Original Title: Into the Bittensor Ecosystem

Original Author: 0xJeff, AI Investor

Original Compiler: Rhythm Little Deep

Editor's Note: The author introduces the Bittensor ecosystem, a Web3 platform that promotes decentralized AI development through "Darwinian AI." The author shares their passion for cryptocurrency and AI, exploring the conveniences and potential risks of centralized AI products, such as data ownership and platform stability issues. Bittensor fosters the natural selection and evolution of AI models through competition and incentive mechanisms, utilizing the $TAO token and subnet structure, attracting investor attention.

The following is the original content (reorganized for better readability):

Cryptocurrency has always been fascinating to me. There’s always something new to learn. I am naturally curious and enjoy asking many "silly" questions to tech people just to gain insights and learn from their valuable experiences.

Artificial Intelligence (AI) is no exception; in fact, things are evolving at an astonishing pace. Web2 tech giants are continuously improving their models, primarily applying AI to launch various AI-driven use cases:

@canva launched AI tools that enable non-technical artists and creators to easily build interactive experiences and enhance their creations with AI.

@YouTube introduced a new AI tool that allows creators to generate background music for videos.

Ride-hailing platforms like Grab deployed agentic AI to support merchants and driver partners.

E-commerce platforms like Lazada introduced generative AI tools to help sellers enhance sales, marketing, and customer service.

There are countless examples like these. Practical use cases of using generative AI and agentic AI to improve workflows have been continuously adopted among enterprises and retail users.

The advantage of these technologies is their accessibility—you can find free or low-cost solutions almost everywhere. The benefits far outweigh the financial costs.

However, people often overlook the hidden trade-offs when using these AI products, such as:

Who owns your data?

Can others take your ideas and develop competing products?

Is the platform secure? Will your data be leaked?

If the platform goes down (like AWS once did), will your business come to a halt? Is there a risk to customer funds?

Can you always access your platform? Do you need to verify your identity? If the platform shuts down, will you still own your products or business?

There are many more questions (which I discussed in more detail in previous articles if you haven't read them).

Centralized players hold centralized power, and their decisions can (unintentionally) have a huge impact on your life.

You might say it doesn’t matter—perhaps you don’t use these tools often, or you believe these companies will act in the best interest of users. That’s fine. You might even want to invest in these AI startups because they are tapping into a massive market. But the problem is—you can’t. Unless you are at @ycombinator or a top venture capital firm, you cannot access these investment opportunities.

On the other hand, in Web3 AI, there are many investable AI ecosystems where teams are dedicated to bringing decentralized AI products and services to users. One of the most investable decentralized AI (DeAI) ecosystems is @opentensor (Bittensor).

Bittensor: Darwinian AI

Bittensor belongs to the "Darwinian AI" category—driving the evolution of AI through natural selection. Imagine this as a Hunger Games version of AI, where each subnet has its own "Hunger Games," with "miners" as participants (or "tributes"). They compete against each other on specific tasks using their models and data. Only the fittest models (the best-performing models) will be rewarded. Weaker models will be replaced or evolve (through training, tuning, or learning from other models). Over time, this will form a stronger, more diverse, and high-performance AI ecosystem.

What makes Bittensor particularly exciting is its competition and incentive mechanisms designed to align incentives among different stakeholders. I outlined the challenges faced by Web3 AI agent teams in the tweet below…

tl;dr: Current agent tokens are a good tool for speculators and teams to create hype, but they are detrimental to user acquisition and retention and cannot serve as an incentive mechanism to retain talent (developers, founders, etc.), especially when prices drop.

Bittensor addresses this issue through market-driven mechanisms, allocating $TAO emissions to subnets, thereby incentivizing and supporting team operations. The market decides which subnets receive more emissions by staking $TAO within the subnet. Once staked, $TAO is converted into Alpha subnet tokens. The more people stake, the higher the price of Alpha tokens, and the more emissions (in the form of Alpha tokens) you receive.

The emission mechanism of TAO is very similar to BTC, with a fixed total supply of 21 million tokens, halving every four years (7200 $TAO emitted to subnets daily). The first $TAO halving is expected to occur around January 5, 2026, at which point the circulating supply will reach 10.5 million tokens.

Why This Matters to Investors

I won’t delve into technical details here—I just want to share why I believe Bittensor is one of the most exciting ecosystems from a trading/investment perspective.

