Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Screenshots of profits and videos of contract operation records are flooding social media platforms, quickly stirring up a wave of emotions throughout the community.

On Bitget, the VOXEL perpetual contract suddenly sparked a thrilling "arbitrage game." This seemingly "unexpected windfall" feast ultimately became the focus of a storm. Within just a few hours, the event was filled with controversy and countless questions, from a surge in trading volume to skyrocketing funding rates, followed by risk control restrictions and trade rollbacks.

This article will outline the course of events, analyze the "arbitrage" path and Bitget's funding rate mechanism, and clear away the layers of fog.

A "Windfall" Frenzy Ignites a Storm Across the Internet

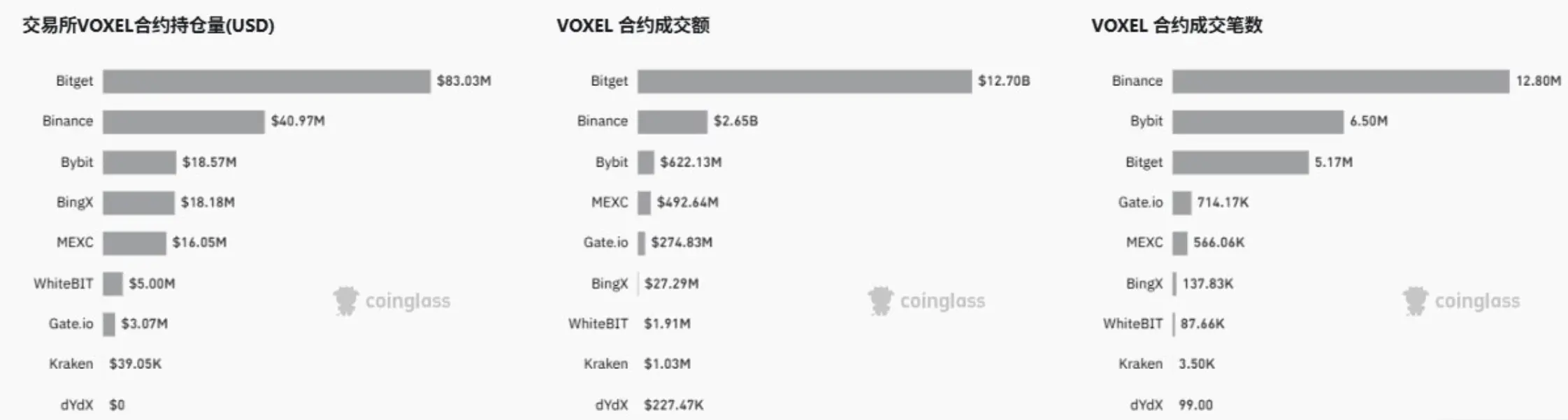

On the afternoon of April 20, the VOXEL/USDT perpetual contract on the Bitget trading platform suddenly "soared," with prices fluctuating violently between $0.125 and $0.148. Trading volume surged, with the VOXEL contract trading volume exceeding $12.7 billion that day, surpassing mainstream cryptocurrencies on the platform.

During this period, Bitget's contract positions and trading volume far exceeded those of other exchanges.

The community began to suspect that Bitget's market-making bot might have a flaw, continuously mismatching orders incorrectly, leading to abnormal liquidity.

Meanwhile, several KOLs and community users posted, pointing out that this contract might have a "risk-free arbitrage" window, with some achieving huge profits through high-frequency operations in a short time. It was reported that some users repeatedly traded with a principal of 100 USDT, earning over 100,000 USDT; others made 7,000 USDT from 200 USDT, with a return rate as high as 35 times. Various profit screenshots and operation videos quickly spread on social media.

However, many users soon found their accounts frozen and funds unable to be withdrawn. Bitget subsequently responded that some accounts were temporarily restricted from operations due to risk control triggered by trading behavior. In the evening, Bitget's Chinese head, Xie Jiayin, stated that some accounts had completed trade rollbacks and restored trading, deposit, and withdrawal functions. If liquidation occurred due to risk control restrictions, the platform would take full responsibility.

Thus, this storm surrounding arbitrage, mechanisms, and the platform's handling methods continued to ferment within the community.

