Once Bitcoin breaks through the historical high of $110,000, it is likely to soar.

Written by: Arthur Hayes, Founder of BitMEX

Compiled by: AIMan @ Jinse Finance

For me, the ski season in Hokkaido ended in mid-March this year. However, the lessons learned from the mountain can still be applied to President Trump's "tariff frenzy." Every day is different, with too many variables interacting—no one knows which snowflake or which turn on the ski slope will trigger an avalanche. The best we can do is estimate the probability of an avalanche occurring. A more accurate technique for assessing slope instability is ski cutting.

Before descending, one skier from the team will traverse the starting area, jumping up and down in an attempt to trigger an avalanche. If successful, the way the avalanche spreads on the slope will determine whether the guide thinks the slope is suitable for skiing. Even if an avalanche is triggered, we can still continue skiing, but we must carefully choose our direction to avoid triggering more severe consequences than a loose powder slide. If we see cracks or large snow slabs loosening, we should leave quickly.

The key is to try to quantify the worst-case scenario based on current conditions and take appropriate action. Trump's self-proclaimed "Liberation Day" on April 2 was a ski-style reduction of the steep and dangerous side of global financial markets. The tariff policy of the Trump team drew from a trade economics book titled "Balanced Trade: Ending America's Trade Deficit at an Unbearable Cost" and took an extreme stance. The announced tariff rates were worse than the worst-case estimates of mainstream economists and financial analysts. In avalanche theory terms, Trump triggered a sustained weak layer avalanche, threatening to destroy the entire fugazi (a term originating from the Vietnam War referring to something fake) portion of the dirty fiat financial system.

The initial tariff policy represented the worst outcome, as both the U.S. and China took extreme positions, opposing each other. Despite the severe volatility in financial asset markets, leading to global losses of trillions of dollars, the real issue was the rise in volatility in the U.S. bond market (measured by the MOVE index). This index briefly surged to a historical high of 172 points during trading, after which the Trump team extricated itself from the danger zone. Within a week of announcing the tariff policy, Trump softened his plans, suspending the imposition of tariffs on all countries except China for 90 days. Subsequently, Boston Fed Governor Susan Collins wrote in the Financial Times that the Federal Reserve was ready to do whatever it takes to ensure the market operates normally. Days later, volatility still failed to significantly decrease. Finally, U.S. Treasury Secretary Scott gave an interview to Bloomberg, declaring to the world that his department was large enough, especially because it could significantly increase the speed and scale of Treasury buybacks (see Jinse Finance's previous report "Arthur Hayes: I believe BTC can reach $250,000 by the end of the year because the U.S. Treasury has taken the lead over the Federal Reserve"). I describe this series of events as a shift in policymakers from "everything is fine" to "everything is terrible, we must take action," leading to a market surge, and most importantly, Bitcoin hitting a bottom. That's right, folks, I predict $74,500 is a local low.

Whether you describe Trump's policy shift as a retreat or a shrewd negotiation strategy, the result is that the government deliberately triggered a financial market avalanche, and the situation was so severe that they adjusted their policy within a week. Now, as a market, we know a few things. We understand what happens to bond market volatility in the worst-case scenario, we recognize the levels of volatility that trigger behavioral changes, and we know what monetary leverage will be employed to mitigate this. Using this information, we as Bitcoin holders and cryptocurrency investors know that the bottom has already appeared, because the next time Trump escalates tariff rhetoric or refuses to lower tariffs on China, Bitcoin will rise, as people expect monetary officials to run the printing press at maximum levels to ensure bond market volatility remains low.

This article will explore why taking an extreme stance on tariffs leads to dysfunction in the Treasury market (measured by the MOVE index). Then, I will discuss how U.S. Treasury Secretary Bessent's solution—Treasury buybacks—will add a significant amount of dollar liquidity to the system, even though technically, buying old bonds by issuing new ones does not increase dollar liquidity in the system. Finally, I will discuss why the current situation of Bitcoin and the macroeconomy is similar to that of Bessent's predecessor Yellen, who increased Treasury issuance in the third quarter of 2022 to exhaust the Reverse Repo Program (RRP). Bitcoin hit a local low after FTX in the third quarter of 2022, and now, after Bessent introduced his "non-quantitative easing" quantitative easing policy, Bitcoin has reached a local low in this bull market cycle in the second quarter of 2025.

