Author: BITCOIN MAGAZINE PRO

Compiled by: Tim, PANews

Bitcoin did not experience the explosive start many expected in early 2025. After peaking above the $100,000 mark, the price significantly retraced, leading investors and analysts to question: what stage is Bitcoin currently in within the halving cycle? In this article, we will cut through the market noise and delve into a series of key on-chain indicators and macroeconomic signals to assess whether the Bitcoin bull market still has sustainability or if it is about to face a deeper correction.

Healthy Correction or End of the Bull Market?

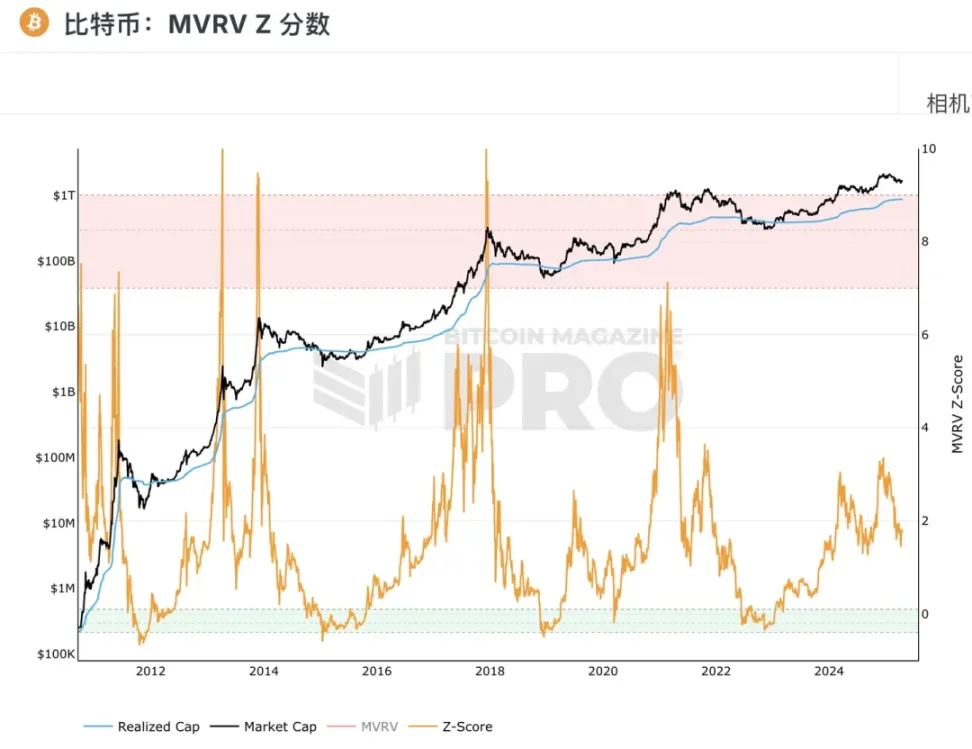

An ideal entry point is the MVRV-Z indicator. This long-standing valuation metric measures asset status by comparing the market value of cryptocurrency to its realized value (Market Value to Realized Value). When this value fell from a peak of 3.36 to around 1.43, it coincided with Bitcoin's price dropping sharply from nearly $100,000 to a temporary low of $75,000. Intuitively, this 30% price retracement is indeed quite severe.

Figure 1: Recently, the MVRV Z-Score has rebounded from a low of 1.43 in 2025.

Historically, the current level of the MVRV-Z indicator often marks a local bottom rather than a top. In past cycles such as 2017 and 2021, the market experienced similar corrections, after which BTC prices resumed an upward trend. In short, although this downturn has shaken investor confidence, it is essentially consistent with historical corrective movements within a bull market cycle.

