Author: Frank, PANews

As the pinnacle of celebrity coins, the launch of the TRUMP token has triggered extreme FOMO in the market and attracted many large investors. However, with the overall MEME market cooling down and the exposure of insider teams, the price of TRUMP has plummeted from a peak of $75 to a low of $7.2, a drop of over 90%. On April 18, the TRUMP token experienced a 4% token unlock, and the market estimates that this will exacerbate panic around the token, leading to further declines. On the other hand, news emerged on April 20 that Trump plans to host a dinner for TRUMP token holders. With a combination of positive and negative factors, the TRUMP token seems to have begun to stabilize and rebound.

Previously, PANews conducted an in-depth analysis of the holding chips of TRUMP tokens (Related reading: “The Wealth Truth of TRUMP Tokens: Large Investors Compete in the Arena, Average Purchase of $590,000, $1.09 Million Bought Within a Minute of Token Launch”). Three months have passed. How are the large investors faring now? What new changes have occurred in the distribution of TRUMP tokens?

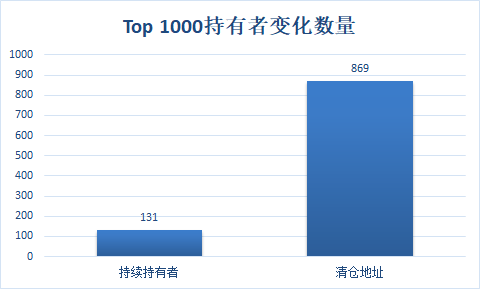

Large Investors Can't Withstand the Plunge, 86.9% Have Liquidated

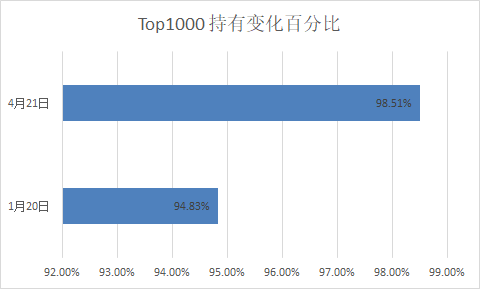

Comparing the overall data, the turnover of large TRUMP investors has been quite frequent over the past three months. Compared to data from January 20, among the top 1,000 token holders, 86.9% of large investors chose to liquidate their tokens, totaling 48 million tokens, accounting for 24% of the total circulation.

As of April 21, data shows that the number of TRUMP tokens held by the top 1,000 addresses is approximately 98.51%, an increase of 3.68% from 95.83% on January 20. This data indicates that the turnover of TRUMP tokens is significant, and during the low phase, it seems that the chips have become more concentrated.

In the past three months, among the newly added large addresses, Robinhood has become a prominent new large address among exchanges, increasing its token holdings by 1.44% over three months. Additionally, addresses from exchanges like Crypto.com and Meteora, which are primarily focused on the U.S. market, have seen a significant increase in token holdings. Among individual large investors, many began entering at the peak price of TRUMP at the end of January and are still continuously adding to their positions after being trapped, but overall, they are facing significant losses. From the perspective of token holdings, these addresses have purchased 12.2% of the tokens after January 20.

Among the large addresses that continue to hold, the development addresses have increased their holdings by approximately 1.38 million tokens; however, most of these tokens were transferred back from other smaller addresses and not purchased to increase holdings.

Among the liquidated addresses, according to PANews observations, many of the top large investors began buying around January 18 and chose to liquidate before or on February 1, most of them having made considerable profits.

Overall, the earliest profit-taking TRUMP investors have basically exited the market. Many of the newly entered addresses are large investors who were trapped after repeatedly bottom-fishing at high prices after January 20. However, from trading behavior, many large investors still seem optimistic about the future of the TRUMP token and continue to add to their positions.