Maximum Pain

I want to reiterate that Trump's goal is to reduce the U.S. current account deficit to zero. Achieving this goal quickly requires painful adjustments, and tariffs are the government's usual tactic. I don't care whether you think this is good or bad, nor do I care whether Americans are ready to work more than 8 hours in iPhone factories. Part of the reason Trump was elected is that his supporters believe globalization has harmed them. His team is determined to fulfill campaign promises, prioritizing "Main Street" over "Wall Street." All of this is predicated on the assumption that those around Trump can be re-elected through this path, but that is not a certainty.

The reason the financial markets crashed on Liberation Day is that if foreign exporters earn fewer dollars or have no dollar income at all, they cannot buy as many or any U.S. stocks and bonds. Furthermore, if exporters must change their supply chains or even rebuild them within the U.S., they must partially fund the reconstruction by selling their liquid assets (such as U.S. bonds and stocks). This is why the U.S. market and any market overly reliant on U.S. export income collapsed.

At least in the initial phase, there was a glimmer of hope as fearful traders and investors flocked to the U.S. Treasury market. Treasury prices rose, and yields fell. The yield on the 10-year Treasury bond fell significantly, which was good for Bessent, as it helped him issue more bonds to the market. However, the extreme volatility in bond and stock prices exacerbated market volatility, which was undoubtedly a death knell for certain types of hedge funds.

Hedge funds hedge… sometimes, but always using a lot of leverage. Relative Value (RV) traders typically identify the relationship or spread between two assets, and if the spread widens, they leverage to buy one asset and sell another, expecting mean reversion. Generally, most hedge fund strategies are implicitly or explicitly shorting market volatility on a macro level. Mean reversion occurs when volatility decreases. When volatility increases, things become chaotic, and the stable "relationship" between assets breaks down. This is why risk managers at banks or exchanges that provide leverage to hedge funds will raise margin requirements when market volatility increases. When hedge funds receive margin calls, they must close their positions immediately, or they will be liquidated. Some investment banks are happy to bankrupt clients during periods of extreme market volatility through margin calls, taking over their bankrupt clients' positions, and then profiting when policymakers inevitably print money to suppress volatility.

What we really care about is the relationship between stocks and bonds. Since U.S. Treasuries are nominally risk-free assets and also global reserve assets, when global investors flee the stock market, Treasury prices rise. This makes sense because fiat currency must exist to earn returns, and the U.S. government, due to its ability to print money effortlessly, will never voluntarily default in dollar terms. The real value of Treasuries may decline, and indeed it does, but policymakers do not care about the real value of those garbage fiat assets flooding in from abroad.

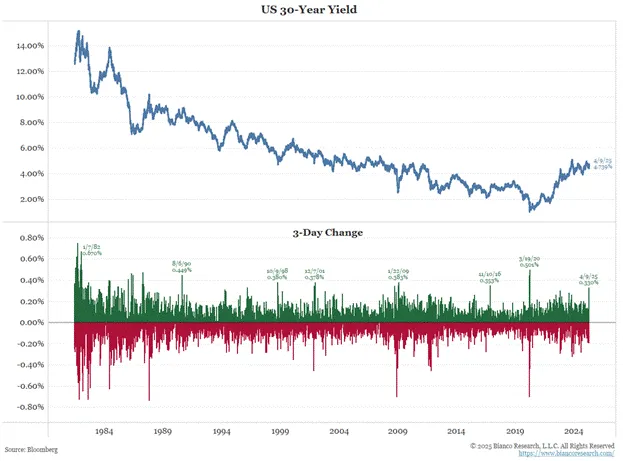

In the initial trading days following "Liberation Day," the stock market fell while bond prices rose/yields fell. Then, something happened, and bond prices fell in sync with the stock market. The yield on the 10-year Treasury bond experienced unprecedented back-and-forth fluctuations not seen since the early 1980s. The question is, why? The answer, or at least the answer policymakers believe, is extremely important. Is there a structural problem in the market that must be fixed by some form of money printing from the Federal Reserve and/or the Treasury?

