Metaplanet News: Latest $28M Bitcoin Buy Sparks Market Buzz

Japan’s Metaplanet is back in the spotlight after buying more Bitcoin. The company has just purchased 330 BTC for $28.2 million, raising its total holdings to 4,855 BTC. That’s worth close to $500 million today. This shows the organisation is fully committed to its “Bitcoin-first” approach, even while the crypto market remains uncertain.

Metaplanet’s Bitcoin Journey

Metaplanet, based in Tokyo, began buying Bitcoin about a year ago. Since then, it has changed its business to focus mainly on this digital coin. The latest purchase was shared by CEO Simon Gerovich on social media, showing the company paid an average price of $85,605 per coin. Earlier this month, the company also bought 696 BTC after a strong performance in the first quarter of the year.

Source: X

To pay for its purchase, Metaplanet has been raising money through stock sales and bonds. So far in 2025, the company has seen a return of 119.3% on the investments of this digital coin, proving that the strategy is working well.

How Metaplanet Compares to MicroStrategy

Even though the company is growing fast, it’s still behind MicroStrategy in terms of BTC holdings. MicroStrategy, owned by BTC supporter Michael Saylor , has a total of 531,644 coins as of April 16 —by far the largest holding by any public company.

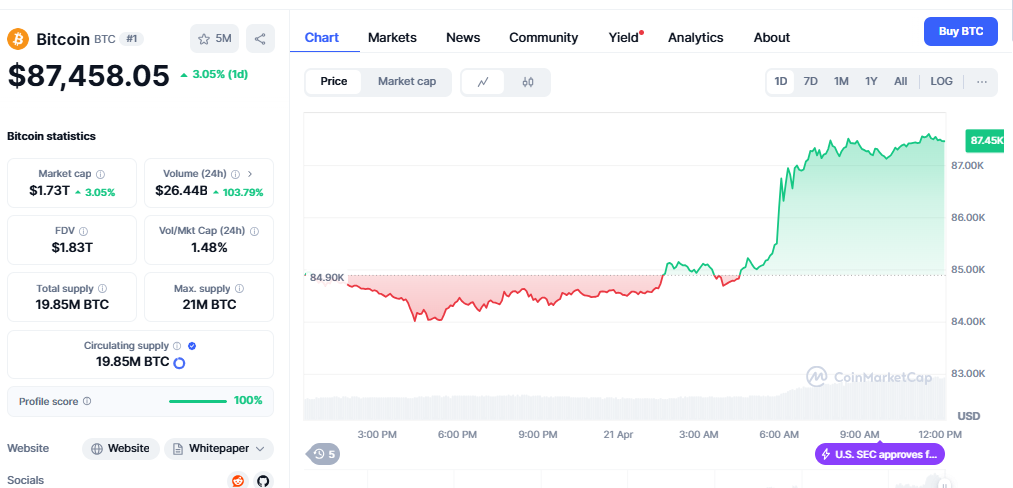

Still, both companies are part of the Bitwise OWNB Index, which tracks firms that hold over 1,000 coins. Both Metaplanet and MicroStrategy use a similar method called dollar-cost averaging. This means they buy this digital asset in smaller amounts over time to avoid buying all at once during high prices. This event has resulted into a sudden of surge in the coin's price within 24 hours, it is currently trading at $87,417 with an increase of 3% in a day, as per the reports of CoinMarketCap.

Source: CoinMarketCap

Why Are They Buying Bitcoin Now?

During the U.S. - China tradeWar and Tariff Announcement, market crashed and the coin's price went down, Microstrategy and Metaplanet considered this as an opportunity and purchased the coins in bulk.

Another cause could be the inflation threat and a recession in the global economy. Some organizations now consider BTC as a safe option to invest money, it is like “digital gold”. The large buying also transmits a clear indication to the general public, that organisations perceive this digital asset has a strong potential and it is worth for long term investments. It seems to be moving on its own, which makes it attractive when the rest of the economy feels unstable.

What This Means for Bitcoin’s Future

When such an event occurs where big organisations buy large amounts of the digital currency, it results in creating more demand while reducing the amount available to others. It could increase the prices. If more companies start following the above companies, BTC could emerge as a regular tool in business finances.

It also develops trust in Bitcoin. It will be looked at as a strong financial tool rather than a risky digital asset. In short, Metaplanet’s latest buy—along with MicroStrategy’s ongoing purchases—shows growing confidence in Bitcoin’s role in the financial world.

Also read: What Is A HoneyPot? Spur Protocol Quiz Answers 21 April 2025免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。