Original Title: "Data Review: Changes in TRUMP Large Holder Positions Over the Past 3 Months, 86.9% of Large Holders Have Liquidated, Some Have Unrealized Losses Exceeding $30 Million"

Original Author: Frank, PANews

As a peak creation of celebrity coins, the launch of the TRUMP token triggered extreme FOMO in the market and attracted many large holders. However, with the overall cooling of the MEME market and the subsequent exposure of insider teams, the price of TRUMP plummeted from a peak of $75 to a low of $7.2, a decline of over 90%. On April 18, the TRUMP token experienced a 4% token unlock, with the market estimating that this would exacerbate panic around the token, leading to further declines. On the other hand, on April 20, news emerged that Trump planned to host a dinner for TRUMP token holders. With a combination of positive and negative news, the TRUMP token seems to have begun to stabilize and rebound.

Previously, PANews conducted an in-depth analysis of the holding chips of the TRUMP token (Related Reading: "The Wealth Truth of TRUMP Token: Large Holders Compete in the Arena, Average Purchase of $590,000, $1.09 Million Bought Within 1 Minute of Token Launch"), and three months have passed. How are the large holders faring now? What new changes have occurred in the distribution of TRUMP tokens?

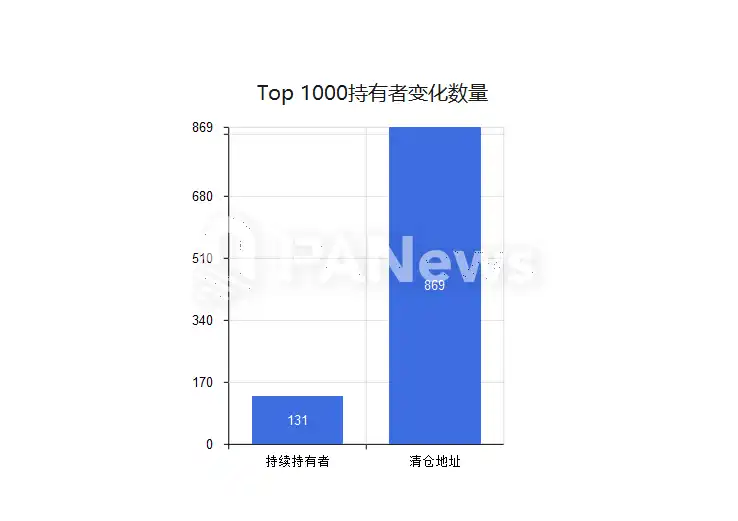

Large Holders Can't Withstand the Plunge, 86.9% Have Liquidated

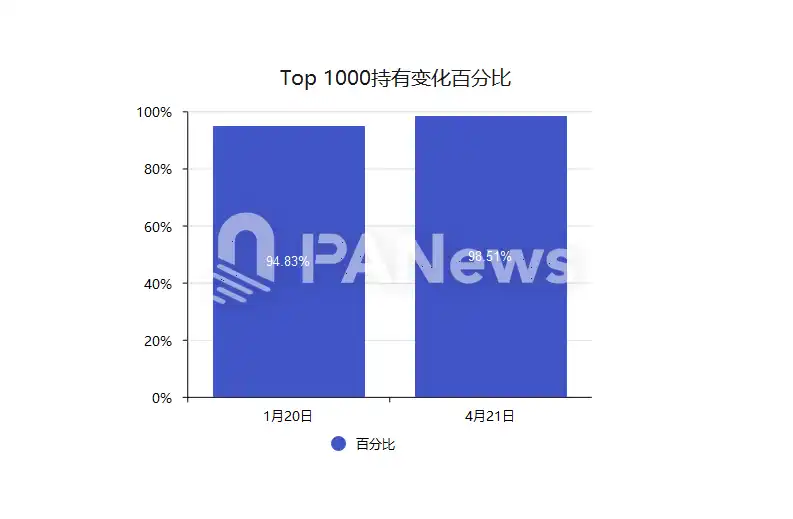

Looking at the overall data, the turnover of large holders of TRUMP has been quite frequent over the past three months. Compared to data from January 20, among the top 1,000 token holders, 86.9% of large holders chose to liquidate their tokens, totaling 48 million tokens, accounting for 24% of the total circulation.