In addition to the dynamics mentioned above, trading Alpha subnet tokens feels like trading and mining simultaneously.

This is because every time the price of Alpha tokens appreciates, you not only feel the price appreciation but also receive $TAO emissions (in the form of Alpha tokens).

If the subnet performs exceptionally well and ranks higher, the $TAO you initially staked will experience significant price appreciation and a surge in emissions. The earlier you stake $TAO to a subnet, the higher your annual percentage yield (APY) will be (because the market has not caught up, and the number of stakers and $TAO is relatively low).

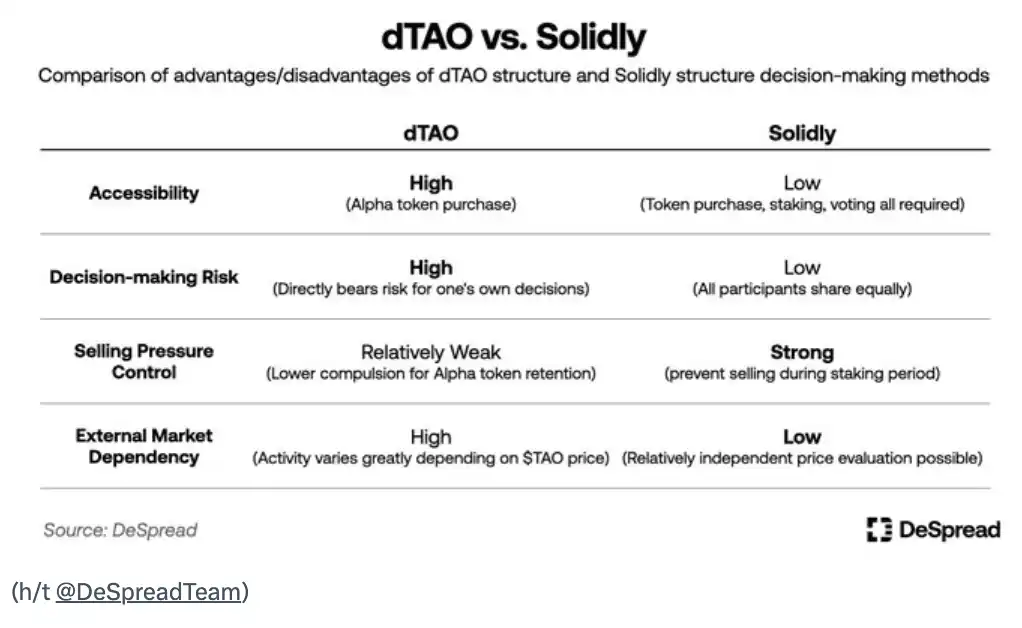

dTAO vs Solidly

Solidly's ve(3,3) requires long-term locking and continuous participation. Losses from incorrect voting (voting for the wrong LP pool) are borne by all holders (emissions are sold off, causing the price to drop for all token holders).

In contrast, dTAO does not require long-term locking; anyone can enter or exit at any time, but staking in subnets requires significant due diligence (DYOR). Investing in the wrong subnet can lead to substantial losses (as people can easily exit without a lock-up period).

However, the FDV (Fully Diluted Valuation) is too high! How to invest in a subnet with an FDV exceeding $500 million?

FDV may not be the best metric here, as subnets are still in the early stages, and market capitalization (MC) may be more suitable (if you are trading in the short to medium term).

If you are concerned about inflation, understanding the 18%/41%/41% emission distribution is helpful—these are the emissions received by subnet owners, validators, and miners (in the form of Alpha tokens). As a staker/Alpha token holder, you profit from the 41% portion of validators because you delegated $TAO to them when you staked.

Many subnet owners continue to hold the Alpha tokens obtained from emissions as a show of confidence, and many actively engage with validators and miners to ensure they are optimistic about the project and avoid large-scale token sell-offs (this information can be checked on taostats).

