Author: Tanay Ved

Translation: Baihua Blockchain

Key Points:

Circle is projected to achieve $1.7 billion in revenue in 2024, with 99% coming from interest income on USDC reserves. The distribution costs with partners like Coinbase and BN total $1.01 billion, reflecting the critical role of trading platforms in expanding USDC's reach.

The total supply of USDC has rebounded to $60 billion, with a 30-day average transfer volume reaching $40 billion, indicating a recovery in market confidence and cross-chain adoption. However, USDC remains sensitive to interest rate changes, competitive pressures, and regulatory developments.

The use of USDC on major trading platforms continues to grow, currently accounting for 29% of BN's spot trading volume, thanks to Circle's strategic partnerships.

Looking ahead, Circle's next phase may rely on diversifying from passive interest income to active revenue sources, including tokenized assets, payment infrastructure, and capital market integration.

Introduction

Circle is the largest stablecoin issuer in the U.S. and the company behind the $60 billion market cap USDC, which recently filed for an IPO, providing insights into the financial status and strategic outlook of this cryptocurrency infrastructure company. As the only direct investment avenue in the fastest-growing areas of cryptocurrency in the public market, Circle's IPO application comes at a critical time when stablecoin legislation is gradually taking shape and competition is intensifying. Although market conditions may lead to a delay in the IPO, we will extract key information from Circle's IPO documents, analyze its revenue sources, the impact of interest rates on its business, and the role of platforms like Coinbase and BN in shaping USDC distribution, while assessing Circle's positioning in an increasingly competitive market.

Circle Financial Overview

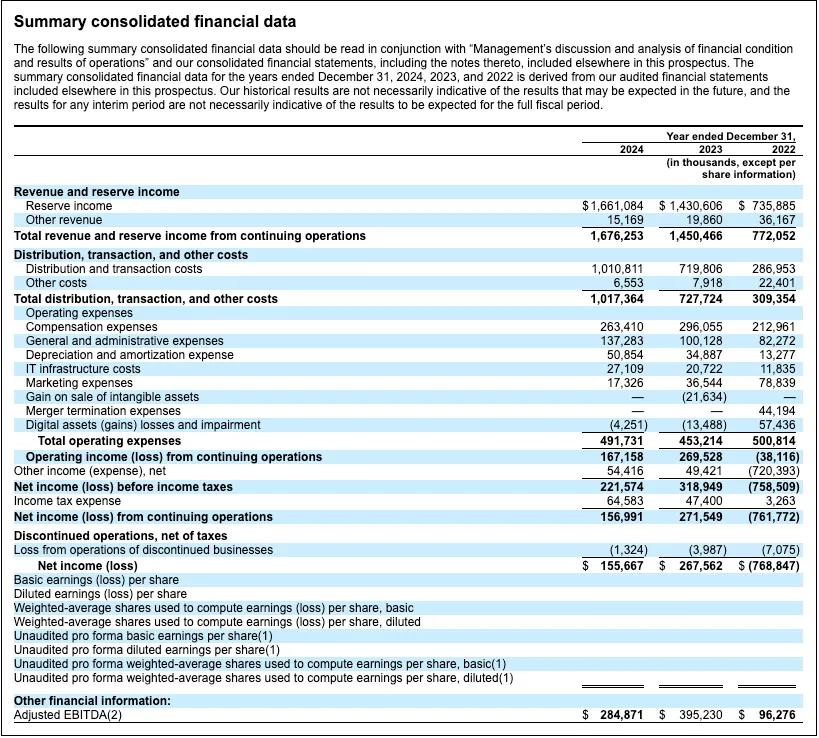

From its initial Bitcoin payment application to becoming a leading stablecoin issuer and cryptocurrency infrastructure provider, Circle has faced numerous challenges in its 12-year journey. After explosive revenue growth of 450% in 2021 and 808% in 2022, growth slowed in 2023, with an 88% increase in revenue, as USDC was impacted by the collapse of Silicon Valley Bank. By the end of 2024, Circle reported revenue of $1.7 billion, a 15% year-over-year increase, indicating a more stable expansion trend.

Source: Circle S-1 Filing

However, profitability has been compressed, with net income and adjusted EBITDA declining by 42% and 28%, respectively, to $157 million and $285 million. Notably, Circle's financial data shows that revenue is highly concentrated in reserve interest income, with distribution costs with partners like Coinbase and BN amounting to approximately $1.01 billion. Nevertheless, these factors have driven a recovery in USDC supply, which grew 80% year-over-year to $44 billion.

On-Chain Growth of USDC

USDC is at the core of Circle's business, launched in 2018 in partnership with Coinbase. USDC is a tokenized form of the U.S. dollar, allowing users to store value digitally and transact on blockchain networks, achieving near-instant, low-cost settlements. USDC operates on a full reserve model, backed 1:1 by highly liquid assets, including short-term U.S. Treasury bills, overnight repurchase agreements, and cash held by regulated financial institutions.