As of April 21, data shows that the amount of TRUMP tokens held by the top 1,000 addresses is approximately 98.51%, an increase of 3.68% from 95.83% on January 20. This data indicates that the turnover of TRUMP tokens is significant, and during the low phase, it seems that the chips have become more concentrated.

In the past three months, among the newly added large holder addresses, Robinhood has become a prominent new large holder address among trading platforms, increasing its token holdings by 1.44% over three months. Additionally, trading platform addresses like Crypto.com and Meteora, primarily in the U.S. market, have seen significant increases in token holdings. Among individual large holders, many began entering at the price peak of TRUMP at the end of January and are still continuously increasing their positions after being trapped, but overall, they are suffering significant losses. From the perspective of token holdings, these holding addresses bought 12.2% of the tokens after January 20.

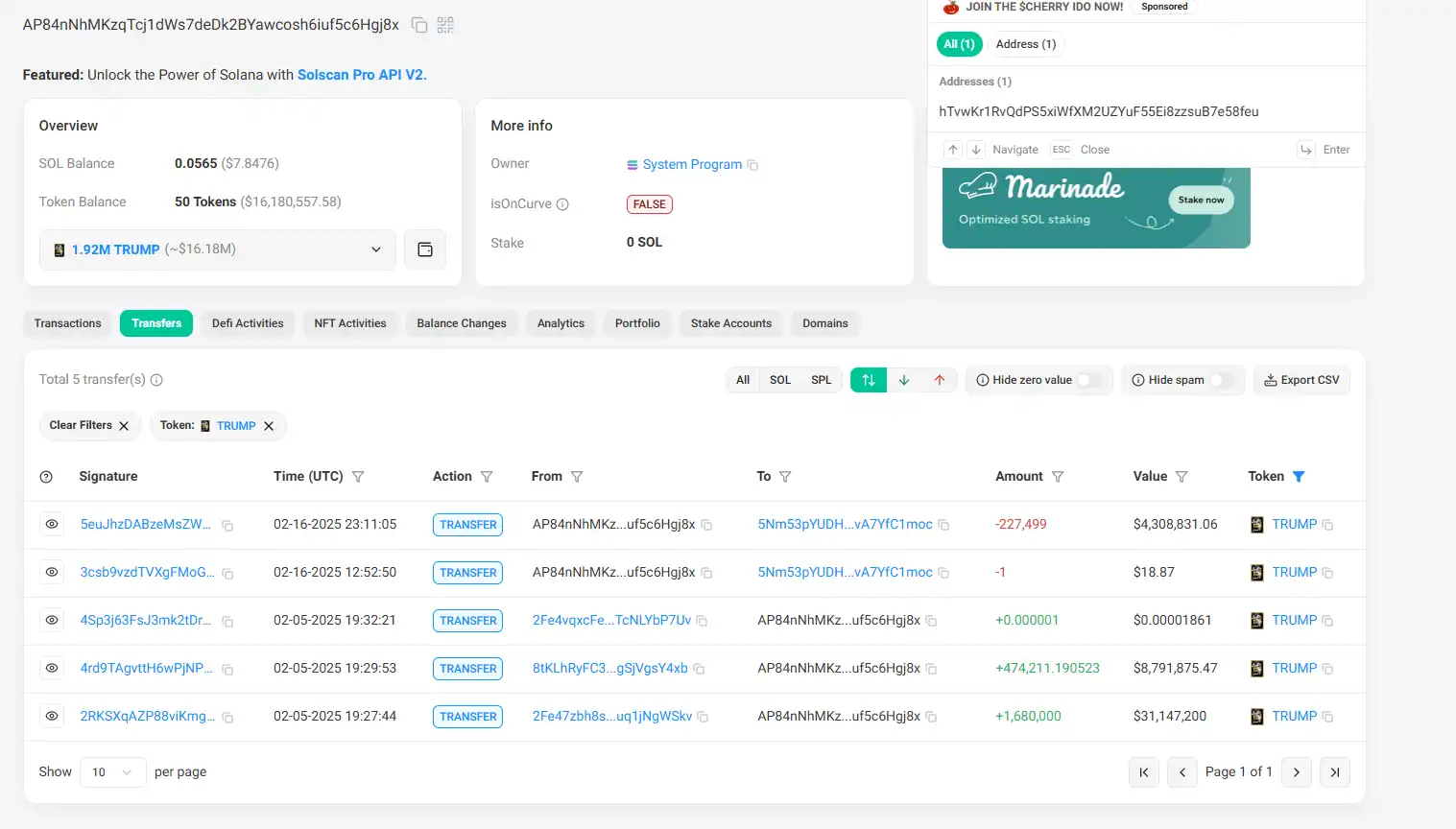

Among the large holder addresses that continue to hold, the development addresses have increased their holdings by approximately 1.38 million tokens; however, most of these tokens were transferred back from other smaller addresses and were not purchased to increase holdings.

Among the liquidating addresses, according to PANews observations, many of the top large holders began buying in around January 18 and chose to liquidate before or on February 1, most of whom made considerable profits.

Overall, the earliest profit-taking TRUMP large holders have basically exited the market. Many of the newly entered addresses are large holders who were trapped after repeatedly bottom-fishing at high prices after January 20. However, from trading behavior, many large holders still seem optimistic about the future of the TRUMP token and continue to increase their positions.

Some Made $25 Million Exiting, Some Lost $33.66 Million

Among the large holders who liquidated to break even, the address 2Fe47zbh8svDNGNehFy1NY8bsjQNtomvKFuq1jNgWSkv (hereinafter referred to as "2Fe47") likely made the largest profit. This address received 25 million TRUMP tokens from the founding address before the TRUMP token was launched for trading, immediately distributing them for sale in the market after the launch. Later, it received another 27 million tokens from the founding address 5e2qR and sold them again, totaling over $112 million in funds, ultimately consolidating the remaining tokens back to the founding address 5e2qR. Data from January 20 shows that this address held over 1 million tokens, which have now been completely liquidated. From the operational path, this address is suspected to be a small address of the TRUMP token project team.