From Bianco Research, the bottom shows the degree of abnormality in the 3-day change of the 30-year bond yield. The extent of change triggered by tariff panic is comparable to market volatility during financial crises such as the COVID-19 pandemic in 2020, the global financial crisis in 2008, and the Asian financial crisis in 1998. This is not a good sign.

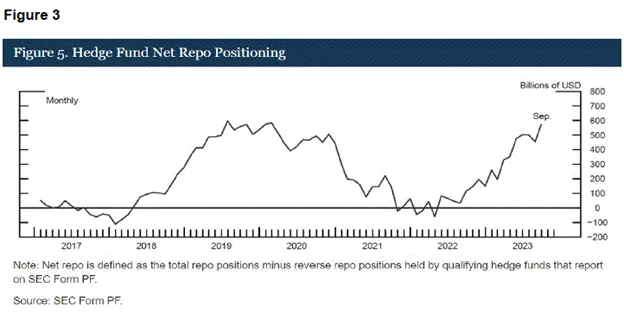

The Treasury basis trade positions of RV funds may be liquidated, which is a problem. How large is the scale of this trade?

February 2022 was crucial for the U.S. Treasury market, as President Biden decided to freeze the Treasury holdings of Russia, the world's largest commodity producer. This effectively indicated that property rights no longer exist as rights but as privileges, regardless of who you are. Therefore, overseas demand continued to weaken, but RV funds filled this gap as marginal buyers of U.S. Treasuries. The above chart clearly shows the increase in repo positions, which can serve as a representation of the scale of basis trade positions in the market.

Overview of Basis Trading:

Treasury basis trading refers to buying cash bonds while simultaneously selling bond futures contracts. The margin requirements of banks and exchanges are crucial. The size of RV funds' positions is limited by the cash amount required for margin. Margin requirements fluctuate with market volatility and liquidity factors.

Bank Margin:

To obtain the cash needed to purchase bonds, the fund engages in repurchase agreement (repo) transactions. Banks agree to pay a small fee to immediately advance cash, with the bonds to be purchased serving as collateral for settlement. Banks will require a certain amount of cash margin to cover the repo.

The greater the bond price volatility, the higher the margin required by banks.

The worse the bond's liquidity, the more margin banks will require. Liquidity is always concentrated in certain maturities of the yield curve. For the global market, the 10-year Treasury is the most important and has the highest liquidity. When the latest issued 10-year Treasury is auctioned, it becomes the "on-the-run" 10-year bond. It is the most liquid bond. Then, over time, it moves further away from the liquidity center and is considered "off-the-run." As time passes, new issues naturally become "off-the-run," while the cash needed to fund repo transactions increases as the market waits for the basis to collapse.

Essentially, during periods of high market volatility, banks worry that if they need to liquidate bonds, prices will drop too quickly, and there won't be enough liquidity to absorb their market sell orders. Therefore, they will raise margin limits.

Futures Exchange Margin:

Each bond futures contract has an initial margin level, which determines the cash margin amount required for each contract. This initial margin level will fluctuate with market volatility.

Exchanges are concerned about their ability to close positions before the initial margin is completely exhausted. The faster the price volatility, the more difficult it is to ensure solvency; therefore, as market volatility increases, margin requirements will also rise.

Eliminating Fear:

The significant impact of Treasury basis trading on the market and the financing methods of major participants has been a hot topic in the Treasury market. The Treasury Borrowing Advisory Committee (TBAC) has provided data in its recent Quarterly Refunding Announcement (QRA) confirming the following statement: since 2022, the marginal buyers of U.S. Treasuries have been RV hedge funds participating in such basis trading. Below is a link to a detailed paper submitted to the U.S. Commodity Futures Trading Commission (CFTC), based on data provided by TBAC since April 2024.

The cyclical reflexive market event chain amplifies in a terrifying way in each cycle, as follows:

If bond market volatility rises, RV hedge funds will need to deposit more cash with banks and exchanges.

