Original author: TRACER

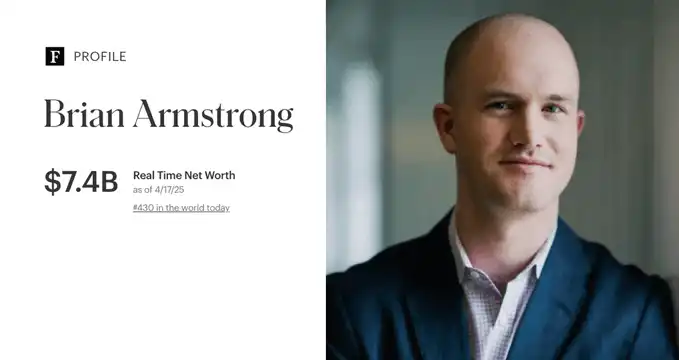

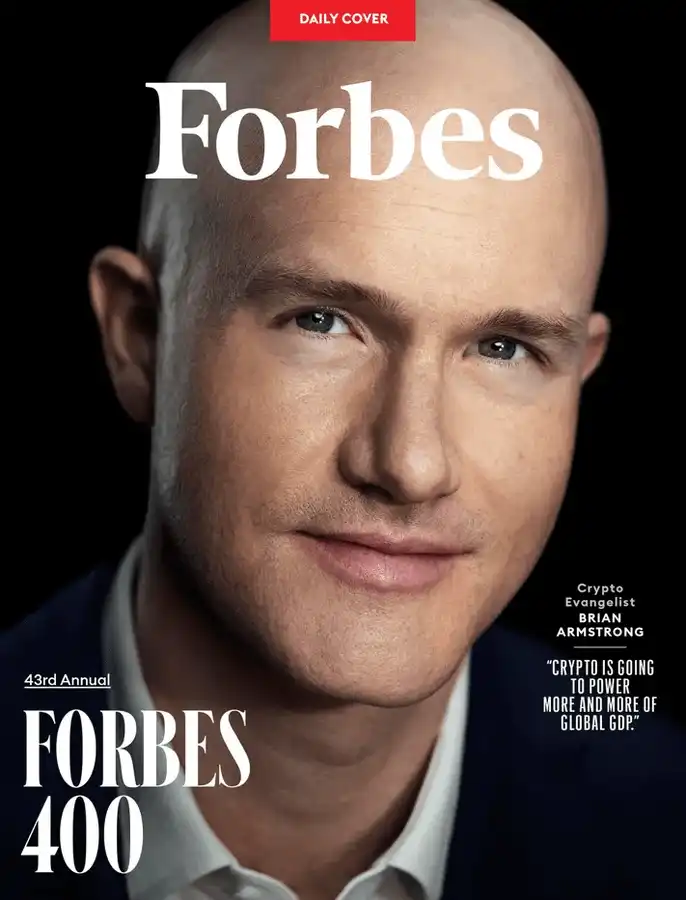

Brian Armstrong is one of the wealthiest figures in the cryptocurrency field. He founded the Coinbase exchange and earned $8 billion in just five years, with Forbes ranking him as one of the world's top investors. Here are his Memecoin secrets, strategies, and five major predictions.

The tremendous growth of the cryptocurrency industry owes much to a few key individuals, and Brian Armstrong is one of them. He entered this field driven by a belief in technology and fundamentally changed his life trajectory through his faith in Bitcoin. Brian Armstrong's personal journey and industry insights are worth revisiting for inspiration:

Brian was born in San Jose, California, and showed entrepreneurial potential from a young age. He once admitted in an interview that he was called to the principal's office for selling candy on the school playground. During high school, he developed a passion for internet technology and began learning programming.

He later attended Rice University, where he earned a master's degree. After graduation, he chose to live in Buenos Aires, Argentina, for a year, during which he experienced hyperinflation firsthand. The method to combat this economic turmoil—cryptocurrency—became the focus of his future research.

After graduating from college and going through a series of jobs, he co-founded a tutoring service platform with a friend. The platform allowed teachers to post their information and offer tutoring services to potential student clients. Brian Armstrong served as the CEO of this project for eight years, ultimately selling it for a price equivalent to 21 times his annual income.

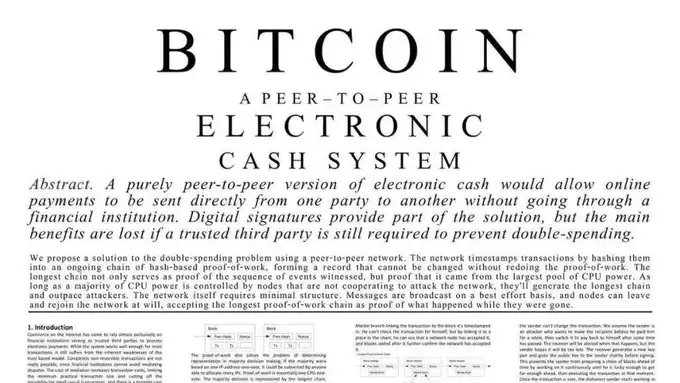

Brian Armstrong first learned about Bitcoin during the Christmas season of 2010 while staying at his parents' home in San Jose. He stumbled upon the foundational document written by Satoshi Nakamoto—"Bitcoin: A Peer-to-Peer Electronic Cash System." From that moment, he began to consider starting a significant venture.

He adopted a guiding principle for entrepreneurship: "The wealthy are not the gold miners, but the ones selling shovels." At that time, there was a direct competitor in the industry, the famous Mt. Gox, but the platform suffered from severe trading delays. In 2021, Brian Armstrong and Fred Ehrsam officially registered Coinbase.

Coinbase began to attract significant investment, with a valuation more than eight times Brian's original target. He initially aimed to create a company valued at $1 billion. Today, Brian Armstrong lives an ideal life, possessing immense wealth. He actively shares his insights and advice, which you should definitely consider:

Currently, Brian Armstrong firmly believes in the necessity of reforming cryptocurrency regulatory policies. The previous government severely hindered the industry's development, and now is the best time to correct this issue. Discussions are underway to appoint a pro-cryptocurrency SEC chairman and establish a clear and stable legal framework, which would be a significant boon for the cryptocurrency market.

Brian Armstrong holds a rather positive view of Memecoins and believes they have certain development prospects. In his view, just as GIFs and internet memes have become part of the internet economy, Memecoins could also become an important cultural and even economic phenomenon. This is a substantial viewpoint worth deep consideration.

Brian also shared a media browsing tip: you should never listen to those promoters on YouTube. When analyzing projects, focus on three core elements:

- The number of GitHub code contributions

- The team's activity level on Twitter and Discord

- The response to criticism; if the project team remains silent, that is a dangerous signal.

The current policies of the Trump administration may significantly increase the inflow of institutional funds into the market, as government actions will effectively enhance the confidence of financial institutions. The core driving force is that the government is advancing legislation related to stablecoins and digital dollars.

Brian Armstrong believes that cryptocurrency will never replace the traditional financial system but will serve as a strong complement to it. Exchange-traded funds (ETFs), asset custody services, and products that deeply integrate with banks and fintech platforms will become development trends. This is essentially a practical suggestion: be sure to develop products that can interface with traditional financial structures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。