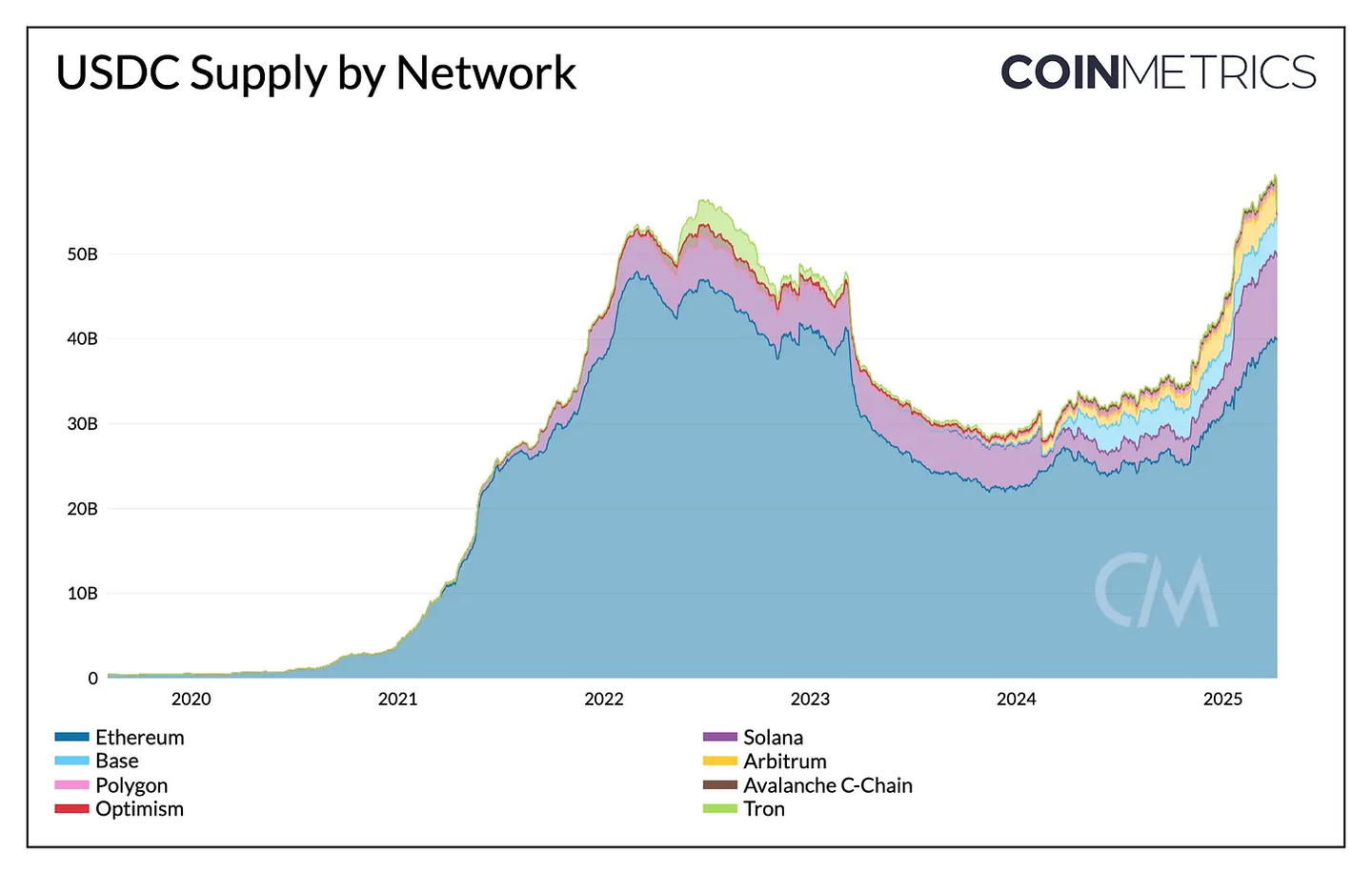

Source: Coin Metrics Network Data Pro & Coin Metrics Labs

The total supply of USDC has grown to approximately $60 billion, firmly holding the position of the second-largest stablecoin after Tether's USDT. Despite pressure on market share in 2023, it has rebounded to 26%, reflecting a recovery in market confidence. Of this, approximately $40 billion (65%) is issued on Ethereum, $9.5 billion on Solana (15%), and $3.75 billion on Base Layer-2 (6%), with the remainder distributed across chains like Arbitrum, Optimism, Polygon, and Avalanche.

The velocity and transfer volume of USDC have also significantly increased, with a 30-day average transfer volume reaching approximately $40 billion. By 2025, USDC transfers primarily occur on Base and Ethereum, sometimes accounting for 90% of the adjusted total transfer volume.

