Original Title: "Is the Base Team Personally Rug Pulling? Uncovering the Zora Token Issuance Scheme: From a $600 Million Valuation to On-Chain Casinos"

Original Author: Lawrence, Mars Finance

Today, we are going to talk about a big news that has made the entire crypto circle go wild—Zora, the NFT platform that once claimed to "make internet creation free and valuable," has officially announced on Twitter that it will issue its token!

This move has left the retail investors both excited and anxious. After all, anyone who has been in the crypto space knows that whenever a project shouts slogans like "community co-construction" and "ecological incentives" while issuing tokens, there’s always a familiar scent of retail investors in the air.

But this story is much more thrilling than an ordinary dog project. It not only involves the capital games of Coinbase's direct troops but also features an official playing "token werewolf" in a magical plot, prompting the entire industry to start pondering:

When every tweet can become a battlefield for trading tokens, are we witnessing an on-chain renaissance or just watching the roar of the retail investor harvesting machine?

1. Zora's Rise: From NFT Freshness to Social Media Madness

To clarify the token issuance scheme this time, we need to dig into Zora's background.

Let's rewind to 2021, when the hottest thing in the crypto world wasn't dog coins, but NFTs. Two former Coinbase employees teamed up to create an NFT platform called Zora, with a slogan that echoed loudly: "We want artists to make money standing up!"

The beginning of this story sounds very positive, right? In the early days, they indeed did some creative things: for example, helping the digital fashion brand Saint Fame with DAO governance and organizing virtual fashion weeks; or issuing TAPE tokens for musicians that could be exchanged for physical tapes, and even coming up with the "buy NFT and get concert tickets" gimmick.

At that time, Zora was practically a utopia for Web3 artistic youth—until they realized that relying solely on selling digital artworks couldn't even cover the server electricity bills.

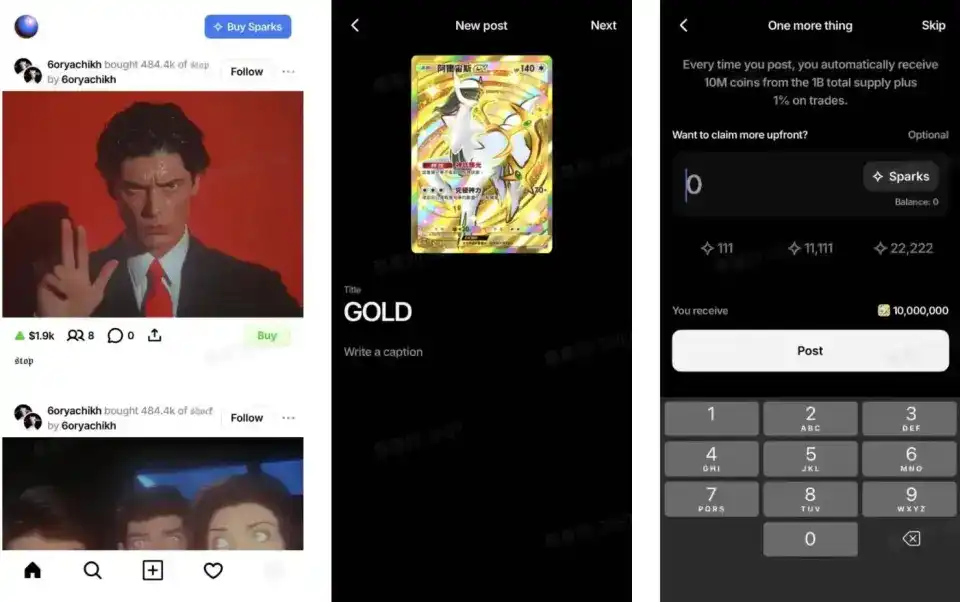

So starting in 2023, Zora completely turned dark. First, they latched onto the OP Stack to create their own Layer 2 network, drastically reducing gas fees; then they changed their product into an "on-chain version of Instagram"—where posting a tweet could automatically generate ERC-20 tokens, and liking or commenting could mine tokens, even cursing could be monetized. This move was simply brilliant!

Previously, artists had to struggle to create art and music, but now, any random passerby could post a lunch photo, and the system would reward them with 10 million "braised beef noodle coins," with creators earning a 1% fee from each transaction.

Even more bizarrely, Zora introduced "token socialization": the more tokens you hold, the shinier the golden border of your personal homepage becomes, effectively turning token trading into a QQ show-off.

