Waking up to optimistic sentiments surrounding the improvement of US-China trade relations, Bitcoin has surged past $93,000, rising over 7% in 24 hours. However, a report from CryptoQuant indicates that on-chain data shows underlying market fundamentals still exhibit vulnerabilities, with BTC facing resistance levels.

According to Coinglass data, $490 million was liquidated across the entire network in the past 12 hours, with $450 million coming from short positions.

Meanwhile, gold has significantly retreated from its intraday historical high of $3,500, closing down 1%. The world's largest gold ETF, SPDR Gold Trust, saw its holdings decrease by 11.47 tons from the previous day, with current holdings at 947.70 tons.

This round of price increases is not merely a short-term reaction to the warming of US-China trade relations, but rather a risk repricing under multiple macro signals. In this storm of policy games and risk aversion demands, Bitcoin is once again viewed as a "safe haven" for capital, with its price surge possibly being a preemptive response from the market to future inflation, dollar credit, and changes in the global geopolitical landscape.

Can the tariff reversal be sustained?

The primary reason for Bitcoin's recent rise is attributed to the Trump administration's shift in tariff policy.

Yesterday, US Treasury Secretary Yellen told investors at a closed-door meeting at JPMorgan that the current tariff stalemate with China is unsustainable. He anticipates a "de-escalation in the near future" and described the current situation as a "trade embargo." However, he also warned that a more comprehensive agreement between the US and China may still take years to achieve.

Subsequently, President Trump stated to the media at the White House that the US tariffs on China "will be significantly reduced from the current level of 145%," alleviating concerns about further escalation of the trade war.

Currently, the Trump administration has engaged in trade negotiations with multiple countries, including Japan, India, South Korea, the EU, Canada, and Mexico. White House Press Secretary Caroline Levitt stated that the Trump administration has received 18 trade agreement proposals from other countries, adding that "all parties involved hope to see a trade agreement reached."

Despite this, Trump has not publicly indicated his intention to cancel the "10% base tariff" he set. He continues to insist that other countries should lower their own import taxes and eliminate various non-tariff barriers, which the US considers obstacles to American exports.

Decoupling Bitcoin from traditional finance

According to the International Monetary Fund (IMF) World Economic Outlook report released in April 2025, the US economic growth forecast for this year has been downgraded to 1.8% from 2.7%, while the inflation forecast has been raised from 1.9% to 3%. The report also predicts a broader slowdown in the global economy. Less than an hour after the report was released, Bitcoin surged to its highest point in seven weeks, breaking the $90,000 mark.

Some analysts point out that Bitcoin's recent performance supports the view that it is decoupling from traditional finance and tech stock trends. Patrick Liou, Vice President of Institutional Sales at Gemini, stated that Bitcoin's mild "divergence" reflects investors' cautious attitudes in the face of US political and macro risks, especially following President Trump's recent criticisms of the Federal Reserve's monetary policy and the progress of post-war trade negotiations.