Source: Coin Metrics Network Data Pro

These metrics indicate that as stablecoins gain traction as a dollar alternative in emerging markets and the appeal of payment and fintech infrastructure increases, the usage of USDC continues to grow. This also reflects Circle's cross-chain strategy, with USDC being widely available on major blockchains and supported by interoperability tools like the Cross-Chain Transfer Protocol (CCTP).

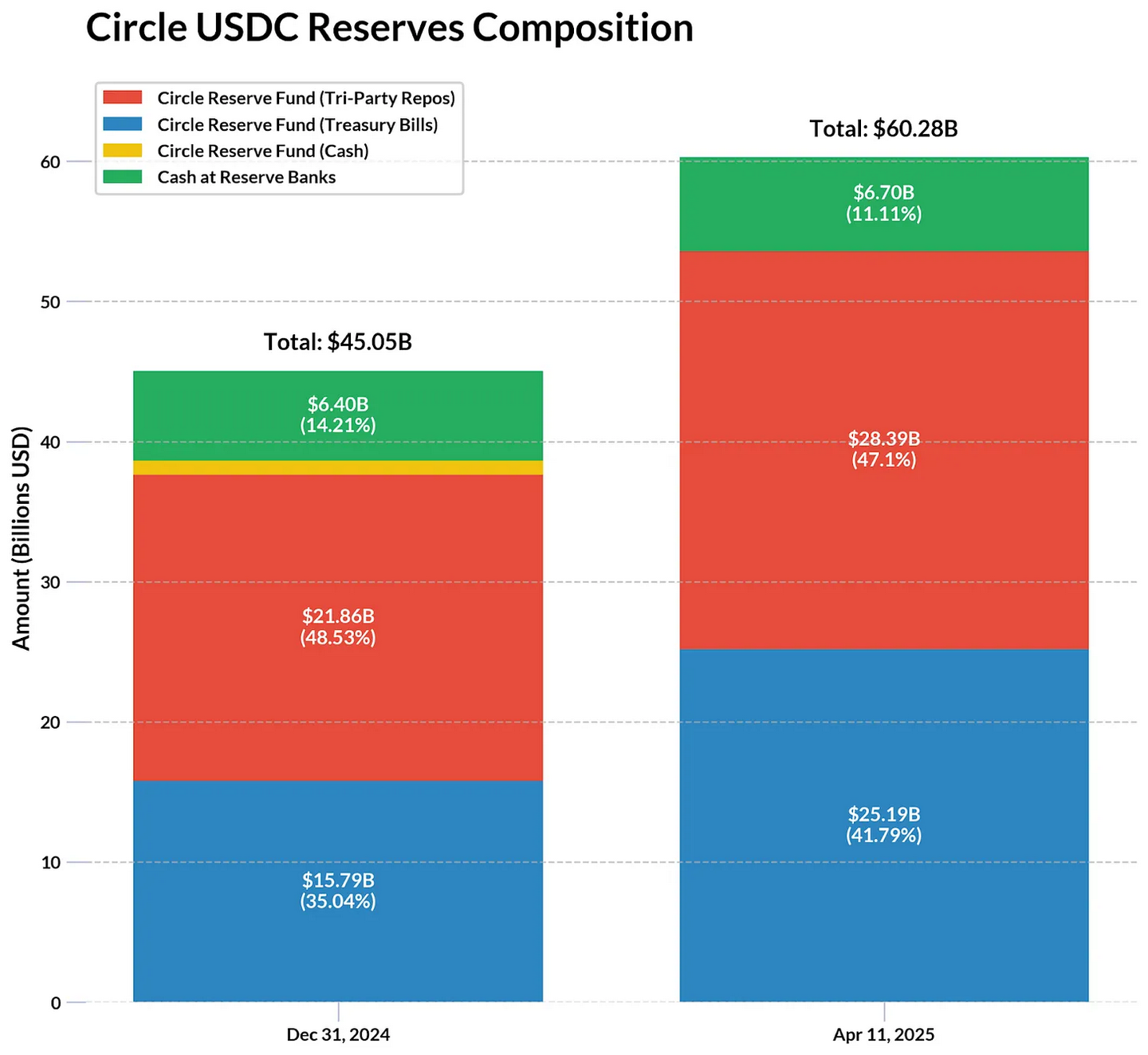

Reserve Composition and Interest Rate Sensitivity

For every dollar of USDC issued, Circle invests reserves in a portfolio of highly liquid, low-risk assets, such as short-term U.S. Treasury bills and cash deposits. This structure allows Circle to earn income from reserves while ensuring liquidity and redemption stability for USDC holders. Circle disclosed in its filings that reserve income for 2024 is projected to be $1.6 billion, accounting for 99% of total revenue, indicating a high dependence on interest rates in its revenue structure.