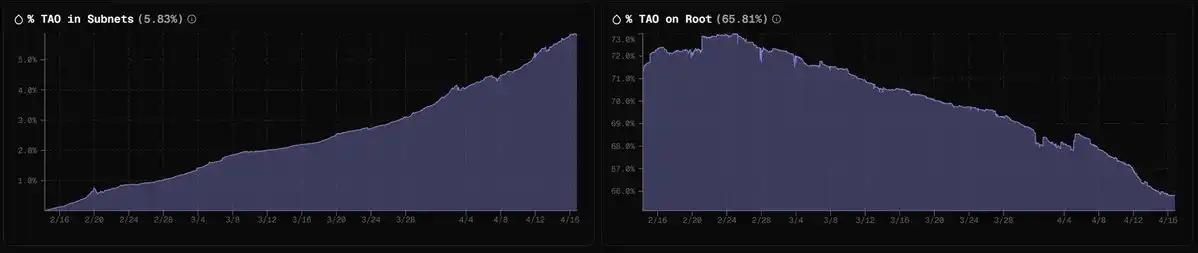

Zooming out, one of the best charts showing trends within the Bittensor ecosystem is as follows:

Source: taoapp

Since the launch of dTAO in February, the %TAO in Root (the original subnet managing the Bittensor incentive system) has been continuously decreasing, while the %TAO in subnets has been continuously increasing. This indicates that stakers/investors are increasingly willing to take risks (the conservative APY for staking in the Root network is about 20-25%, with no price appreciation for Alpha subnet tokens).

This trend aligns with the speed at which subnet teams are launching products. Since the launch of dTAO, teams need to build publicly, develop products that users want, iterate quickly, and find product-market fit (PMF), acquire users, and generate actual utility and substantial revenue quickly. Since I entered this ecosystem, I have felt that the development speed of teams is much faster than in other ecosystems (due to competition and incentive distribution mechanisms).

This leads to the unique investable DeAI use cases of subnets.

Leading Subnets and Use Cases

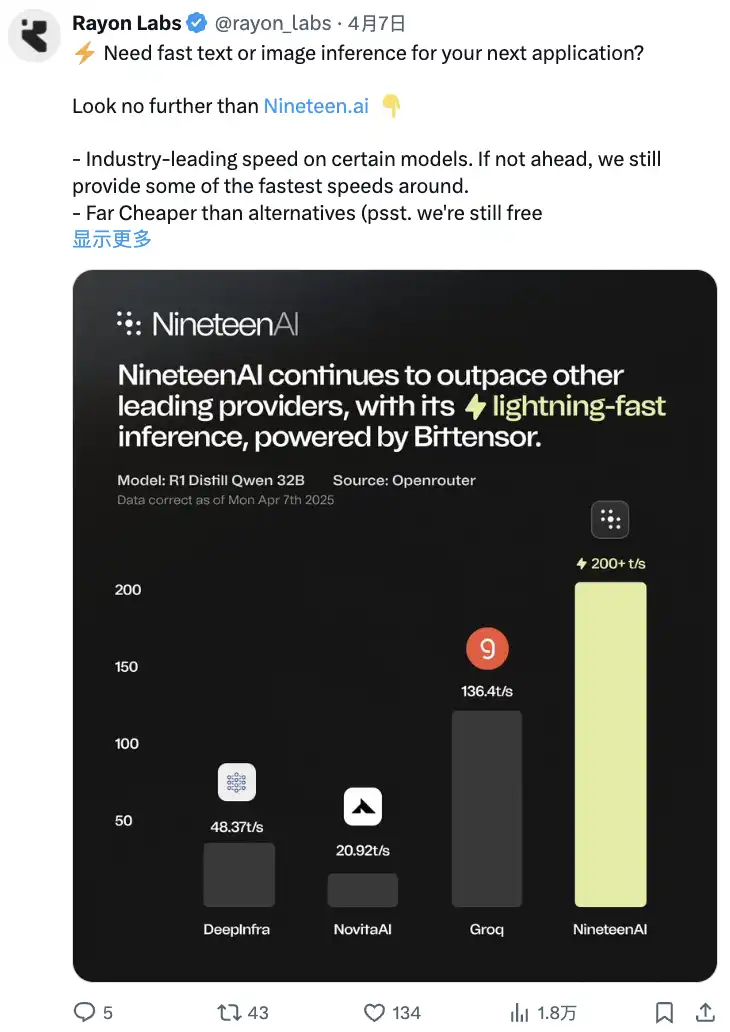

Considered to be the best at launching products with PMF for the general public, the teams that execute professionally and continuously build publicly are @rayon_labs

—SN64 (Chutes), SN56 (Gradients), SN19 (Nineteen).

