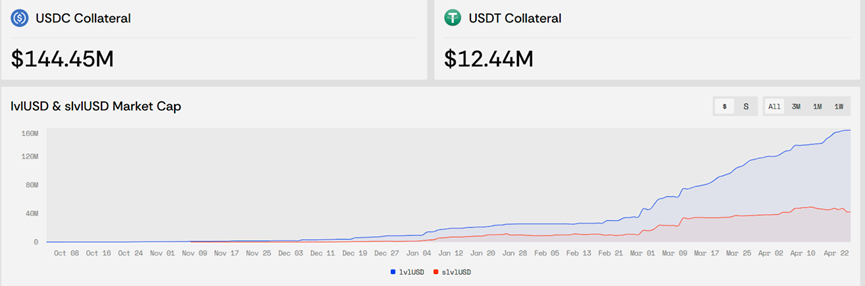

Level Breaks Through $150 Million TVL

Level has achieved an important milestone, with total locked value surpassing $150 million. This is not just a numerical victory, but a testament to Level's advantage in the fiercely competitive stablecoin arena.

Stablecoin Market: Distribution is Key

Stablecoins are the backbone of the crypto market, serving as a perfect liquidity flywheel with a mature product-market fit. However, the current market is dominated by a "distribution-first" model. Data from 2024 clearly reveals this: USDC issuer Circle generated approximately $1.7 billion in revenue but paid $900 million to distribution partner Coinbase and made a one-time payment of $60 million to Binance. These figures highlight a key reality—stablecoin issuers must invest huge sums to compete for user holdings through centralized exchanges and other channels. This high distribution cost creates significant barriers for new players entering the market and competing for market share with USDT and USDC.

Level's Unique Strategy

Level does not aim to replace USDT or USDC but instead chooses to absorb these two major assets. Its platform stablecoin $lvlUSD can only be minted using USDC or USDT, integrating these mainstream stablecoins into its ecosystem. This design aligns with Level's core philosophy: to provide a stablecoin that combines security, composability, and high yields, rather than directly competing with existing giants.

Why Mint $lvlUSD? The answer lies in yield. Since the launch of yield distribution in mid-December 2024, $slvlUSD (the yield-bearing version of $lvlUSD) has consistently offered an annualized yield of 8.3%, higher than the deposit rate for USDC on Aave. These yields come from depositing the reserve assets of $lvlUSD (USDC and USDT) into top lending protocols like Aave and Morpho, generating scalable, reliable, and low-risk yield streams.

Key Pillars of Level's Success

Level's model is based on several key factors, supported by data and partnerships:

Top Lending Protocol Support

Level's yield generation relies on deep integration with Aave and Morpho, two of the most trusted and proven lending protocols in DeFi. These partnerships ensure that the reserve assets of $lvlUSD can generate stable, low-risk yields while maintaining transparency and reliability.

TVL Resilience Amid Market Volatility

Despite an 18.6% drop in the total market capitalization of the crypto market in Q1 2025, the TVL of $lvlUSD has consistently shown steady growth without decline. This stability reflects users' high trust in Level and the protocol's ability to continuously create value under any market conditions.

Endorsement from Top Institutions

Level has the backing of Dragonfly Capital and Polychain Capital, two of the top venture capital firms in the crypto space. Their endorsement signifies confidence in Level's potential to reshape the utility of stablecoins and secure a significant position in the trillion-dollar stablecoin market.

Solving the Distribution Dilemma

From a game-theoretic perspective, stablecoin competition resembles a coordination game, where distribution channels hold asymmetric power. Issuers like Circle and Tether must incentivize platforms like CEX to prioritize promoting their assets, resulting in a costly and inefficient equilibrium. Level breaks this dynamic by bypassing traditional distribution battles. $lvlUSD requires minting with USDC or USDT, fully leveraging the existing liquidity and trust of these stablecoins while offering superior yield propositions. This design creates a win-win situation: users receive higher yields, and Level captures TVL without competing on distribution costs with rivals.

Additionally, Level's integration with leading DeFi protocols enhances the composability of $lvlUSD, allowing users to leverage it across multiple platforms for additional yield opportunities. This capital efficiency strengthens the protocol's network effects, with each integration further enhancing the utility and appeal of $lvlUSD.

Future Outlook

Level's $150 million TVL milestone is not just a number but a testament to a scalable and sustainable model. By focusing on low-risk yield generation, deep protocol integration, and aligned distribution strategies, Level has secured a favorable position in the stablecoin market. As DeFi continues to mature, Level's ability to provide ongoing value while maintaining security and transparency will solidify its status as a leader in the next generation of stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。