Background and Reasons for the Rise

On April 23, 2025, the price of Bitcoin (BTC) has surpassed $93,000, reaching a new recent high. Recently, the rise in Bitcoin is closely related to the global demand for safe-haven assets. QCP Capital analysts pointed out in their Telegram broadcast that capital is shifting towards safe-haven assets, with Bitcoin and gold becoming the main beneficiaries as investors withdraw from dollar risks. As the spot Bitcoin ETF listed in the U.S. warms up, the inflow of funds has once again strengthened Bitcoin's price momentum.

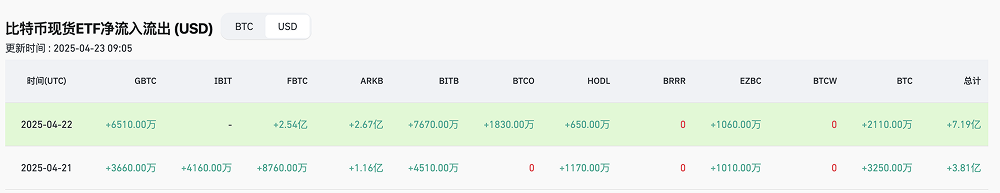

Data shows that BTC ETF recorded net inflows of $381 million and $719 million on April 21 and 22, respectively, which played a crucial role in driving Bitcoin's price. Additionally, the return of price premiums on Coinbase also indicates a recovery in institutional confidence in Bitcoin. Bitcoin's status as a safe-haven asset is continuously strengthening, especially against the backdrop of rising global economic uncertainty, with more and more funds choosing to enter this non-correlated asset.

Candlestick Patterns and Market Trends

- Candlestick Pattern Analysis: Breakthrough and Pullback

Bitcoin experienced a strong rise between April 21 and April 23, breaking through the key range of $88,000 to $93,000. A significant bullish candlestick was formed at the time of the price breakout, accompanied by increased trading volume, indicating strong market recognition of the current price range.

Although the price is currently close to the high of $93,000, there are still no clear sell signals in the current candlestick pattern, and the market's upward momentum remains strong. Short-term consolidation may become a characteristic of the upcoming trend, with prices likely oscillating between $90,000 and $93,000, waiting for further momentum accumulation.

- Important Price Ranges

- Support Level: The current support level is around $90,000, which is a recent consolidation area, and the market has strong support at this price range. If the price pulls back to this level, it may attract buying again.

- Resistance Level: The resistance level above is between $93,000 and $94,000. If Bitcoin can break through this resistance and stabilize in this area, the target price may aim for $95,000 or higher.

Technical Indicator Analysis

MACD: The DIF line is firmly above the DEA line, and the MACD histogram continues to expand, indicating that the market's upward momentum remains strong. The current increase in MACD shows sustained bullish strength, with no signs of weakness in the short term. Technically, the price is still in a strong state, especially with the support of market inflows, which may continue to maintain this trend.

RSI: The RSI is currently at 74.49, close to the overbought zone of 80. Although the RSI is near overbought levels, indicating strong upward momentum in the market, it also suggests potential pullback risks in the short term. When the market approaches the overbought area, there is usually some consolidation or pullback.

KDJ: The K value (77.24) is significantly higher than the D value (56.42), and the J value (94.31) remains high, indicating that Bitcoin's upward momentum is still strong in the short term. This KDJ pattern continues to support the upward trend, indicating that the market is still in a bullish phase, and any pullback may only be a minor adjustment.

OBV: OBV shows sustained capital inflows, with a current value of 336,219.49, indicating that market support is very strong. A high OBV value suggests that the price increase of Bitcoin is effectively supported by capital inflows, and the upward momentum in the short term may continue.

Large Capital Movements and Market Sentiment

- Large Capital Inflows

On-chain data shows strong inflows into the BTC ETF, especially the net inflow of $381 million, indicating that market confidence in Bitcoin is recovering. With increasing demand for Bitcoin from U.S. institutional investors, the market liquidity of Bitcoin has been further enhanced.

- Market Sentiment

Current market sentiment is relatively optimistic, with the Fear and Greed Index in the greed zone. Investor sentiment is gradually recovering, especially in the context of falling U.S. stocks, where the demand for Bitcoin as a safe-haven asset is continuously increasing. The sustained inflow of funds is driving Bitcoin's price upward, and market expectations for further increases in the future are also strengthening.

Today's Trend Prediction and Market Outlook

In the short term, Bitcoin may maintain a consolidation range between $90,000 and $93,000. If market sentiment remains positive, the price may break through the resistance level of $93,000 and head towards $94,000 or even $95,000. However, due to the RSI value being close to the overbought zone, the market may face some pullback pressure in the short term. If the price falls below the support level of $90,000, attention should be paid to the strength of support at lower levels.

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。