Author: Hua Li Hua Wai

A few days ago, a friend left a message in the background asking: Since the crypto market is already in a bear market, should we give up Bitcoin to embrace gold?

This sounds like an interesting question.

As for whether we are in a bear market or a bull market, we have already discussed this in several articles a few days ago, so I won't elaborate on it here. Today, we mainly continue to talk briefly about gold and Bitcoin.

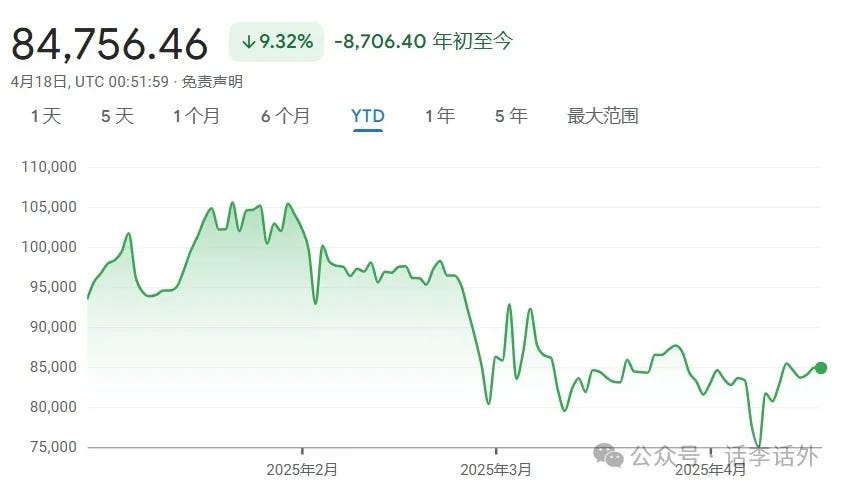

Recently, many people have been attracted by the rise of gold, while stocks and cryptocurrencies seem less appealing. From the beginning of the year to now (YTD), the return on gold has reached 26.75%, while the S&P 500 has a return of -10.2% and Bitcoin -9.3%. As shown in the figure below.

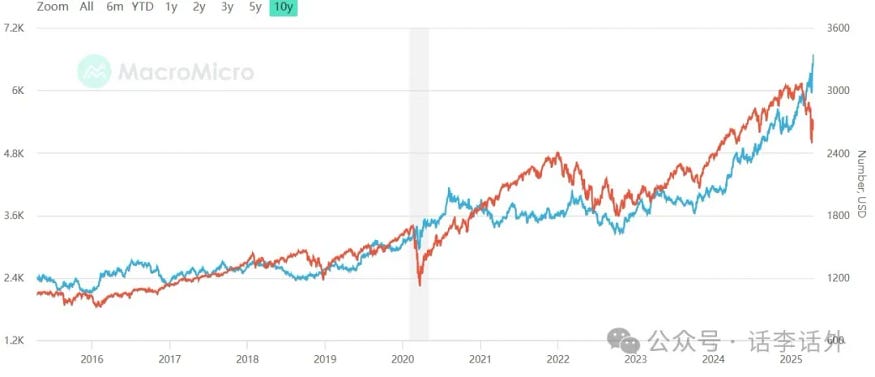

If we make a simple comparison of the historical trends of gold and the S&P 500, we can find that since 2020, there has been a noticeable difference in performance between the U.S. stock market and gold. As shown in the figure below (the blue line represents gold, and the red line represents the S&P 500).

In February 2020, the U.S. stock market began to plummet rapidly, while gold started to rise quickly. A similar situation seems to have occurred again in February 2025. Of course, the factors leading to the sharp decline in the U.S. stock market and the surge in gold prices during different periods are also different. For example, the last time it was mainly due to the impact of the global pandemic, while this year it is mainly due to issues like U.S. tariffs (refer to our article published on April 14 for more details).

In fact, the basic logic of gold's rise seems quite simple: as long as the world is not peaceful, both the U.S. stock market and cryptocurrencies will plummet, while the price of gold will soar.