USDC reserves are primarily held in the Circle Reserve Fund, a government money market fund registered with the SEC and managed by BlackRock. According to Circle's monthly attestations, financial statements, and the BlackRock Circle Reserve Fund, as of April 11, $53.5 billion (approximately 88%) of USDC reserves are composed of U.S. Treasury bills and overnight repurchase agreements with multiple financial institutions, all with maturities of less than 2 months. Additionally, 11% of the reserves are held as cash in regulated banks.

Source: Circle Transparency & BlackRock Circle Reserve Fund

Based on Circle's projected reserve income of $1.6 billion for 2024 and approximately $44 billion in reserve assets, the annualized yield is estimated to be around 3.6%. If interest rates remain at current levels and the supply of USDC remains stable or grows, Circle's reserve income may remain stable.

Our previous research on the decline of USDC supply during periods of rising interest rates shows that Circle's reserve income is highly correlated with current interest rates, indicating the sensitivity of its revenue model to interest rate changes. The effective federal funds rate for 2024 is projected to be between 4.58% and 5.33%. If interest rates decline, what will Circle's outlook be? In the S-1 filing, Circle estimates that a 1% decrease in interest rates could lead to a reduction of $441 million in stablecoin reserve income, which is a key risk outlined in the filing.

Since Circle retains all earnings (unlike issuers like Ethena and Maker that pass interest to holders), its business model remains sensitive to future interest rate changes, competitive pressures, and regulatory evolution.

Distribution, Distribution, Distribution

The Role of Coinbase and BN

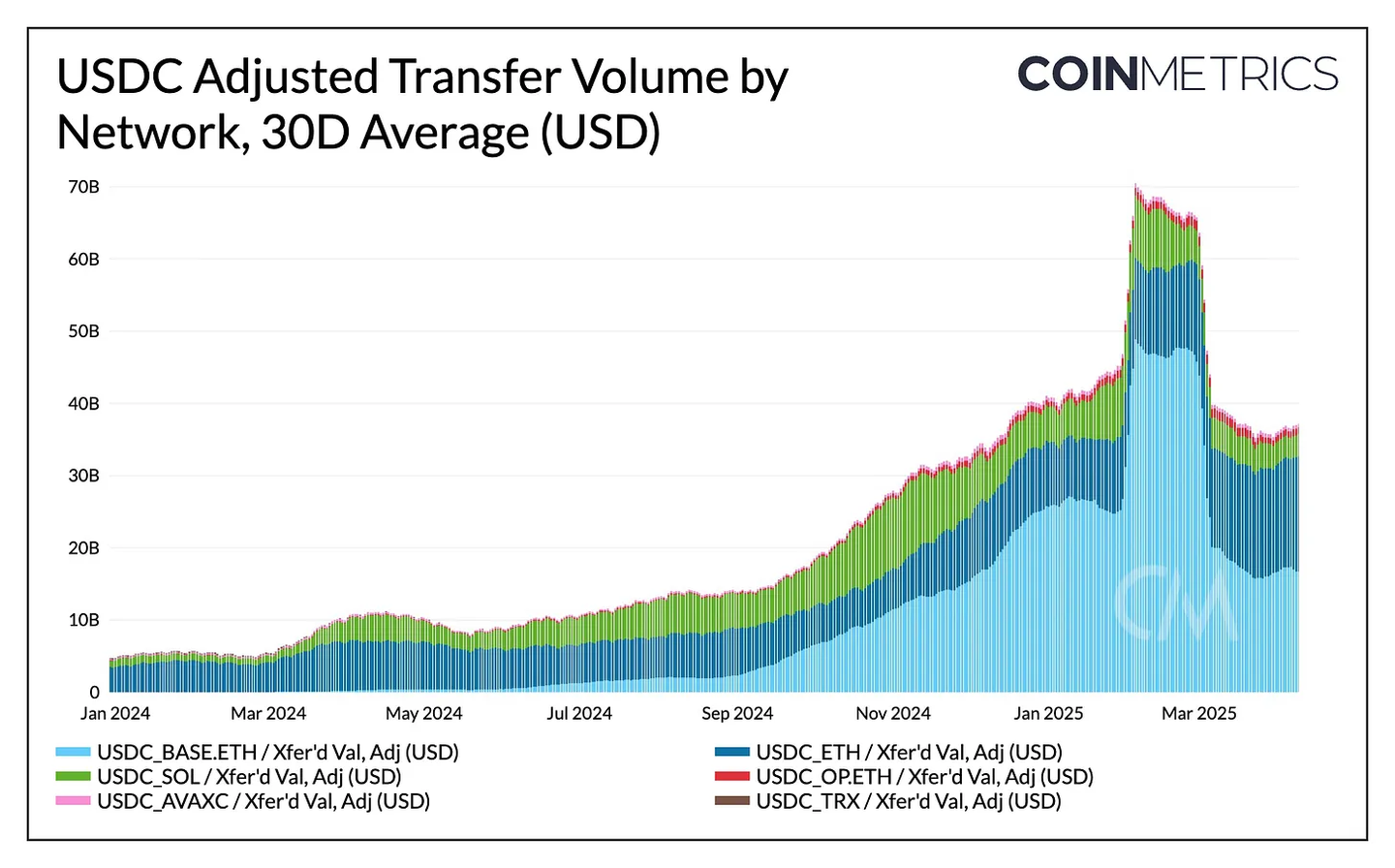

Circle's IPO documents also reveal the importance of partners like Coinbase and BN in driving USDC adoption. In 2024, its distribution costs totaled $1.01 billion, a 40% increase from 2023 and a 150% increase from 2022.