With this "everything can be tokenized" combo, Zora snatched a piece of the pie from OpenSea. By 2024, they had raised over $60 million, with a valuation soaring to $600 million, backed by top institutions like Coinbase Ventures and Paradigm.

But anyone with clear eyes could see: when a social platform starts teaching users how to trade tokens, it’s not far from the scythe being drawn.

2. The Token Issuance Drama: A "Scientific Pig Farming" Guide from Top VCs

Sure enough, on March 3 of this year, Zora officially announced it would issue the ZORA token on the Base chain, with a total supply of 10 billion tokens. On the surface, the distribution plan seemed "conscientious": 10% airdropped to users, 20% for ecological incentives, and 5% for liquidity.

But a closer look at the terms reveals a catch—65% of the tokens (company treasury + team + strategic contributors) will start unlocking after 6 months. In plain language, it means: "Retail investors rush in first, and we major shareholders will come to cash out after half a year."

Even more audaciously, the official statement said: "ZORA is not a governance token; it is purely an entertainment token, and holders have no rights." This is essentially a clear indication: what we are issuing is not stock, but casino chips.

But did you think that was the end? Zora also conducted two snapshots:

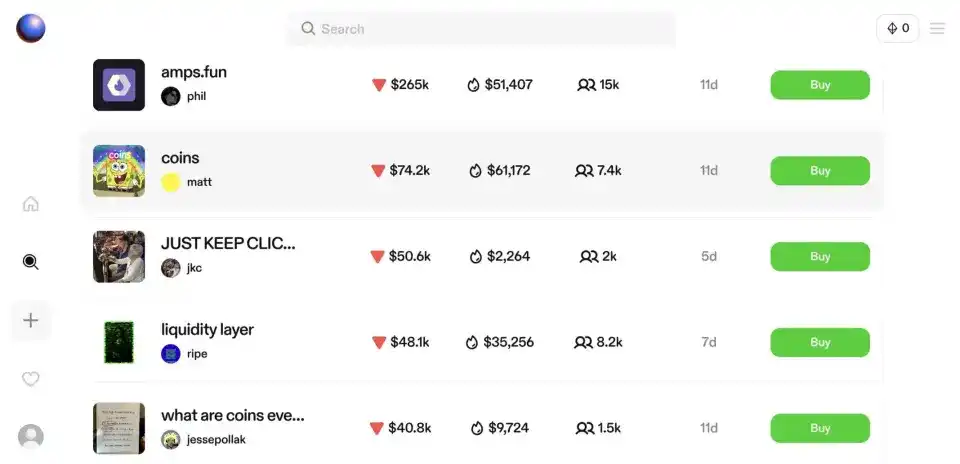

The first one was cut off on March 3, rewarding old retail investors; the second one was cut off on April 20, attracting new retail investors. The result was that over the past two months, Zora's on-chain trading volume surged by 47%, with countless people frantically posting on the platform to boost interactions, and some even using scripts to mass-produce garbage content like "Good morning, Earth" and "Today's constipation."

The most magical part is that some opportunists calculated: to enter the top 30% of airdrop eligibility, you need to interact at least 21 times. As a result, professional teams emerged on the platform to help people boost likes and comments, with prices ranging from $50 to $200. This operation made me exclaim in admiration—turns out Web3's "community incentives" are just getting users to spend money on bots to inflate their data.

3. Base's "Divine Assistance": The Official Playing Werewolf

Just as retail investors were going crazy on Zora, another main character appeared: Jesse Polla, the head of the Base protocol. This guy has been frequently posting "Content Coin" on Zora since February of this year. For example, turning meeting minutes into tokens, putting community announcements on-chain, and even tokenizing a trailer for Vitalik's documentary.

According to him, this is to promote an on-chain renaissance of "content as tokens, tokens as content."