Pay Attention to Smart Money Movements

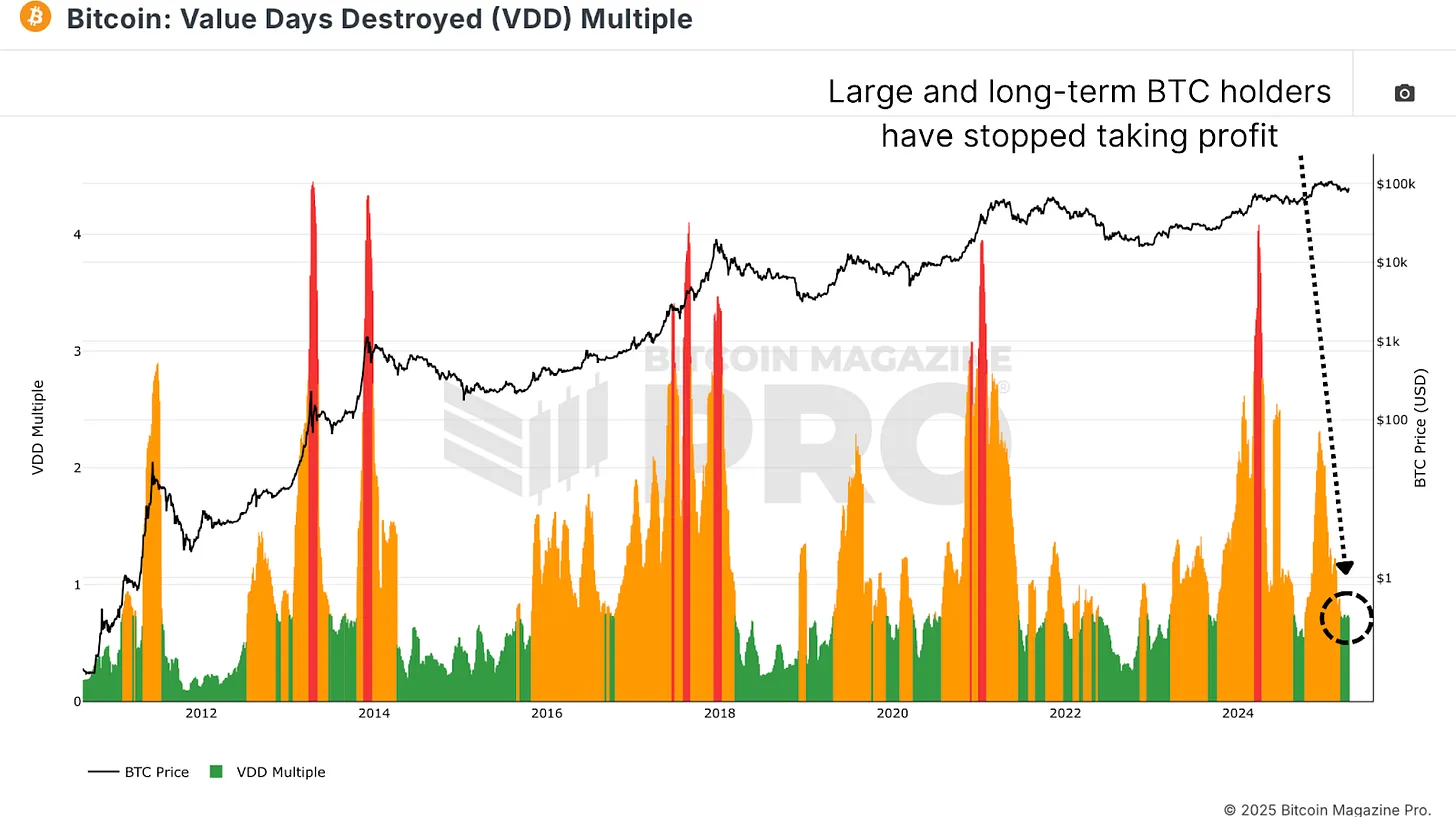

Another key indicator is the Value Days Destroyed (VDD) multiple. This metric weighs the holding time of Bitcoin before transactions to measure its on-chain transfer speed. When this multiple surges, it typically indicates that experienced holders are taking profits; if it remains low for an extended period, it may suggest that the market is in an accumulation phase.

Currently, this indicator is deeply entrenched in the "green zone," with levels similar to those at the end of a bear market or the beginning of a recovery. Given that BTC prices have sharply reversed from above $100,000, we may be witnessing the end of a profit-taking wave, while some long-term accumulation behaviors have become increasingly evident, indicating that participants are positioning themselves for future price increases.

Figure 2: The current VDD multiple indicates that long-term holders are in an accumulation phase.

