Original Title: Ethereum Reimagined: Restoring Control and Value to ETH

Original Author: Momir, IOSG Ventures

TL;DR

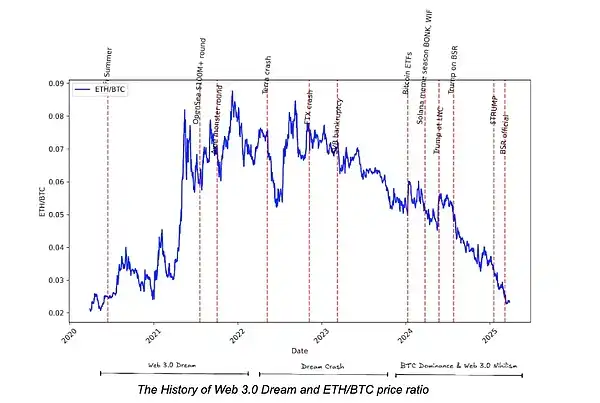

The enthusiasm for the Web3 vision that peaked in 2021 has faded, and Ethereum is facing severe challenges. Not only has the market's perception of Web 3.0 shifted, but Ethereum is also contending with fierce competition from emerging platforms like Solana for the remaining market share. Key issues such as Layer 2 fragmentation, erosion of value attribution, dilution of ecological control, and lack of leadership further undermine Ethereum's user experience and economic value, and with the rising influence of Layer 2 networks, Ethereum's impact is being shaken. These factors have ultimately led to one of the most severe price corrections in ETH's history.

However, hope remains: by promoting L2 interoperability, prioritizing the improvement of ETH-centric infrastructure, and adopting decisive, performance-oriented leadership, Ethereum still has the opportunity to regain its former glory. Ethereum's solid underlying architecture and vibrant developer ecosystem remain its lasting advantages, but strategic action must be taken swiftly to restore ETH's preeminent status.

The cognitive shift from the Web3.0 utopia to a harsh reality forces the market to reassess Ethereum's core value proposition. The once-hopeful ideal of a "user-governed decentralized internet" has now been replaced by a more ironic narrative: the cryptocurrency space is either a store of value game dominated by Bitcoin or has devolved into a digital casino. This reversal of sentiment has particularly impacted Ethereum: it prides itself on being the cornerstone of a new internet paradigm but must confront growing skepticism.

More critically, Ethereum is no longer the sole spokesperson for the Web 3.0 vision. Whether one is optimistic or pessimistic about the industry's future, it is clear that platforms like Solana are becoming new centers of crypto consumer activity. In this context, this article aims to analyze Ethereum's most pressing strategic challenges and propose practical solutions to help it regain an advantage in the ever-evolving landscape.

Core Challenges

Ethereum faces numerous challenges, but this analysis focuses on the four most urgent issues: L2 network fragmentation, decline in value capture ability, dilution of ecological control, and lack of strategic leadership.

L2 Network Fragmentation and User Experience Disruption

The most significant crisis is the fragmentation of Layer 2 networks. The introduction of multiple competing execution layers has disrupted user experience and on-chain liquidity, eroding the composability advantage that Ethereum's mainnet once proudly held, an advantage that remains clear in monolithic blockchains like Solana.

For users, they must navigate inconsistencies among various protocols, standards, and cross-chain bridges, making the seamless interaction initially promised by Ethereum difficult to achieve. Developers bear the burden of maintaining multiple versions of protocols across various L2s, and startup teams face complex market entry strategies due to the need to allocate limited resources in a fragmented ecosystem. As a result, many consumer-facing applications choose to migrate to Solana, where users and entrepreneurs can focus on entertainment and innovation without the complications of fragmented infrastructure.

Dilution of Ecological Control: An Increasingly Serious Threat

More seriously, Ethereum has outsourced its scalability roadmap to L2, a decision that is continuously weakening its control over its own ecosystem. General-purpose L2 Rollups generate strong network effects as they build their own ecosystems, gradually evolving into insurmountable moats. Over time, these execution layers gain increasing influence relative to Ethereum's settlement layer, and the community may gradually overlook the importance of the mainnet settlement layer. Once assets begin to exist natively on the execution layer, Ethereum's potential for value capture and influence will be significantly diminished, and the settlement layer will ultimately become a commoditized service.

Erosion of Value Attribution: Structural Challenges

The rise of L2 has significantly impacted ETH's value capture, with these platforms increasingly claiming MEV and transaction fee revenue, greatly reducing the value flowing back to Ethereum's mainnet. This shift redirects economic benefits from ETH holders to L2 token holders, weakening the intrinsic motivation to hold ETH as an investment asset. While this trend is an inevitable challenge for any Layer 1 token—whether modular Ethereum or monolithic integrated chains—Ethereum experiences this phenomenon earlier and more acutely due to its initial practice of a centralized L2 approach.

