On the 22nd, U.S. President Trump stated at the White House that tariffs imposed on China will significantly decrease. Although he emphasized that they will not drop to zero, his attitude has softened. This sudden change in stance may be a response to U.S. Treasury Secretary Mnuchin's previous comments that high tariffs on China are unsustainable. Mnuchin had said in an interview that negotiations with China will be very difficult, and both sides believe the current situation is unsustainable. This comment quickly became headline news in European and American media, indicating that the market is highly concerned about the possibility of easing tensions in the U.S.-China trade war.

In addition to the easing of the U.S.-China trade war, Trump has recently focused his attacks on Federal Reserve Chairman Powell for not lowering interest rates sooner, causing the market to worry about the Fed's independence. However, yesterday Trump also backtracked, stating that he has no intention of firing Powell, but simply hopes to accelerate the pace of interest rate cuts.

Under these dual favorable conditions, U.S. stocks performed well on the 22nd, with the Dow Jones Industrial Average soaring by 1016.57 points, the S&P 500 index rising by 129.56 points, the tech-heavy Nasdaq index increasing by 429.62 points, and the Philadelphia Semiconductor Index climbing by 80.14 points; the seven major tech giants in the U.S. also closed higher across the board.

With the global financial atmosphere improving, Bitcoin, as the leader in cryptocurrencies, began to rebound strongly, with its price breaking through the $94,000 mark this morning, reaching a high of $94,142.5. As of the time of writing, the price is quoted at $93,671, with an increase of about 6.62% in the last 24 hours.

Overall, Trump's latest stance on tariffs and monetary policy has sparked widespread resonance globally. If the U.S.-China trade war de-escalates and global liquidity increases, it is expected to stimulate global economic performance this quarter, injecting momentum into Asian stocks, European and American stocks, and emerging markets.

However, trade dialogues still have uncertainties, and trends in the dollar, inflation, and U.S. bonds need to be closely monitored. Overall, the market is experiencing a short-term rebound, but in the medium to long term, attention must be paid to the process of digesting global macroeconomic and political risks.

