This article will introduce the basic principles and bottom-fishing applications of Cointime Price.

Author: Mr. Beig

Introduction

The Cointime Price series of articles is much more advanced compared to the first five articles. If this is your first time reading the "On-chain Data Academy series," and you want to learn about on-chain analysis knowledge, it is recommended to start with the first five articles.

🔸TL;DR

- The Cointime Price series will be divided into three articles, this is the first one.

- This article will introduce the basic principles and bottom-fishing applications of Cointime Price.

- Cointime Price is a brand new and efficient BTC pricing method.

- It is stricter compared to Realized Price and more sensitive compared to LTH-RP.

🟡 Basic Introduction to Cointime Price

The concept of Cointime Price originated on 2023/08/23, proposed in the "Cointime Economics" produced in collaboration between Ark Invest and Glassnode.

The calculation logic of Cointime Price itself is relatively complex, and this article will try to explain it in a straightforward manner.

Cointime Price is a pricing model designed for the unique UTXO structure of BTC.

In this article, I intend to skip the complex calculation process and directly introduce the principles.

In simple terms, since BTC itself is a blockchain, there will always be a verification process for block production and transfer transactions.

Cointime Price differs from traditional on-chain pricing methods by adopting a "time-weighted" approach:

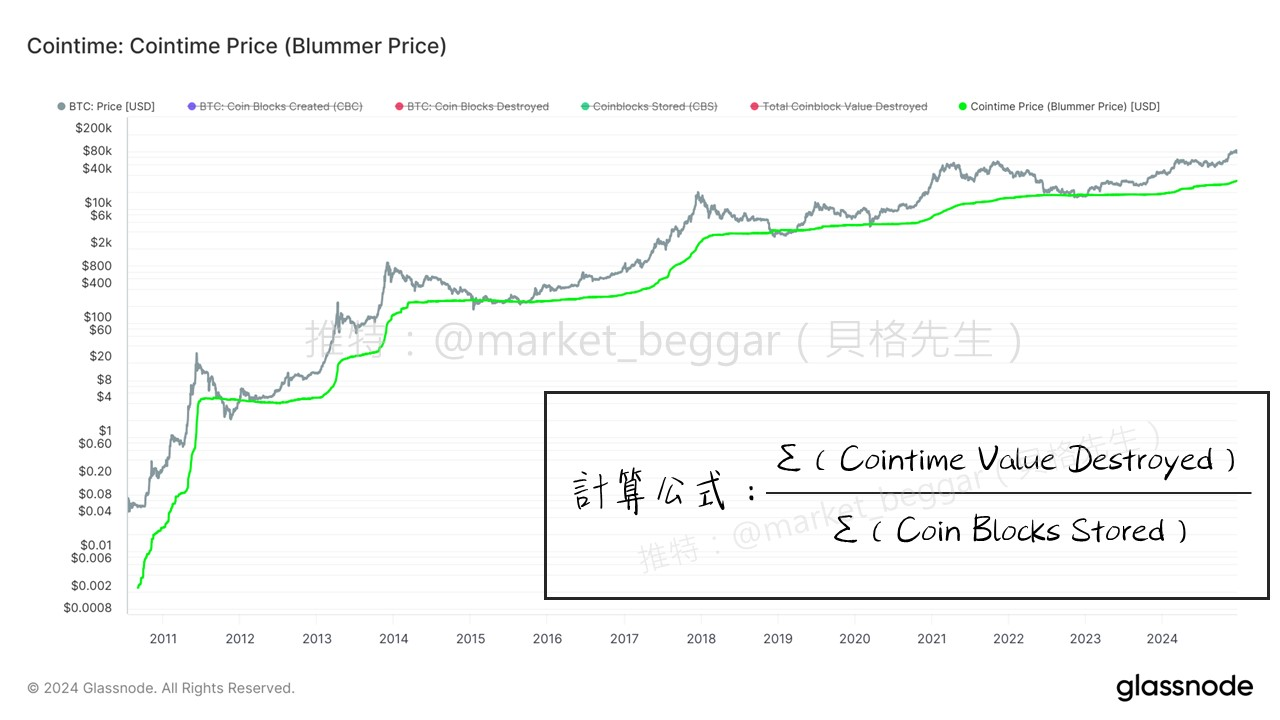

As shown in the figure above, the green line represents Cointime Price, and the calculation formula is illustrated.

This involves three concepts:

- Coin Blocks Created (CBC)

In the n-th block, CBC = the circulating supply of BTC at that time.

- Coin Blocks Destroyed (CBD)

When a corresponding amount of BTC is transferred, it is deemed as destroyed.

The amount of transferred BTC is multiplied by the time these BTC were held (the number of blocks passed before the transfer),

resulting in CBD, which can be interpreted as "the time-weighted amount of BTC."