It is foreseeable that as application layers dominate MEV capture, not only will monolithic blockchains face similar dilemmas, but even L2s themselves will encounter value capture crises. Although this is not a predicament unique to Ethereum, how to formulate a precise strategy to address this structural challenge remains a core issue that urgently needs resolution.

Leadership Crisis: The Idealism Dilemma

In addressing the aforementioned challenges, Ethereum has also exposed deep-seated strategic leadership deficiencies. The community has long been mired in a back-and-forth balancing act between efficiency goals and egalitarian values, hindering critical progress. Meanwhile, the commitment to "trustworthy neutrality" in governance, while initially aimed at reducing regulatory and state crackdown risks, often becomes a constraint on strategic decision-making. Additionally, ETH holders lack mechanisms to directly influence significant strategic choices, with their only means of expressing dissatisfaction often being to sell their tokens.

In hindsight, while these issues are easy to define, they may stem, to some extent, from considerations of regulatory pressure and national-level risks rather than a lack of insight into governance and leadership.

Strategic Responses: Challenges and Solutions

L2 Network Fragmentation: Self-Correcting Mechanisms

Two paths to resolve the L2 fragmentation crisis:

First, rely on market mechanisms (natural selection) to achieve organic integration of the ecosystem, ultimately forming 2-3 general-purpose L2s that dominate the market in terms of absolute activity. Other projects may either exit the competition or transform into Rollup service providers targeting vertical scenarios;

Second, establish strong interoperability standards to eliminate internal friction within the Rollup ecosystem and prevent a single execution layer from building a monopolistic moat.

Ethereum should seize the current window of influence it still holds over L2 to promote the second solution. It must recognize that this dominance is continuously eroding day by day; the slower the action, the weaker the strategic effectiveness. By building a unified L2 ecosystem, Ethereum hopes to regain the composability advantage of the mainnet era and compete directly with monolithic chains like Solana on the user experience front.

However, relying solely on market-driven integration will cast a shadow over ETH's future prospects. Once a power-law distribution emerges around 2-3 dominant execution layers, Ethereum's influence over these execution layers may significantly diminish; in such cases, each execution layer will often prioritize the value attribution of its own token, marginalizing ETH and weakening Ethereum's economic model. To avoid this scenario, Ethereum must act decisively to shape its own L2 ecosystem, ensuring that value and control remain tied to the mainnet and ETH.

Value Recapture Mechanism

Relying solely on the narrative of "productive assets" is not a sustainable long-term strategy for ETH (or any Layer 1 token). The time window for Layer 1 to dominate MEV capture will last at most five years, as the trend of value capture levels continuously migrating upstream to the application stack has become established. Meanwhile, Bitcoin has firmly established itself in the "store of value" narrative, making it likely that if ETH attempts to compete in this area with BTC, it may be viewed by the market as "Bitcoin for the poor," akin to the historical positioning of silver relative to gold. Even if ETH could demonstrate a clear advantage in value storage in the future, such a transformation may take at least a decade, and Ethereum cannot afford to wait for such a long cycle. Therefore, during this period, Ethereum must carve out a unique narrative path to maintain its market relevance.

Positioning ETH as "internet-native currency" and the highest quality on-chain collateral is the most promising direction for the next decade. While stablecoins dominate as payment mediums in on-chain finance, they still rely on off-chain ledgers; the true role of an internet-native and unstoppable currency has yet to be substantively occupied, and ETH uniquely possesses this first-mover advantage. However, to achieve this goal, Ethereum must regain control over the general execution layer in the ecosystem and prioritize driving ETH adoption rather than allowing the proliferation of Wrapped ETH standards.

Regaining Ecological Dominance

Reestablishing ecological ownership can be achieved through two key avenues: first, by enhancing the performance of Ethereum L1 to reach levels comparable to centralized chains, ensuring that consumer applications and decentralized finance experiences are seamless; second, by launching Ethereum-native Rollups, focusing all business development and adoption efforts on this. By concentrating ecological activities on infrastructure controlled by ETH, Ethereum can strengthen ETH's core position within the ecosystem. This requires Ethereum to shift from the outdated "ETH-compatible" paradigm to an "ETH-led" ecological model, prioritizing direct control over core resources and maximizing ETH's value capture.

However, whether reclaiming ecological control or enhancing ETH adoption rates, these are tricky decisions that may alienate key contributors such as Rollup and liquid staking providers. Ethereum must carefully weigh the balance between the need for strengthened control and the risk of community fragmentation to ensure that ETH can successfully establish its new narrative as the cornerstone of the ecosystem.

Leadership Innovation

Ultimately, Ethereum's leadership must innovate to address governance and strategic challenges. Ethereum leaders need to adopt a performance-oriented mindset, a stronger sense of urgency, and a pragmatic attitude to drive ecological development. This shift requires abandoning the previous excessive insistence on "trustworthy neutrality," especially when making decisions about product roadmaps and ETH asset positioning, necessitating more decisive decision-making.

