RWA is an important growth vector in the crypto space, with the potential to bring trillions of traditional financial assets onto the blockchain.

Author: Ash

Compiled by: Deep Tide TechFlow

Similar to stablecoins and payments, RWA (Real World Asset tokenization) is an important growth vector in the crypto space, with the potential to bring trillions of traditional financial assets onto the blockchain.

Recent Institutional Developments:

@BlackRock launched BUIDL (tokenized treasury fund)

@FTI_Global launched FOBXX (on-chain money market fund)

@PayPal expanded the PYUSD stablecoin to the @solana network

@stripe acquired @Stablecoin company for $1.1 billion to enhance stablecoin infrastructure

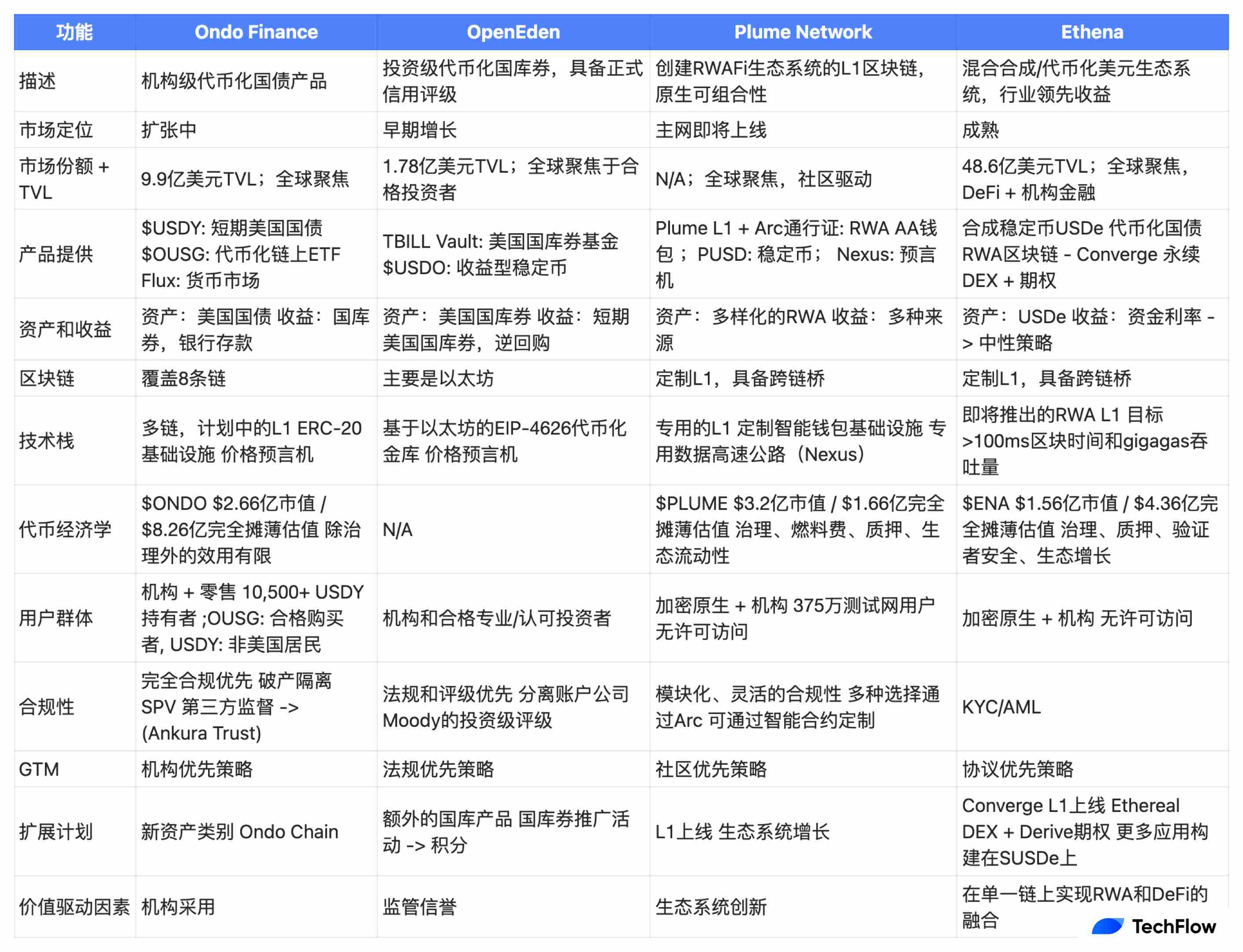

Comparative Analysis

- ### @OndoFinance (@nathanlallman)

a) Core Value Proposition

With a total locked value (TVL) of $990 million, it offers institutional-grade tokenized treasury products across eight chains