To a certain extent, these funds will be unable to bear additional margin calls and must close positions simultaneously. This means selling cash bonds and repurchasing bond futures contracts.

As market makers reduce the scale of quotes for the given pricing spread to protect themselves from harmful one-way flows, liquidity in the cash market declines.

As liquidity and prices decline together, market volatility further increases.

Traders are well aware of this market phenomenon, and regulators themselves, along with their financial journalist allies, have been issuing warning signals about it. Therefore, as bond market volatility intensifies, traders will rush to buy ahead of forced sell-offs, exacerbating downward volatility and causing the market to collapse faster.

If this is a known source of market pressure, what policies can the U.S. Treasury implement within its department to maintain the flow of funds (i.e., leverage) to these RV funds?

Treasury Buybacks

A few years ago, the U.S. Treasury launched a bond buyback program. Many analysts look to the future, pondering how this will foster or encourage certain money-printing behaviors. I will outline my theory on the impact of buybacks on the money supply. But first, let’s understand how the program works.

The Treasury will issue new bonds and use the proceeds to buy back illiquid old bonds (off-the-run bonds). This will lead to an increase in the value of old bonds, potentially exceeding their fair value, as the Treasury becomes the largest buyer in the illiquid market. RV funds will see the basis between old bonds and bond futures contracts narrow.

Basis Trading = Long Cash Bonds + Short Bond Futures

As the Treasury is expected to purchase bonds, the prices of cash bonds will rise along with the prices of old bonds.

Thus, RV funds will lock in profits by selling the currently higher-priced old bonds and closing their short bond futures contracts. This releases valuable funds for banks and exchanges. As RV funds are making profits, they will directly engage in basis trading at the next Treasury auction. As prices and liquidity rise, volatility in the bond market will decrease. This reduces the margin requirements for the funds and allows them to hold larger positions. This is the best embodiment of pro-cyclical reflexivity.

Knowing that the Treasury is providing more leverage to the financial system, the market will now relax. Bond prices rise; everything is fine.

U.S. Treasury Secretary Besset boasted about his new tool in an interview, as the Treasury can theoretically conduct unlimited buybacks. However, the Treasury cannot issue bonds at will without a spending bill approved by Congress. The essence of buybacks is that the Treasury issues new debt to repay old debt, and the Treasury has already issued new debt to repay the principal of maturing bonds. Since the Treasury buys and sells bonds with a primary dealer bank in the same name, the cash flow of this transaction is neutral, so it does not need to borrow money from the Federal Reserve for the buyback. Therefore, if reaching the buyback level can alleviate market concerns about a collapse in the Treasury market and lead to the market accepting lower yields on bonds that have not yet been issued, the Treasury will go all out for buybacks. It won't stop and can't stop.

Explanation of Treasury Supply

Besset knows that the debt ceiling will be raised at some point this year, and the government will continue to squander with increasing intensity. He also knows that Elon Musk is not cutting spending fast enough through his Department of Government Efficiency (DOGE), due to various structural and legal reasons. Specifically, Musk's estimate for spending cuts this year has dropped from an expected $1 trillion per year to a paltry $150 billion (at least considering the massive scale of the deficit). This leads to an obvious conclusion: the deficit may actually widen, forcing Besset to issue more Treasuries.

Currently, the deficit for fiscal year 2025 as of March is 22% higher than the deficit for the same period in fiscal year 2024. Let’s trust Musk— I know some of you would rather burn a Tesla while listening to Grimes (Musk's ex-girlfriend)—he has only been working on it for two months. More concerning is the uncertainty regarding the impact and strength of tariffs on corporations, combined with the stock market decline, which will lead to a significant drop in tax revenue. This points to a structural reason that even if DOGE successfully cuts more government spending, the deficit will continue to widen.

Deep down, Besset worries that due to these factors, he will have to raise borrowing expectations for the remainder of the year. As the impending flood of Treasury supply approaches, market participants will demand significantly higher yields. Besset needs RV funds to increase their investments, utilizing maximum leverage to completely buy out the bond market. Therefore, buybacks are imperative.