- Coin Blocks Stored (CBS)

CBS = total CBC - total CBD, which can be understood as "the time-weighted amount of BTC that has not been spent."

In the figure above, the numerator of the formula is the sum of each CBD generated during transfers multiplied by the corresponding amounts.

Based on the above, we can derive three characteristics of Cointime Price:

Due to the time-weighted design, when long-term holders transfer (distribute) a large amount, the rate of change of Cointime Price will increase.

Since transactions involve both buying and selling, from the buyer's perspective, the numerator in the formula can also be seen as the "total time-weighted expenditure currently in the market"; dividing this value by CBS gives the "average cost of chips in the market after time-weighted processing."

Since CBD considers transfer behavior, no transfer means no CBD will be generated, effectively eliminating the impact of lost chips from ancient times.

🟡 Comparison with LTH-RP

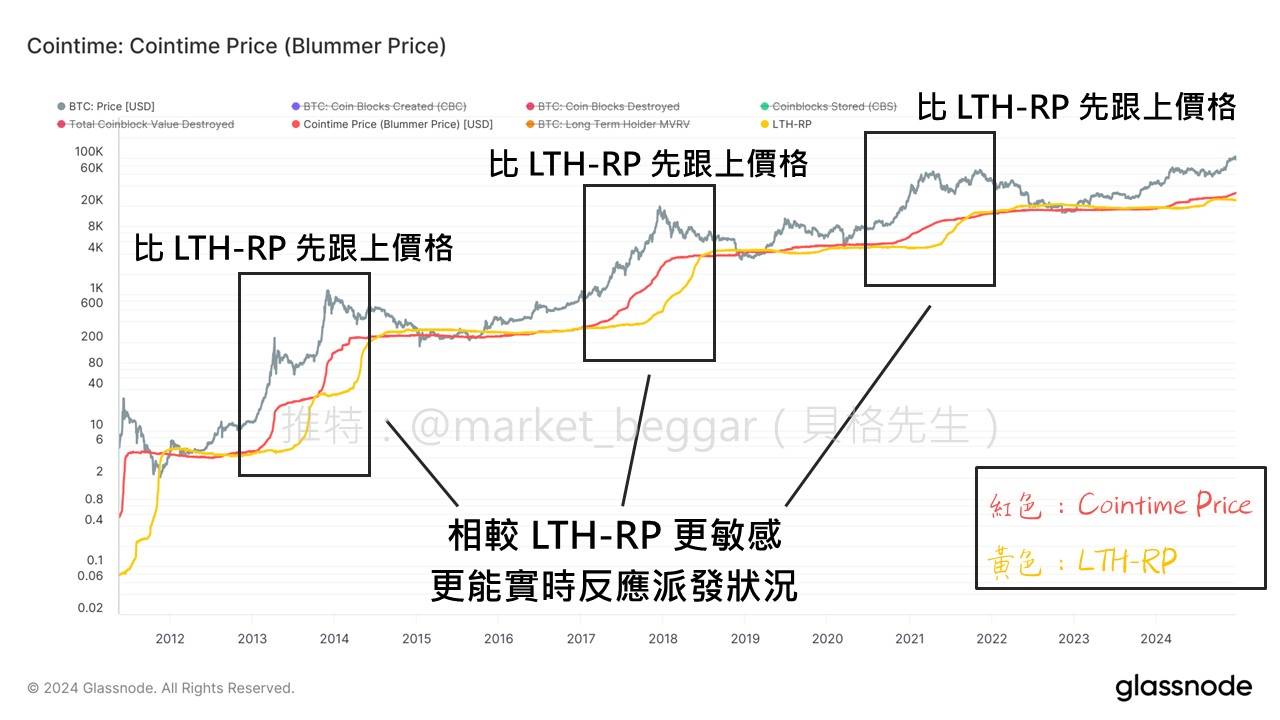

In previous articles, I introduced LTH-RP, which simply refers to the average cost of BTC purchased by long-term holders.

Since Glassnode defines LTH as "chips held for more than 155 days," it can only provide a relatively rough definition for "long-term";

Cointime Price, on the other hand, directly considers "how long the chips were held when the transfer behavior occurred,"

therefore, compared to LTH-RP, Cointime Price is more precise and sensitive.

As shown in the figure above: every time a major upward wave arrives, Cointime Price always reacts one step ahead of LTH-RP, indicating the occurrence of distribution behavior more promptly.

Therefore, in my analysis, I actually prefer to use Cointime Price to analyze the market.

🟡 Bottom-Fishing Applications

As mentioned earlier, Cointime Price is a fair pricing method for BTC through time weighting.

If the market price falls below Cointime Price, it means the market price is lower than the true value of BTC,

which is usually a good bottom-fishing opportunity.

As shown in the figure below: I have marked the historical points where BTC prices fell below Cointime Price, and you can see that these correspond to good entry opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。