation centered around a "rug pull" scam, sparked by a deleted screenshot from a Telegram channel circulating online. However, this speculation was quickly debunked—upon verification, the deleted group was not an official Mantra channel. Cointelegraph confirmed that the project's Telegram community was still operating normally at the time of publication.

Mantra's first statement released on the X platform was brief and immediately provoked a strong backlash from the community.

April 13 (22:00 - 00:00 UTC)

Mantra co-founder and CEO John Patrick Mullin released a detailed statement on the X platform, accusing the abnormal fluctuations of the OM token of being caused by "reckless forced liquidations initiated by centralized exchanges against OM holders."

"From the timing and depth of the crash, account positions were suddenly forced closed without warning," Mullin stated.

"This occurred during a low liquidity period on Sunday evening UTC (early morning Asia), which, to put it mildly, is a significant oversight, and to put it more seriously, we cannot rule out deliberate market manipulation by centralized exchanges."

April 14 (00:00-02:00 UTC)

According to blockchain tracker Lookonchain, at least 17 wallets deposited a total of 43.6 million OM (worth $227 million) into Binance and OKX in the days leading up to the crash.

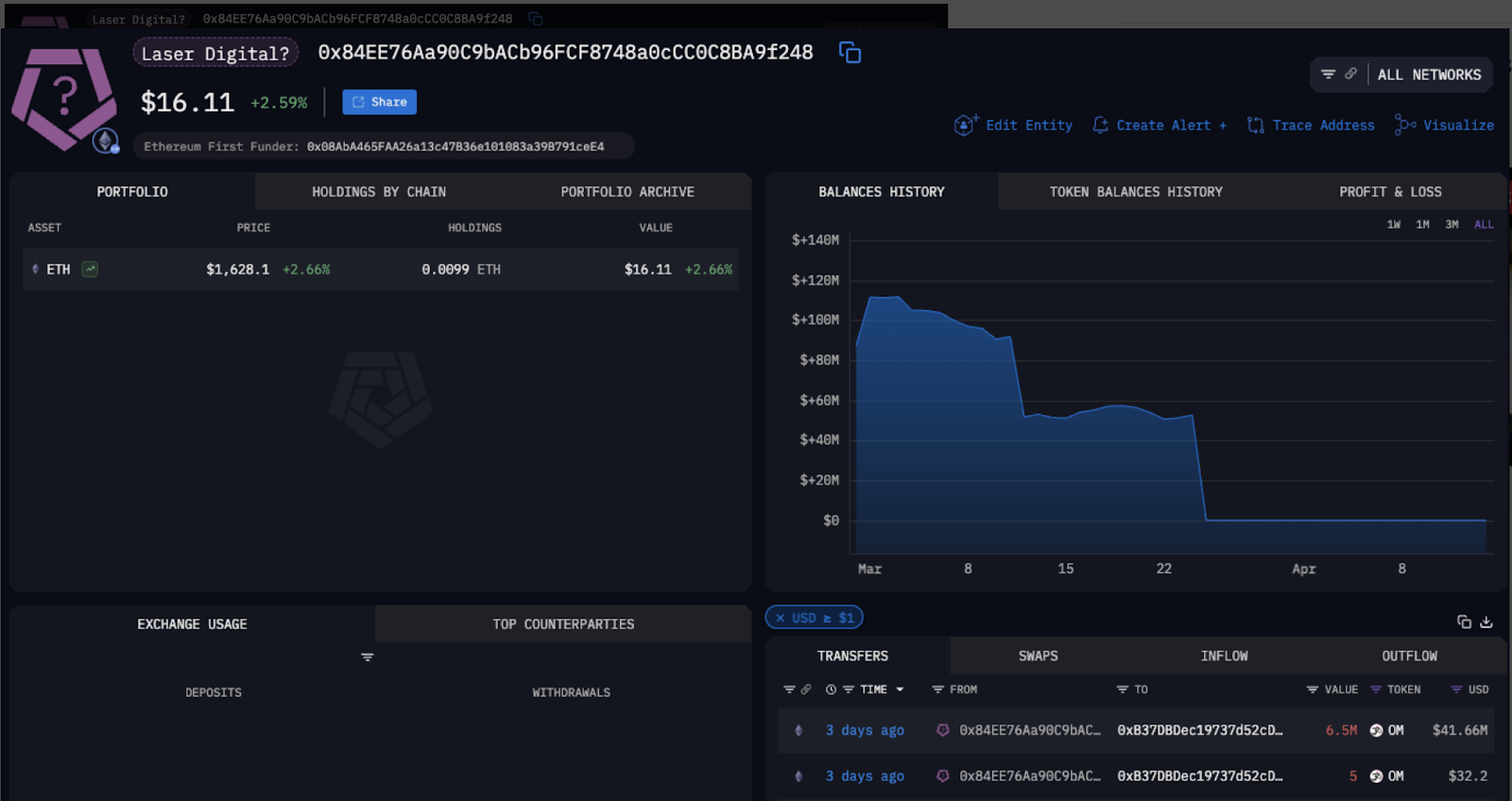

Two of these wallets were flagged by blockchain data platform Arkham Intelligence as belonging to Mantra strategic investor Laser Digital. This labeling sparked further speculation and accusations against Laser Digital. As of the time of writing, the accuracy of Arkham's labeling had not been confirmed, and the platform had not responded to Cointelegraph's request for clarification.

