Large funds have made their own choices, leaving the market open for smaller funds.

Written by: Zuo Ye

After large funds have made their own choices, the market for smaller funds has opened up.

In this cycle, the bull and bear markets are not idle, with VC, KOL, and stablecoins being the three major trends. Among them, KOL itself is also an asset that can be tokenized.

The choices for VCs are increasingly narrow, focusing on stablecoins and "simple investment" products to create momentum, and reinvesting in already issued token projects, all of which are lower-risk options with certain returns.

On April 16, the on-chain Delta neutral yield stablecoin (YBS) project Resolv completed a $10 million seed round financing led by Maven11, marking its first public financing since its establishment in 2023.

Compared to Ethena's aggressive approach, Resolv is relatively low-key, but its innovations are on par with any peer. In summary, it can be divided into: a more unique yield model, more on-chain yield sources, and more complex token economics.

The American Gold Rush Dream of Russian Geeks

A gesture from Trump has led to the restoration of Russian citizenship.

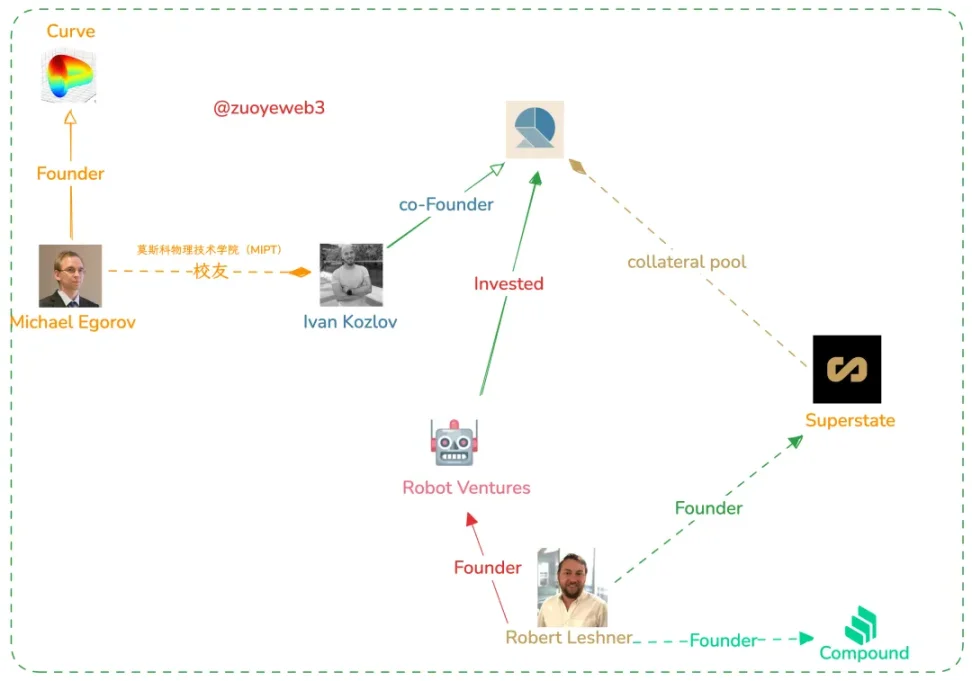

The leading investor Maven11 is based in the Netherlands, with participating funds like Robot Ventures mostly being American. The three founders of Resolv, Ivan Kozlov, Fedor Chmilevfa, and Tim Shekikhachev, are all science graduates educated in Russia.

There is reason to suspect that this financing was completed long ago but was not announced to avoid suspicion. Referencing Ethena's need for exchange VC support, the YBS project at least requires a liquidity fund to cope with black swan events.

Image caption: Resolv founding team social engineering diagram

Image source: @zuoyeweb3

Whether on-chain works or not, Ethena believes it does not, while Arthur Hayes thinks it needs to form a profit alliance with CEX to stabilize the liquidity of USDe. ENA is thus exchanged with various exchange VCs to secure the long-term stability of the protocol by relinquishing minting rights.

In contrast to Ethena's compromise attitude, Resolv presents a strong embrace of the on-chain ecosystem and is determined to capture the market with higher yields.

