Source: Cointelegraph Original: "{title}"

The Layer1 blockchain Sui, developed by San Francisco's Mysten Labs, announced a partnership with World Liberty Financial (WLFI) on March 6. According to the agreement, Sui's native token SUI will be included in WLFI's "macro strategy" strategic token reserve, and both parties will explore product development opportunities together.

This decentralized finance (DeFi) protocol has sparked controversy due to its association with the Trump family. Although WLFI insists that no family members hold executive positions, Eric Trump does serve as one of the board managers.

Furthermore, while WLFI claims to be a DeFi innovator, it actually relies on Aave v3 for its lending functionality, raising questions about its originality and independence.

The inclusion of SUI in WLFI's reserve is not entirely surprising—Trump's son Eric has publicly stated his support for and ownership of the cryptocurrency. According to Messari data, Sui has performed well in 2024, with its market capitalization soaring 153% last quarter, and its on-chain DEX experiencing a year-on-year trading volume increase of 1591%. DefiLlama shows that Sui currently ranks in the top 20 by market capitalization and is among the top ten in the DeFi space with a total locked value (TVL) of $1.28 billion.

The Sui community generally welcomes this partnership, but industry insiders have raised sharp questions about WLFI's compliance and business model.

Industry Questions WLFI's Business Substance

Criticism mainly focuses on the project's value proposition. Several community members pointed out that WLFI is merely repackaging existing services from Aave without bringing any real innovation.

Mike Dudas, managing partner at crypto venture firm 6MV, directly called the project a "pay-to-play" capital game.

Source: Mike Dudas

Andre Cronje, co-founder of Sonic Labs and a key figure in DeFi, as well as the creator of Yearn, offered even harsher criticism. He emphasized the high fees and problematic reinvestment strategies that extract value from crypto companies rather than providing real utility.

Source: Andre Cronje

Alan, Chief Marketing Officer of Axia8 Ventures, criticized:

"The project team is groveling for divine favor, hoping that through this operation, their token might be included in the reserve. What is all this for? Just to pump up the token price."

As of the time of publication, WLFI has not publicly responded to these criticisms. Cointelegraph has reached out to WLFI for comment but has not received a reply.

Market Reaction and Strategic Intent

After the announcement of the partnership, the price of SUI surged nearly 12% to close to $3, ultimately stabilizing at $2.85, a 5.7% increase from before the announcement.

The price of SUI token surged and then retraced, followed by a rebound. Source: CoinGecko

WLFI co-founder Zak Folkman stated that the choice of Sui was due to its "American heritage" and scalability, which is interpreted as WLFI focusing on U.S. projects endorsed by Eric Trump.

Eric publicly disclosed his ownership of SUI last December, further strengthening market associations.

Source: Route 2 FI

Folkman added:

"Given our plans for foundational DeFi assets in the coming months, partnering with Sui is a natural choice."

Sui's object-centric data model and parallel transaction processing architecture make it an ideal underlying infrastructure for DeFi applications. Compared to traditional account models, Sui constructs assets as independent objects, allowing for rapid ownership transfer and real-time status updates without the need for network-wide consensus. This design significantly enhances capital flow efficiency, collateral management capabilities, and smart contract execution effectiveness in the DeFi space.

After partnering with WLFI, Mysten Labs' CEO promoted Sui's "superpowers." Source: Evan Cheng

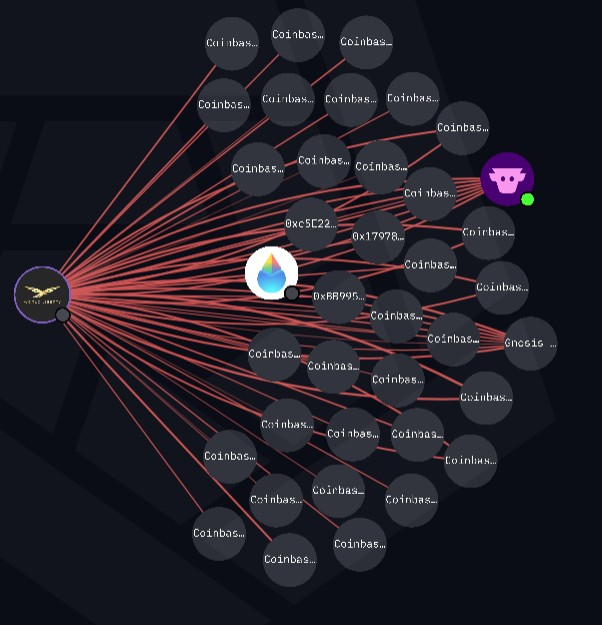

On-chain data shows that, according to wallet statistics tracked by Arkham Intelligence, WLFI currently holds approximately $80 million in crypto assets. However, it is noteworthy that the institution has transferred most of its holdings to Coinbase Prime custody accounts, making its complete asset allocation difficult to trace.

Mysten Labs CEO Evan Cheng leveraged the opportunity to promote Sui's "object-centric data model" as a means to enhance DeFi liquidity efficiency. On-chain data indicates that WLFI holds approximately $80 million in crypto assets, but most have been transferred to Coinbase Prime custody accounts, making them difficult to track. Analyst EmberCN estimates its total holdings at $336 million, and if it has not reduced its positions, it currently faces an unrealized loss of about $88 million, with ETH losses amounting to $67.35 million.

On March 6, on-chain analyst EmberCN estimated WLFI's total crypto asset holdings at $336 million, covering tokens such as Ethereum (ETH), Wrapped Bitcoin (WBTC), TRON (TRX), Chainlink (LINK), Aave (AAVE), Ethena (ENA), MOVE, Ondo (ONDO), and Sei (SEI). The analyst specifically noted that WLFI added $21.5 million in WBTC, ETH, and MOVE holdings on the eve of the White House crypto summit on March 7.

"Since WLFI had previously transferred this portion of assets to Coinbase Prime custody accounts, it is currently impossible to confirm whether they have completed any sales." EmberCN emphasized in the translated post that WLFI claims these assets have not been liquidated.

If the holdings remain unchanged, the current unrealized loss is approximately $88 million, with ENA experiencing the largest percentage loss at -63%, while ETH leads in absolute loss with $67.35 million (-31%).

Meanwhile, Sui is actively expanding its presence in Washington's political circles. Mysten Labs co-founder Adeniyi Abiodun revealed on February 4 that multiple "key talks" are underway to expand the ecosystem. A month later, he hinted that SUI might become an ETF candidate, and on March 6, Delaware filing documents indicated that Canary Capital may be preparing a SUI ETF. However, due to historical instances of false filings, the industry remains cautious.

Related Articles: Bank for International Settlements Report: Cryptocurrencies and DeFi May Widen Wealth Gap and Undermine Financial Stability

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。