Another large holder, 3AWDTDGZiW8joyfA52LKL7GUWLoKBCBUBLUE5JoWgBCu, began buying heavily right after TRUMP was launched on January 18, spending a total of $78.55 million to buy in, and ultimately sold for $103 million, making a profit of $25.17 million. However, the last entry was between January 25 and January 27, when the user believed that the TRUMP token had dropped to a low point, spending $12.78 million to build a position, but by February 2, seeing the price continue to drop, they liquidated all for $9.23 million. Overall, this address still achieved considerable gains on the TRUMP token.

Another large holder began buying TRUMP tokens heavily from various trading platforms around January 20, spending a total of $45.73 million to buy 1.11 million tokens, with an average cost of about $41. After selling 300,000 tokens for $17.6 on February 7, they still hold 810,000 tokens, currently facing an unrealized loss of about $33.66 million, with a loss rate of 73%. This is the address with the highest single loss among the newly entered large holders.

Coincidentally, the user of the address 6qgBGeZgPyxdobeHhcNtAqVe927zodpiuoufhwGN8BhP operated similarly to the above address, also starting to accumulate tokens through several related addresses from January 20, spending a total of $16.67 million, and currently still holding $6 million worth of tokens, with losses exceeding $10 million.

The extreme volatility of the TRUMP token is like a "reality show" in the crypto market, showcasing both the wealth myths in the speculative wave of MEME coins and revealing the harsh realities of high-leverage gambling. From the precise cashing out of early large holders to the subsequent buyers sinking into the mire, the winners and losers in this game have been clearly delineated by the market. Although Trump's "dinner benefit" temporarily injected rebound momentum into the token, the shadow of highly concentrated chips and suspected manipulation by the project team lingers.

Currently, the TRUMP token seems to be catching its breath after the negative news has been exhausted, but its fate remains firmly tied to the resonance of celebrity effects and market sentiment. For retail investors, this rollercoaster-like market undoubtedly serves as a lesson in risk education: in the battlefield of MEME coins lacking fundamental support, even "top-tier traffic" endorsements may merely be a glamorous facade for capital harvesting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。