Today's homework is much easier to write compared to yesterday. The US stock market rebounded significantly, not only recovering the losses from yesterday but also rising quite a bit. The VIX briefly fell back below 30, but none of this was due to any new positive news; the policy situation is almost the same as when the market dropped yesterday. Therefore, it can be concluded that investors are gradually losing interest in the disputes between Trump and Powell. As the US stock market rises, Bitcoin continues to maintain its upward momentum, hovering around $91,000 for a long time.

However, given the current economic and political situation, it is still too early to say that the market has entered a reversal. The rebound is more due to the fact that it had indeed dropped too much yesterday, and we are gradually entering the earnings season. More importantly, the GDP data to be released at the end of the month will determine the trajectory of the US economy. If the GDP data performs well, there is still a chance to aim for a higher position. As long as there is no monetary easing, a complete reversal will still be quite difficult, as liquidity constraints remain.

In simpler terms, even if the US stock market and $BTC can continue to rise, assets that rely more on liquidity, such as the Russell 2000 and altcoins, will still find it hard to reverse like the current situation.

However, there are indeed better opportunities for the US in the near future, such as Trump stopping his antics on tariffs, a potential ceasefire between Russia and Ukraine, and the strong resilience of the US economy, which could break the chain reaction of negative impacts since Trump took office. But again, as long as monetary policy has not completely shifted, a large amount of capital will still concentrate on top assets, such as AI in the US and Bitcoin in cryptocurrency.

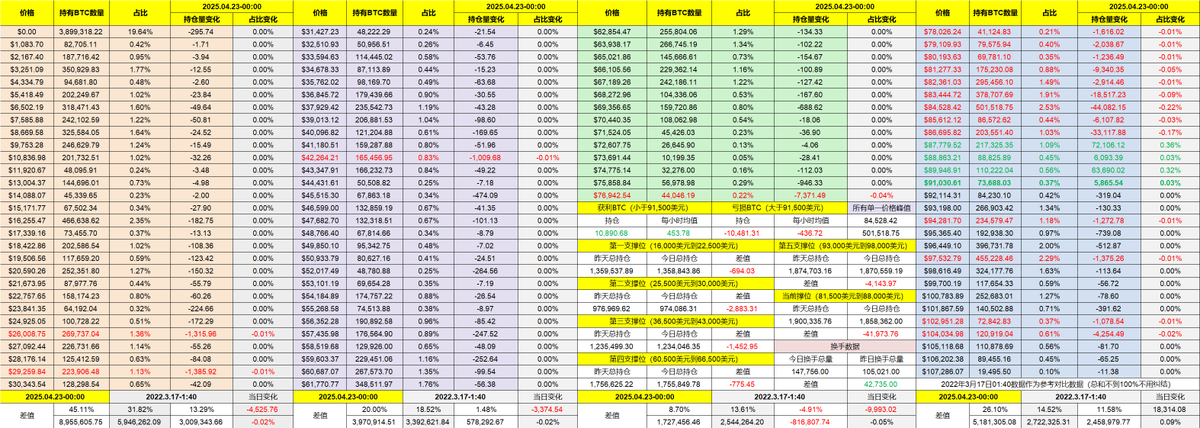

Looking back at Bitcoin's data, with today's $BTC price rising again, even breaking through $91,000, there is a noticeable increase in turnover. Especially in the last two days, short-term investors who bought the dip are exiting in large numbers, indicating that they are not very optimistic about the upcoming market. In contrast, investors who are facing losses and those who made early profits are still in a wait-and-see state and have not increased their turnover due to the rise.

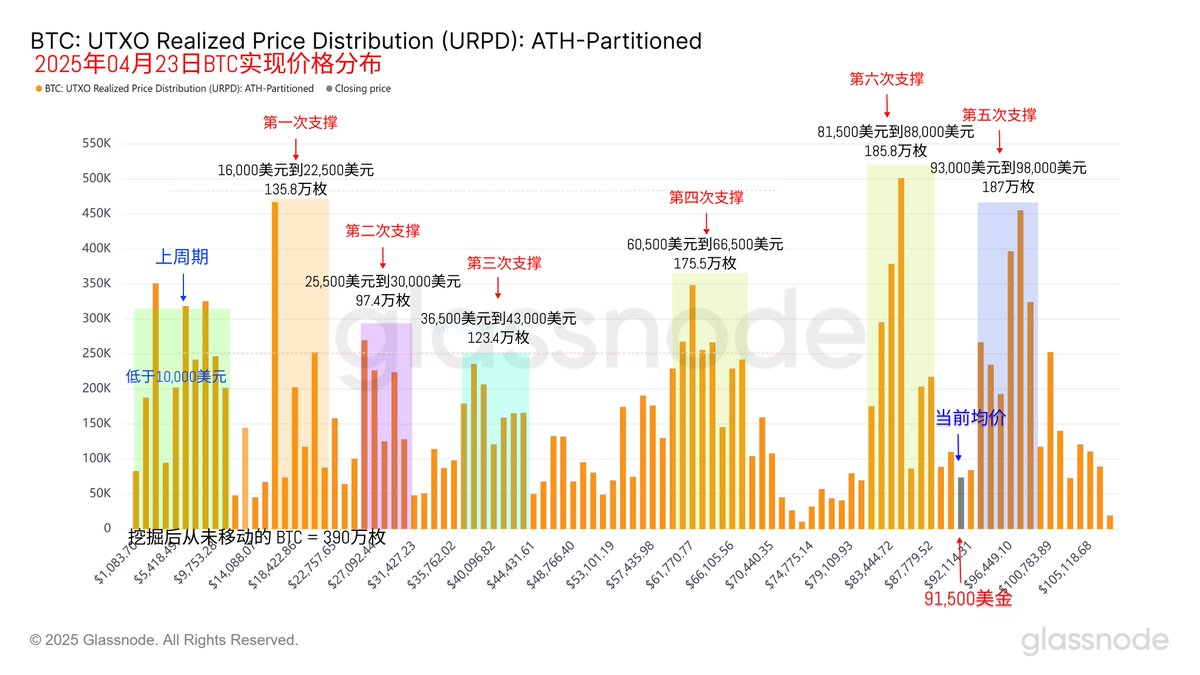

The current support levels remain between $81,500 to $88,000 and $93,000 to $98,000. Having such close support levels is quite rare, especially since the range between $93,000 to $98,000 has not seen significant changes for over three months, indicating that the sentiment among these investors is very stable.

However, the yield on the 10-year US Treasury bonds is still not optimistic and does not show a significant downward trend, suggesting that the market's direction has not yet been fully determined.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。