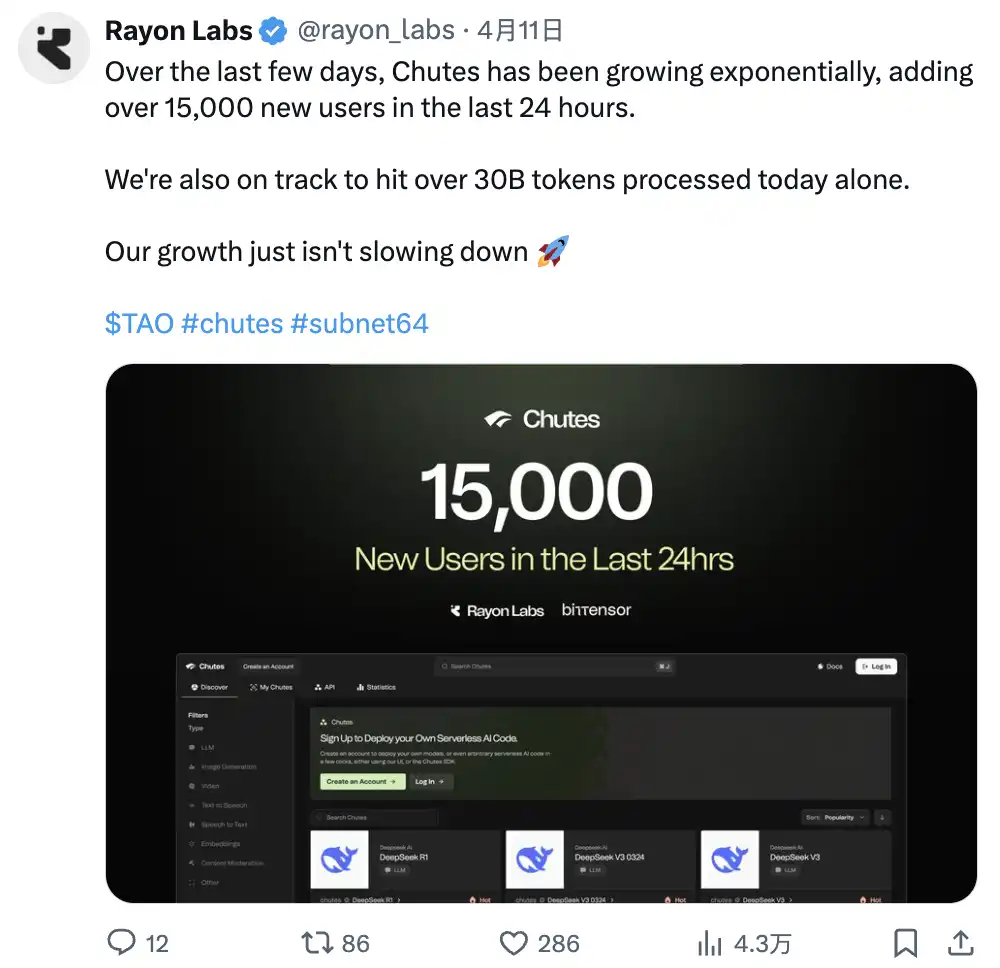

Chutes—provides infrastructure that allows you to easily deploy AI in a serverless manner. The best case is the recent AWS outage; if you rely on centralized providers, an outage can cause your AI applications to come to a halt (potentially leading to financial losses or vulnerabilities) due to a single point of failure.