"Harvesting VOXEL" Path Breakdown

Aside from community disputes, the arbitrage path of "turning 100 U into over 100,000 U" is equally eye-catching. According to community user @suwanyu7777, the entire operational logic is not complicated; the key lies in utilizing the violent fluctuations in price within a specific range, combined with the platform's market-making system's anomalies, to achieve profit harvesting.

- Locking in the Anomalous Fluctuation Range

First, some users observed that the VOXEL/USDT contract price was rapidly fluctuating within a fixed range (e.g., $0.135-$0.148), while trading volume surged significantly. This anomaly may stem from a malfunction in the market-making bot's algorithm, causing it to continuously place incorrect orders and execute trades within that price range, thus opening a "risk-free arbitrage" window.

- Setting Trading Strategies

Arbitrageurs typically use high leverage combined with a simple strategy path:

- Build long positions at low levels: for example, opening a long position at $0.135;

- Set take-profit levels at high levels: setting a take-profit at $0.148;

- Quickly execute trades to lock in profits: due to the market-making system's errors continuously matching orders, take-profit orders can almost be executed instantly.

For instance, some users mentioned opening a long position at $0.135 and taking profit at $0.148, with the bot "automatically filling orders," achieving rapid profits.

- High-Frequency Compounding Operations

Due to frequent fluctuations in price within a specific range, and the bot continuously "cooperating," users can repeatedly perform long-take-profit operations, locking in small profits each time. Through high-frequency trading, profits accumulate rapidly.

"Amplifier" Funding Rate

Behind this arbitrage feast, the funding rate of the VOXEL contract also experienced extreme fluctuations. It once soared to a "ceiling" level of -2%, far exceeding the common range of 0.01% to 0.1%. After the incident, discussions about Bitget's funding rate arose in the community. To clarify this mechanism, we consulted the relevant explanations on Bitget's official website.

The funding rate consists of two parts: "interest rate (I)" and "premium index (P)," with a buffer zone of ±0.05% set, along with upper and lower limits for the funding rate to constrain extreme values.

The core formula is:

Funding Rate (F) = Clamp([Average Premium Index (P) + Clamp (Interest Rate (I) - Average Premium Index (P), -0.05%, 0.05%)], Funding Rate Lower Limit, Funding Rate Upper Limit)

Here, the premium index measures the degree of deviation of the market's buy and sell orders from the index price:

Premium Index (P) = [Max(0, Impact Buy Price - Index Price) - Max(0, Index Price - Impact Sell Price)]/Index Price

The interest rate is dynamically set based on time intervals:

Interest Rate (I) = (0.03%)/Funding Interval, Funding Interval = 24/Funding Interval Time

Bitget's mechanism is fundamentally based on the "weighted average premium" principle, calculating the interest rate and the average premium index per minute, then calculating its weighted average value every N hours. The closer it is to the settlement time, the greater the coefficient of the premium index. Ultimately, the funding fees paid or received by users equal the position value × funding rate.

However, under extreme emotions and high leverage stacking, this mechanism, originally designed for "price anchoring," can also become an amplifier of market sentiment. When the funding rate drops to -2%, the profit space for arbitrageurs is significantly enlarged, attracting more speculators to rush in, forming a spiral acceleration.

The Path of Trust in Crisis

As the event has developed, a large number of "online public relations consultants" have emerged on platform X, offering Bitget "crisis management guidelines": some suggest that the platform roll back funds to compensate affected users and establish a BGB mining pool to distribute remaining funds to BGB holders, reflecting the platform's responsibility; others suggest that the market maker's operational errors be openly explained, compensating affected users while allowing market makers and users to negotiate solutions for accounts with abnormal profits.

Additionally, many voices have proposed constructive ideas around "enhancing user stickiness," such as retaining accounts that profit normally within a certain fluctuation range and considering partial profit + BGB installment unlocking for frequent high-frequency arbitrage behaviors; it is also suggested to establish a "platform optimization suggestion fund" to reward users who report abnormal mechanisms or vulnerabilities, thereby guiding the community to co-build the ecosystem.

Public sentiment is still fermenting, but the storm also reflects users' higher expectations of the platform. In a high-leverage, fast-paced market, even a small crack can trigger the next storm. The platform can only stabilize its course between risk and trust by continuously learning and proactively evolving.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。