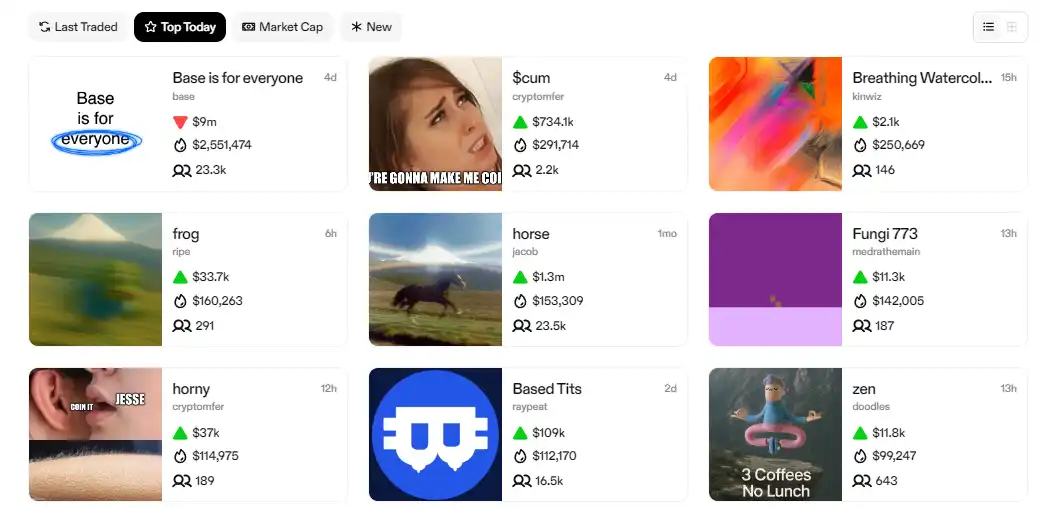

But the public's eyes are sharp—on April 17, the official Base Twitter suddenly released the "Base is for everyone" token, which instantly reached a market cap of $17 million, only to plummet 90% within five minutes.

This plot is more thrilling than a roller coaster:

- 3:12 Official Twitter issued the token, KOLs collectively hyped it.

- 4:30 Market cap skyrocketed.

- 4:35 Whales sold off, prices plummeted.

- 5:00 The 28th rights protection group was formed.

Faced with the anger of retail investors, the Base official calmly responded: "We didn't sell tokens; this is just an art experiment~"

Even more outrageous, Jesse Pollak added: "When I issue 1 token, they say I'm rug pulling; when I issue 10 tokens, they say I'm hyping; only when I issue 100 tokens will they understand this is the future of new media." Translated, this means: "You country bumpkins don’t understand high art; you deserve to be retail investors!"

But ironically, this farce allowed Zora to completely break out. With the "Base is for everyone" token skyrocketing 10 times the next day, more retail investors rushed into Zora, fearing they would miss the next "official dog coin." At that moment, the Zora team was probably laughing in their beds—this zero-cost marketing was more effective than buying ads on CCTV.

4. Scythe or Paintbrush: What Big Picture is Zora Painting?

At this point, some viewers might ask: Is Zora really making such a big fuss just to harvest retail investors? We must objectively say that this matter cannot be dismissed outright.

From a product logic perspective, Zora is indeed innovating:

- Breaking the dimensional wall between NFTs and tokens: Using the ERC-20z standard to turn images and videos directly into tradable assets, solving the liquidity problem of NFTs.

- Restructuring the creator economy: Automatically issuing tokens for every piece of content, turning likes and shares into "productivity."

- Financializing social media: Transforming Weibo's trending topics into token price rankings, completely unleashing human gambling instincts.

But the problem is, when all content becomes a target for trading tokens, the internet turns into Las Vegas. Last August, on-chain detective ZachXBT turned his investigation report into a Zora token, intending to create a piece of performance art, but the token was crazily speculated to $14 million. The guy was so scared that he tweeted overnight: "I really didn't mean to let people speculate!"

This story tells us: in Zora's world, even anti-fraud campaigns can turn into dog coins.

Even more frightening are the technical vulnerabilities: Since Zora's liquidity pools are fully automated, any content token can be traded as soon as it goes live. This gives sniper bots an opportunity—they can detect new tokens in milliseconds, pump the price to attract followers, and then instantly dump for profit.

In other words, issuing tokens on Zora is equivalent to sending heads to an army of robots.

5. Retail Investor Survival Guide: How to Survive Three Episodes in an On-Chain Casino

Finally, here are a few pieces of advice for those looking to rush into the ZORA token:

- Beware of unlocking period bombs: 65% of tokens will unlock after six months, and team sell-offs could trigger an avalanche.

- Be cautious of social media bots: 90% of likes and comments on the platform are generated by bots.

- Stay away from "official dog coins": 90% of the 27 tokens issued by the Base team have already gone to zero.

- When a project says "this is not a financial product," it is 100% a financial product.

In the end, Zora's token issuance drama is both a fireworks show of on-chain renaissance and a mirror reflecting human greed.

When we are ecstatic or devastated over a tweet token on Zora, perhaps we should remember that ancient truth: in a casino, the only ones who always win are the ones selling the chips.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。