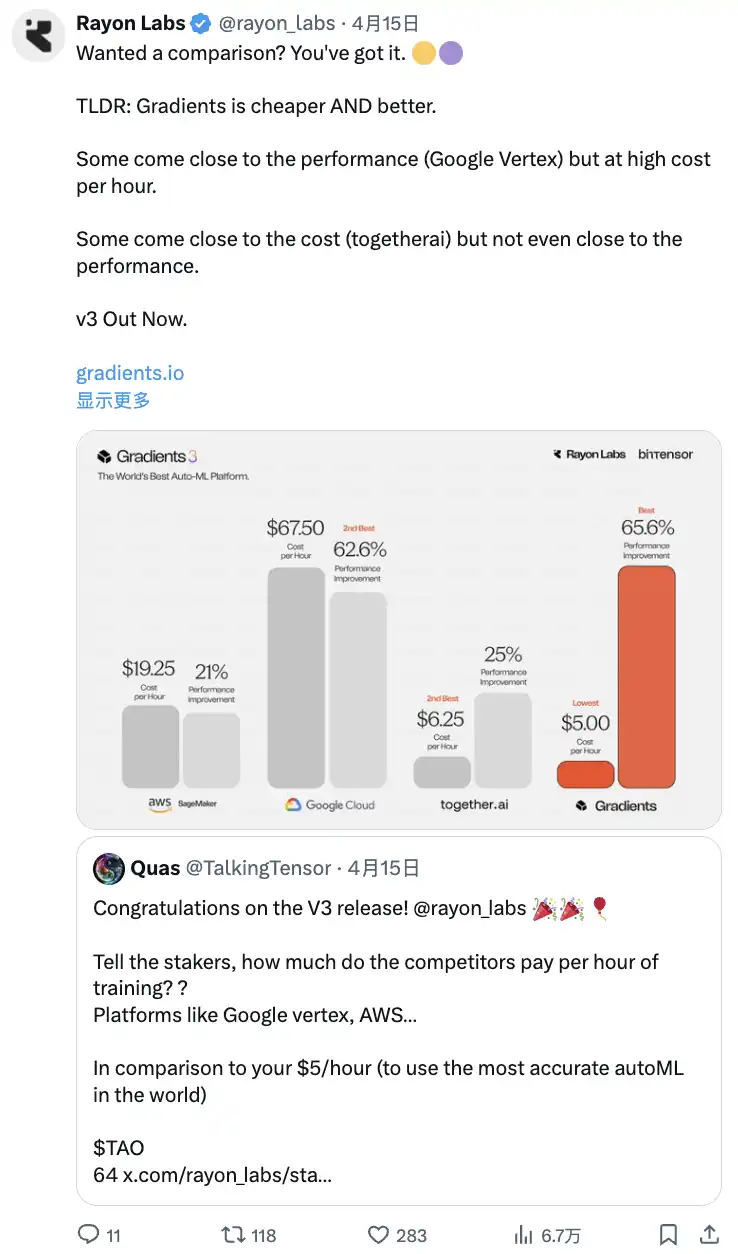

Gradients—anyone without coding knowledge can train their own AI models on Gradients (for specific use cases, image generation, custom LLM). The recently launched v3 is cheaper than its peers.

Nineteen—provides a fast, scalable, decentralized AI inference platform (available for anyone for text and image generation use cases, much faster than its peers).