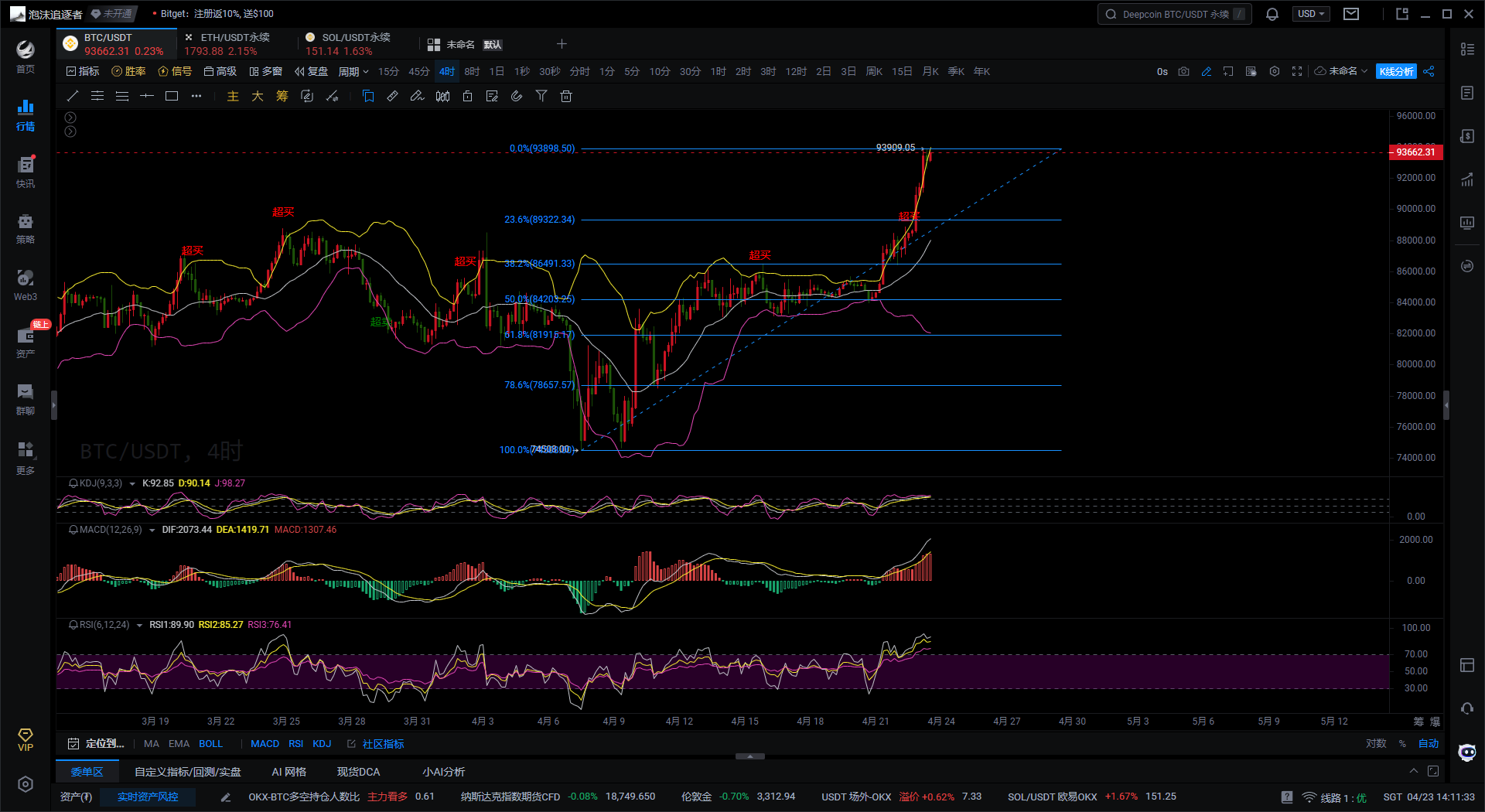

Bitcoin Four-Hour Chart

The current price trend shows a strong breakout, currently continuing to rise along the upper Bollinger Band. The Bollinger Band has noticeably widened, indicating that the market has entered a strong trending upward phase. Although the current upward trend is very strong, the price has deviated significantly from the middle Bollinger Band, indicating a technical need for a pullback to the middle band or a test of the upper band support in the short term.

From the KDJ indicator perspective, all three line values are in the overbought zone. It is important to note that an overbought state does not mean a decline will happen immediately, but when the indicator remains at high levels for too long, it does pose a risk of a technical pullback. The MACD indicator shows that the DIF line is significantly ahead of the DEA line, and the MACD red histogram continues to expand, indicating that the current bullish momentum is very strong, with no signs of a top divergence appearing temporarily.

The current price has reached $93,660, close to the highest point of this round of increases. Attention should be paid to several key retracement support levels: the 23.6% retracement level at $89,322, the 38.2% level at $86,491, and the 50% level at $84,205. It is particularly important to note that if the price pulls back and falls below the key support level of $84,205, the current upward trend may face a risk of reversal.

In summary, Bitcoin is currently in a strong bullish trend, with technical indicators showing a significant increase; however, caution is needed for high-level fluctuations or short-term pullbacks. Additionally, the price is close to the previous high of $94,900, which poses a risk of a double top.

A 100% accurate suggestion is not as valuable as providing you with the correct mindset and trend. After all, teaching someone to fish is better than giving them a fish; suggestions may help you earn temporarily, but learning the mindset will help you earn for a lifetime! The focus is on the mindset, grasping the trend, and planning positions in the market. What I can do is use my practical experience to assist you, guiding your investment decisions and business management in the right direction.

Writing time: (2025-04-23, 14:10)

(Written by - Master Says Coin) Disclaimer: Online publication has delays, and the above suggestions are for reference only. The author is dedicated to research and analysis in the fields of Bitcoin, Ethereum, altcoins, foreign exchange, stocks, etc., and has been involved in the financial market for many years, possessing rich practical experience. Investment carries risks, and caution is required when entering the market. For more real-time market analysis, please follow the official account Master Says Coin for discussion and exchange.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。