More Complex Token Economics

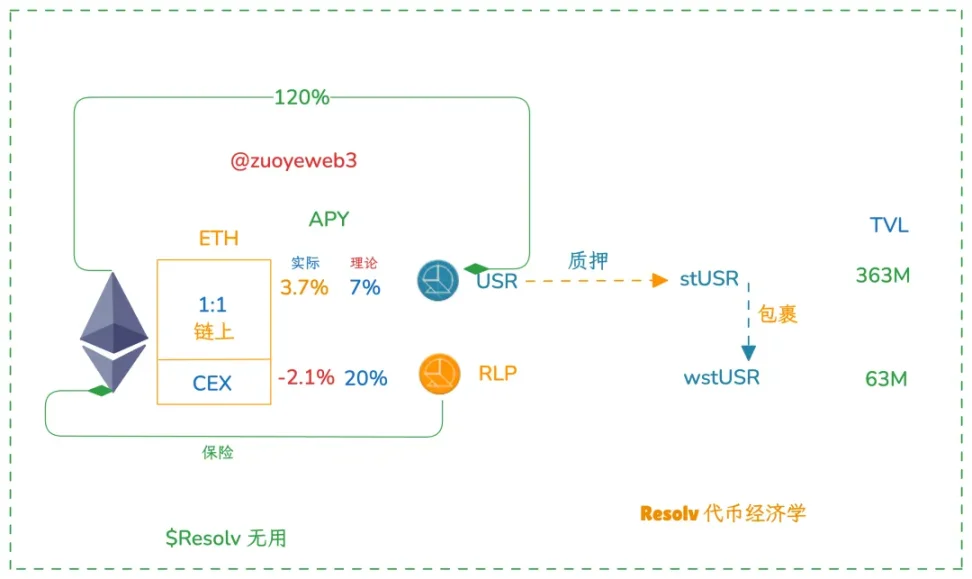

Unlike Ethena's dual-token mechanism of stablecoin + governance token, Resolv actually has three tokens: the stablecoin USR, the insurance fund and LP Token RLP, and the governance token $RESOLV.

Image caption: Resolv token economics

Image source: @zuoyeweb3

It is important to note that Resolv's governance token does not serve a special role similar to ENA's profit alliance. Ethena's ENA is essentially a proportional representative of AP (Authorized Issuer), and in extreme cases, ENA has little effect on retail investors but is crucial for the operation of the Ethena protocol.

Resolv focuses on the dual-yield token system formed by USR and RLP. Users can theoretically mint USR at a 1:1 ratio by depositing USDC/USDT/ETH, and most of this asset will be stored in on-chain protocols or Hyperliquid to minimize asset losses caused by CEX hedging.

In a unique twist, Resolv has designed the RLP token, primarily used to cover funds hedged in CEX. Additionally, it offers higher yields, with USR's annualized yield between 7%-10%, while RLP ranges from 20%-30%, though this is theoretical and has not yet reached expected values.

More On-Chain Yield Sources

Compared to Ethena, Resolv is more actively embracing the on-chain ecosystem. From a yield perspective, YBS is divided into yield-bearing assets like stETH and CEX contract hedging fees.