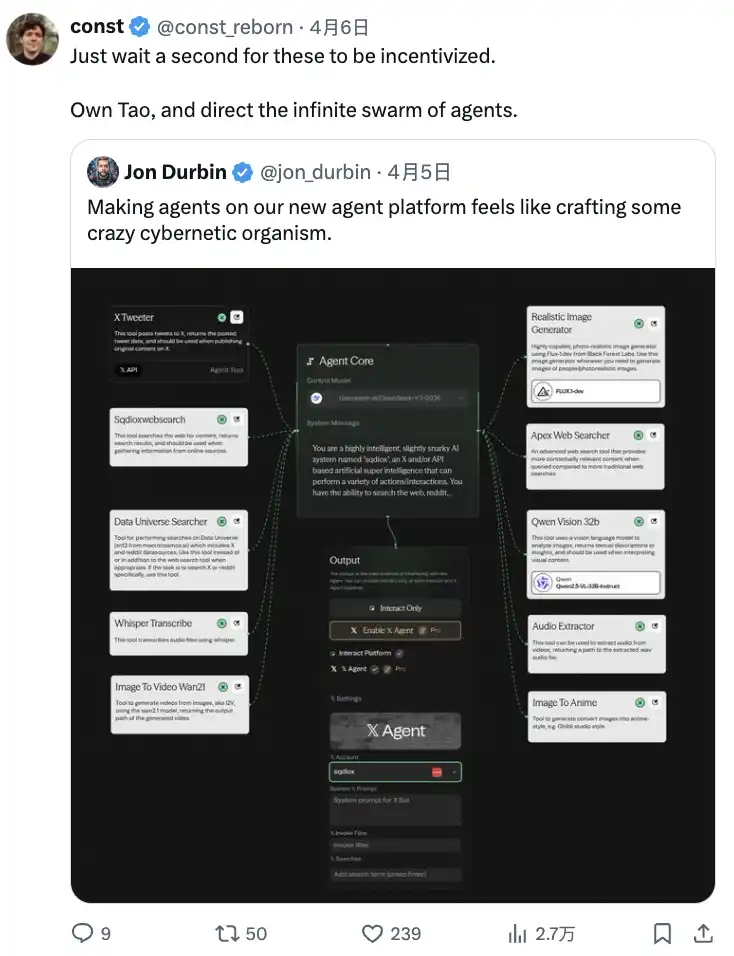

In addition, Rayon is launching the Squad AI agent platform, an easy-to-use drag-and-drop node-style AI agent building platform that has garnered widespread interest from the community.

These three subnets collectively account for over 1/3 of the total $TAO emissions—demonstrating the team's ability to build publicly and deliver high-quality products that users want (Rayon is praised as the top team by many subnet owners).

Gradients has grown 13 times in a month (current market cap of $32 million).

Chutes has grown 2.3 times (market cap of $63 million).

Nineteen has grown 3 times (market cap of $18 million).

This trend does not seem to be stopping in the short term, especially with the adoption rate of Chutes (currently the top-ranked subnet).

In addition to Rayon Labs' subnets, there are many interesting teams—protein folding, deep fakes/AI content detection, 3D modeling, trading strategies, role-playing LLMs. I haven't delved into everything yet, but I think the easiest to understand is the subnet under "prediction systems" (taopill), especially:

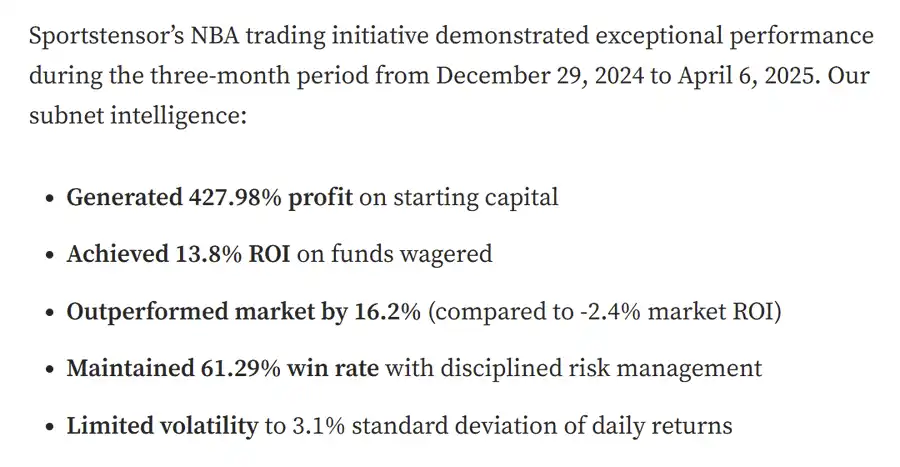

SN41 @sportstensor

You may know them through @AskBillyBets. Sportstensor is an intelligence that aids Billy's decision-making (the core team leading Billy is @ContangoDigital, a VC investing in DeAI and also a validator and miner for the Bittensor subnet).

What makes SN41 unique is its product—the Sportstensor model. This is a competition among miners to have the best models and datasets to predict sports game outcomes.

Example: In the latest NBA season, if you follow the crowd and bet on popular teams, you would have about a 68% accuracy/win rate. Does this mean everyone can make big money betting on popular teams? No, in fact, they lose money. If you bet $100 on each popular team, your return on investment (ROI) would be negative, losing about $1,700.

While popular teams have a higher win rate, the odds are better, meaning you earn less when you guess correctly. People tend to flock to bet on popular teams, leading to low odds for underdog teams, which means if you pick the right underdog, you can make a lot of money.

The Sportstensor model plays a role here. Miners run their own machine learning models (Monte Carlo, random forests, linear regression, etc.), using their own data (free or proprietary) to achieve the best results. Sportstensor then averages/mediates these results as intelligence to identify advantages in the market.

The actual market odds might be 25:75, while the model might show odds of 45:55. This 15-point gap represents the advantage. If the model finds many such advantages, you can accumulate positive ROI over the long term without needing a high win rate.

