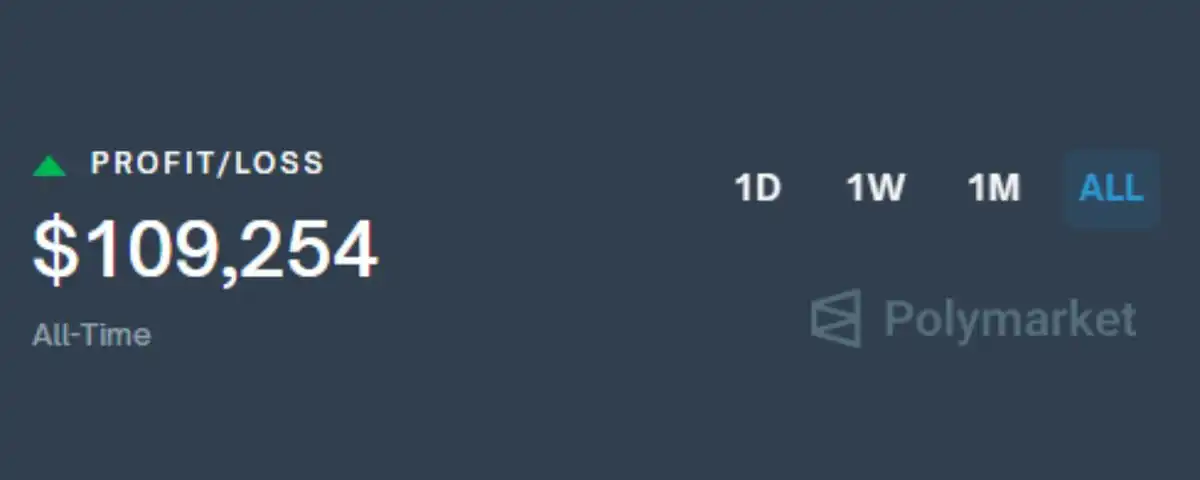

Original Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Author: @PixOnChain, Crypto Researcher

Original Translator:律动小 Deep

Summary: Utilizing pricing discrepancies between prediction markets for arbitrage, combined with quick action and early exit strategies, to earn risk-free profits.

Editor's Note: This article details the author's strategy for earning $100,000 through arbitrage between prediction markets. The author capitalizes on the pricing differences for the same event across different platforms, locking in risk-free profits, with a focus on pricing errors in multi-outcome markets. Key steps include identifying price discrepancies, acting quickly, automating monitoring, and exiting early to improve APY. The author emphasizes the importance of small markets, volatility, and careful rule examination, providing an efficient Web3 arbitrage guide.

Below is the original content (reorganized for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here’s my specific strategy for earning $100,000 from decentralized, inefficient prediction markets—completely without gambling.

Step 1: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5,000 before December?"

· "Will MrBeast run for president?"

· "Will Kanye launch his own token?"

Each market has its own participant crowd.

Each group has its own biases.

This means that different platforms will price the same event… differently.

That’s where the arbitrage opportunity lies.

If platform A has a "yes" price of 40 cents, and platform B has a "no" price of 55 cents…

Regardless of the outcome, you can lock in a profit of 5 cents.

That’s arbitrage.

But there are even better opportunities…

Step 2: Find Your Edge

What works well for me are multi-outcome markets.

These markets are the most prone to issues.

For example:

· Who will win F1 this weekend?

· Which party will win the UK election?

· Who will be the next eliminated contestant on the reality show?

The more outcomes there are = the higher the complexity = the more pricing errors.

In theory, the total probability of all outcomes should equal 100%.

In practice? I often see the market total reaching 110%.

Why? Because most platforms embed hidden fees—"overround."

And many platforms let the crowd determine the odds.

This leads to rich, inefficient arbitrage opportunities.

Step 3: How to Determine if It's an Arbitrage Opportunity

The rule is as follows:

You find the pricing for the same event on different platforms. Choose the lowest price for each outcome. If the total is less than $1, you’ve found an arbitrage opportunity.

Let me show you a real example.