Some Made $25 Million Exiting, Others Lost $33.66 Million

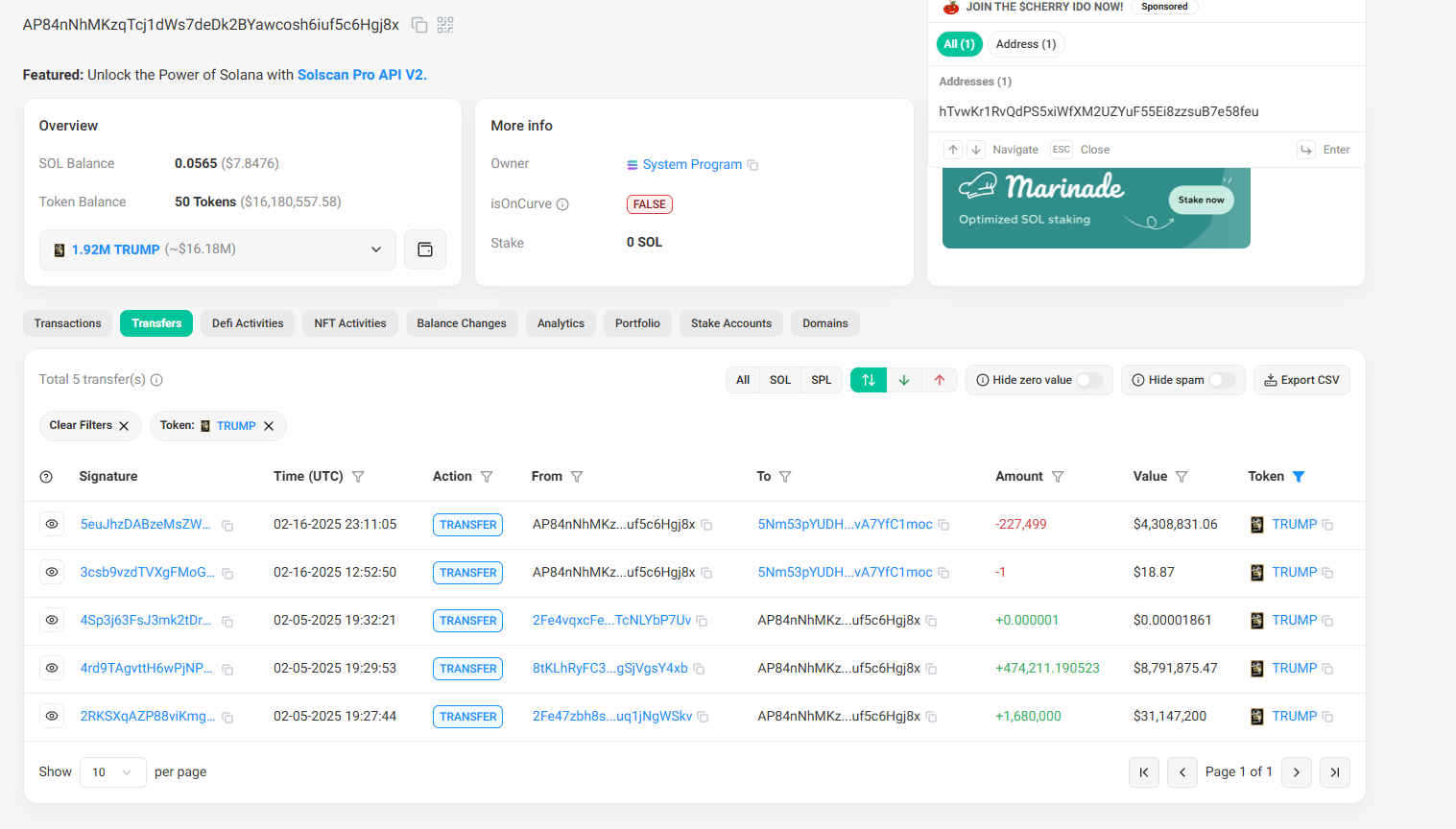

Among the large investors who liquidated to break even, the one with the largest profit is likely the address 2Fe47zbh8svDNGNehFy1NY8bsjQNtomvKFuq1jNgWSkv (hereinafter referred to as "2Fe47"). This address received 25 million TRUMP tokens from the founding address before the TRUMP token was launched. After the launch, it immediately distributed and sold them in the market, later receiving another 27 million tokens from the founding address 5e2qR and selling them again, totaling over $112 million in funds, ultimately consolidating the remaining tokens back to the founding address 5e2qR. Data from January 20 shows that this address held over 1 million tokens, which have now been completely liquidated. From the operational path, this address is suspected to be a small address of the TRUMP token project team.

Another large investor, 3AWDTDGZiW8joyfA52LKL7GUWLoKBCBUBLUE5JoWgBCu, began buying heavily right after TRUMP was launched on January 18, spending a total of $78.55 million to buy in, and ultimately selling for $103 million, making a profit of $25.17 million. However, the last entry was between January 25 and January 27, when the user believed that the TRUMP token had dropped to a low point, spending $12.78 million to build a position, but by February 2, seeing the price continue to drop, they liquidated everything for $9.23 million. Overall, this address still achieved considerable gains on the TRUMP token.

Another large investor began purchasing TRUMP tokens heavily from various exchanges around January 20, spending a total of $45.73 million to buy 1.11 million tokens, with an average cost of about $41. After selling 300,000 tokens for $17.6 on February 7, they still hold 810,000 tokens, currently facing a loss of about $33.66 million, with a loss rate of 73%. This is the address with the highest single loss among the newly entered large investors.

Coincidentally, the user of the address 6qgBGeZgPyxdobeHhcNtAqVe927zodpiuoufhwGN8BhP operated similarly to the above address, also starting to accumulate tokens through several related addresses from January 20, spending a total of $16.67 million, and currently still holding $6 million worth of tokens, with losses exceeding $10 million.

The dramatic fluctuations of the TRUMP token resemble a "reality show" in the crypto market, showcasing both the wealth myths of the MEME coin speculation wave and revealing the harsh realities of high-leverage gambling. From the precise cashing out of early large investors to the subsequent buyers sinking into a quagmire, the winners and losers in this game have been clearly delineated by the market. Although Trump's "dinner benefit" has temporarily injected rebound momentum into the token, the shadow of highly concentrated chips and suspected manipulation by the project team lingers. Currently, the TRUMP token appears to be catching its breath after the negative news has subsided, but its fate remains firmly tied to the resonance of celebrity effects and market sentiment. For retail investors, this rollercoaster-like market is undoubtedly a lesson in risk education: in the battlefield of MEME coins lacking fundamental support, even the endorsement of "top-tier traffic" may just be a glamorous facade for capital harvesting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。