Original Title: "The Dilemma and Breakthrough of the Blockchain Primary Market: From Value Loss to Ecological Reconstruction"

Original Author: Lawrence, Mars Finance

I. The Industry Mirror of Du Jun's Declaration: Structural Contradictions in the Primary Market Exposed

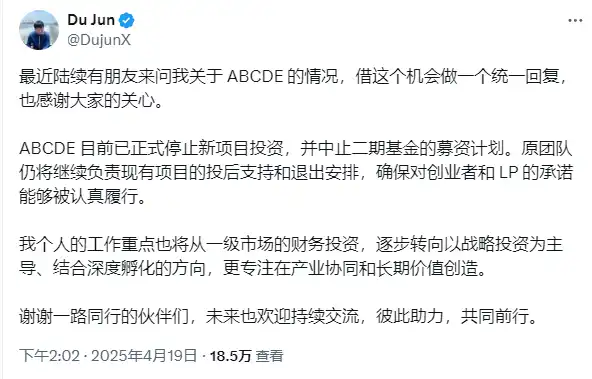

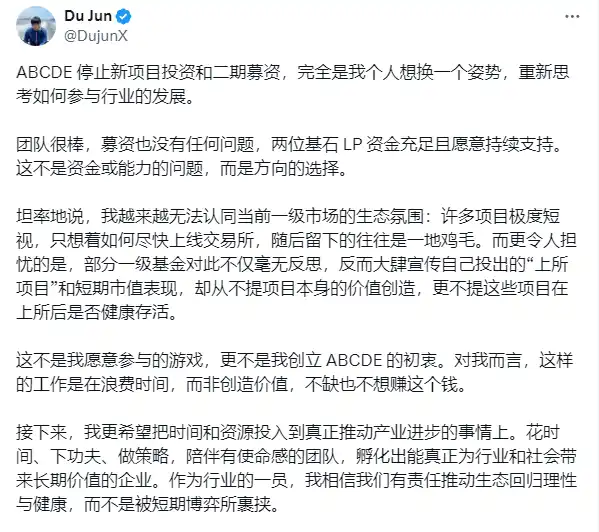

The decision by Du Jun, founder of ABCDE Capital, to suspend new investments and the second phase of fundraising is like a touchstone thrown into the deep pool of the blockchain industry, with the ripples reflecting the systemic contradictions currently present in the primary market.

This industry veteran, who has participated in the operations of heavyweight institutions such as Huobi and Node Capital, sharply pointed out the core issues of the industry with terms like "short-sighted games" and "lack of value creation": in the frenzy of token liquidity, the original intention of the blockchain technology revolution is being alienated by the market value management of trading platforms and institutional arbitrage games.

This alienation presents significant characteristics at the data level: according to CoinMarketCap statistics, in the first quarter of 2025, the number of new trading platform projects globally reached 327, but only 12% of these projects maintained positive technical iteration three months after listing, with the average token price dropping by 67% compared to the opening price.

What is even more alarming is that some institutions have industrialized the operation of "private placement - listing - market value management - exit," compressing the investment cycle to 6-8 months, leading to a large number of projects becoming "code shells + economic model packaging."

The deep-rooted cause of this phenomenon lies in the unique "triple mismatch" of the blockchain industry:

Time Value Mismatch: The traditional VC exit cycle of 7-10 years has been compressed to 18-24 months under the impact of token liquidity, creating an inversion between the technology accumulation period and the capital return period.

Valuation System Mismatch: The network effects of protocol layer projects have yet to manifest, while market value has already pre-paid the future value of 5-10 years through token models.

Responsibility Boundary Mismatch: Institutions simplify post-investment management to trading platform docking services, neglecting the responsibilities of technology route correction and ecological co-construction.

This systemic distortion is devouring the innovative momentum of the industry.

When developer forum Gitcoin data shows that the number of original blockchain protocol code submissions in Q1 2025 has decreased by 23% year-on-year, while the number of token economic model white papers has surged by 178%, we must face the reality: the industry is regressing from a technology-driven value internet to a liquidity casino dominated by financial engineering.

II. Value Reconstruction Coordinate System: Resetting Technical Anchor Points and Investment Logic for the Next 3-5 Years

In the fog of liquidity overflow and value loss, rebuilding investment logic requires a return to the essential attributes of blockchain technology—creating a new trust infrastructure through cryptography and distributed consensus. Based on technological evolution trends and the needs of the real economy, the future key areas for investment will exhibit three major characteristics:

1. Breakthrough Innovations at the Protocol Layer

Cross-Chain Interoperability Protocols

The "island effect" of the current public chain ecosystem severely restricts application landing, and cross-chain protocols like Cosmos IBC and Polkadot XCM need to achieve qualitative breakthroughs. Next-generation protocols should possess:

- Sub-second atomic swap capabilities (current average 3-8 seconds)

- Heterogeneous chain smart contract interoperability frameworks

- Dynamic fee models to resist witch attacks

- Such technological breakthroughs will release trillions of dollars in cross-chain liquidity, giving rise to new financial protocols and data markets.

