Selected News

pump.fun Platform's Weekly Token Graduation Rate Has Increased for Three Consecutive Weeks

LUCE Surged Over 80% Before Retreating, Market Cap Currently Reported at $13.88 Million

U.S. Dollar Index Falls Below 98 for the First Time Since March 2022

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

TAO: Today's discussion about TAO mainly focuses on its significant price increase and its potential as a leading cryptocurrency, with many users expressing optimism about its future growth. Key topics include: TAO's recent breakthrough of resistance levels, the impact of Raoul Pal's interview on its valuation, and the growing interest in the Bittensor subnet. Overall market sentiment is very positive, with many opinions predicting that TAO will continue to rise and comparing its potential to Bitcoin. The discussion also emphasizes TAO's importance at the intersection of artificial intelligence and cryptocurrency, with multiple tweets noting its performance surpassing other crypto assets.

VOXEL: Today, VOXEL became a hot topic due to its significant price surge, reportedly increasing over 200% in the past 24 hours. This spike in trading volume and price has been attributed to a market-making bot malfunction on the Bitget platform, leading to unusual trading activity. Some users reportedly profited significantly from this loophole, and Bitget has announced an investigation and may roll back some trades. This incident has sparked discussions about the platform's risk management and market-making mechanisms, drawing comparisons to past issues faced by other exchanges.

Featured Articles

The lack of interest rate perpetual contract tools similar to CME in DeFi leads to significant interest rate volatility and an inability to hedge risks. Introducing interest rate perps can help both borrowers and lenders lock in rates, achieve arbitrage and risk management, and promote the integration of DeFi with TradFi, enhancing market efficiency and stability.

This story is much more stimulating than an ordinary dog project. It not only involves the capital games of Coinbase's core team but also features a magical plot where officials personally engage in "token Werewolf" games, prompting the entire industry to ponder: When every tweet can become a battlefield for token speculation, are we witnessing an on-chain Renaissance or merely observing the roar of the harvesting machine?

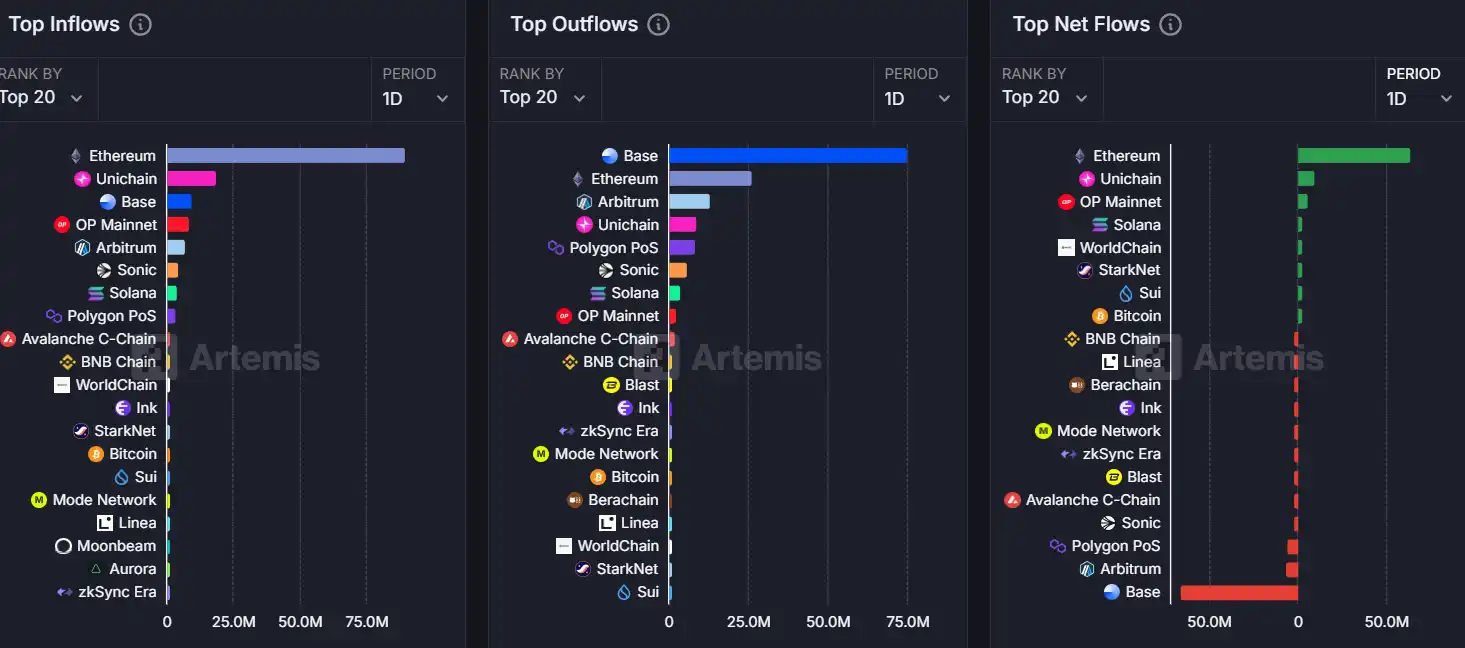

On-Chain Data

On-chain capital flow situation as of April 21

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。