Meanwhile, Mullin responded to community questions under his X post, suggesting that internal investigation results indicated that one exchange was the main cause of the crash, stating that it was not Binance.

April 14 (UTC 02:00-05:00)

Both Binance and OKX responded to the situation. Binance stated, "Binance is aware that MANTRA's native token OM has experienced significant price volatility. Our preliminary investigation indicates that the developments over the past day are the result of cross-exchange liquidations."

OKX CEO Star Xu posted on X, "This is a major scandal for the entire crypto industry. All on-chain unlock and deposit data is public, and the collateral and liquidation data of major exchanges can be investigated. OKX will prepare all reports!"

OKX pointed out, "After the incident, we conducted an investigation based on publicly available on-chain data and internal trading data, and identified significant changes in the tokenomics of MANTRA tokens since October 2024.

"Our investigation also found that multiple on-chain addresses have been executing potentially coordinated large-scale deposits and withdrawals across various centralized exchanges since March 2025."

April 14 (UTC 05:00 - 12:00)

Laser Digital firmly denied the ownership of the wallets flagged by Arkham and reported by Lookonchain, pointing out that the related labels were severely misidentified.

"We want to be absolutely clear: Laser did not deposit any OM tokens into OKX. The mentioned wallets are not Laser wallets," the company stated on X, sharing three token addresses to support its claim that no sales occurred.

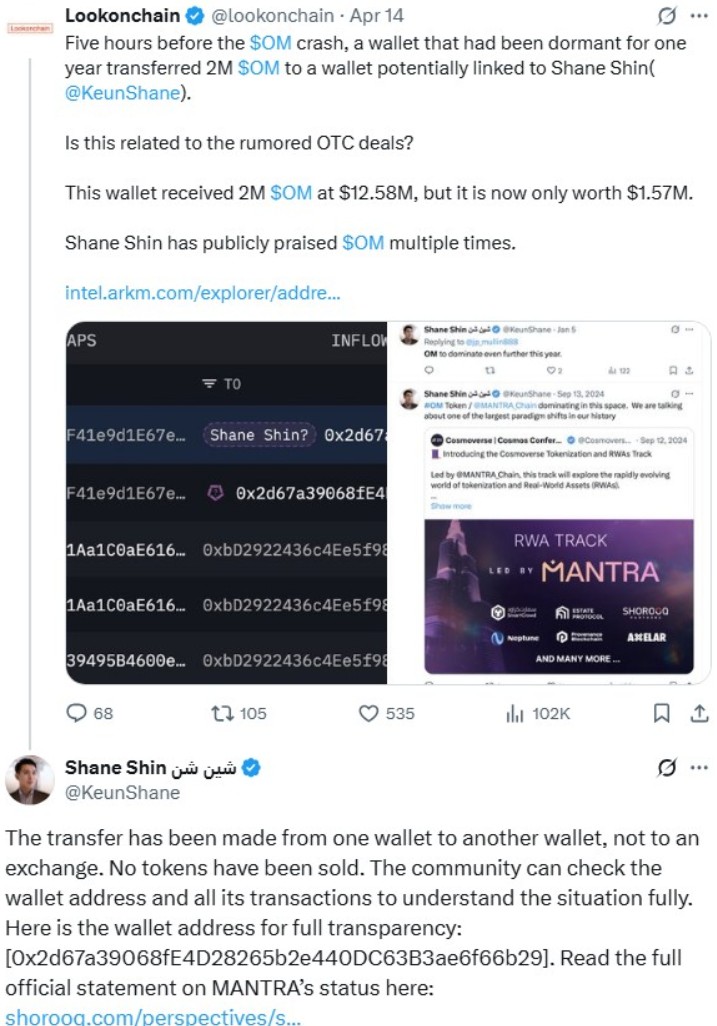

Lookonchain identified another wallet using Arkham data that only became active a few hours before the crash, having been dormant for a year. This wallet was marked as belonging to Shane Shin, founding partner of Shorooq Partners, and had received 2 million OM shortly before the crash.

April 14 (UTC 12:00-13:00)

Mullin participated in Cointelegraph's Chain Reaction program and denied reports that Mantra's major investors sold off OM before the crash. He refuted claims that the team controlled 90% of the supply.

"I think this is unfounded. We released a community transparency report last week that showed all the different wallets," Mullin said, pointing to the dual-token setup of Ethereum and Mantra's mainnet. Additionally, he assured users that the recovery of the OM token is the team's top priority.

"We are still in the early stages of formulating a possible token buyback plan," he said.

April 14 (UTC 13:00-16:00)

More speculation began to surface. On-chain analytics firm Onchain Bureau accused market maker FalconX of being the culprit behind the price crash, directly pointing to its loan option model—which allows market makers to borrow tokens and execute guaranteed purchases at contract expiration.

