On April 20, Bitget released an announcement in response to the abnormal trading events that occurred on its platform regarding contract trading pairs. This incident, which drew widespread market attention due to a surge in trading volume and abnormal price fluctuations, raised suspicions of market manipulation. Bitget quickly took action, suspending the functions of related accounts, promising to launch a compensation plan, and emphasizing the security of platform funds.

Cause of the Incident: VOXEL/USDT Trading Volume Anomaly

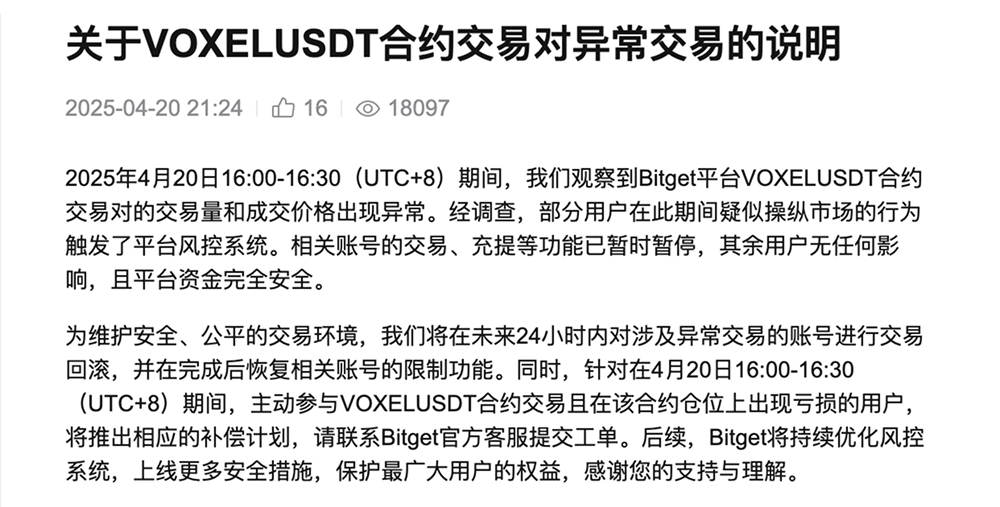

According to Bitget's announcement, from 16:00 to 16:30 (UTC+8) on April 20, 2025, the trading volume and price of the VOXEL/USDT contract trading pair exhibited significant anomalies. AICoin data indicated that the 24-hour trading volume for this trading pair reached as high as $12.72 billion, far exceeding Bitcoin's trading volume of $4.756 billion during the same period, leading to speculation about abnormal trading within the community. VOXEL, as a relatively niche gaming token, saw its price surge over 50% in the past 24 hours, with some periods experiencing increases of 138% to 150%, far beyond normal market volatility ranges.

Industry analysts pointed out that such drastic price fluctuations and surges in trading volume could stem from market manipulation or a malfunction of the platform's trading bots. Crypto analyst Dylan stated on social media that the issue was more likely due to a bug in Bitget's trading bots rather than active manipulation by users. There were also voices in the community questioning whether some market participants might have used high-leverage contracts to amplify volatility for profit.

Bitget's Swift Response

Following the incident, Bitget quickly initiated an investigation. At 17:29 (UTC+8) on April 20, the head of Bitget's China region released a preliminary statement via the X platform, confirming that they had noticed the abnormal behavior of the VOXEL/USDT contract trading pair and were investigating, emphasizing that trading, deposits, and withdrawals were functioning normally. Subsequently, Bitget's official announcement further disclosed that the abnormal trading triggered the platform's risk control system, and some accounts were identified as suspected of market manipulation, leading to a temporary freeze of trading, deposit, and withdrawal functions.

Bitget's CEO Gracy Chen stated in an interview with Cointelegraph that the abnormal trading originated from operations between individual market participants, rather than an issue with the platform itself. She emphasized that user fund security was not affected, and the losses were not a systemic issue within the platform. Bitget promised to roll back operations for the involved accounts within 24 hours, recover improper profits, and restore the functions of the related accounts.

Compensation Plan and User Feedback

To mitigate the impact of the incident on ordinary users, Bitget announced a compensation plan for users who participated in VOXEL/USDT contract trading and incurred losses during the period from 16:00 to 16:30 on April 20. Users can contact official customer service to submit a ticket for compensation. In the announcement, Bitget stated that it would continue to optimize its risk control system and introduce more security measures to protect user rights.

However, Bitget's handling of the situation has also sparked dissatisfaction among some users. X platform user @web3wsl questioned whether it was reasonable for the platform to define normal profits as "abnormal trading" and restrict withdrawals, expressing concerns about user fund security. Some users pointed out that the issue might lie with the platform's market makers rather than retail users, criticizing Bitget's unilateral decision to roll back trades, which could undermine user trust and even lead to user attrition.

Conclusion

Bitget's rapid response and transparent handling of the VOXEL/USDT abnormal trading incident reflect its sense of responsibility as a leading exchange. Although there are disputes regarding some measures among users, the platform's promised compensation plan and risk control optimization mark a temporary conclusion to the incident. In the future, as the crypto market matures, similar incidents may drive the industry towards higher standards in technology, regulation, and user protection.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。