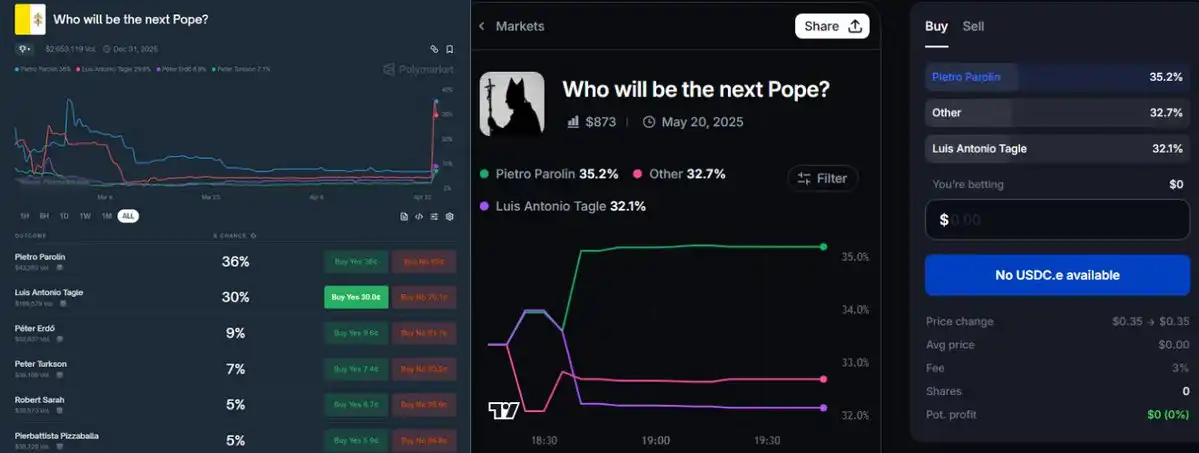

Market: Who will be the next pope?

Two platforms are running this market simultaneously.

The prices are as follows:

Polymarket/Myriad

We choose the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Others: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy all three outcomes.

One of them must win.

You are guaranteed to get back $1.

Profit: 2.1 cents per trade = 2.1% risk-free return.

That’s arbitrage.

You’re not betting on who will become the pope. You’re betting that the two platforms cannot agree on the pricing of potential candidates. When they disagree—that’s when you profit.

P.S. This isn’t the best opportunity, just one I found today.

Myriad has lower liquidity, but there are two other platforms showing similar price discrepancies.

If you monitor more markets, you can find bigger opportunities.

I usually only enter when the annual percentage yield (APY) is above 60% (APY = (price difference / settlement days) × 365).

This market price difference is 2.1%, with a settlement time of 29 days:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking up funds for a month just for a 26% APY? Pass.

But what if the same price difference has a settlement of only 7 days?

That’s over 100% APY—I would enter.

How to find these high APY opportunities?

Step 4: Race Against Time

Arbitraging in prediction markets is a race against time. Once a price discrepancy appears, you usually only have a few minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible—automate this part.

At first, I opened tabs for 7 platforms simultaneously. Refreshing like a madman. Using price alerts on Discord, Telegram, and Twitter.

Sometimes, I could spot price discrepancies just from muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the price difference is gone.

The best price discrepancy I caught was 18%, and the trading volume was substantial.

Make sure you have enough liquidity to deploy in each market and understand all fees.

Step 5: Early Exit

Most people wait until the results are announced. I don’t. Most of my profits are made while the results are still unknown.

Suppose I buy all outcomes at 94 cents. This locks in a 6-cent price difference. One of the outcomes will pay $1.

But I don’t have to wait.

If the market tightens—those same shares can now be sold for 98 cents or 99 cents—I exit.

This only works if all outcome prices remain stable.

If one outcome skyrockets while others plummet, there’s no exit opportunity.

So I monitor the entire portfolio. When the total value rises, I exit.

This significantly increases your APY and allows for quicker rotations between different markets.

Extra Tips

· Look for overlapping events (e.g., "Trump wins the 2024 election" and "Republicans win")—hidden arbitrage opportunities are there.

· Target small markets—more pricing errors, less competition.

· Use less popular platforms—more price discrepancies, greater advantages + potential airdrop rewards.

· Carefully read settlement rules—one word can change the outcome.

· Always triple-check the order book and your buy prices. Include all fees in your calculations.

I spent 2.5 months earning $100,000.

Some weeks had no opportunities. Some weeks were busy.

The more volatile the market = the larger the price discrepancies.

So if the market is quiet, don’t rush, keep clicking. There will always be another market that makes a mistake.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。