1. Should we give up Bitcoin to embrace gold?

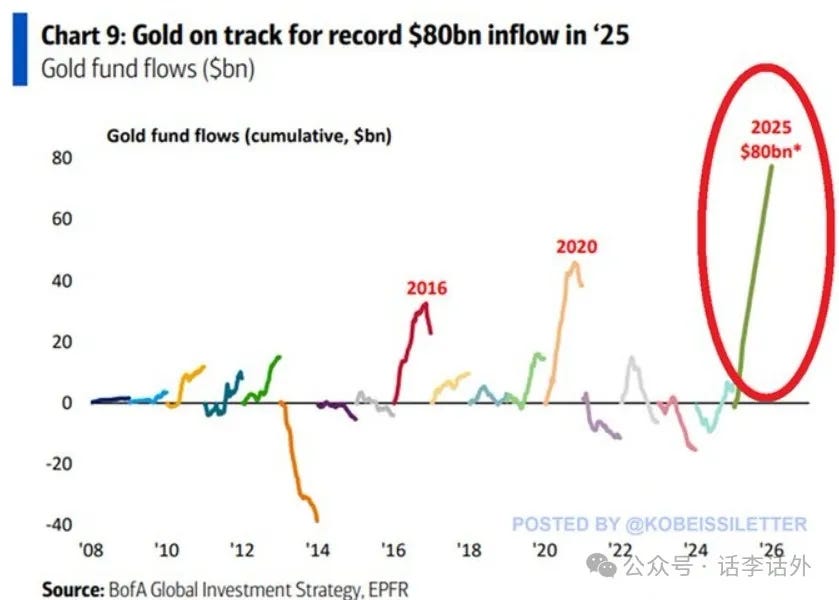

According to data from The Kobeissi Letter, net inflows into gold funds have reached a record $80 billion this year, double the previous high set in 2020, as investors inject funds into the gold market at a record pace for hedging (some of this money may also be for short-term speculation). As shown in the figure below.

In the coming period, if we continue to be in a persistent and uncertain environment, then in the medium to long term, the price of gold is likely to continue to rise, especially when the U.S. dollar may face some crises, this bullish sentiment will be even stronger.

So, should we give up Bitcoin to embrace gold now? This question still depends on your asset allocation ratio and risk preference!

Here, the asset allocation ratio refers to the distribution of your assets:

For example, if you have 10 million RMB, how would you plan this portion of your assets? For instance, what proportion would you use to buy fixed assets (such as houses), what proportion would you invest in traditional financial products (such as savings, wealth management, funds), what proportion would you invest in the stock market (such as A-shares, Hong Kong stocks, U.S. stocks), what proportion would you invest in precious metals (such as gold), and what proportion would you invest in cryptocurrencies (such as BTC)…

Here, risk preference refers to your specific investment strategy:

If you invest 1 million RMB (which is 10% of your total assets) in cryptocurrencies, the first thing you need to understand is that cryptocurrencies are both a field with high returns and extremely high risks, and you must be mentally prepared to possibly lose this 10% of your assets at any time.

Next, you need to customize your investment strategy, which means you need to consider long-term, medium-term, and short-term investment cycles, while also choosing specific fields or targets based on your personal time and energy. For example, you can further divide the 1 million RMB into 9:1 or 5:3:2 or 6:2:1:1, etc. Taking 5:3:2 as an example, you could allocate 50% of your position for low-risk long-term investment in Bitcoin (mainly long-term investment), 30% for on-chain financial management (mainly flexibility), and 20% for high-risk speculative investments (mainly short-term speculation).

In short, before deciding to invest, you first need to clarify (plan) the following:

- Your asset allocation method

- Your specific allocation model or strategy under different allocations

Then, you can execute specific investment choices (gold, Bitcoin, etc.) and investment plans:

- Establish and form your own trading system or trading logic based on different strategies

- As time goes by, maximize the overall asset scale for the best possible returns based on your trading system/logic

So, returning to the question of whether to give up Bitcoin to embrace gold: if you didn't know what to do before, then I believe you should have some ideas now. And if, after reading the above thoughts, you still don't know what to do, our suggestion is to keep your money safely in the bank and not to engage in any risky investments (including gold, stocks, cryptocurrencies).

Especially now, gold is already at a relatively high level in the short term, and ordinary people should not speculate and chase high prices unless they know what they are doing. If you are a medium to long-term investor, for example, if your goal is to follow trends over the next few years, then you can consider gradually building positions when gold experiences a phase of correction.