"The project party did not pay the market maker service fee monthly but instead signed a contract stipulating that the market maker could forcibly purchase 1 million tokens at a price of $1 upon expiration. Clearly, after the contract expired, the market maker exercised this right and sold off for cash," Onchain Bureau stated in a now-deleted tweet.

Shortly after this accusation was made, Onchain Bureau added that FalconX had contacted them to deny being Mantra's market maker. Mullin also responded to clarify that FalconX was not the project's official market maker, but merely a trading partner.

Meanwhile, on-chain detective ZachXBT disclosed new clues, stating that individuals associated with Reef Finance had sought large OM collateral loans before the crash.

Our Understanding of the OM Crash

Currently, various speculative versions are circulating in the market. The initial panic ranged from "rug pull" scams to insider trading, with the Mantra team repeatedly denying these claims by publishing wallet addresses and continuously responding to inquiries on social media and in the media, emphasizing that the project team did not run away.

Mantra also denied that the price crash was related to the contract expiration of market maker FalconX. Some doubts pointed towards Laser Digital, but the latter stated that it was due to a labeling error by Arkham Intelligence.

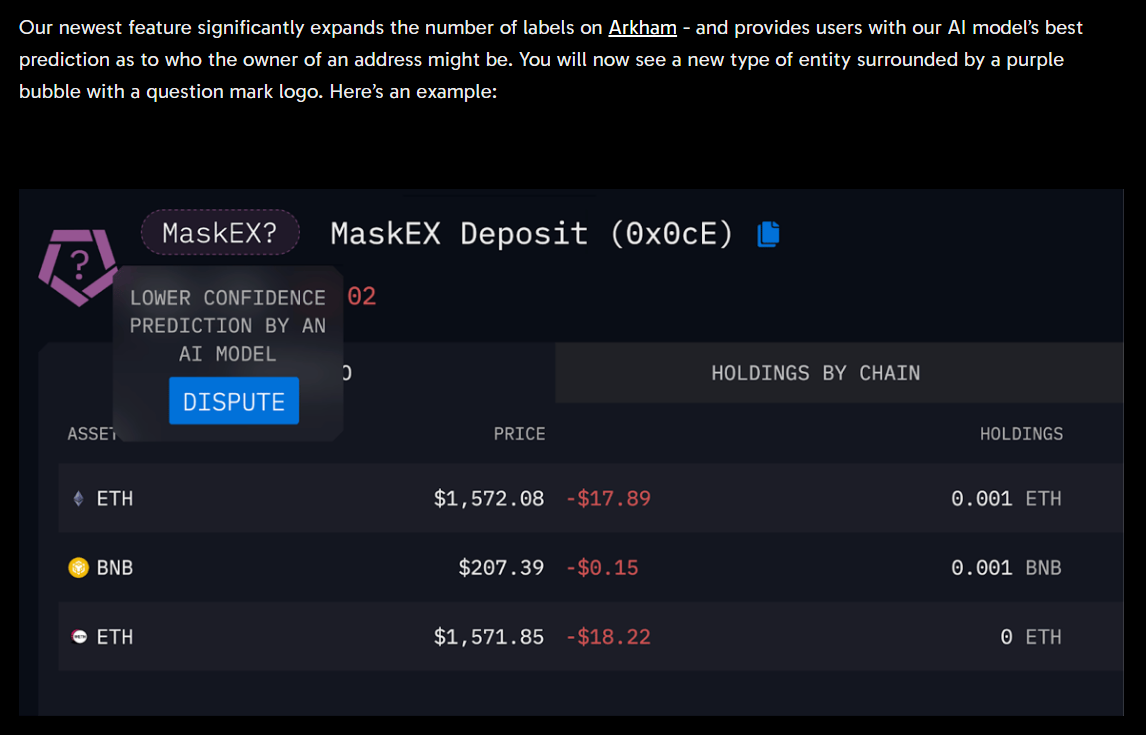

As of the time of publication, Arkham Intelligence had not responded to Cointelegraph's inquiry regarding the accuracy of the labels. It should be noted that the labeling of Laser Digital on the Arkham platform is actually a low-confidence prediction generated by its AI model (marked in magenta), rather than a verified blue-label entity.

Source: Arkham Intelligence

In the days following the OM token crash, Mullin first announced that he would destroy all tokens held by the team, but later changed his statement to indicate that he would first dispose of his personal share.

On April 16, Mullin released an "Incident Statement" and promised to provide a complete accident report. The statement reiterated that the project team did not lead any token sell-off actions, and that the team's share remains locked, while emphasizing that they would advance a token buyback and burn plan, but did not provide a new explanation for the crash's cause.

Mullin revealed to Cointelegraph that he had hired an unnamed blockchain analyst to investigate the root cause of the crash, but the details of the investigation remain confidential.

Related Articles: Report: Cantor plans to establish a $3 billion crypto investment company in collaboration with SoftBank, Bitfinex, and Tether.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。