The positive impact of buybacks on dollar liquidity is not as direct as central bank money printing. Buybacks are neutral to both budget and supply, allowing the Treasury to conduct unlimited buybacks to create massive RV purchasing power. Ultimately, this enables the government to raise funds at affordable rates. The more debt issued that is not purchased with private savings but rather with leveraged funds created through the banking system, the greater the increase in the money supply. Then we know that when the amount of fiat currency increases, the only asset we want to hold is Bitcoin. Let’s go!

Clearly, this is not an infinite source of dollar liquidity. The amount of unissued Treasuries available for purchase is limited. However, buybacks are a tool that can help Besset alleviate market volatility in the short term and provide funding for the government at affordable levels. This is why the MOVE index is falling. As the Treasury market stabilizes, concerns about the collapse of the entire system also subside.

The Same Scenario

I compare this trading strategy to that of the third quarter of 2022. In the third quarter of 2022, a "decent" white boy like Sam Bankman-Fried (SBF) went bankrupt; the Federal Reserve was still raising interest rates, bond prices were falling, and yields were rising. Yellen needed to find a way to stimulate the market so she could open the market's throat with a red-bottomed stiletto and expel bonds without triggering a gag reflex. In short, just like now—due to the shift in the global monetary system, market volatility is increasing—this is a bad time to ramp up bond issuance.

RRP Balances (White) vs. Bitcoin (Gold)

Just like today, but for different reasons, Yellen could not expect the Federal Reserve to loosen monetary policy because Powell was engaged in his Paul Volcker-inspired juggling act of prohibition. Yellen, or some exceptionally clever aides, correctly deduced that the ineffective funds held in RRP (reverse repo) by money market funds could be attracted into the leveraged financial system by issuing more U.S. Treasuries, which these funds were happy to hold because the yields were slightly higher than RRP. This allowed her to inject $2.5 trillion of liquidity into the market between the third quarter of 2022 and early 2025. During this period, the price of Bitcoin increased nearly sixfold.

This sounds like a rather optimistic setup, but people felt panic. They knew that high tariffs and the Chi-Merica divorce were detrimental to stock prices. They thought Bitcoin was just a high-beta version of the Nasdaq 100 index. They were bearish, not believing that a seemingly harmless buyback plan could increase future dollar liquidity. They stood by, waiting for Powell to loosen policy. He could not directly loosen policy or implement quantitative easing like previous Federal Reserve chairs from 2008 to 2019. Times have changed, and the burden of money printing has increasingly fallen on the Treasury. If Powell truly cared about inflation and the long-term strength of the dollar, he would eliminate the effects of the actions taken by the Treasury under Yellen and now Besset. But he did not do that then, and he will not do that now; he will be left in a "turtle" chair, overwhelmed and manipulated.

Just like in the third quarter of 2022, people believed that after Bitcoin hit a cyclical low of around $15,000, it might fall below $10,000 due to a series of adverse market factors stacking up. Now some believe that Bitcoin's price will fall below $74,500, dropping below $60,000, and that the bull market is over. Yellen and Besset are not playing around. They will ensure that the government secures funding at affordable rates and suppresses volatility in the bond market. Yellen issued more short-term Treasuries than long-term Treasuries, injecting limited RRP liquidity into the system; Besset will issue new debt to buy back old debt and maximize the RV funds' ability to absorb the new bond supply. Neither of these is the quantitative easing policy that most investors are familiar with and recognize. Therefore, they overlook it, and once Bitcoin confirms a breakout, they will have to chase the price.

Verification

For buybacks to have a net stimulative effect, the deficit must continue to rise. On May 1, we will learn about the upcoming borrowing plans through the U.S. Treasury's Quarterly Refunding Announcement (QRA) and how they compare to previous estimates. If Besset has to borrow more or expects to borrow more, it means tax revenue is expected to decline; therefore, with spending remaining constant, this will lead to an expanded deficit.

Then, in mid-May, we will receive the official deficit or surplus data for April from the Treasury, which will include the actual data from April 15 tax revenues. We can compare the year-on-year changes for fiscal year 2025 to observe whether the deficit is expanding. If the deficit increases, the volume of bond issuance will increase, and Besset must do everything possible to ensure that risk-averse funds can increase their basis trading positions.