2. Gold and Bitcoin

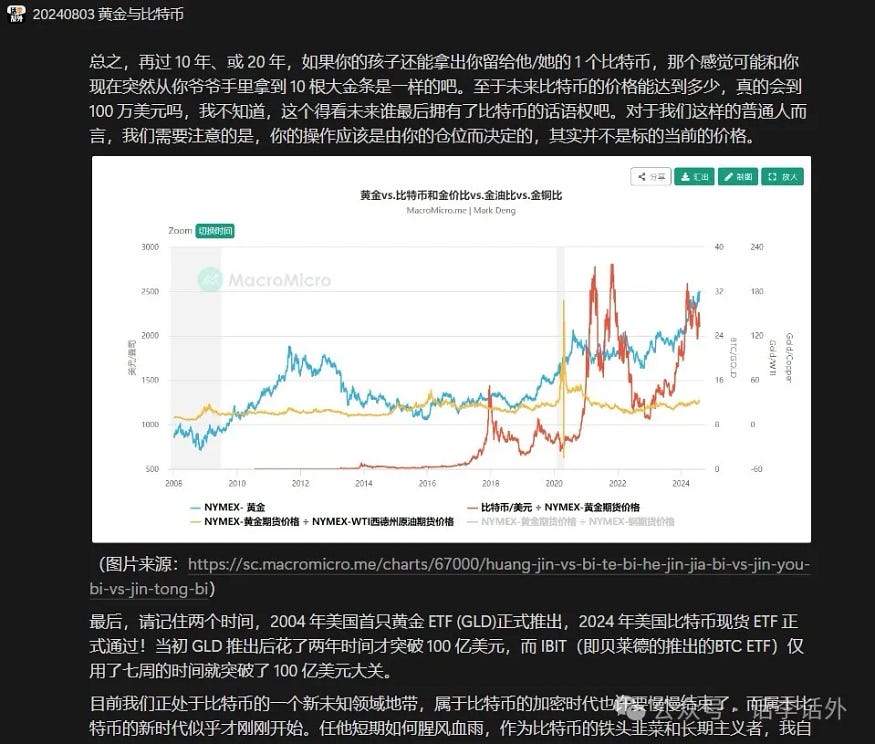

I remember in an article last year (August 3, 2024), we specifically sorted out the topic of gold and Bitcoin. As shown in the figure below.

Continuing from the previous topic, in the medium to long term, gold remains the best asset to combat inflation (although gold also experiences about 3-5% inflation annually) and to cope with the global uncertain environment. If your investment cycle is 5 years, 10 years, 15 years, or 20 years, you can buy and hold gold at any time without needing to think too much, just allocate a certain proportion of funds to persistently invest in gold.

If you are looking to short-term speculate on gold's recent rise, then you need to manage your position allocation and risk management, and you also need to choose your targets wisely, such as whether you want to buy physical gold, gold ETFs, or gold stocks (such as FSM, PPTA, DRD, etc.), and so on…

As for Bitcoin, although many people compare it to "digital gold," at this stage, Bitcoin does not yet possess the attributes of gold (nor can it directly replace gold unless major countries around the world eventually establish reserves for Bitcoin, complete the distribution of interests, and form corresponding mechanisms in terms of crypto policies). However, if you still have confidence in the long-term prospects of the crypto field, then Bitcoin remains a top choice.

1) From a decentralization perspective

Both gold and Bitcoin seem to belong to decentralized assets. For example, the main holders of gold are central banks and investment institutions, but it is also a universal asset, as much gold is held privately, such as an estimated 25,000 tons of private gold holdings in India, about 16,000 tons in China, and about 8,000 tons in the U.S.

The main holders of Bitcoin are countries, whales, and investment institutions (with strategic reserve plans in countries like the U.S., Bitcoin may increasingly concentrate in the hands of nations and investment institutions), but currently, many retail investors also hold Bitcoin, as shown in the figure below.

2) From a mining cost perspective

Gold and Bitcoin differ in this regard. For example, the current mining cost of gold is about $1,000–1,400 per ounce (varying by country), while the mining cost of Bitcoin is about $40,000–60,000 (varying by mining equipment), as shown in the figure below.

However, gold has a certain inflation rate, while Bitcoin has a fixed supply of 21 million coins.

3) From a consensus perspective

Both gold and Bitcoin are viewed as Store of Value assets, but their sources of consensus, nature of consensus, and stability differ.

For example, in terms of consensus source, gold has a stronger global consensus, as it has undergone thousands of years of human usage history, while Bitcoin has only existed for a little over a decade.

It can be said that gold is more of a consensus sediment of human "history," while Bitcoin is a consensus attempt for the "future."

Of course, besides the comparisons we mentioned above regarding decentralization, mining costs, and consensus, there are many other ways to find similarities or differences between gold and Bitcoin.

Since gold represents a historical consensus sediment and Bitcoin represents a future consensus attempt, the idea of giving up Bitcoin to embrace gold, or giving up gold to embrace Bitcoin, seems to be an extreme choice.

In summary, we can choose to buy gold at certain stages, or choose to buy Bitcoin at certain stages, or we can buy both gold and Bitcoin for long-term reserves. This decision is based on your personal preferences, asset allocation, and risk management. Short-term investment relies on technical skills (ability to grasp indicators, filter information, analyze data, etc.), while long-term investment relies on mindset (investment logic, grasping cyclical trends, values, etc.). If your focus is only on the present, but you lack good technical support for trading, such as seeing a target rise or become popular and then abandoning your current target to chase high prices or trends, this repeated investment mentality may ultimately lead to getting nothing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。