Check out their full trading report (if you want to dive deeper):

This is the model result shared in their latest report, and the data is quite impressive. The team also runs a betting fund monthly, with an initial buffer of $10,000, using profits to continue betting. By the end of the month, they use profits to buy back Alpha tokens. The team made about $18,000 in profit in March.

Depending on how you use the intelligence, the results can vary significantly. For example, if the intelligence shows 35:65, while the actual market odds might be 40:60. Someone might bet based on this, while you might not, because the gap is small and lacks sufficient advantage. Billy's use of intelligence differs from Sportstensor. (Currently, no one knows how to consistently achieve positive ROI, as it is still early.)

Sportstensor plans to further monetize their intelligence by creating a dashboard that allows users to easily understand insights and make betting decisions based on them.

I personally like this team because their product has many development directions. We have already seen how Billy attracts attention and excites sports fans to follow betting. As the team covers various sports, the agents may change the way people interact, bet, and feel.

SN44 @webuildscore

Score originally built a product similar to Sportstensor but shifted to computer vision after realizing that the ability to predict future events could bring more value.

To understand this, you need computer vision to analyze the content on the screen, allowing AI to understand the objects on the screen, locate and label data, and then draw conclusions using different algorithms (for example, the probability of a player making a certain move), converting all of this into a universal score to enhance player performance (and identify talent early).

Miners compete to label objects (this is the primary goal of miners). Score uses its internal algorithms to draw conclusions (currently so).

When you score players (similar to Elo in chess or League of Legends, but more refined and dynamic… changing dynamically based on player decisions and their impact in each game), as a club owner, you can do many things, such as discovering talent when players are very young. If you have videos of children's games, the analysis method is the same as for professional games. This quantifies the entire football world using a unified approach.

With proprietary data, Score can monetize the scores and insights, selling them to data brokers, club owners, sports data companies, and bookmakers.

Soon, users will be able to upload videos on Score's self-service platform, where miners will label them. Typically, football match videos require hours of labeling, while miners can label a 90-minute match in just 10-12 minutes, far faster than other platforms. Users can use the labeled data for their own models and use cases.

I like Score because it can be applied to fields beyond sports, such as autonomous vehicles, robotics, etc. In a world filled with data garbage, high-quality proprietary data is extremely valuable.

SN18 @zeussubnet

This is a new subnet that has recently gained a lot of attention. I haven't had the chance to communicate with the team yet, but the product is very interesting.

Zeus is a machine learning-based weather/climate prediction subnet designed to surpass traditional models, providing faster and more accurate predictions.

This intelligence is highly sought after by hedge funds, as accurately predicting the weather can better forecast commodity prices (hedge funds are willing to pay millions of dollars for this intelligence because if they can win in commodity trading, they can earn hundreds of millions).

The Zeus subnet is a new addition, having recently acquired subnet 18. Its Alpha token has risen 210% in the past 7 days.

Other interesting subnets that I haven't delved into yet

@404gen_ SN17—Infrastructure for AI-generated 3D assets. Creating 3D models for games, AI characters, virtual streamers, etc. Recent integration with

@unity may enable seamless 3D model generation, changing the creation process for Unity's 1.2 million monthly active users.

@metanova_labs SN68—Decentralized science (DeSci) drug discovery subnet, transforming drug discovery into collaborative, high-speed competition, addressing traditional challenges such as cost and time (the traditional process takes over a decade and costs billions).

There’s more to explore, and I will share after further research. I started with the easiest to understand (since I am not a technical person).

Conclusion

I try to avoid being overly technical. There are many high-quality resources explaining the technical aspects of dTAO, emissions, incentive distribution, and all stakeholders.

Based on my experience in the agent craze (from October 2024 to now), it is important to stay flexible. I have held too many project tokens, and I believe dTAO provides a good mechanism that allows me to flexibly rotate different investable DeAI startups.

Currently, there are not many participants, and users can achieve 80%-150%+ APY, plus the price appreciation of subnet tokens. This dynamic may change in the next 6 months as more people join, and the bridging, wallet, and trading infrastructure of the TAO ecosystem improves.

For now, I suggest you enjoy the TAO PvE season and learn more about the cool DeAI technologies with me.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。