Tariff Policy and Federal Reserve Attitude Intensify Market Volatility

Author: WOO X Research

In April 2025, Trump's tariff policy brought severe fluctuations to the global financial markets. On April 2, he announced the implementation of "reciprocal tariffs" on major trading partners, setting a 10% baseline tariff and imposing higher rates on specific countries: 34% on China, 20% on the EU, and 32% on Taiwan (with exemptions for semiconductor products). The 10% baseline tariff officially took effect on April 5, exacerbating global supply chain tensions. On April 9, Trump suspended high tariffs for 75 countries that had not retaliated for 90 days (until July 8), but increased tariffs on China to 145%, citing China's 34% retaliatory tariffs on U.S. goods. The EU announced a suspension of retaliatory tariffs on €21 billion worth of U.S. goods until July 14 to allow for negotiation space.

These policies triggered a strong market reaction. The S&P 500 lost $5.8 trillion in market value within four days of the tariff announcement, marking the largest single-week loss since the 1950s. Bitcoin prices fluctuated between $80,000 and $90,000. On April 17, Federal Reserve Chairman Powell stated at the Chicago Economic Club that tariffs could raise inflation and suppress growth, but the Fed would not intervene in the market by cutting interest rates, focusing instead on long-term data. Goldman Sachs and JPMorgan raised the probability of a U.S. recession to 20% and 45%, respectively. Corporate profits and prices could be affected, leaving the market outlook murky. In such times, what should investors do? Low-risk stablecoin yield products in DeFi may be a good choice to stabilize during this turbulent period, and below are four stablecoin-based yield products.

This article does not constitute investment advice; investors should conduct their own research.

Spark Saving USDC (Ethereum)

Connect your wallet through the Spark official website (spark.fi), select the Savings USDC product, and deposit USDC.

Note: Spark is a decentralized finance (DeFi) platform that provides a front-end interface for the blockchain-based liquidity market protocol SparkLend. Users can participate in lending and borrowing activities through this platform.

Source of Yield: The yield from saving USDC comes from the Sky Savings Rate (SSR), supported by income generated from cryptocurrency collateral loan fees, U.S. Treasury investments, and providing liquidity to SparkLend, among others. USDC is converted 1:1 to USDS through the Sky PSM and deposited into the SSR treasury to earn yield, with the value of the sUSDC token increasing as yield accumulates. Spark assumes the liquidity of USDC.

Risk Assessment: Low. USDC has high stability, and Spark's multiple audits reduce smart contract risks. However, attention should be paid to the potential impact of market volatility on liquidity.

Current Data Situation:

Data Source: Spark Official Website

Berachain BYUSD|HONEY (Berachain)

Visit the Berachain official website, enter BeraHub, connect a Berachain-compatible wallet, and select the BYUSD/HONEY pool on the Pools page to provide liquidity by depositing BYUSD and HONEY. Users receive LP tokens, which can be staked in the Reward Vaults to earn BGT.

Note: Berachain is a high-performance, EVM-compatible Layer 1 blockchain that uses an innovative Proof of Liquidity (PoL) consensus mechanism to enhance network security and ecological vitality by incentivizing liquidity providers. This product is a BYUSD/HONEY liquidity pool deployed on Berachain's native DEX BEX, where HONEY is Berachain's native stablecoin (multi-asset collateral, soft-pegged to the U.S. dollar), and BYUSD is another stablecoin on the Bear Chain.

Source of Yield: The yield primarily comes from BGT rewards (3.41% APR, based on staking weight and validator allocation of BGT emissions, updated every 5 hours) and trading fees within the pool (0.01% APR, from a share of transaction fees). BGT is Berachain's non-transferable governance token, which can be burned 1:1 for BERA (irreversible) and shares fee income from core dApps like BEX, HoneySwap, and Berps (specific ratios determined by governance). The BYUSD/HONEY pool has lower price volatility risk due to its stablecoin pair characteristics.