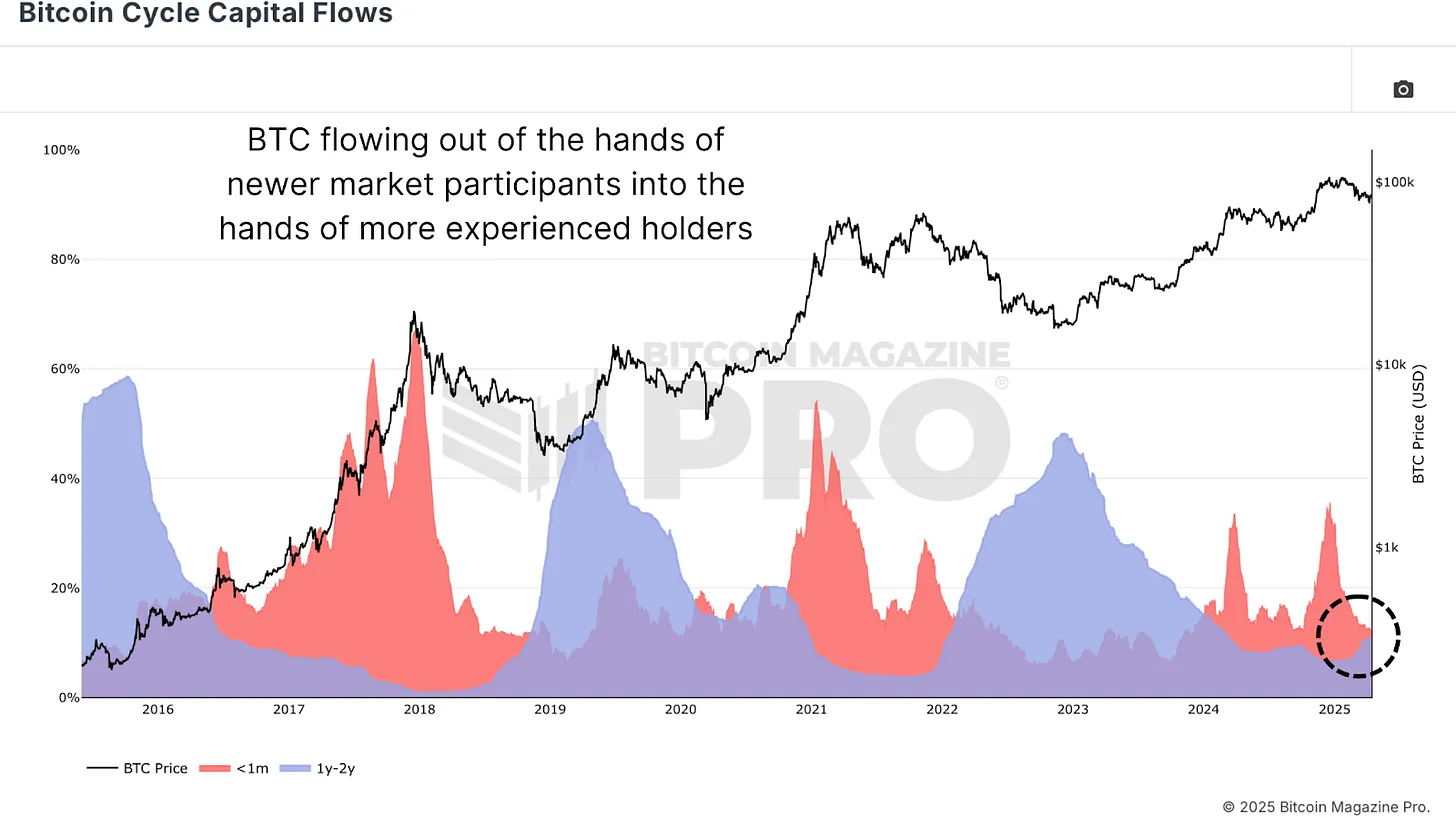

One of the most insightful on-chain indicators is the "Bitcoin Cycle Capital Flow Chart," which segments realized capital by coin age, isolating different groups such as new entrants (holding time < 1 month) and medium-term holders (1-2 years) to observe capital migration paths. The red band (new entrants) surged sharply near the historical high of $106,000, indicating that a significant amount of panic buying driven by FOMO occurred at the market top. Since then, the activity of this group has significantly cooled, returning to levels consistent with the early to mid-stages of a bull market.

Conversely, the group holding tokens for 1-2 years (typically accumulators with macro insights) has resumed increasing their holdings. This inverse relationship reveals the core logic of market operations: when long-term holders accumulate at the bottom, new investors often experience panic selling or choose to exit. This ebb and flow of capital movement closely aligns with the "accumulation—distribution" pattern observed during the complete bull market cycle of 2020-2021, reflecting typical characteristics of historical cycles.

Figure 3: The Bitcoin Cycle Capital Flow Chart shows that BTC is flowing back to more experienced holders.

What Stage Are We In Now?

From a macro perspective, we can divide the Bitcoin market cycle into three key stages:

- Bear Market Stage: Deep Correction (70-90%)

- Recovery Stage: Reclaiming Historical Highs

- Bull Market Growth Stage: Parabolic Rise After Breaking Previous Highs

The bear markets of 2015 and 2018 lasted approximately 13-14 months each. Our recent bear market cycle also lasted 14 months. The recovery stage in historical cycles generally requires 23 to 26 months, and we are currently within this typical recovery time window.

Figure 4: Using historical cycle trends to predict potential bull market peaks.

However, the performance of this bull market phase has been somewhat unusual. Bitcoin did not immediately experience a surge after breaking historical highs; instead, it retraced. This may indicate that the market is building a higher low before entering a steeper upward channel in the exponential growth phase. If we reference the average durations of 9 months and 11 months for exponential phases in past cycles, assuming the bull market can continue, we expect the potential peak of this cycle to occur around September 2025.