Over 10,500 USDY holders, adopting a regulation-first strategy to compliantly bridge traditional finance with decentralized finance

Strong institutional relationships

Multi-chain strategy, planning to launch a layer one chain to solidify its position as a leader in the tokenized U.S. treasury market

$ONDO market cap of $2.6 billion, fully diluted valuation of $8.2 billion. Limited utility beyond governance, hoping to see more value flow back to the token

b) Challenges

Geographic restrictions (USDY is not open to U.S. investors)

High entry barrier for OUSG (limited to accredited purchasers and qualified investors)

Limited asset diversity and availability, restricted to U.S. treasuries

Competition from traditional financial institutions launching their own solutions

c) Effective Market Strategy

- Adopting a top-down strategy by partnering with major financial institutions, initially focusing on institutional users before expanding to the retail market.

- ### @OpenEden_X (@jeremyng777)

a) Core Value Proposition

Offers investment-grade tokenized treasury bills, formally supported by credit ratings from Moody's.

Its regulation-first strategy focuses on qualified investors

Focused on U.S. treasury bills, ensuring holders' returns directly reflect the performance of the underlying U.S. treasury portfolio

$USDO is a yield-bearing stablecoin fully backed by U.S. treasury bills

Currently conducting a treasury bill promotion as a market strategy

b) Challenges

Smaller ecosystem and market influence compared to competitors

Limited chain diversity (mainly focused on Ethereum)

Community development is not mature enough

c) Effective Market Strategy

- Establish regulatory credibility first (obtaining Moody's investment-grade rating)

- ### @plumenetwork (@chriseyin)

a) Core Value Proposition

Building a dedicated layer one chain specifically for RWAFi (Real World Asset Finance)

Full ecosystem approach: RWA AA wallet + Arc (tokenizing any asset) + pUSD stablecoin + nexus oracle (data highway)

Community-first strategy with a strong focus on composability and programmability

$PLUME market cap of $320 million, fully diluted valuation of $1.6 billion. Used for governance, gas fees, staking, and ecosystem liquidity

b) Challenges

New tech stack and RWAFi ecosystem have not been validated

Lower institutional recognition compared to Ondo

Success of the layer one ecosystem is crucial in a competitive blockchain environment

c) Effective Market Strategy

- Community-first strategy, building a large ecosystem focused on RWA protocols and dApps before the mainnet launch. Initially targeting crypto-native users, then expanding to institutional users.

- ### @ethenalabs (@gdog97)

a) Core Value Proposition

As a leading hybrid player, it has approximately $10 billion in total locked value (TVL) and assets under management (AUM), with Ethena products accounting for $6.4 billion and Securitize tokenized assets for $4 billion

Rich product portfolio: USDe stablecoin + Ethereal perpetual contract decentralized exchange (DEX) + Derive options + building Converge layer one chain

$ENA market cap of $1.5 billion, fully diluted valuation of $4.3 billion. Used for governance, staking, validator security, and ecosystem growth

b) Challenges

The synthetic dollar model relies on centralized exchanges (CEX) for perpetual futures trading (counterparty risk exists)

Limited differentiation in Converge layer one chain infrastructure

Profitability depends on positive funding rates

c) Effective Market Strategy

- A dual approach strategy that meets the needs of on-chain DeFi whales while attracting institutional users, expanding through high yields, integrating USDe into dApps and CEX, and establishing institutional credibility through strategic partnerships

It can be seen that each protocol is carving out its own niche market while forming the infrastructure that could fundamentally reshape global capital markets.

Image source: @ahboyash, compiled by Deep Tide TechFlow

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。