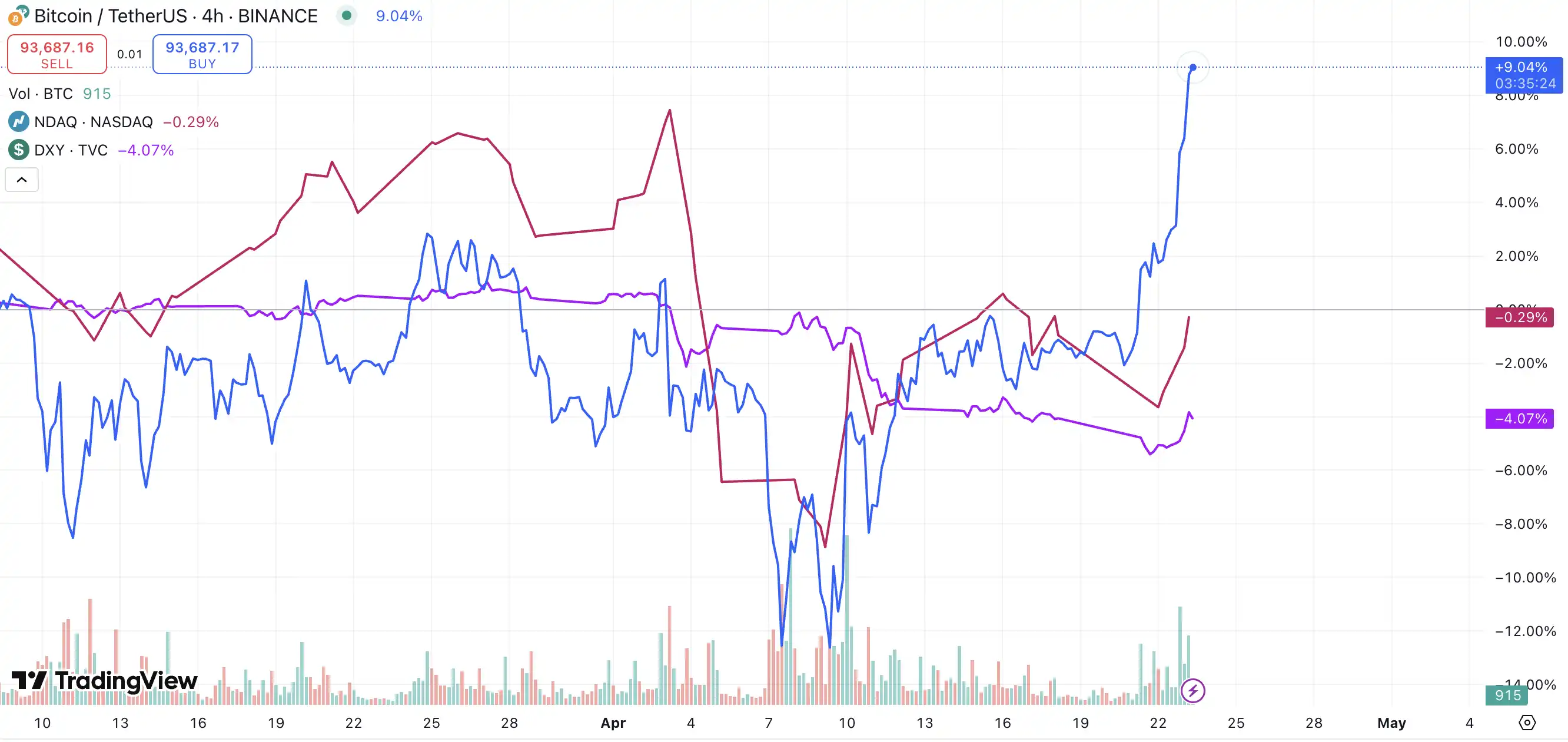

Comparison chart of BTC with Nasdaq and the US Dollar Index

"We noticed that real signs of 'decoupling' began to emerge on Sunday night," Patrick Liou believes. "Considering Trump's increasingly aggressive rhetoric towards the Federal Reserve, coupled with the commencement of trade agreement negotiations after 'Liberation Day,' investors are in a risk-off mode when assessing the US market. Interestingly, one of the directions of capital rotation is Bitcoin, and we can clearly see that Bitcoin is showing a significant decoupling trend from US stocks and the dollar."

After the Western Easter holiday, the stock market saw a pullback on Monday, but Bitcoin rose against the trend, closely following gold's strong performance. Bitcoin spot ETFs recorded a net inflow of $381.4 million that day, the highest single-day capital inflow since the end of January, further demonstrating strong market demand for Bitcoin.

Analysts at QCP Capital noted that soaring gold prices, a weakening dollar, and institutional funds flowing into Bitcoin collectively support the argument that "Bitcoin is decoupling." "The resilience of Bitcoin in overnight trading further reinforces the market narrative of decoupling," QCP analysts stated. "As funds shift towards safe-haven and anti-inflation assets, Bitcoin and gold are becoming the biggest beneficiaries of capital fleeing dollar risk."

Although analysts from QCP Capital and Bernstein emphasized Bitcoin's appeal as a safe-haven asset, Wintermute OTC trader Jake O. cautioned that this "decoupling" phenomenon could be disrupted after a dollar rebound.

"As I mentioned yesterday, I believe this wave of market movement is primarily driven by a weakening dollar. If that is the case, once the DXY stabilizes, the decoupling of Bitcoin from US stocks may be difficult to sustain. This is the most critical variable this week, and this hypothesis has yet to be truly tested."

Trump has no intention of firing Powell

On April 22, after Trump criticized Federal Reserve Chairman Powell on Truth Social as a "major loser" and called for immediate interest rate cuts, even considering removal, market concerns about the independence of the Federal Reserve surged, causing the dollar index (DXY) to quickly drop below 98, hitting a nearly three-year low.

Bitunix analysts stated that if political pressure in the US continues, it could undermine the legal framework of the Federal Reserve, prompting global capital to accelerate its search for safe havens. This could also accelerate the shift of funds from the dollar to Bitcoin and stablecoins, which possess anti-censorship and anti-seizure properties.

However, last night, European Central Bank President Lagarde stated in an interview: "Both Powell and I are used to political pressure, and I have great respect for him. I believe Powell will not be removed." Citigroup's chief economist stated that Trump will not fire Federal Reserve Chairman Powell, "that boundary will not be crossed."

Therefore, Trump's lack of intention to fire Powell has maintained the stability of the global financial market order. However, if Trump were to indeed fire Federal Reserve Chairman Powell, the dollar index and US stocks would face further downward pressure, while Bitcoin and gold would become the safe-haven choices for mainstream capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。