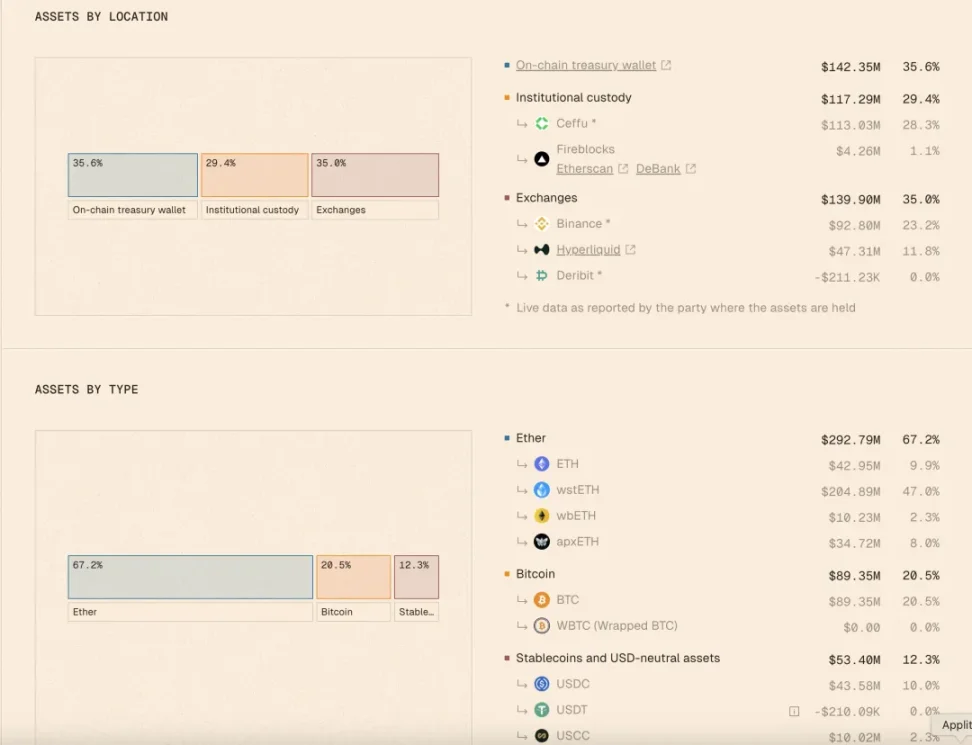

On-chain yields may be higher than CEX hedging, but a prominent issue is that Hyperliquid's liquidity is clearly not as robust as Binance and other competitors. Currently, the ratio of hedging contracts between Binance and Hyperliquid is about 7:3, hence the value of RLP lies here.

RLP is a leveraged yield token that maintains a higher yield with less capital. For example, the current RLP TVL is only $63 million, less than 20% of USR, making it suitable for high-risk tolerant users.

To vent a bit, due to the price movements of ETH, most ETH bulls envisioned by YBS may very well not materialize for a while, and currently, RLP's yield is negative.

A More Unique Yield Model

The difference between USR and USDe is minimal; Resolv has introduced RLP as an insurance mechanism because it currently cannot completely eliminate the involvement of off-chain CEX and USDC, so Resolv aims to minimize its negative impact.

Image caption: Resolv data

Image source: @ResolvLabs

Theoretically, USR will be fully minted from on-chain assets in excess (currently at a 120% ratio, with 40% being on-chain assets), and some minted collateral will be used for institutional custody and off-chain CEX hedging.

At this point, Resolv's capital efficiency is clearly not as good as Ethena's complete off-chain CEX hedging. Resolv's RLP needs to "make up" for this yield, at least to break even with Ethena.

Future Outlook for YBS

Ethena has only opened the door for YBS; it does not signify an end.

The yield rate of USR is between 7% and 10%, while RLP's yield rate is between 20% and 30%, followed by risk isolation. For example, with 1.2U of ETH, the reserve for minting 1USR is hedged on-chain and in Hyperliquid, with 0.2U used to mint RLP and hedge on Binance.

Even if Binance collapses, USR can ensure rigid redemption. In fact, RLP's theoretical risk exposure is at 8%. The innovation lies in that Ethena completely relies on Perp CEX for capital efficiency and security, taking a step forward.

It can also be understood as taking a step back. In Ethena's mechanism, as long as CEX does not maliciously attack, there is basically no possibility of a death spiral. In the most extreme case, the Ethena protocol can stabilize the market through negotiations with large holders and its own funds, similar to how the founder of Curve stabilized the token price through OTC during extreme market conditions.

Resolv, on the other hand, places more yields and funds on-chain, which means it has to face various impacts of on-chain combinations. Binance may not target ENA, but that does not mean it will spare Hyperliquid. This can be referenced from previous writings about Hyperliquid: 9% for Binance, 78% for centralized exchanges.

Ultimately, in a fiercely competitive environment, it is often impossible to guarantee a balance between safety and yield. Resolv essentially launched around the same time as Ethena, but its current TVL and issuance are far inferior to Ethena, leaving fewer choices for latecomers.

However, the number of ships participating in the YBS grand voyage will continue to increase. In the low-interest financial management era, the project party's startup costs will be lower than during DeFi Summer.

This is somewhat counterintuitive. Typically, during the DeFi Summer era, as long as there is a product prototype, funds would flood in. But do not forget that the return requirements for farming often exceed 20%, as evidenced by UST, while Ethena's benchmark sUSDE stabilizes below 5%.

In other words, as long as the APY of new entrants to YBS can surpass 5%, there will be adventurers participating, opening up the possibility of retention to kickstart the flywheel. However, how to present the increasing number of YBS to uninformed retail investors is not something that can be easily solved by simply finding KOLs for promotion and VC endorsements.

Conclusion

The combination of USR and RLP is more like a hybrid product of Hyperliquid and Ethena, LP Token + YBS. I refer to it as the Sonic/Berachain transformation of the YBS ecosystem, all aiming to surpass existing products through more complex mechanism designs.

At the same time, risks are clearly rising. Any LP Token mechanism will face the dilemma of creating liquidity for the sake of liquidity, and the insurance mechanism of RLP has not yet been tested by extreme market conditions, while USDe has experienced decoupling.

Decoupling is the rite of passage for stablecoins, and I hope Resolv can overcome this step.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。