While the relationship between Coinbase and Circle is well-known, the documents show that their financial ties are even closer. In 2024, Coinbase earned $908 million from USDC-related activities, accounting for approximately 13.8% of its total revenue. Under the revenue-sharing agreement with Circle, Coinbase receives 100% of the interest on USDC held on its platform and 50% of the interest on USDC held elsewhere. As the supply of USDC on the Coinbase platform increased from 5% in 2022 to 20%, most of the economic benefits appear to accrue to Coinbase. The documents also disclose a one-time payment of $60.25 million to BN to facilitate distribution in a similar manner.

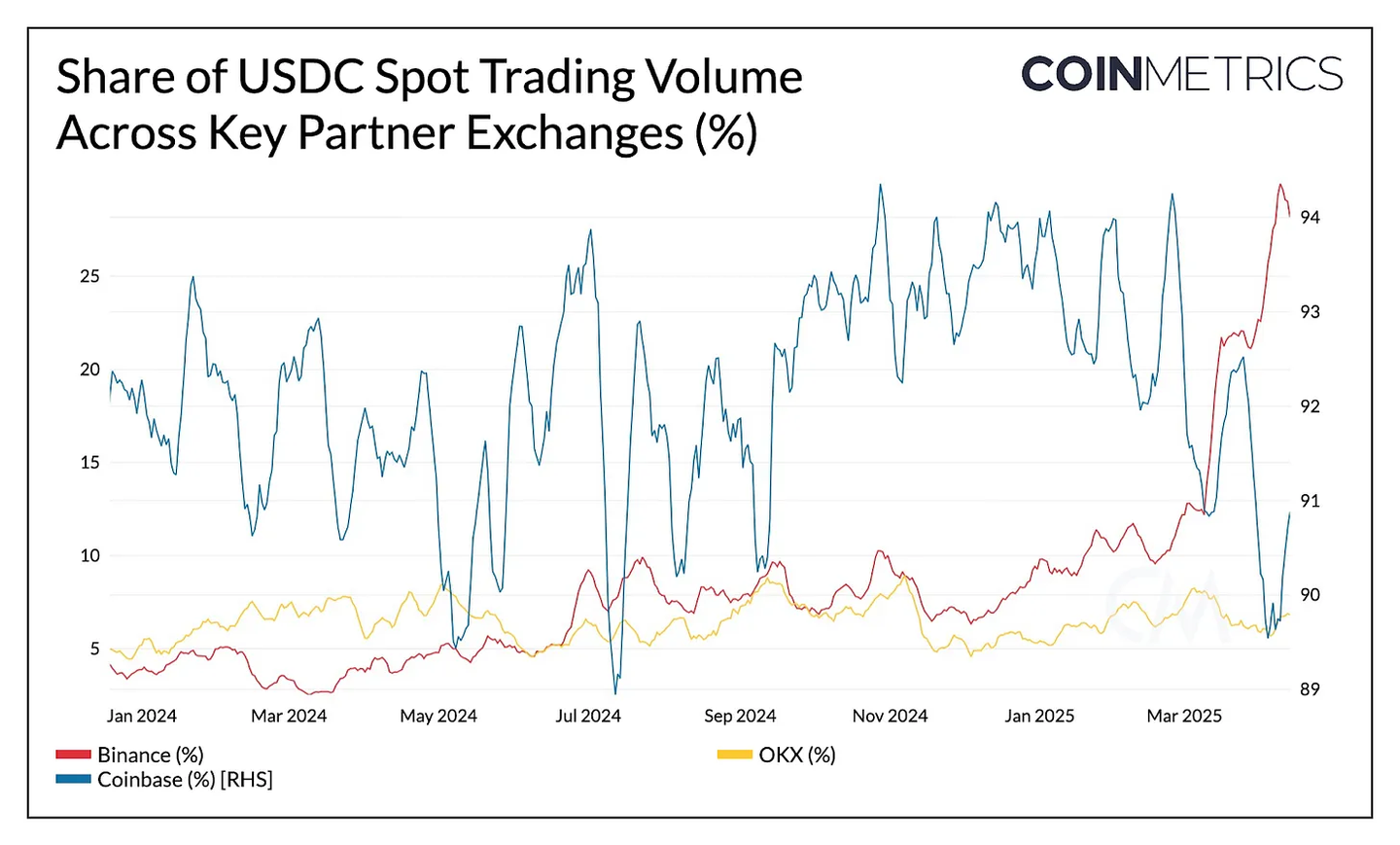

Source: Coin Metrics Market Data Feed

Observing the spot trading activity of key partner trading platforms, USDC currently accounts for 29% of BN's spot trading volume (approximately $6.2 billion), surpassing its share after the recent decoupling of FDUSD, second only to USDT, which accounts for about 50%. On Coinbase, USDC drives approximately 90% of the combined USD and USDC spot trading market.

