As of now, the Nasdaq and S&P 500 have recovered the losses from yesterday. The market is gradually "de-mystifying" Trump. The decline yesterday was due to Trump's hard confrontation with Powell, which caused investor distrust. However, 24 hours later, nothing has occurred that could reverse the market.

The rebound in U.S. stocks is likely because they fell too much; the market's panic has been corrected. However, to say that the market has entered a reversal is still unlikely. It is more probable that we are seeing a rebound. Additionally, this week and next week are both earnings seasons, which may provide temporary breakthroughs in macro sentiment.

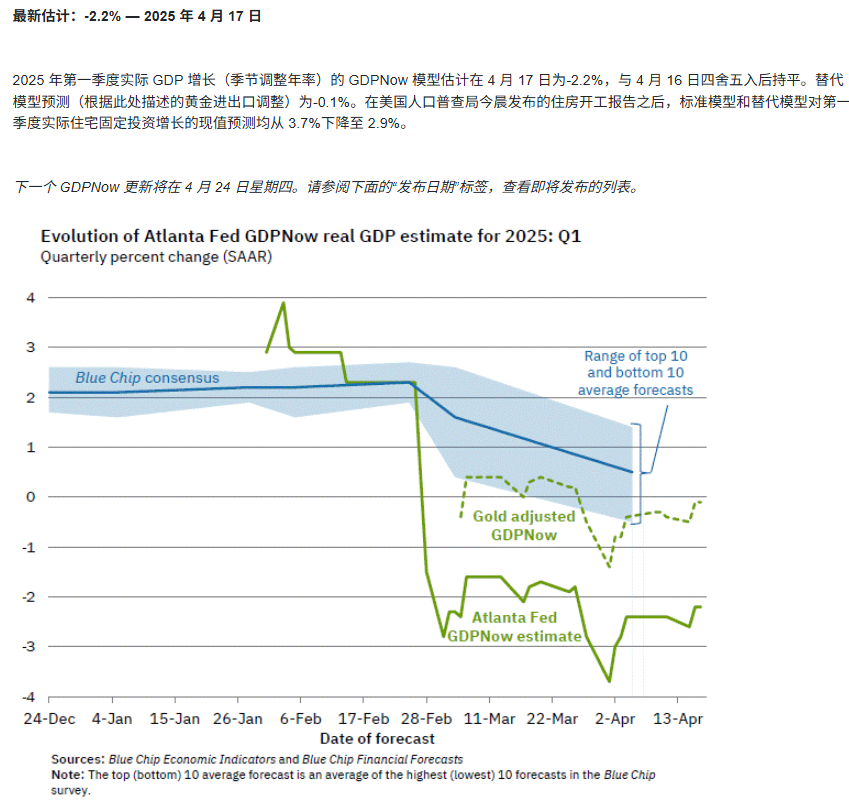

However, the GDP data at the end of the month will still be a watershed for the trend in May. If the GDP is positive, it at least proves that the U.S. has not reached a recession, although it won't strengthen rate cut expectations. It would be a relief for the economy. But if the GDP is negative, especially with GDPNow forecasting -2.2%, then the expectations for rate cuts will be more negative than positive.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。