Commercialization Engine for Zero-Knowledge Proofs

Privacy computing technologies like zk-SNARKs are transitioning from "cryptographic toys" to commercial infrastructure. Investment focus should shift to:

- Hardware-accelerated zkVM (e.g., RISC Zero architecture optimization)

- Composable privacy data markets (medical data, supply chain finance scenarios)

- Compliance-friendly auditing proof systems

- According to ABI Research, the market size related to zero-knowledge proofs is expected to exceed $4.7 billion by 2028, with an average annual growth rate of 62%.

Decentralized Storage Protocol Reconstruction

The security crisis of traditional centralized cloud storage (e.g., the 2024 AWS outage resulting in $3.7 billion in losses) has created new demands:

- Content-addressed permanent storage protocols

- Storage proof and economic model innovations (e.g., Filecoin virtual machine)

- Enterprise-level storage compliance solutions

- This field will give birth to the "digital Noah's Ark" of the Web3 era.

2. Value Capture Revolution at the Middleware Layer

DeFi 3.0 Liquidity Protocols

Going beyond the current AMM/DEX paradigm, the next generation of protocols needs to address:

- Impermanent loss dynamic hedging mechanisms

- Multi-chain liquidity aggregators

- Compliance stablecoin payment tracks (e.g., fully reserved collateralized stablecoins)

- Circle's Q1 2025 report shows that the scale of compliant stablecoin cross-border payments has increased by 320% year-on-year, validating the potential in this direction.

DAO Governance Infrastructure

The current dilemma of less than 15% participation in DAO voting calls for technological breakthroughs:

- Dynamic reputation systems based on behavioral data

- Multi-level delegation frameworks

- On-chain/off-chain governance hybrid engines

- Such tools will elevate DAOs from "governance toys" to "digital economic operating systems."

Physical Asset Tokenization Protocols

Tokenizing traditional financial assets requires overcoming three major bottlenecks:

- Mapping of legal entities and smart contract responsibilities

- Dynamic valuation oracle networks

- Compliance clearing mechanisms

- Boston Consulting Group predicts that by 2030, the market size for RWA tokenization will reach $16 trillion, creating structural opportunities.

3. Paradigm Shift Opportunities at the Application Layer

Decentralized Social Graphs

The data monopoly of Web2 social platforms is creating new demands:

- User sovereignty data storage protocols

- Social relationship credential systems on-chain

- Anti-censorship content distribution networks

- Protocols like Farcaster have proven that decentralized social networks can achieve DAUs comparable to traditional platforms.

AI + Blockchain Fusion Protocols

Key breakthroughs in the era of large models:

- Distributed computing power markets (e.g., Render Network upgrades)

- Model training data rights confirmation protocols

- AI behavior auditing chains

- Such protocols will reshape the $300 billion AI infrastructure market.

Energy Internet Protocols

Investment blue oceans in the context of carbon neutrality:

- Green electricity traceability and carbon credit tokenization

- Distributed energy trading markets

- Grid resilience forecasting models

- According to the International Energy Agency, the global distributed energy market size is expected to exceed $1.2 trillion by 2028.

III. Navigating Through the Fog of Cycles: Selection Logic and Investment Strategies for Quality Tracks

In specific investment practices, it is recommended to adopt the "TSVC Three-Dimensional Evaluation Model":

Technology Dimension

- Does the core protocol address specific boundaries of the "impossible triangle" (e.g., Aptos improves TPS through parallel execution)?

- Originality of code and patent barriers (reject fork projects)

- Balance of the development team's academic background and engineering capabilities

Social Value

- Does it create new types of trust production relationships (e.g., Helium reconstructing telecommunications infrastructure)?

- Reasonableness of user value capture mechanisms (avoiding Ponzi token models)

- Compliance inclusivity design (reserving regulatory interfaces)

Economic Model

- Positive correlation between token utility and protocol revenue (e.g., dYdX trading fee destruction mechanism)

- Dynamic balance of inflation models and network effects

- On-chain architecture design resistant to MEV attacks

Using this model for evaluation, the following tracks have excess return potential:

- Modular Blockchain Middleware

Similar to Celestia's data availability layer, enhancing scalability by decoupling execution and consensus layers. According to Messari, by 2027, modular blockchains will support 58% of new generation protocols.

- Intent-Centric Execution Networks

Protocols like Anoma's "intent pool" architecture can increase transaction efficiency by 5-8 times while reducing gas costs by 60%.

- Decentralized Science (DeSci) Infrastructure

Research data rights confirmation, peer review incentive protocols, and other areas are expected to reshape the $200 billion research funding allocation system.

IV. Future Declaration to Investors

As Du Jun and others choose to jump out of the mire of short-term games, the industry is ushering in a historical turning point for value return. Projects that truly focus on underlying technological innovation, are committed to expanding trust boundaries, and dare to reconstruct production relationships will gain the vitality to traverse cycles.

In the next 3-5 years, blockchain investment should no longer be financial alchemy wrapped in code but should return to its essential mission—rebuilding the trust cornerstone of value transfer in the digital world through distributed ledgers and cryptographic protocols. This requires investors to maintain keen insights into technological frontiers while possessing the resolve to counter human greed. Only in this way can we capture truly world-changing great protocols in the ongoing digital economic revolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。