Despite high costs, Circle's distribution efforts have translated into significant adoption at the trading platform level, driving USDC's liquidity and a credible $10 billion in cross-platform spot trading volume.

Beyond Trading Platforms: Empowering DeFi and Business

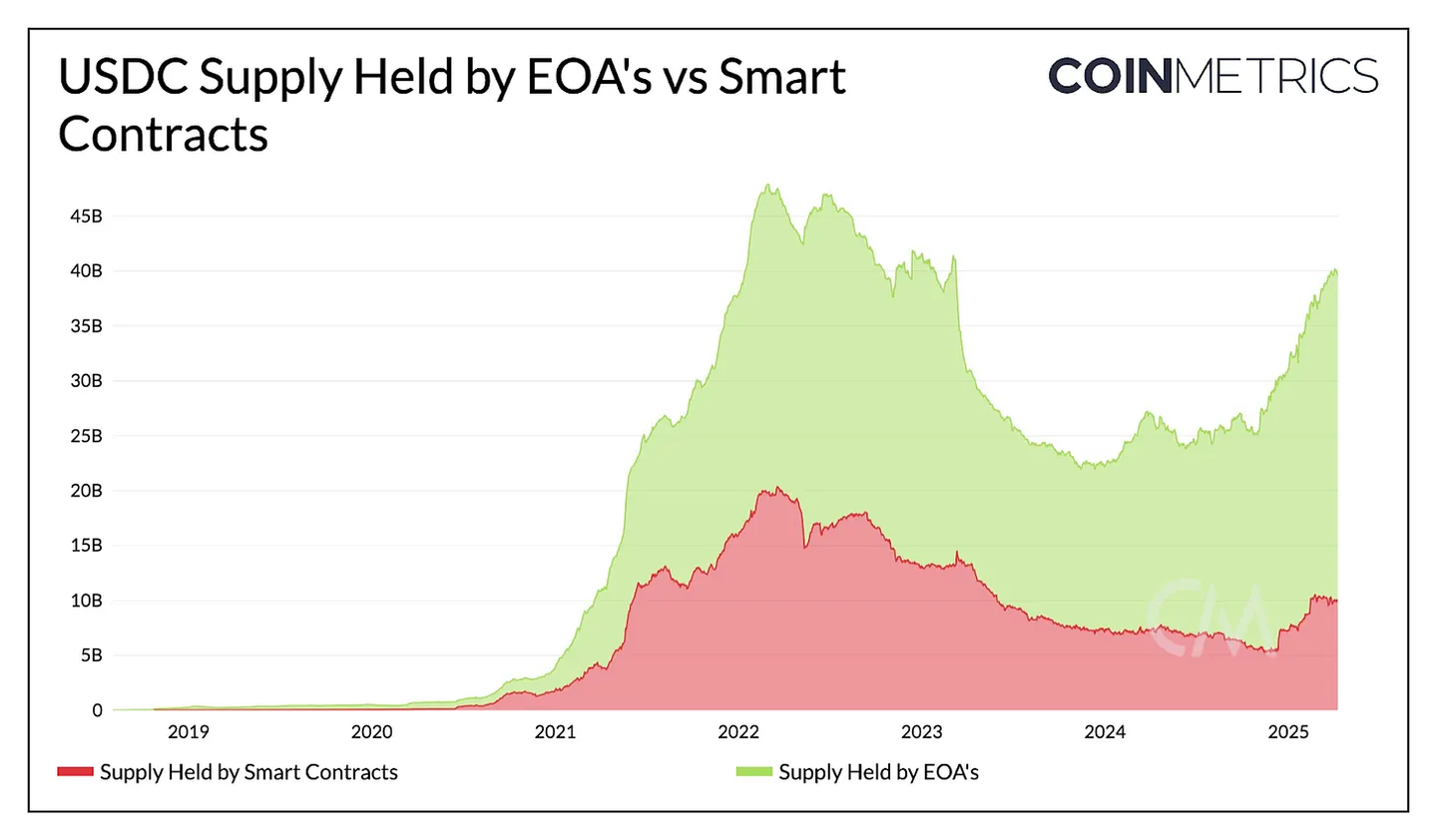

By distinguishing the USDC supply held in smart contracts versus externally owned accounts (EOA) on Ethereum, we can understand the distribution of USDC in user wallets and applications. Currently, approximately $30 billion is held by EOAs, representing a year-over-year growth of 66%, while about $10 billion is in smart contracts, with a year-over-year growth of around 42%. The growth in EOA balances may reflect an increase in holdings by trading platform custodians and individual users, while the growth in smart contracts indicates the importance of USDC as collateral in the DeFi lending market and liquidity for decentralized exchanges (DEX).