Risk Assessment: Low to Moderate. BYUSD and HONEY are stablecoins with stable prices; Berachain's PoL mechanism has been audited by Trail of Bits and others, resulting in low smart contract risk. However, BGT rewards depend on validator allocation and governance decisions, which may fluctuate due to emission adjustments.

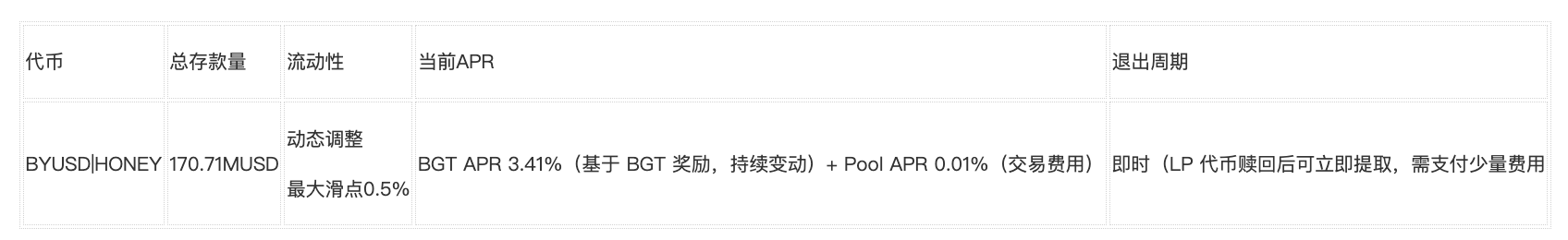

Current Data Situation:

Data Source: Berachain Official Website

Provide Liquidity to Uniswap V4 USDC-USDT0 (Uniswap V4)

Connect your wallet through the Merkl official website (app.merkl.xyz), deposit USDC or USDT into the "Provide Liquidity to Uniswap V4 USDC-USDT0" product to provide liquidity to Uniswap V4.

Note: Merkl is a DeFi investment aggregation platform that offers users a one-stop solution covering liquidity pools, lending protocols, and other opportunities. This product provides liquidity to the USDC/USDT pool on Uniswap V4 through Merkl. Uniswap V4, launched in 2025, introduces a "hooks" mechanism that allows developers to customize pool functions, such as dynamic fee adjustments and automatic rebalancing, enhancing capital efficiency and yield potential.

Source of Yield: UNI token incentives.

Risk Assessment: Low to Moderate. The USDC/USDT pool is a stablecoin pair with low price volatility risk, but attention should be paid to smart contract risks and the potential decline in yield after the incentive period ends.

Current Data Situation:

Data Source: Merkl Official Website, Uniswap Official Website

Echelon Market USDC (Aptos)

Visit the Echelon Market official website (echelon.market), connect an Aptos-compatible wallet, select the USDC pool on the Markets page, and deposit USDC to participate in supply. Users receive supply certificates, and yield accumulates in real-time.

Note: Echelon Market is a decentralized cryptocurrency market based on the Aptos blockchain, developed using the Move programming language. Users can borrow or lend assets through non-custodial pools to earn interest or use leverage. This product allows users to deposit USDC into the funding pool on the Aptos mainnet, participate in supply, and earn yield. Echelon Market is integrated with the Thala protocol, which provides stablecoins and liquidity layers on Aptos, generating deposit receipt tokens like thAPT.

Source of Yield: Yield includes USDC supply interest (5.35%) and Thala's thAPT rewards (3.66%). thAPT is Thala's deposit receipt, minted and redeemed 1:1 for APT, with a 0.15% fee charged upon redemption, which goes into the sthAPT (staking yield token) reward pool.

Risk Assessment: Low to Moderate. USDC has high stability, but attention should be paid to smart contract risks in the Aptos ecosystem and the impact of thAPT redemption fees on yield. Instant exit provides high liquidity, but market volatility may affect the value of thAPT rewards.

Current Data Situation:

Data Source: Echelon Market Official Website

Summary

The table is arranged by TVL from largest to smallest for reference only and does not constitute investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。