Macroeconomic Risks

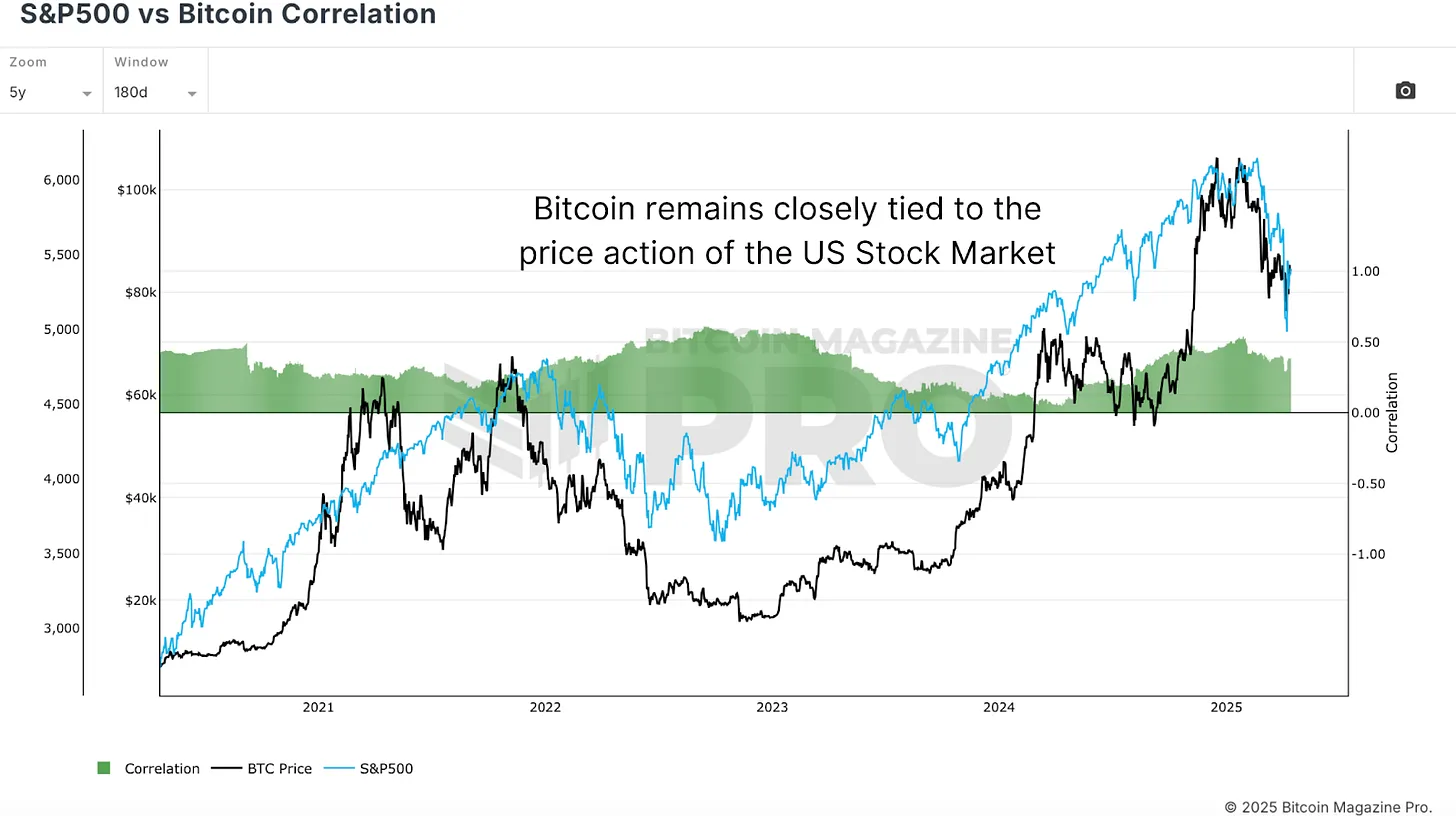

Despite encouraging on-chain data, macroeconomic headwinds still exist. Analysis of the correlation between the S&P 500 index and Bitcoin indicates that Bitcoin remains highly correlated with the U.S. stock market. As concerns about a potential global recession grow, the continued weakness in traditional markets may impact Bitcoin's ability to rebound in the short term.

Figure 5: Correlation between Bitcoin and U.S. stocks.

Conclusion

As we have seen in our analysis, key on-chain indicators such as the MVRV Z value, Value Days Destroyed, and Bitcoin cycle capital flow suggest that the market is exhibiting a healthy development pattern consistent with cyclical laws, showing signs of continued accumulation by long-term holders. However, significant macroeconomic uncertainties remain in the market, which are key risks that need to be closely monitored.

This cycle is slower and more volatile than previous cycles, but it has not broken the historical structural pattern. Bitcoin seems poised for another upward move, and if traditional markets do not deteriorate further, it may reach new peaks in the third or early fourth quarter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。