Source: Coin Metrics Network Data Pro

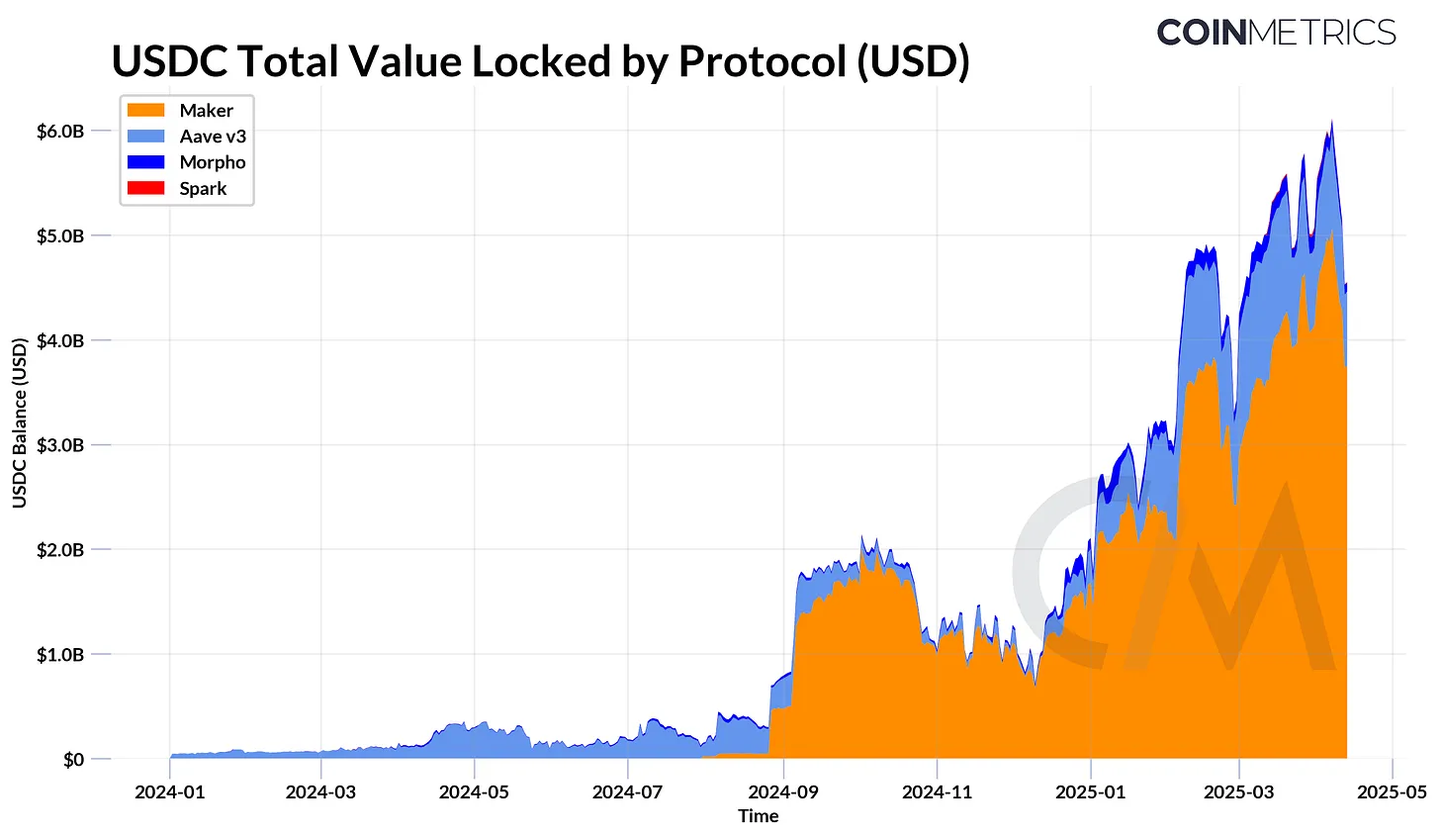

USDC continues to play a foundational role in the DeFi lending market, with protocols like Aave, Spark, and Morpho locking up over $5 billion (representing the portion of USDC supply that is not borrowed). For collateralized debt protocols like Maker (now Sky), approximately $4 billion of USDC supports the issuance of Dai/USDS through its peg stability module.