Trading Strategy

When Trump was skiing, a steep slope suddenly dropped, triggering an avalanche. Now, we finally know the level of pain or volatility (measured by the MOVE index) that the Trump administration can endure before moderating any policies that the market perceives will negatively impact the cornerstone of the fiat financial system. This will trigger a policy response, the effects of which will increase the supply of fiat dollars available for purchasing U.S. Treasuries.

If the increase in the frequency and scale of buybacks is not enough to calm the market, the Federal Reserve will ultimately find a way to loosen policy. They have already stated they would do so. Most importantly, they lowered the rate of quantitative tightening (QT) at the recent March meeting, which is favorable for dollar liquidity in a forward-looking manner. However, beyond quantitative easing, the Federal Reserve can do more. Here is a brief list of procedural policies that are not quantitative easing but can enhance the market's ability to absorb new Treasury issuances; one of these may be announced at the Federal Reserve meeting on May 6-7:

Exempting Treasury bonds from the bank supplementary leverage ratio (SLR) requirements. This allows banks to use unlimited leverage to purchase Treasury bonds.

Implementing a "QT reversal," where the funds raised from maturing mortgage-backed securities (MBS) are reinvested into newly issued Treasury bonds. The size of the Federal Reserve's balance sheet remains unchanged, but this will bring $35 billion of marginal buying pressure to the Treasury market each month for the next several years until all MBS holdings mature.

When Trump next presses the tariff button—he will do so to ensure countries respect his authority—he will be able to demand more concessions, and Bitcoin will not suffer the same fate as some stocks. Bitcoin knows that given the current and future insane levels of debt required for the dirty financial system to operate, deflationary policies cannot be sustained in the long term.

The collapse of the Mt. Sharpe World ski resort triggered an avalanche in the secondary market, which could have quickly escalated to a five-level event, the highest level. But the Trump team responded swiftly, changing course and pushing the empire to another extreme. The foundation of the avalanche is crystallized dollar bills provided by the buybacks of U.S. Treasuries, solidified by the driest and wettest "powder" (pow pow). It is now time to transition from the difficult climb with a backpack full of uncertainty to jumping off a powder pillow, cheering for how high Bitcoin will fly.

As you can see, I am very optimistic about Bitcoin. At Maelstrom, we have maximized our cryptocurrency positions. Now, everything revolves around buying and selling different cryptocurrencies to accumulate Bitcoin. During the slump when Bitcoin's price fell from $110,000 to a low of $74,500, the highest buying volume was for Bitcoin. Bitcoin will continue to lead the market as it is the direct beneficiary of the increased dollar liquidity injected to mitigate the impacts of the U.S.-China decoupling. Today, the international community views Trump as a madman wielding tariffs aggressively, and any investor holding U.S. stocks and bonds is looking for something with anti-establishment value. Physically, that is gold. Digitally, that is Bitcoin.

Gold has never been seen as a high-beta version of U.S. tech stocks; therefore, as the overall market collapses, it performs well as the oldest anti-establishment financial hedge tool. Bitcoin will break free from its ties to U.S. tech stocks and rejoin gold in the "only up, no down" category.

What about altcoins?

Once Bitcoin breaks through the historical high of $110,000, it is likely to soar, further solidifying its dominance. Perhaps it won't rise to $200,000. Then, Bitcoin will start rotating into junk coins. Alt season (AltSzn: Chikun), let’s go!

Aside from those shiny new junk coin metadata, the best-performing tokens are those that can both generate profits and return profits to stakers. Such projects are few and far between. Maelstrom has been working hard to accumulate positions in certain qualified tokens and has not yet finished buying these gems. They are gems because they have been battered like all other junk coins in the recent sell-off, but unlike 99% of the garbage projects, these gems actually have paying customers. Due to the large number of tokens, it is impossible to persuade the market to give your project another chance after launching tokens in Down Only mode on CEX. Junk coin treasure hunters want higher staking APY, with rewards coming from actual profits, as these cash flows are sustainable. To promote our products, I will write a full article introducing some of these projects and why we believe their cash flows will continue to grow in the near future. Until then, hurry up and back the truck up to buy everything!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。