At the same time, the market has expressed dissatisfaction with Ethereum's practice of outsourcing critical infrastructure—from Rollups to staking—to decentralized entities. To reverse this situation, Ethereum must bid farewell to the old model of "aligned with ETH" and shift to a new model of "led by ETH," ensuring that core infrastructure operates under a single token system ($ETH). This move will further solidify ETH's core position and restore market confidence in Ethereum's strategic direction.

Marketing Challenges and Narrative Potential

Despite facing numerous challenges, Ethereum still possesses deep advantages that support its position in the crypto space—advantages that are often downplayed by its leadership, allowing negative criticism to overshadow its core narrative. Systematically outlining these advantages helps establish an objective framework for understanding Ethereum's potential.

Proven Infrastructure

Ethereum stands alongside Bitcoin, providing unparalleled decentralized security that meets the stringent requirements of sovereign entities and large financial institutions. The security guarantees offered by its consensus mechanism far exceed those of other smart contract platforms, ensuring true censorship resistance—an essential feature for infrastructure that carries hundreds of billions of dollars in value. The Ethereum DeFi ecosystem has accumulated approximately $76.32 trillion in value (TVL × days), with very few significant security incidents, and its time-tested security moat continues to deepen.

Currently, the scale of stablecoins hosted on Ethereum has surpassed $120 billion, with these funds primarily accumulated during an era where regulatory frameworks remain unclear and institutional adoption has yet to solidify. As the regulatory environment gradually clarifies and institutional demand drives further growth in stablecoins, it is expected that the scale of stablecoins hosted on Ethereum will exceed $1 trillion within the next decade. This growth will stem not only from new issuance demand but also from the market's trust in its security and composability, potentially solidifying its position as a cornerstone of global finance.

Forward-Looking Design

Ethereum's architecture exhibits significant foresight. Compared to Bitcoin, it offers a more comprehensive transition plan against quantum attacks, with a continuously evolving technical culture driving innovation. Unlike the security budget constraints that $BTC may face in the future, Ethereum's flexible monetary policy allows it to maintain strong security incentives while adapting to market conditions, ensuring long-term resilience.

Unmatched Developer Ecosystem

Ethereum boasts the largest and most diverse developer community in the blockchain space, with nearly a decade of accumulated knowledge and best practices. This intellectual and social capital builds another layer of moat for the EVM ecosystem, allowing it to maintain a leading edge in innovation speed and application scale.

Modular Path: The Only Solution for Scalable Decentralized Systems

Ethereum's modular design has made significant progress in balancing decentralization, scalability, and security. Over time, it has become increasingly clear that for monolithic chains to achieve global financial-scale, they must sacrifice decentralization; whereas Ethereum's modular strategy represents the only viable solution for sustainable scaling while maintaining minimal trust and decentralization. The correctness of this strategic choice will become more evident over time.

The Most Customizable Tech Stack

Ethereum's L2 ecosystem offers unparalleled customization, making it the preferred platform for vertical application scenarios and institutional adoption. Institutions can build dedicated L2s based on Ethereum L1, utilizing technologies like Fully Homomorphic Encryption (FHE) for privacy protection; companies like Robinhood can replicate traditional financial order flow payment mechanisms on their own L2s through a "pay for ordering rights" model. These L2s are anchored to Ethereum L1—the world's most secure public ledger—creating a unique security redundancy: even if a particular L2 fails, users can still revert to L1 for trustless settlement. This "ultimate safety net" is a unique value proposition of the Ethereum ecosystem.

Market Signals: ETH Enters Historic Oversold Territory

Recent price movements of ETH have made it an unfavored asset in the eyes of investors, with ETH holders expressing their lack of confidence in recent developments through their selling behavior. This sharp decline has occurred only six times in ETH's ten-year history, with five of those instances happening in the early stages. For Ethereum, now in its tenth year of development, encountering such a magnitude of value reassessment during its maturation phase undoubtedly sends a significant warning signal to the entire ecosystem. Historical data shows that strong rebounds have occurred within six months following the first five similar correction events, injecting a glimmer of hope into the current predicament.

However, whether ETH can replicate historical patterns or continue its steep downward trajectory will directly depend on the strategic signals released by Ethereum's leadership in the short term and the strategic execution over the next twelve months. Despite the challenges, the current situation is not irretrievable; if practical strategies can be formulated and implemented, a strong recovery is still possible.

To reshape its industry leadership and restore market confidence in ETH, Ethereum must immediately address the following core challenges: first, it needs to enforce robust L2 interoperability standards to alleviate fragmentation and retain the seamless composability that once defined the mainnet; second, it must shift from the old model of "aligned with ETH" to an "ETH-led" ecological model, prioritizing L1 scaling and Ethereum-native Rollups to reestablish control and maximize ETH's value capture; finally, the leadership must evolve towards a performance-driven decision-making approach, abandoning "trustworthy neutrality" and unifying critical infrastructure under the $ETH token system.

If decisive action is not taken, Ethereum will face the risk of being eroded by competitors like Solana and becoming a commoditized settlement layer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。