Source: Coin Metrics ATLAS & Reference Rates

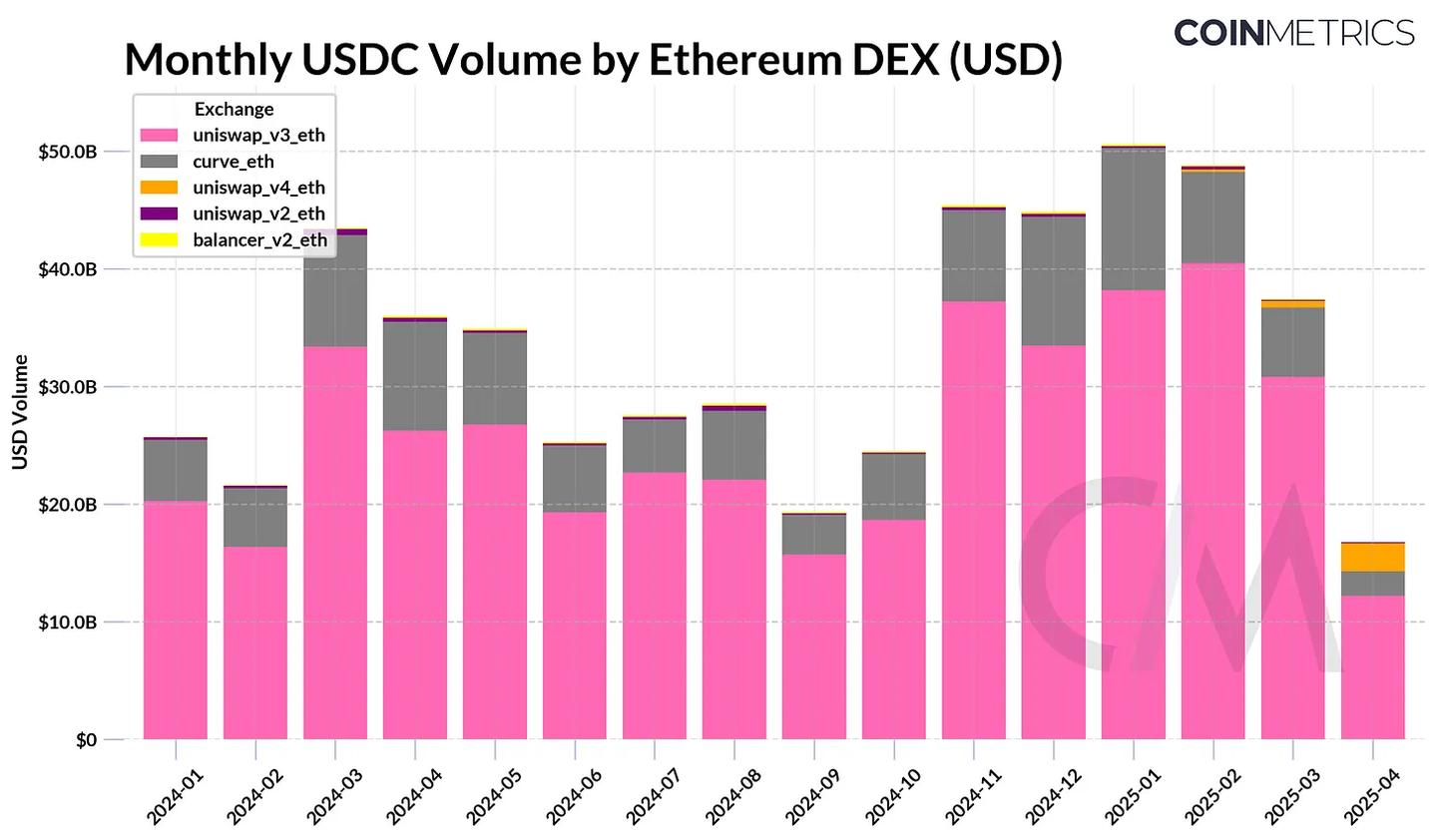

Similarly, USDC is a key source of liquidity for various DEX pools, facilitating trades that maintain stable value. It is also increasingly supporting on-chain foreign exchange markets, especially with the rise of other fiat-pegged stablecoins like Circle's MiCA-compliant stablecoin EURC.

Source: Coin Metrics DEX Data

Conclusion

The on-chain growth of USDC reflects a recovery in market confidence, but Circle's documents also highlight key challenges, particularly high distribution costs and a severe reliance on interest income. To maintain momentum in a low-interest-rate environment, Circle aims to diversify its revenue through active product lines like Circle Mint and by expanding tokenized asset infrastructure through the acquisition of Hashnote, the largest issuer of tokenized money market funds.

With increasing regulatory clarity, especially the SEC's stance that stablecoins are not securities, Circle is in a favorable position. However, it now faces intensifying competition from overseas issuers like Tether and a new wave of U.S. competitors leveraging policy changes. Although Circle's valuation remains undetermined, its IPO will mark the first opportunity for direct investment in the growth of stablecoin infrastructure in the public market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。